Startup Valuation in a Downturn: What Founders Should Know

Introduction to Certified Startup Valuation Downturn

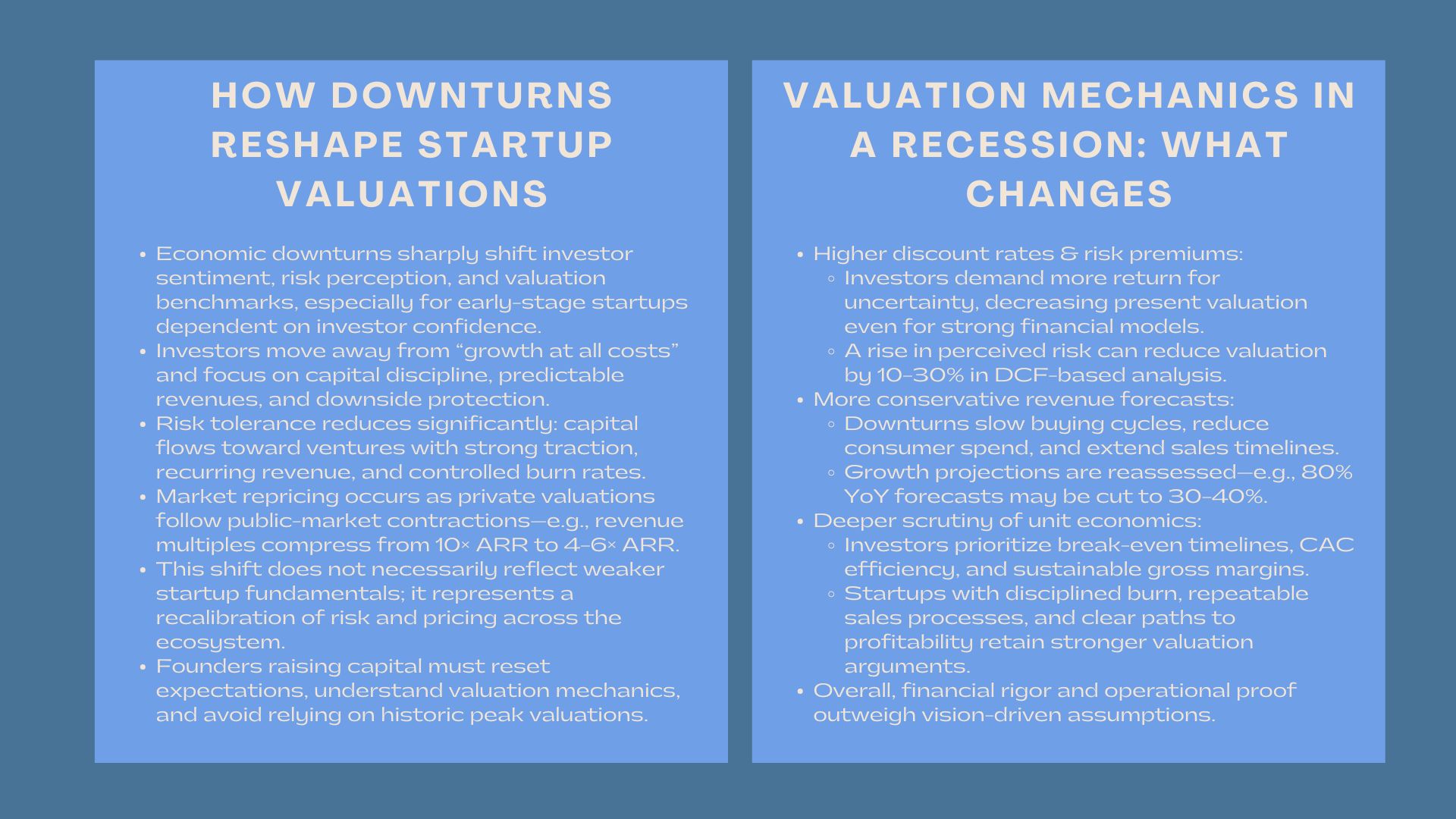

Depressions in the economy are issues that threaten the existence of the company and the sanity of the price formed. The market crunch can drastically change the risk perception, growth prospects and valuation in startups and especially in early stage start ups where investor confidence is a crucial factor in the development of the company. Uncertainty shall see a higher growth of selective investors, a high cost of capital and assumptions on which valuations based on aggressiveness will no longer be a viable operation.

