Cross-Border IP Valuation: Managing Transfer Pricing Risks in ASEAN

The Certified Cross-Border IP Valuation Training ASEAN

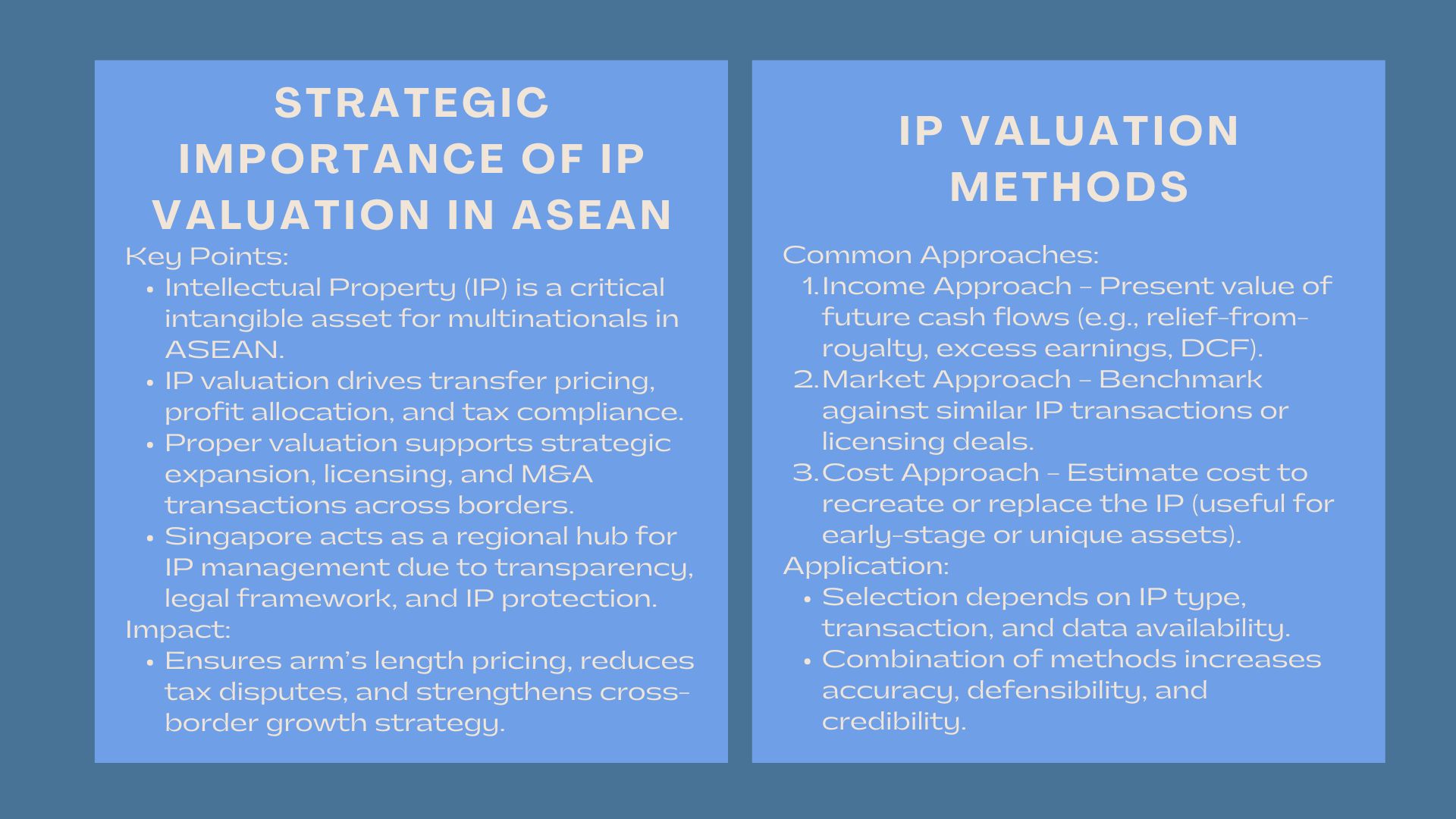

With the increased activities of multinational firms in the Southeast Asian region, intellectual property (IP) has become a crucial subject of management and determination of value of intellectual property as a taxation requirement as well as in strategic value realization. The interlinking economies of ASEAN, spearheaded by Singapore, Malaysia, Thailand, Indonesia and Vietnam, present huge potential on the cross-border expansion. They are however also associated with complex regulatory issues especially with regard to transfer pricing and IP ownership set ups.

