Quick Contact

Need Help?

Please Feel Free To Contact Us. We Will Get Back To You With 1-2 Business Days.

[email protected]

+65 9730 4250

Download

Company White Paper

1.30 MB

Company Media Kit

1.22 MB

Purchase Price Allocation (PPA) Valuation

What is Purchase Price Allocation valuation?

As the name suggests, valuation is the process of finding out the exact value of a company or business. Business valuation can focus on the entire organization, an ownership interest, a certain liability, or an asset. Companies ought to understand the importance of valuation lest they won’t have an idea of the best direction as we advance. It explains why it is crucial in financial markets, including corporate and investor activities.

Valuation has seen businesses make informed and strategic decisions. It is no secret that that’s something that has helped many companies head in the right direction. Company valuation also helps a business determine the drivers that can play a huge role in determining the drivers boosting the business’s success. Once identified, the company will do everything in its power to improve these drivers, thus realizing its optimum business value.

We offer specialized and quality buy and sell business valuation and consultancy services delivered within the set timelines. Our customized buy & sell valuation services are provided by experts who are regularly updated with the latest events on the global market. Our team provides high-quality and cost-effective solutions targeted to meet our client’s business needs.

Why do we need a valuation?

Companies do a purchase price allocation for the following reasons

What is a purchase price allocation used for?

A purchase price allocation, or PPA, is an accounting technique used to determine the value of assets and liabilities acquired in a business purchase or M&A transaction. Under the widely adopted international financial reporting standards (IFRS), purchase price allocations remain an important component of financial accounting. In order to correctly account for these purchase transactions, companies undergo intense analyses and record unique values for each type of intangible asset involved. A purchase price allocation typically includes factors such as purchase price accounts payable, debt retirement costs, goodwill, and other burdensome or non-operational liabilities. By properly allocating the purchase price in this way, companies can ensure that their financial statements are accurate and that they comply with IFRS requirements. Ultimately, purchase price allocations help businesses navigate complex asset acquisitions and provide valuable information to investors and stakeholders alike.

Purchase Price allocation Report

A best purchase price allocation report is a type of content analysis that is used to determine the value of an acquired company. The body of the report then provides a detailed analysis of the target company’s assets and liabilities, including both tangible and intangible assets. The report concludes with a valuation analysis that determines the fair market value of the target company. The purchase price allocation report is an important tool for both buyers and sellers in an M&A transaction, as it helps to ensure that the purchase price is fair and equitable.

This analysis is then used to help establish the fair market value of the company and goodwill on acquisition. Purchase price allocation reports are often used in mergers and acquisitions, as they can provide insights into the true value of a company. In addition, purchase price allocation reports can be useful for tax purposes, as they can help to classify which assets are subject to capital gains tax.

GET SERVICES ONLINE

We are a specialized Purchase Price Allocation (PPA) valuation company providing end-to-end assessment services when you want to exit or invest in any business. Our team has extensive experience in the field of valuation

EXPERIENCED TEAM

Our valuation team is headed by a professional having more than 20 years of experience.

COMPETITIVE PRICING

We are all about delivering value at competitive pricing to our clients that will fit your budget.

CONFIDENTIALITY

We ensure that all financial data gathered and provided are kept completely confidential.

KEEP YOUR BUSINESS COMPLIANT FOR PURCHASE PRICE ALLOCATION AFTER M&A

Valuation for Intangibles

The valuation of intangibles is a process that involves the identification, measurement, and allocation of the purchase price paid for an entity to the various intangible assets acquired. The valuation of intangibles is commonly performed in connection with mergers, acquisitions, and other transactions in which the purchase price paid includes an allocation to intangible assets. The valuation of intangibles can also be performed for financial reporting purposes, such as when reporting the fair value of goodwill on the balance sheet. There are several methods that can be used to value intangibles, such as the relief from royalty method or the income approach. The selection of the suitable method and valuation approach depends on several factors, including the type of the intangible asset being valued, its importance to business, acquisition value, etc. For example, if the valuation is being conducted for financial reporting purposes, generally accepted accounting principles (GAAP) will need to be considered. When valuing intangibles, it is essential to consider all relevant factors to arrive at a fair and accurate valuation. Some of the factors that should be considered include:

– The nature of the intangible asset being valued (e.g., patents, copyrights, trademarks, etc.)

