When businesses engage in mergers and acquisitions (M&A) or purchase significant assets, it is essential to determine the accurate value of these transactions. Purchase Price Allocation (PPA) is a crucial accounting process that helps companies allocate the purchase price to the acquired assets and liabilities correctly. To ensure compliance and precision, especially when dealing with intangible assets, companies often turn to intangible asset purchase price allocation services in Singapore for M&A compliance. One effective way to navigate this complex task is by leveraging the expertise of a specialized team, such as Valueteam, which offers comprehensive purchase price allocation services for mergers and acquisitions in Singapore alongside expert M&A valuation services in Singapore.

What is Purchase Price Allocation (PPA)?

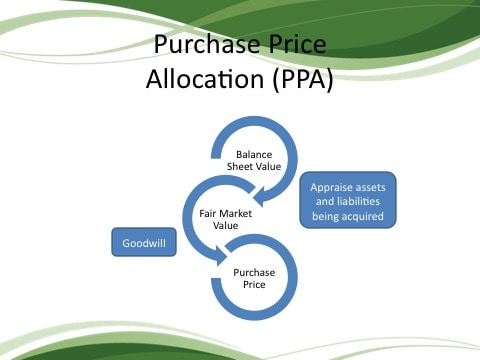

PPA is an accounting process that breaks down the total purchase price of a transaction to assign values to specific assets and liabilities acquired. This allocation is crucial for financial reporting and tax purposes, as it impacts the company’s balance sheet, income statement, and tax liabilities.

The Role of Valueteam in Purchase Price Allocation

Valueteam is a team of experts specializing in valuation and financial analysis. They play a pivotal role in the PPA process by providing a systematic and unbiased evaluation of assets and liabilities. Here’s how Valueteam can help your organization through the PPA process:

1. Expertise in Valuation: Valueteam comprises professionals with extensive experience in valuing various asset classes, including tangible and intangible assets. They employ recognized valuation methodologies and industry-specific knowledge to ensure accuracy.

2. Compliance: Valueteam is well-versed in accounting standards and regulatory requirements, ensuring that your PPA is in compliance with relevant financial reporting standards, such as the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP).

3. Unbiased Assessment: An impartial perspective is crucial during PPA. Valueteam provides an independent valuation that eliminates bias and ensures objectivity in assigning values to acquired assets and liabilities.

4. Efficiency: PPA can be a time-consuming process. Valueteam’s expertise streamlines the process, allowing your organization to focus on integrating the acquired assets and realizing synergies.

5. Tax Optimization: Proper PPA can have a significant impact on your tax liabilities. Valueteam helps in optimizing tax benefits by appropriately allocating values to different assets and liabilities.

6. Enhanced Decision-Making: Accurate PPA results enable better decision-making. Whether it’s assessing the deal’s profitability or managing post-acquisition integration, having a clear understanding of the asset and liability values is critical.

7. Risk Mitigation: Inaccurate PPA can lead to financial misstatements and potential regulatory issues. Valueteam minimizes these risks by conducting a thorough and compliant valuation.

The Role of PPA in Accurate Financial Reporting and Regulatory Compliance

Purchase Price Allocation PPA has to be instrumental in proper financial reporting and the regulations engulfing an acquisition. The PPA process is so painstaking in assigning the purchase price of all acceptables tangible and intangible assets and assumed liabilities. This elaborate process of accounting is mandatory in order to depict the factual value on the balance sheet as well as in the income statement and this avoids misstatements of finances. Utilizing specialized PPA valuation services for mergers and acquisitions in Singapore ensures that the allocation process is conducted with precision and in compliance with applicable standards. Moreover, when paired with professional company valuation services for strategic business decisions in Singapore, organizations are empowered to make informed decisions that align with long-term financial goals. Among the key benefits of purchase price allocation in financial reporting and tax planning are improved transparency, enhanced investor confidence, reduced risk of regulatory penalties, and more accurate representation of financial health—factors essential to sustaining market integrity and trust.

Conclusion

Purchase Price Allocation through Valueteam is a strategic move for organizations involved in M&A activities or significant asset purchases. By leveraging their expertise, businesses can ensure a transparent, accurate, and compliant allocation of purchase prices, ultimately leading to better financial reporting, optimized tax outcomes, and improved decision-making. Trusting Valueteam to handle your PPA is an investment in the future success of your organization.