Valuing Digital Assets: From Crypto Tokens to NFTs

Learn the Certified Digital Asset Valuation Course Singapore

The emergence of blockchain technology has led to the emergence of a new category of assets, i.e., digital assets. Since the advent of cryptocurrencies and stablecoins, NFTs and tokenized assets of the real world are a major value item on balance sheets and investment portfolios. With the increased exposure of businesses and investors to digital holdings, a precise knowledge on how to value them has been necessary in the transparency of financial statements and to make sound decisions.

In contrast to traditional assets, the digital assets function in a decentralized setting, with the volatility of markets, liquidity, and regulatory frameworks being diverse. This complexity makes valuation both a technical and conceptual challenge for professionals dealing with digital asset valuation Singapore and beyond.

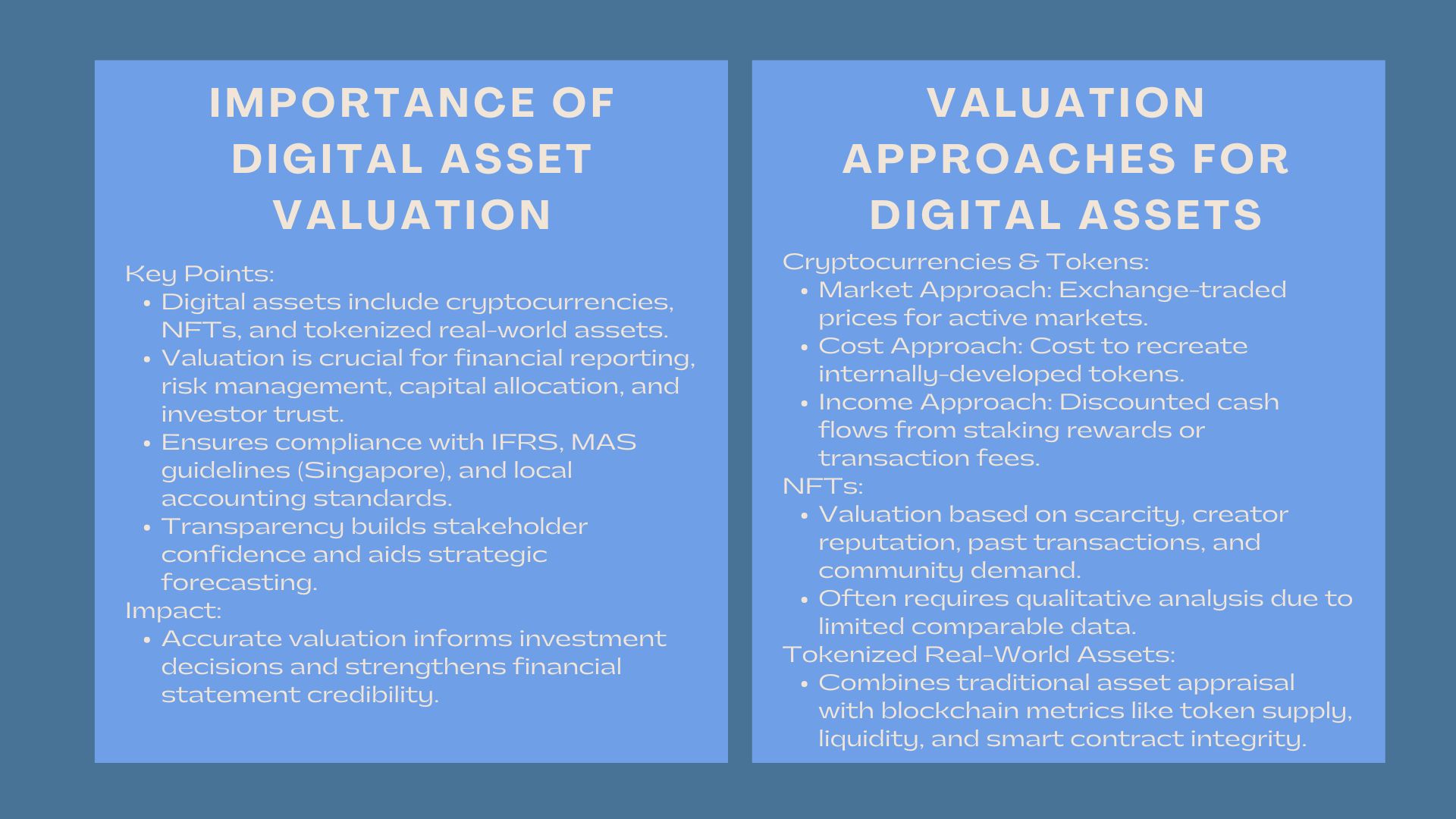

The Importance of Digital Asset Valuation

The Importance of Digital Asset Valuation

Regulators, auditors and tax authorities have accepted digital assets as legitimate financial resources. In the right valuation, proper reporting will be maintained, adherence to IFRS and local accounting standards, and make informed investment choices. In the case of businesses with crypto tokens or NFTs, valuation assists in risk management, capital allocation, as well as strategic forecasting.