– The strength of the underlying intangibles

– Future potential of these intangibles

Valuation of Tangible Assets

The process of allocating the acquisition price among the various components of an asset is known as purchase price allocation (PPA). This process can be quite complex, and it is typically performed by an experienced valuer. The valuation of tangible assets is a key component in the purchase price allocation valuation process. This process is used to determine the fair market value of land, buildings, and factories that are being purchased.. The goal of the PPA process is to arrive at a fair market value for the asset that is being purchased along with the business. There are a number of different methods that can be used to value a property, but the most common approach is to simply look at the purchase price or value using a variety of methods, including appraisals, market surveys, and comparative market analyses This method is often used when valuing land or buildings, as it provides a clear starting point for the valuation process. However, this approach can be problematic when valuing more complex assets, such as factories or businesses. This is an important process to allocate the purchase price among the various components of the asset in order to arrive at a more accurate valuation.

OUR DETAILED APPROACH

Valuation is a complex process, and the right methods depend on different factors like industry, stage of the company, size of the company, business models, etc. We apply unique models for each of our projects based on our detailed analysis.

PRICE CONSIDERATION

First, Company needs to pay the total consideration paid for the acquisitions of the target company. This includes all kinds of cash and non-cash considerations paid or transferred by the company. In the analysis, the company also has to correctly estimate the liabilities paid or assumed in the M&A transaction. These must be appropriately evaluated and included in the calculation of the Price Consideration for the M&A Transaction

Purchase price allocation (PPA) is the process of giving a fair value to all the assets acquired and liabilities assumed of a target company. When a private or listed business that compiles financial statements in accordance with IIFRS buys or merges with another business during the merger or acquisition process and has paid the purchase price or consideration in the acquisition, the business must carry out this activity.

Put another way, a price purchase allocation should normally be made in the event of a business acquisition or a change in the company’s management. This approach typically results in some unassigned residual value made up of goodwill in this case, the purchase price given to the target

