Top Tech Company Valuation Experts in Singapore – Startups & Unicorns

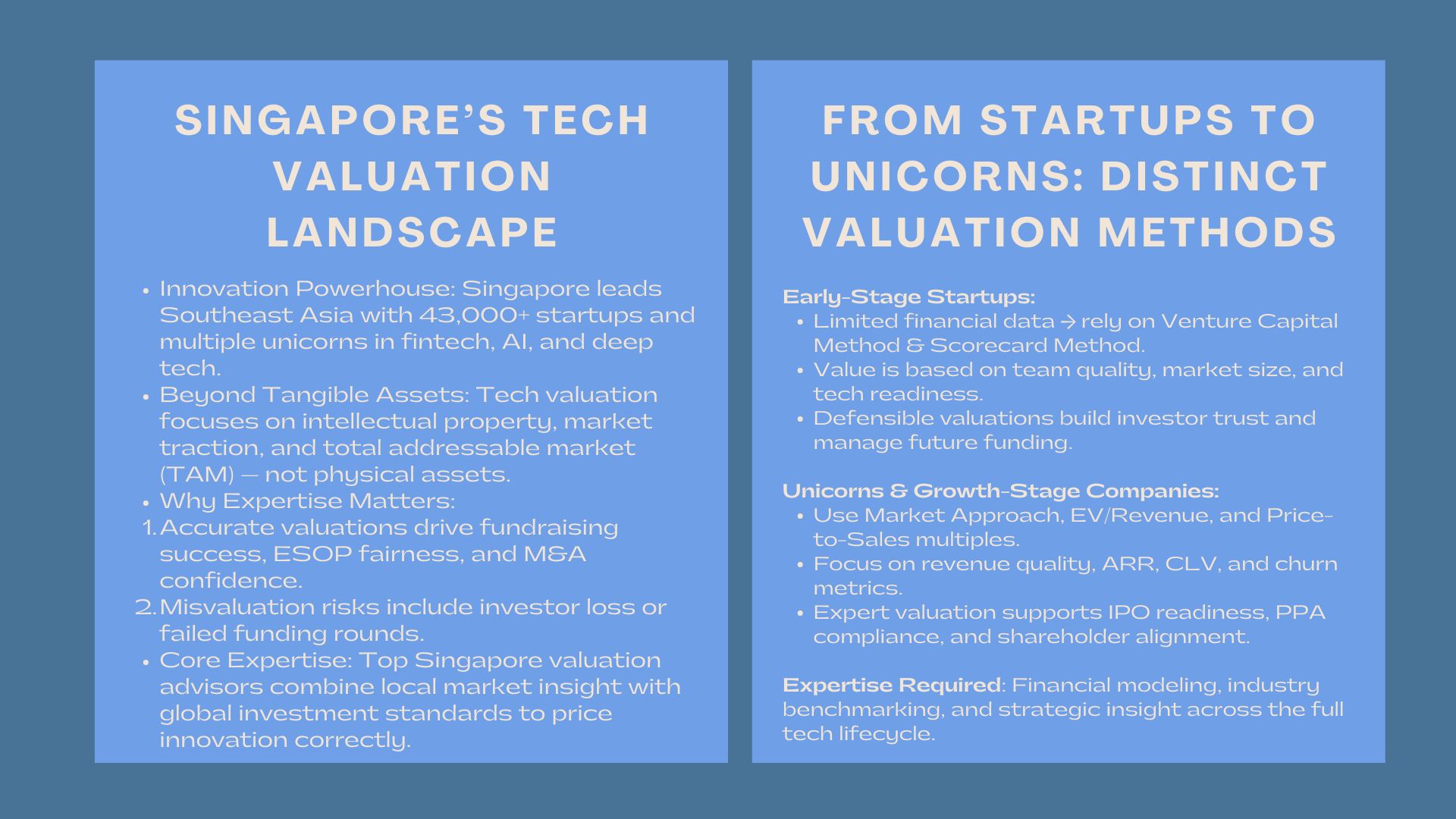

Singapore has been the unquestioned technology and innovation hub in Southeast Asia. The stakes of corporate finance are exponentially high with a list of more than 43,000 startups, not to mention a growing number of unicorns and decacorns, pioneers of fintech, deep tech, AI, and logistics.

In contrast to traditional industries, a technology company (especially at high-growth or pre-profit stage) is not valued based on tangible assets, but on intellectual property, market traction, proprietary technology, and the magnitude of its Total Addressable Market (TAM). The skill in valuing these high-risk fast assets is needed, and it takes much more than standard financial statements.

To the founders, venture capital (VC) firms, corporate investors, CFOs in Singapore, it is important to have access to really expert valuation advisory. The valuation of the right establishes the success of fundraising, fair equity compensation (ESOPs) and regulates M&A deals.

An incorrect valuation may result in foregoing millions of dollars or the inability to raise the next funding round. This article pinpoints the required expertise and methodologies that are used by Top Tech Company Valuation Experts in Singapore who know the local ecosystem and the international standards of investment needed to value the next generation of tech giants correctly.

Going through the Tech Valuation Landscape: Startups vs. Unicorns.

Going through the Tech Valuation Landscape: Startups vs. Unicorns.

Valuation of a pre-revenue startup is vastly different than valuation of a market dominant unicorn. The expert consultants should be able to smoothly move through the entire technology lifecycle and use the right methodologies at each step to make sure the valuation is correct and defensible.

Early-stage Startup Valuation.