Trust among the stakeholders is also established through the valuation process as it shows transparency and accountability. With institutions adding blockchain-based assets on the balance sheets, effective valuation frameworks will close the digital innovation-financial reporting framework.

The Fundamental Precepts of Digital Assets Valuing.

Estimating the Market Value and Liquidity.

The initial move towards appreciating any type of digital asset is the market dynamics. Value indicators such as market capitalization, trading volume and liquidity are important. Active market prices are useful as a valuation point of reference in the case of the major traded cryptocurrencies such as Bitcoin or Ethereum. Nonetheless, in the case of illiquid or recently issued tokens, an analyst has to rely on proxy data or discounted cash flow models to provide fair value.

Accounting and Regulatory System.

There is still a development of digital assets by various jurisdictions. Regulators in Singapore like the Monetary Authority of Singapore (MAS) have come up with directives as far as classifying and reporting crypto assets is concerned. Valuation is commonly classified under fair value measurement provisions under the IFRS and therefore must have constant procedures and disclosed assumptions.

Volatility and Risk Adjustments.

Cryptocurrencies are infamously frail. A good valuation methodology must consider extreme price movements, liquidity constraints and counterparty risks. Distortion of the results of valuation can be minimised using weighted averages, volatility indexes and long-term price modelling.

Valuation Approaches for Different Types of Digital Assets

Cryptocurrencies and Tokens

For fungible tokens and cryptocurrencies, the cryptocurrency valuation framework generally applies one of three methods:

- Market Approach: It employs exchange-traded prices on reputable platforms. Best in ideal case of tokens where the markets are active and trading volumes are guaranteed.

- Cost Approach: Values the cost to recreate the asset and is generally used with tokens developed internally, or blockchain infrastructure.

- Income Approach : Calculates future cash flows or utility value, discounted to present value. In general, tokens are commonly used to create staking rewards or transaction fees.

Non-Fungible Tokens (NFTs)

NFTs are distinctive digital illustrations of ownership, which are usually associated with art, collectibles, or electronic rights. Appreciating NFTs is done through the evaluation of scarcity, reputation of the creator, history of the transaction, and the demand of the community. As similar sales information can be unavailable, NFT value is frequently based on qualitative analysis assisted by the outcomes of the previous auctions or the floor price on big marketplaces.

Tokenized Real-World Assets

Blockchain can be used to tokenize real-world assets such as real estate, art or equities. Valuation in this case is a mixture of conventional appraisal of assets and blockchain-based measures including token supply, trading liquidity, and smart contract integrity. These mixed models are a more detailed picture of intrinsic and market value.

Problems in Digital Asset Valuation.

Lack of Standardization

The digital asset valuation, in contrast to the traditional financial instruments, does not have a universally recognized framework. Cross boundary differences among accounting standards and market practices are likely to provide inconsistent valuations among firms.

Information Assurance and Responsibility.

Blockchain data is not modifiable but it may be difficult to interpret. Perceived value may be distorted by differences in exchange reporting, liquidity manipulation or wash trading. Valuation experts are required to thoroughly screen the sources of data and immanentize anomalies.

Rapid Market Evolution

New asset classes and valuation techniques continue to be created at the same rate as innovation in blockchain ecosystems. It is important to keep in touch with the trends and regulatory changes in the market so as to keep the valuation accurate.

Best Practices of Reliable Valuation.

- Implement Multi-Method Solutions: The integration of market, cost and income solutions will increase accuracy and reduce distortions caused by volatility.

- Make sure of Regulatory Compliance: ensure that valuation matches the local and international reporting standards, especially that of fair value measurement of the IFRS 13.

- Engage Independent Valuation Experts: Third-party reviews are objective, and these are credible enough, particularly when it comes to audit and transactions.

- Frequent Revaluation: The nature of the market is volatile thus frequent revaluation will maintain fairness in the financial statements.

Digital Asset Valuation in the Future.

The methodologies of valuation will keep on changing as blockchain is being used in finance, entertainment, and commerce. Machine learning and Artificial Intelligence are being considered in order to enhance precision with the help of predictive analytics and automated market data processing. Transparency and accountability of regulations will further enhance the confidence in the digital asset reporting.

Singapore has been developing as a regional centre of safe and transparent practices of valuation because it has progressive policies on its digital economy and a sound regulatory framework. The colliding of finance, technology and governance will be the way the future professionals will determine the value of digital.

Conclusion

The approach to valuing digital assets, such as crypto tokens, NFTs, and tokenized assets, will need a multidisciplinary team of knowledge in finance, technology, and regulatory acumen. With the transparent, standardized and adaptive methods and practices applied, business and investors will be able to make wise decisions in this fast changing environment. People who learn to art and science of valuing digital assets will set the pace in defining the meaning of value in the digital economy in the coming years.