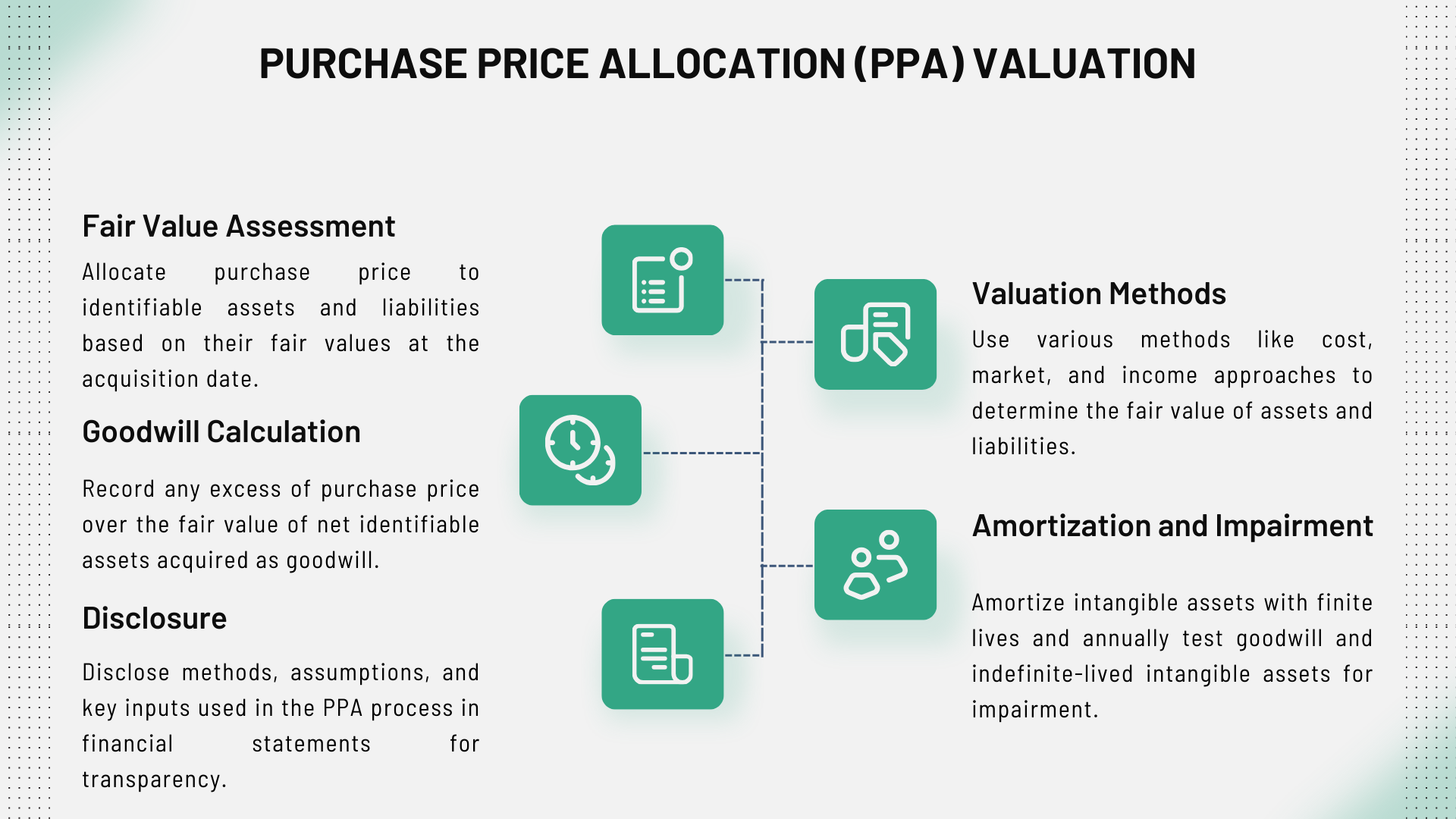

VALUATION OF TANGIBLE ASSETS

The second step is to find all types of tangible assets like land building, fixed assets, machinery, etc., acquired in the M&A Valuation process. Then, these assets are valued using various methods like cost, market, and income approaches. This must align with different accounting, valuation, and reporting guidelines under multiple rules and regulations.

There here are four basic steps in a purchase price allocation that the company have to follow if they need to analyze the transaction from the financial and tax purposes, these are given below:

- Price Consideration : First, Company needs to the total consideration paid for the acquiziation of the target company. This includes all kinds of cash and non cash consideration paid or transferred by the Company. In the analysis, the Company also have to properly estimate the libailities paid or assumed in the M&A transaction and these must be properly estimated and included in the calculation of the Price Consideration for the M&A Transaction.

- Valuation of Tangible Assets The second step is to find all types of tangible assets like land building, fixed assets, machinery, etc acquired in the M&A process. Then, these assets are valued using various methods like cost, market, and income approaches. This has to be inline with various accounting,valuation and reporting guidelines under various rules and regulations.

- Valuation of Intangible Assets : The third step is to identify all the intangible assets like patents, IPs, licenses, contracts, , copyright, formula, process, design, pattern, knowhow etc and then value these assets as per the prevailing valuation and accounting guidelines. In this process, all assets are analyzed and valued at the fair value using cost, market, and income approaches.

- Calculation of Goodwill : The fourth step is to find the find the goodwill, which is price consideration minus the fair value of the tangible and intangible assets.

