We are a team of valuation professionals, with over 20 years experience in valuations. We provide our clients with the highest quality of professional services and accurate valuations.

We provide an efficient, professional and cost-effective service in all aspects of business valuations. Our strength lies in our ability to deliver high quality service at a reasonable cost.

Our company valuation services are available for most types of businesses from sole traders to large corporations. We can provide you with an evaluation on your business, whether it be for purchase price allocation purposes or for other reasons such as inheritance tax planning or divorce settlements.

We also offer a wide range of other services including:

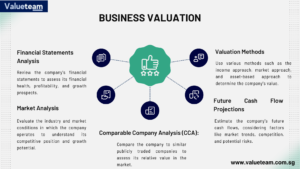

Business Valuation Services

Convertible Instruments Valuation

In addition to providing business valuation services, we also provide property valuation services including residential properties, commercial properties and agricultural land valuations.

Business Valuation Services

We provide valuation services for a wide range of companies and businesses, including start-up and early-stage companies. Our clients include private equity firms, financial institutions, corporate clients and asset management firms.

Company Valuation

Our team of professionals have extensive experience in carrying out valuations for various types of businesses. We have performed valuations for many listed companies as well as private companies. We understand the importance of providing reliable and accurate valuations to our clients.

Business Valuation Services

We have conducted valuations for a wide range of industries including retail, real estate, manufacturing, construction and agriculture sectors. We can assist you with any valuation requirements that you may have whether it be an ESOP valuation or a company valuation share. Our team has extensive experience in all aspects of business valuations including intangible assets, tangible assets and goodwill.

ESOP Valuation

The ESOP (Employee Stock Ownership Plan) is an employee benefit plan that allows employees to invest in their company’s stock through payroll deductions over time. An ESOP valuation determines the fair value of the stock at any point in time during the vesting period so that employees know what they would receive if they chose.

business valuation singapore, Company Valuation, Business Valuation Services, all business valuation, company valuation share, ESOP Valuation, Convertible Instruments Valuation, Brand Valuation Services, Startup Valuation, sbxhrl, Intangibles Valuation, purchase price allocation, real estate valuation, how to value a company, valuer singapore, valuation value Singapore business drivers net tangible assets value$ singapore agricultural companies use fair value for purposes of valuing crops, valuation of tangible assets.