What is Private Company Valuation?

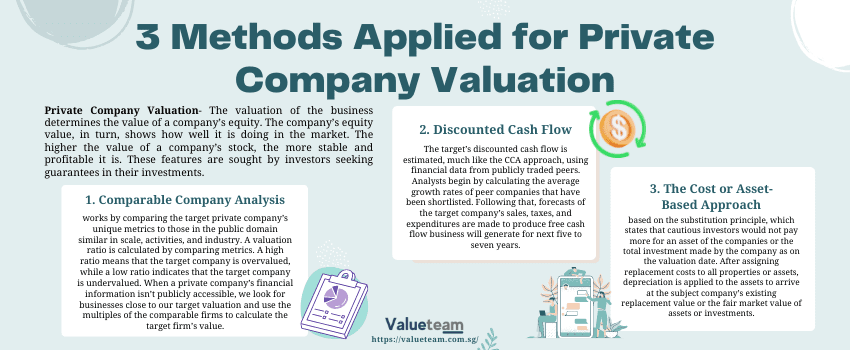

Private Company Valuation: – The valuation of the business determines the value of a company’s equity. The company’s equity value, in turn, shows how well it is doing in the market. The higher the value of a company’s stock, the more stable and profitable it is. These features are sought by investors seeking guarantees in their investments.

Due to the public availability of their financial statements, public corporations are simple to value. On the other hand, private sector valuation is complex and necessitates a professional and meticulous approach to valuation approaches. The method of determining a private company’s current value is known as private company valuation.

Three Methods to Valuate Private Companies

Let’s take a look at the essential methods used to evaluate private companies.

- Comparable company analysis – CCA works by comparing the target private company’s unique metrics to those in the public domain similar in scale, activities, and industry. A valuation ratio is calculated by comparing metrics. A high ratio means that the target company is overvalued, while a low ratio indicates that the target company is undervalued.

When a private company’s financial information isn’t publicly accessible, we look for businesses close to our target valuation and use the multiples of the comparable firms to calculate the target firm’s value. This is the most popular sbxhrl, approach for valuing a private corporation.

- Discounted Cash Flow (DCF) method goes one step higher than the CCA method. The target’s discounted cash flow is estimated, much like the CCA approach, using financial data from publicly traded peers. Analysts begin by calculating the average growth rates of peer companies that have been shortlisted. Following that, forecasts of the target company’s sales, taxes, and expenditures are made to produce free cash flow business will generate for next five to seven years.

- The cost or asset-based approach is based on the substitution principle, which states that cautious investors would not pay more for an asset of the companies or the total investment made by the company as on the valuation date. After assigning replacement costs to all properties or assets, depreciation is applied to the assets to arrive at the subject company’s existing replacement value or the fair market value of assets or investments.

Our Business Valuation Services method has the advantage of not relying on comparables, which are likely to vary from the subject company in significant ways. It’s a sound valuation approach that’s backed up by actual market costs and conditions. The drawback is that this method necessitates a large amount of accurate data and calculations, which take a long time to produce and are also challenging to estimate.

Talk to an expert,

Quickly and Easily

Please call or email contact form and we will be happy to assist you.

What are 4 Benefits of an Independent Valuation?

An Independent valuation defines the process of getting neutral party to conduct a valuation and estimates the value of a property or business.

Let’s take a look at the essential methods used to evaluate private companies.

– Valueteam

Final thoughts: When valuing a private entity, value discounts or premiums should be considered regardless of whether one approach or an average derived from several techniques is used to calculate the value. At Valueteam, we assist the companies to arrive at the fair and proper value of their business. Feel free to contact us to discuss more how we can help you with the valuation of your business