VALUATION OF INTANGIBLE ASSETS

The third step is to identify all the intangible assets like patents, IPs, licenses, contracts, copyright, formula, process, design, patterns, knowhow, etc., and then value these assets as per the prevailing valuation and accounting guidelines. In this process, all assets are analyzed and valued at the fair value using cost, market, and income approaches

Intangibles are one the most critical components of the PPA allocation exercise. In many cases, intangible asset valuation is valued via multiple complex methods and process. In the valuation of intangibles, there are many key factors that impact the valuation including visibility, exclusivity, and protection rights of these assets.

As per various financial reporting standards and guidelines, intangibles assets is measured and valued as a separate asset over and above the goodwill in the purchaser price allocation which is excess price paid over the fair value of all tangibles and intangibles assets. This make the entire PPA process very complex and time consuming.

In addition to identification of intangibles, global accounting and reporting standards also mandate the regular testing of intangibles and goodwill for the impairment. This has to tested regularly and any fall in the value has to be written off and recorded as the guidelines and standards.

CALCULATION OF GOODWILL

The fourth step is to find goodwill, which is price consideration minus the fair value of the tangible and intangible assets.

If a buyer prepares financial statements as per GAAP or IFRS and acquires a company, then as per the reporting requirements, the buyer is obligated to carry out a purchase price allocation except in instances when the acquisition is too insignificant and hence, it will be considered unimportant.

The acquirer’s auditor then carries out a thorough analysis of the valuations of the assets and liabilities. In such a case, you need to offer answers to all the questions from the auditor, which could be a few questions or multiple pages of questions. Therefore, you need to collaborate with an independent valuation expert because greater the valuation quality and richer the experience, lesser will you spend time and money on the evaluation process.

Besides, if the valuation of the acquired intangible assets is of unsatisfactory quality or objectionable to the auditor, you may have to a carry out the valuation from scratch at additional expenses. Therefore, team up with Valueteam for excellent valuation solutions and for saving your time and money and avoiding potential business problems.

Purchase Price Allocation Exercise

Intangibles are Critical in PPA Valuation

Intangibles are one the most critical components of the Best Singapore Purchase Price allocation exercise. In many cases, intangible asset valuation is valued via complex methods and processes. In the valuation of intangibles, many critical factors impact the valuation, including visibility, exclusivity, and protection rights of these assets. As per various financial reporting standards and guidelines, intangibles assets are measured and valued as a separate assets over and above the goodwill in the purchase price allocation, which is the excess price paid over the fair value of all tangibles and intangibles assets. This makes the entire PPA process very complex and time-consuming. In addition to identifying intangibles, global accounting and reporting standards also mandate the regular testing of intangibles and goodwill for the impairment. This has to be tested regularly, and any fall in the value has to be written off and recorded as the guidelines and standards

Compliance with PPA Valuation

If a buyer prepares financial statements as per GAAP or IFRS and acquires a company, then as per the reporting requirements, the buyer is obligated to carry out a best purchase price allocation except when the acquisition is too insignificant. Hence, it will be considered unimportant. The acquirer’s auditor then carries out a thorough analysis of the valuations of the assets and liabilities. In such a case, you need to offer answers to all the questions from the auditor, which could be a few questions or multiple pages of questions. Therefore, you need to collaborate with an independent valuation expert because the more significant the valuation quality and richer the experience, the lesser you will spend time and money on the evaluation process. Besides, suppose the valuation of the acquired intangible assets is unsatisfactory or objectionable to the auditor. In that case, you may have to carry out the valuation from scratch at additional expenses. Therefore, team up with Valueteam for excellent valuation solutions, save your time and money and avoid potential business problems.

Valueteam: Your third-party Purchase price allocation valuation services consultants

At times, many firms single-handedly carry out an acquisition process without the assistance of valuation consultants such as Valueteam. In such a situation, you may miss out on the many crucial benefits that we can offer.

