EdTech valuation business drivers and method

EdTech valuation business drivers and method – Technology is no secret affecting different sectors of our everyday life, including education, and over the years, it has immensely affected this sector, leading to its current development. EdTech is a term combining two major sectors, technology, and education. It refers to tools whose primary purpose is to improve the students’ performances and their learning experience. This article will explain the most popular EdTech valuation business drivers. It will discuss some of the drivers of EdTech’s business and their valuations to determine the profitability of this business.

This article details the EdTech business, explaining some of the major drivers that determine the business’s profitability. Also, we will analyze the valuation process of this business to give you an insight into some of the things you must pay attention to about the EdTech business. Read through the information above to understand more about EdTech business drivers and their valuation.

EdTech valuation business drivers

This sector will explain some of the things you must keep in mind when running an EdTech business. It includes a list of the most popular EdTech business drivers and how these drivers influence the industry. Check it out!

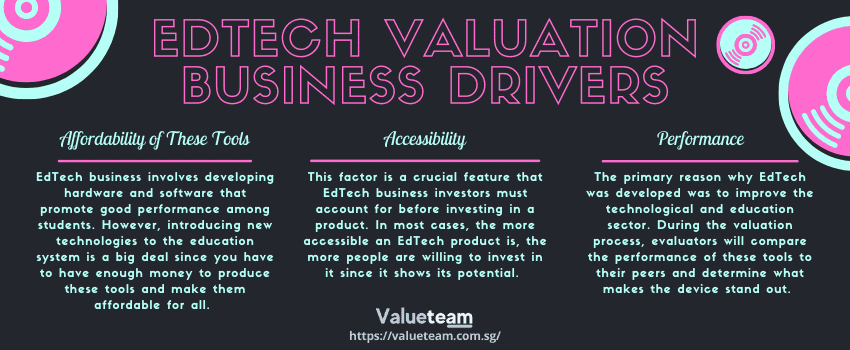

Affordability of these tools: EdTech business involves developing hardware and software that promote good performance among students. However, introducing new technologies to the education system is a big deal since you have to have enough money to produce these tools and make them affordable for all. When investors determine if an EdTech business is worthy of their time, they must check its affordability in the valuation report. Many investors will go for an affordable product; hence, many people can comfortably access the products.

Accessibility: This factor is a crucial feature that EdTech business investors must account for before investing in a product. They answer the questions, how accessible this product is and what devices you need to access it. In most cases, the more accessible an EdTech product is, the more people are willing to invest in it since it shows its potential

Performance: The primary reason why EdTech was developed was to improve the technological and education sector. During the valuation process, evaluators will compare the performance of these tools to their peers and determine what makes the device stand out. In most cases, investors will only consider a business will great performances since good results come with better numbers.

How to evaluate an EdTech business?

They are several ways to evaluate EdTech companies depending on their current state. They include:

Pre-revenue valuation: This method applies to startup EdTech businesses where you evaluate the products and their worth in the market to determine their value.

Established companies’ valuation: The method applies to well-established companies where evaluators use financial records to value the company.

Selling vs. investing valuation: When selling your business, you mainly base your valuation report on the maximum value of the products and services of the company. However, in the case of an investment plan, evaluators base it more on the potential of the business and the current financial figures.

Talk to an expert,

Quickly and Easily

Please call or email contact form and we will be happy to assist you.

Fintech Company & its Drivers – Valuation Process

This article explains some of the most popular drivers of EdTech companies and the methods of valuation.

This article will explain the most popular EdTech valuation business drivers. It will discuss some of the drivers of EdTech’s business and their valuations to determine the profitability of this business.

– Valueteam

Conclusion

EdTech companies are becoming popular as people embrace technology in the education sector. It allows students to access tools that make studying fun and more effective. This article explains some of the most popular drivers of EdTech companies and the methods of valuation.