It is important to understand that valuation fluctuates during recession and founders who are about to raise capital, extend runway, or in a strategic pivot must know these metrics. In this paper, it will focus on one area; the resettlement of the valuation assumptions and expectations of investors in the circumstances of a downturn, and the reasonable expectations under founders.

1. The cause of Downturns Alteration of the Valuation Landscape.

1. The cause of Downturns Alteration of the Valuation Landscape.

Among the core changes in the economic landscape, where startups are operated, there is Downturn. Investors are no longer so much concerned with growth at any cost but with capital allocation discipline in which the valuation increasingly warrants fundamentals.

1.1 Reduced Investor Risk Risk.

In the recession periods, investors re-evaluate their exposure to high risk early stage enterprises that are in the past more volatile and prone to failure. This brings about the scenario of money being channeled to business ventures that have a clear traction, financial management, and predictable income. Using the example of SaaS companies with the value attributed to the presence of monthly recurring traffic, SaaS companies were positively rated during the 2020 recession in comparison to consumer-oriented apps with high burn rates. This shift is a sign of the fact that the investors become more concerned with the downside protection, and the valuation assumptions can be considered to be more conservative.

1.2 Multitasking in Different Markets.

The valuation of the private market follows that of the contracting of the public markets. Times multiples of revenues that would have supported premium values simply work to narrow as other publicly traded companies with similar ratings are trading at a lower level. Only 4-6x ARR in a crunch in a growth market can be reasonably expected of the 10x ARR start-up. These types of changes are not a reflection of the underlying values of the start up but are a repricing of the markets on a broad basis. This realignment is at the core of how startup valuation during recession becomes more disciplined and evidence-based.

2. The Mechanics of Valuation During a Downturn

In addition to investor sentiment, declines also change the financial assumptions on which valuation models run. The awareness of such mechanics makes founders predict investor responses.

2.1 There are increased discount rates and risk premiums.

When there is greater uncertainty, the discount rates will be larger in the discounted cash flow (DCF) models. Investors view downward cash flows to be more risky in future and therefore the present value of cash flow becomes less. The perceived risk can make even a powerful financial model lose its 10-30 per cent of its valuation just because of an increased perception of risk.

2.2 More Conservative Revenue Forecasts.

Recessions lower consumer expenditure, sluggish the buying cycle of enterprises, and extend the line of sales. Forecasts are thus modified downwards by investors. A venture that was forecasting 80 percent year-on-year growth can be requested to explain 30-40 percent. The over-optimistic forecasts not only cause a decline in the credibility, but also increases the valuation decrease in negotiations.

2.3 Scrutiny of Unit Economics

During recessions, profitability paths are more important. Investors now ask:

- At which point will the start-up break even?

- The efficiency of customer acquisition?

- How much marketing expenditure will be needed to push marginal revenue?

A company that has high gross burns and is in control of its burns will be valued more favorable than the one that can only count on future scale.

3. Investor Expectations: What It does Change in a Down turn.

The founders tend to undervalue the speed at which the priorities of investors can change when the pressure on the economy increases. During a down turn, investors focus on strength and discipline in operation.

Preference toward Startups with Easy Revenue Models: This is an indicator reflecting the preference for startups whose revenue models are clear.

3.1 Preference towards Startups with Easy Revenue Models

This is a measure that shows the focus on startups whose revenue process is clear.

Startups that are at concept-stage or are pre-revenue are more scrutinized. Investors are also attracted to business ventures that have proven revenue streams, good customer retention as well as one that has proven market demand. As an example, B2B SaaS, logistics technology, and utilitarian-purpose platforms have a higher chance of being valuable than non-essential consumer applications or hypothetical Web3 initiatives.