Expert third-party valuation consultants such as Valueteam can offer the following advantages of Purchase Price Allocation ( PPA Valuation ):

Accelerate your strategic planning as an independent expert valuation adviser;

Carry out market and company research without revealing your concern;

Facilitate contact with business owners (particularly insightful when contacting not-for-sale ventures);

Expedite flourishing relationships and collaborations with entrepreneurs;

Offer fact-based and expert valuations;

Assist in designing the deal structure;

Offer advice during the initial incorporation of your organization.

Core valuation principles of Valueteam

The following core principles of Valueteam will help you to get a high success rate in all your valuation needs:

Focus on one specific reason to buy or sell a company; more than one reason can be led to ambiguous decisions;

Before choosing companies to acquire, determine the market first, which is the perfect recipe for a great strategic approach;

Demand propels the growth of a company. Therefore, concentrate on the future demand as an essential selection prerequisite;

Concentrate on not-for-sale companies because every company is up for sale for a proper calculation.

OUR EXPERTISE

Diverse and Reliable Services

Valueteam offers diverse and reliable valuation services trusted by companies all over the world. We have vast experience across all business sectors providing you the best solutions for your needs

Customized and Cost-Effective

Our professionals have deep-rooted research mindsets and provide high-quality and cost-effective solutions targeted to meet our client’s business needs.

OUR UNIQUE SERVICES

Diverse and reliable Services

Valueteam offers diverse and reliable valuation services. We are trusted by various companies across the globe. Our team of finance professionals has vast experience across all sectors and stages of a business. We ensure that we will provide you with the best solutions that meet your organization’s needs.

Deep Expertise

We are a team of finance professionals who offer excellent quality and specialized business valuation and advisory services that are delivered within our client’s set timelines. Our services are provided by knowledgeable experts who are regularly updated with the latest and current events on the global market.

Customized and Cost-Effective

Valueteam is composed of professional finance experts who can easily understand client requirements. We make sure to provide targeted and cost-effective solutions without compromising on the quality of the services. With our deep-rooted research mindsets, we can find a business solution that will meet your needs.

How Does Valuation Help Your Business?

Benefits Of Valuing a Business

Business valuation can help you to buy or sell a business with ease, discuss better terms with the buyers or sellers of the company and choose the right time for selling or buying a business

Stimulate Growth

Periodic valuation is a good practice because it helps you evaluate and appraise your business functioning; uncover business areas that need improvement, and quickly raise capital for your business

VALUETEAM: YOUR THIRD-PARTY VALUATION CONSULTANTS

At times, many firms single-handedly carry out an acquisition process without the assistance of valuation consultants such as Valueteam. In such a situation, you may miss out on the many crucial benefits that we can offer.

- Expert third-party valuation consultants such as Valueteam can offer the following advantages:

- Accelerate your strategic planning as an independent expert valuation adviser;

- Carryout market and company research without revealing your concern;

- Facilitate contact with business owners (particularly insightful when contacting not-for-sale ventures);

- Expedite flourishing relationships and collaborations with entrepreneurs;

- Offer fact-based and expert valuations;

- Assist in designing the deal structure;

- Offer advice during the preliminary incorporation of your organisation.

- Core valuation principles of ValueteamThe following core principles of Valueteam will help you to get a high success rate in all your valuation needs:

- Focus one specific reason to buy or sell a company; more than one reason can led to ambiguous decisions;

- Before choosing companies to acquire, choose the market first, which is the perfect recipe for a great strategic approach;

- Demand propels the growth a company. Therefore, concentrate on the future demand as a basic selection prerequisite;

- Concentrate on not-for-sale companies because every company is up for sale for a suitable calculation.

What are the different methods used in a valuation?

Why does your company specialize on valuation?

why is the purchase price allocation (ppa) essential?

why do we need to assess the fair value of assets?

M&A VALUATION

We assist in the valuation of target companies, PPA, and EPS analysis, both pre and post-transaction.

INTANGIBLES VALUATION

We provide all kinds of intangibles like patents, trademarks, IPs etc valuation services for our clients.