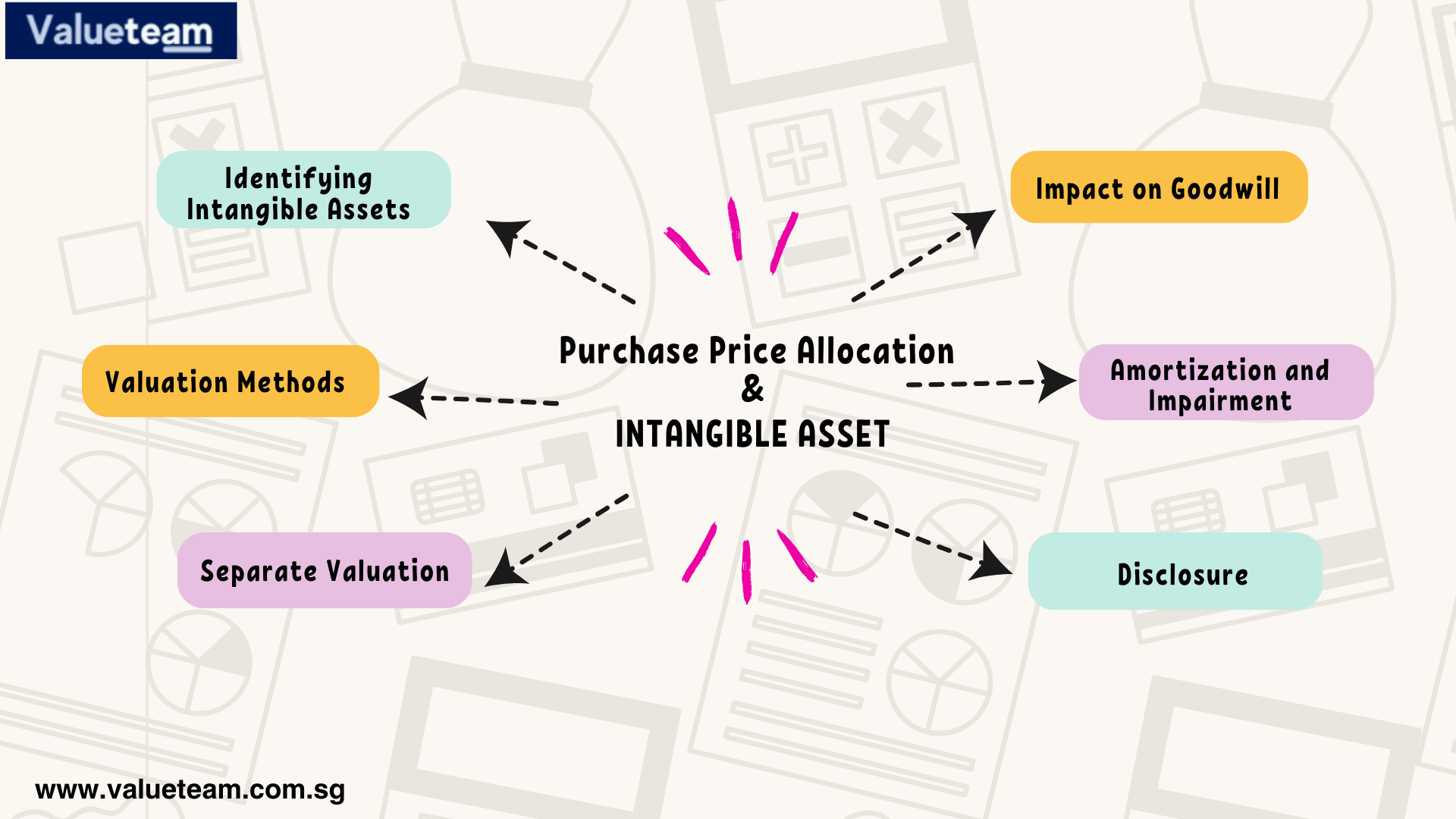

Purchase price allocation is a process of assigning the purchase price to the various assets acquired in a business combination.

The objective of this assignment is to determine the amount of goodwill, if any, that is recognized as an asset on the financial statements of the acquirer.

Goodwill is an intangible asset that arises when one company acquires another for more than its book value (i.e., net assets). It results from paying premium over the fair value of identifiable and separable net assets acquired. Goodwill arises when one company acquires another for more than its book value (i.e., net assets). It results from paying premium over the fair value of identifiable and separable net assets acquired.

business valuation singapore, real estate valuation methods, Company Valuation, Business Valuation Services, all business valuation, company valuation share, ESOP Valuation, Convertible Instruments Valuation, buy side due diligence, Brand Valuation Services, Startup Valuation, sbxhrl, Intangibles Valuation, purchase price allocation, real estate valuation, how to value a company, valuer singapore, valuation value singapore business drivers net tangible assets value$ singapore agricultural companies use fair value for purposes of valuing crops. valuation of tangible assets, ebitda margin formula.

The excess paid over fair value can be allocated among identifiable assets by using specific identification method or by using relative values approach. Specific identification method involves allocating the excess amount among individual assets acquired based on their fair values at acquisition date while Relative Values Approach involves estimating fair values of individual assets acquired based on their proportionate share in total consideration paid by acquirer to seller.

Purchase price allocation (PPA) is the process of allocating the purchase price of an asset to its various identifiable components. The objective of PPA is to allocate the purchase price between those assets that are expected to benefit from the purchase and those that are not expected to benefit from it.

The benefits of PPA include:

A better understanding of the financial effects of an acquisition;

A more accurate calculation of depreciation expense;

The ability to allocate goodwill to identifiable assets;

The ability to value each asset acquired separately for purposes such as impairment testing