How Valuation Strengthens Fundraising Strategy for Startups

Introduction: Certified Startup Valuation and Fundraising Course

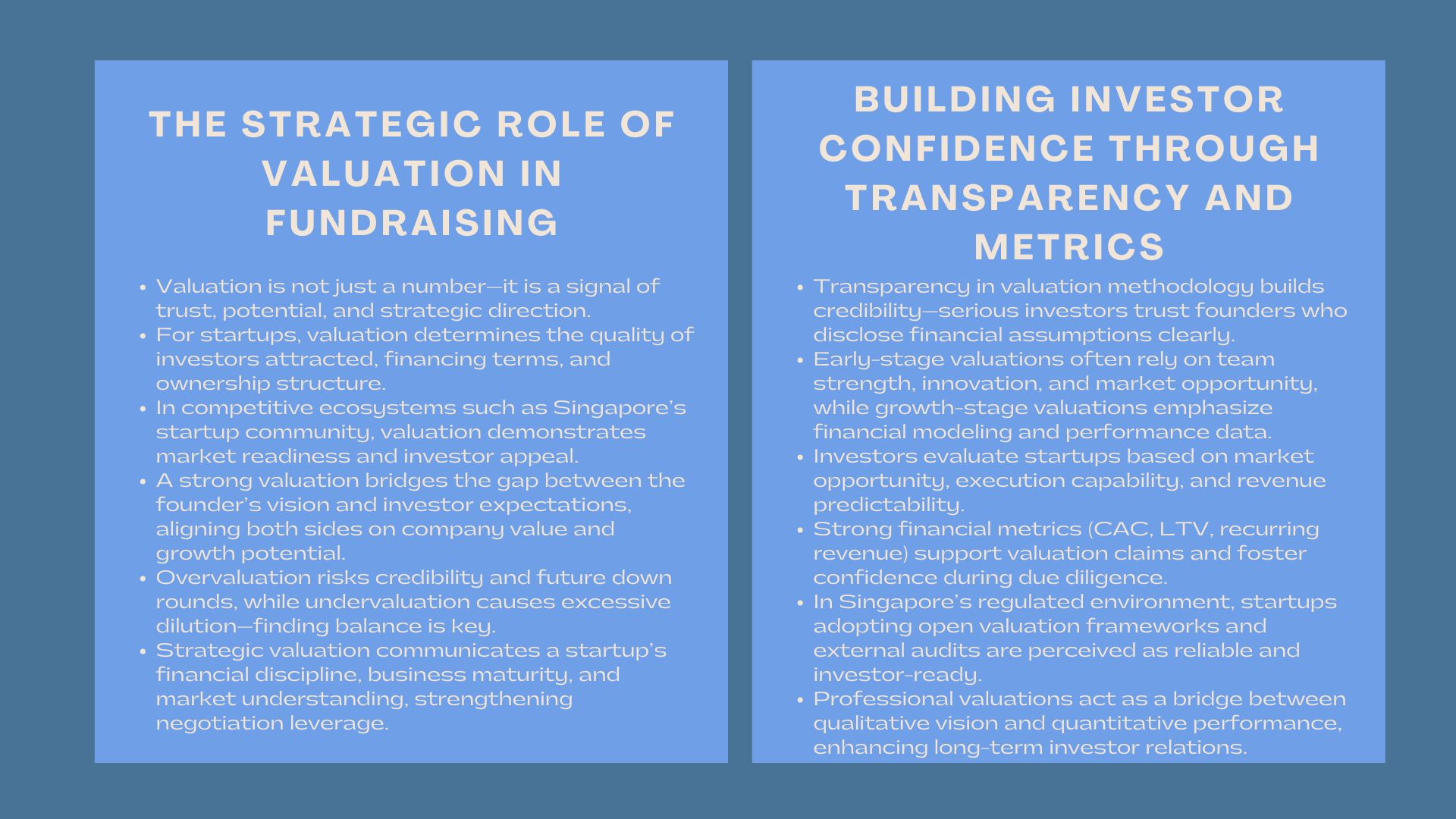

In the case of startups seeking investment, valuation does not simply mean being able to pick a number on the company but a sign of potential, trust, and strategic positioning. The valuation disclosed by a startup can have a direct impact on the caliber of investors it will appeal to, the amount of capital it gets in the form of financing, and even the terms of its capital sources. Within the dynamic Singapore startup community of capital-rich, competition-heavy ecosystems, it is essential to have a sense of how valuation would contribute to the wider foundraising approach.

This article discusses the role of valuation in instilling investor confidence, influencing the nature of negotiation, and creating long-term value in startups that can achieve sustainable growth.

The Strategic Valuation in Fundraising.

The Strategic Valuation in Fundraising.

The valuation is a gap between the vision of a startup and the expectations of an investor. It assists in the process of aligning both sides concerning the value of the company in the present and its future. An under-priced startup can sell too much equity at too early a time, whereas an over-priced startup runs the risk of undermining its own credibility and not living to its commitments on the side of its investors.

Perception and Negotiation Leverage by the investor.

Valuation is regarded by investors as a measure of business maturity, financial discipline and strategy. The startups that are supported by data-driven predictions, market penetration, and scalability have better negotiation power. The clear valuation models are also useful in ensuring that the entrepreneurs do not fall into the trap of overpromising future growth.

Developing Trust by Becoming transparent.

The openness is an important factor to draw in serious investors. Reporting of valuation techniques and financial assumptions is professional and less risk is perceived. In the highly regulated investment climate of Singapore, startups found to exercise open valuation regimes are regarded as better trusted and open to investment.