With seed stage or Series A startups, traditional Discounted Cash Flow (DCF) models tend to be not very reliable because there are no foreseeable cash flows. The valuation experts instead need to use other forward-looking techniques that would take into account the possibility of future outperformance. These are the Venture Capital Method, where an exit valuation, discounted by high-risk-adjusted rates is projected, and the Scorecard Method, where the quality of management of the startup, market size, and product maturity are compared and contrasted against other financed businesses.

Engaging professional tech company valuation consultants for startups in Singapore ensures that the valuation is defensible to sophisticated investors. These analysts are adept at detecting and valuing the intangible assets such as the quality of the team and readiness of the technology, which constitute the majority of the initial value of a startup, as it prepares a strong base to manage the cap tables and future funding rounds.

Focused Knowledge that applies to Unicorns and Growth-Stage businesses.

When a tech company has grown into a unicorn (valued at 1 billion dollars or more), competitive market analysis and revenue model defensibility becomes the focus. The appreciation of these giants demands the requirement of advanced financial modeling, incorporating the complex global market penetration forecasts and planning on the threats of competitive scenario. Experts put significant emphasis on the Market Approach and compare the company with the measures such as Enterprise Value-to-Revenue (EV/Revenue) and Price-to-Sales multiples based on similar deals of publicly traded technology firms or recent acquisitions in the private market.

Nevertheless, such professionals also heavily examine the quality of revenue, including such metrics as Customer Lifetime Value (CLV), churn, and Annual Recurring Revenue (ARR). The insights provided by expert valuation advisors for unicorn technology companies in Singapore are crucial for IPO preparation, complex Purchase Price Allocations (PPA) for acquisitions, and high-stakes shareholder disputes, requiring mastery of both financial engineering and strategic analysis.

The Critical Role of Intangibles, ESOPs, and Global Compliance

The value of a tech company in Singapore is tightly tied to assets that do not appear on a standard balance sheet and institutional investors are in no way prepared to compromise on compliance with local and international reporting standards.

Measuring Intellectual Property and Intangible Assets.

In the case of deep tech, biotech, and fintech companies, intellectual property (IP), such as patents, proprietary algorithms, and customer data are their most valuable asset. The economic value of such intangibles is determined by expert valuation consultants in special techniques, including Relief-from-Royalty Method or Multi-Period Excess Earnings Method. Such strict valuation is essential not only in a strategic purpose, but also in proper reporting of financial status under Singapore Financial Reporting Standards (SFRS).

This valuation has to become resilient to the questioning of auditors and regulatory bodies and consequently, the decision on a skilled compliance-oriented advisor becomes of the utmost importance as far as fundraising credibility and taxation are concerned, as it will make sure that the full strategic value of the company will be reflected on the balance sheet.

Global Advantage and Strategic Advisory.

Another key ingredient of success in startups in Singapore is the capacity to get and keep premium international talent, frequently guided by Employee Stock Option Plans (ESOPs). The frequent, independent valuation, which is regularly made such as once a year, is necessary to issue stock options to meet the local tax laws and to offer the accounting basis of compensation in terms of shares. Such valuations are also technical and are supposed to be of high standards in terms of auditing.

Any mismanagement of the valuation of ESOP may create huge taxation costs or accounting mistakes. The recurring valuation services that are required to handle cap table complexity and make ESOP grants both legally effective and workforce motivated are delivered by expert advisors. The last piece of the puzzle is the strategic advice given, in which consultants present advanced scenario analysis and sensitivity modeling which will enable the clients to negotiate with confidence, strategize and create long-term sustainable growth which will be appreciated and rewarded by the international investor base.

The Competitive Edge: Operational Focus and Exit Strategy

The leading valuation firms provide services that go beyond mere price discovery, and center on the health and ultimate profitable exit of the technology company.

Maximizing Value by improving Operational Efficiency.

The valuation professionals are often expert valuation professionals, who consider the valuation process to be diagnostic and which reveal the operational bottlenecks that choke the enterprise value. Using the capital intensity, customer acquisition cost, path-to-profitability measures, consultants give practical suggestions on how to simplify the processes, streamline technology infrastructure and enhance unit economics. This operational lens will guarantee management team concentrates their efforts on value-accretive activities which will directly raise the chances of achieving the financial milestones needed to go to the next round of funding or desirable exit. A valuation is thereby converted into an action plan to grow.

Establishing a Clean Way to a Lucrative Exit.

To founders and investors, a successful exit, be it a merger, acquisition, or Initial Public Offering (IPO) is the final objective. Such an exit strategy should be planned many years before, whereby certain financial and operational benchmarks should be reached to attract the best acquirers or high valuation of listing. Valuation specialists assist in organizing the business in case of such an exit by consulting on the most appropriate time to exit, the financial cleanup, and valuation story that will attract the target buyer (e.g., a strategy corporate vs. a financial buyer). This beneficial exit strategy is what the most seasoned advisors in the tech finance ecosystem in Singapore can define and implement.

Conclusion: Top Tech Company Valuation Experts in Singapore

Singapore is considered a tech powerhouse, which is built on the strong and reputable valuation of its startups and unicorns. In any business venture, precise valuation is the uncompromising cornerstone of capital raise, equity administration, and strategic mergers and acquisitions. The business cannot afford to incur losses by depending on the services of Top Tech Company Valuation Experts in Singapore, as it is an investment that can help the business achieve its financial potential through the fair valuation of its intellectual property. All the stakeholders, determined to achieve success in the most competitive ecosystem in Asia, must choose an advisor who has the best technical understanding of growth-stage valuation and high compliance standards.