3.2 More attention to Cash Runway and Efficiency.

A secondary rating measure, burn rate, becomes a primary measure. Investors would like to know that the company has 12-24 months to run effectively without using further funding. Companies that lower unwarranted overhead, renegotiate with their vendors, or simplify product development would tend to have a better valuation case.

3.3 Founder Adaptability Emphasis.

Investors are keen to the reaction of founders towards adversity. The ones who are agile, i.e. switching the business models, diversifying revenues, or shrink operations rapidly are seen as less risky. The failure to adapt could lead to a significant downward valuation of startups because of execution risk.

4. Funding Environment in Singapore in a recession.

The startup ecosystem in Singapore is strong, and recessions compound the problems that it faces. The capital environment is further competition and investors increase their standards.

4.1 Greater Competition on Scarcity of Capital.

Despite the schemes backed by the government, investors increase due diligence. In the seed and Series A level, startups have to strive more to be unique. This is a core aspect of startup fundraising challenges Singapore, where the bar for traction, financial governance, and founder capability rises sharply.

4.2 Sector-Specific Valuation Impacts

Some markets in Singapore are still stable: FinTech, logistics, greentech, and enterprise software are still capital-raising. In the meantime, consumer platforms that are discretionary, F & B, and lifestyle startups tend to suffer severe valuation reductions.

4.3 Significance of Government Grants and Co-Investment Schemes.

Enterprise Singapore, EDB, and SEEDS Capital have a stabilizing part played by the government. Valuation compression can be overcome by startups that intelligently utilize these programs to exhibit risk-sharing and improved financial runway.

5. What Founders Need to do to Change Expectations and Strategy.

In bad times, valuation is neither a figure, it is a negotiating instrument and a life support system. These changes need to be made to bring the expectations of valuation in line with the reality in the market. The founders should not stick to the historical valuation. Past funding round highs might not be maintained at present. Taking a lower valuation would save ownership and guarantee survival.

5.1 Fortifying Basics prior to Fundraising.

Discipline is rewarded by investors. Founders should prioritize:

- Improving gross margins

- Improving customer acquisition.

- Reducing operation expenses.

- Proving processes of repeatable sales.

A start-up that has recorded improvement over the years despite macro difficulties, usually warrants a justifiable and reasonable valuation.

5.3 Strategizing to Raise Timings.

In the case of the startup having runway, postponing fundraising until the market conditions stabilize can save the valuation. Alternatively, a smaller bridge round can be raised to stretch the runway in an undue manner.

6. Valuation as a Downturn Communication Tool.

Not only is valuation calculated but communicated. Perception of the founders by their numbers can greatly affect an investor.

6.1 The purpose of this step is to use data to create a narrative.

Founders are supposed to prove all their assumptions on the market size, revenue projections and growth of customers by data. Investors become sceptical with projections that are not supported by evidence or history.

6.2 Transparency as a Supplier of Trust.

It is better to be honest about the issues, slower growth, customer turnover, or product delays, and this instills trust. The investors like founders that are realistic and that have made mitigation plans are preferred.

6.3 Conceptualizing a Long-Term Vision.

Investors are supportive of ambitious, realistic visions even in recessions. The pressure on short-term valuation can be counteracted with a compelling market leadership story by showing the long-term strategic potential.

Conclusion

Slumps bring back discipline, redefined expectations of investors, and re-priced models of valuation. To founders, these changes are significant to understand in order to be able to maneuver capital-raising cycles, negotiate and maintain ownership. Startups can continue to raise capital and position themselves to grow even when the market is undergoing a transformation, especially when valuation is based on realistic assumptions, operational fundamentals are strengthened and the need to adjust to the changing market conditions.

Finally, recessions make the difference between strong businesses and ghost ventures. The founders who come to terms with the reality of the market but who have a clear and data-driven vision are the ones who will keep up the momentum, get committed investors and stronger when things get better.