Valuation Dynamics, as an Investor, and as a Startup Founder.

Valuation in the Early-Stage vs Growth-Stage.

During the seed or a pre- seed level, valuation is usually based on qualitative considerations including team strength, product potential and market opportunity. Investor confidence in startups increases with the quantitative data as an increase in revenue, user retention, and profitability trends.

For growth-stage companies, fundraising valuation strategy Singapore emphasizes financial modeling accuracy and market comparability. The founders have to strike a balance between the expectation of investors and the actual forecasts so that they can be credible in further funding rounds.

The Drivers of Valuation that Investors Like.

There are usually three important value drivers that are evaluated by investors:

- Market Opportunity The startups in spurring markets like fintech, sustainability, or healthtech tend to be valued higher because of the scalability opportunities.

- Execution Capability – Clarity of go to market strategy and strong leadership team go a long way in enhancing investor confidence.

- Revenue Predictability – Startups that have recurring revenue streams or long term contracts amount to less risky investments.

There must be a clear fundraising plan that would communicate the ways in which these factors would translate to value creation in the long run.

Fundraising Common Valuation Approaches.

Although conventional valuation models are commonly modified to suit startups, it is necessary to know what approach can best reflect your company.

Similar Company Analysis (CCA).

The approach compares the start-up to other similar firms which have recently raised capital or were acquired. Founders can also set their business competitively in the market by comparing the revenue multiples or the valuation bases on the number of users.

Discounted Cash Flow (DCF)

DCF is still a conventional method of mature startups that have forecastable income. It values future cash flows to the present value, projecting the future of the cash flows. But with young companies, this approach is less reliable due to the limited historical data.

Venture Capital (VC) Method

The trend computes post-money valuation in terms of expected returns at exit (i.e., IPO or acquisition). It is very helpful among venture investors that would need to estimate the potential of a startup based on their target ROI.

Method of Scorecard and Risk Factor Summation.

The models are popularly applied when the start-up is in its early stages and there is a lack of traditional metrics. They use qualitative benchmarking of such qualitative factors as team strength, market potential and product innovation as a basis of determining valuation.

Balancing between Valuation and Fundraising Objectives.

Determining the Right Pre-Money and Post-Money Valuation.

It is essential to understand pre-money and post money valuation. An overvaluation will cause unrealistic pressure of performance in the future and down rounds and undervaluation will cause excessive dilution of the equity. Founders need to find a balance that will ensure that investors remain attracted, but at the same time preserve long-term ownership.

In Singapore, startups have a tendency to use valuation professionals to make assumptions and present data that appeals to local and regional investors. The availability of the justification of every input to valuation boosts credibility in the due diligence.

Creating Investor Confidence by Metrics.

Investors want the transparency of alignment of valuation and company areas of business metrics. Valuation claims can be proved by demonstrating an increase in recurring revenue, customer acquisition cost (CAC), and lifetime value (LTV) ratios. Regular reporting and high forecast accuracy enhance investor relations and lead to better fundraising performance.

The Prelude Between Valuation and Startup Strategy.

Valuation is not a calculation that is made only once- it keeps on increasing with each funding round, and strategic step. This aggressive model is appropriate in the sense that the valuation will capture the real business progress and not the hype.

Enhancing good Governance and financial Discipline.

The institutional investors are keen on startups that have good governance structures and financial controls. Introducing open accounting systems and audits are indicators of maturity, which positively influences the plausibility of the valuation.

Enhancing Intangible Value

In addition to the financial, startups have the opportunity to increase valuation by improving intangible assets like intellectual property, brand equity and strategic partnerships. These are the factors that make the company stand out among others within a saturated market and appeal to investors who have long term expansion prospects.

Exploiting Professional Advisors on Valuation.

Use of independent valuation consultants has the effect of guaranteeing objectivity and adherence to accounting and regulatory standards. The advisors do not only confirm assumptions but also offer benchmarking skills that are in line with investor expectations.

Startups doing Series A or B startup can take advantage of third-party analysis that will convert performance into quantifiable financial value. This external confirmation will not only soothe the investors but will also help to make the negotiations easier.

Maximizing Pre-fundraising Valuation.

Founders should also undertake internal valuation review to find out the strengths and weaknesses before approaching investors. The most common areas that can affect the investor perception are customer retention, stability of cash flow, and scalability of products.

Applying cost-effective expansion plans and traction through milestones may greatly augment valuation just before fundraising rounds. Statistical storytelling- with financial forecasts- would assist investors in imagining the business expansion opportunities.

Generating Post-Fundraising Round Long-Term Value.

Valuation must be an instrument of future growth as opposed to a temporary fund-raising victim. Businesses that focus on sustainable business models, quantifiable KPIs, open governance still find it easier to bring in capital in future rounds.

Within the framework of the Singapore startup ecosystem, founders that incorporate valuation strategy into their overall growth strategy are in a better position to grow on a global scale without losing confidence of their investors.

For entrepreneurs looking to secure equity funding, focusing on startup pre-money valuation tips can provide an edge in negotiations, ensuring that their company is not only investment-ready but also strategically aligned with market expectations.

Conclusion

The properly established valuation plan will enhance investor confidence and capital-raising possibilities. Having valuation that meets financial performance and governance as well as strategic vision, startups will be able to present themselves as serious, high-potential investments. After all, valuation is not only about numbers, but also readiness to grow, resilience, and a good perspective of the future.