This article discusses the use of accurate IP valuation as the basis of efficient transfer pricing management, its importance in compliance, and ways of businesses to reduce risks in intellectual property cross-border transactions.

The Strategic Value of IP Valuation across Borders.

The Strategic Value of IP Valuation across Borders.

The presence of intangible assets like patents, trademarks, copyrights and software in the modern economy that is knowledge based has a major part in enterprise value. These assets are regularly exchanged or licensed across borders as businesses internationalize and the subsidiaries transfer them amongst themselves. These transactions should be valued at arm length in order to meet the tax laws and not to create conflict with the authorities.

IP as a Catalyst of Transfer Pricing.

The core of the transfer pricing is in the intellectual property as it directly determines the distribution of profits across jurisdictions. When a Singaporean parent company licenses the technology or trademarks to their subsidiaries in the neighboring ASEAN markets, the authorities want the pricing of such transactions to be at the real value in the market. This demands solid and justifiable valuation regimes, which do not contradict OECD Transfer Pricing Guidelines and domestic tax regulations.

The Role of Singapore in ASEAN IP Valuation

Singapore has emerged as the regional hub for cross border IP valuation Singapore due to its transparent legal framework, advanced financial ecosystem, and strong protection of intellectual property rights. In Singapore, a lot of multinational corporations set up holding companies or IP management enterprises that centralize the ownership and facilitate licensing with the ASEAN. Singaporean based valuation professionals are central to the establishment of fair value of cross-border IP transfers and compliance with both the local and international standards.

Getting to know the Transfer Pricing Risks in ASEAN.

Risks of transfer pricing occurs when the transactions between companies are not priced in accordance with the realities in the market and this results in a possibility of correction on the part of the tax authorities. These predicaments are exacerbated by the varying regulatory environment of members of ASEAN because every nation has its interpretation of what constitutes arm length rules.

Disagreement in Taxation within ASEAN.

Most countries within the ASEAN have picked up transfer pricing frameworks as are being practiced by OECD, but the implementation and documentation criteria differ significantly across countries. As an example, Malaysia and Indonesia are attached to modern documentation whereas Vietnam and Thailand are inclined to demand advance pricing agreements (APAs) to conduct multifaceted IP transactions. This heterogeneity redoubles the necessity of standard and open-minded assessment of the intangible assets.

Common Risk Triggers

A number of factors increase transfer pricing risk in cross-border IP arrangement:

- Poor Valuation Evidence: The absence of supporting royalty rates or licensing fee using credible valuation reports.

- Intangible Migration Problems: The transfer of ownership of IP to low tax havens without sufficient economic reality.

- Misaligned Profit Attribution: Exceeding/ underspending profits between parent and subsidiary organizations.

- Regulatory Scrutiny: Scrutiny by tax authorities of IP-intensive sectors like technology, pharmaceuticals and consumer products is also on the rise.

These problems demand not only compliance but a strategic vision of the design of models of IP ownership and licensing.

Important Multinational IP Valuations.

An IP valuation, which is defensible, must prompt the utilization of global recognized methods, which are compliant with the IFRS and OECD ideals. Selection of method will vary according to the nature of the IP, availability of data and type of transaction which is involved.

Income Approach

In this method, the present value of the future cash flows that can be assigned to the IP are estimated. The most popular methods are relief-from-royalty method, excess earnings method, and the discounted cash flow (DCF) analysis. They are popular in patents, trademarks and software where future earnings are foreseeable.

Market Approach

The market method involves matching the recent deals of similar IP assets with the fair value. Although data may be scarce in ASEAN markets, the approach is useful to benchmark royalty rates and assumptions corroboration.

Cost Approach

The cost approach values are estimated at the cost of recreation or replacement of the IP. It is very common in cases with early-stage technologies or unique proprietary systems whose income projections are not clear.

The ASEAN Perspective on Valuation

Given the diversity of business environments across the region, intangible asset valuation ASEAN demands local market knowledge combined with international valuation standards. As an illustration, the process of valuing a brand applicable in various ASEAN nations has to take into account market share, purchasing power and economic situation in each jurisdiction in order to establish rightful and justifiable transfer prices.

Transfer Pricing Risk Management Strategies.

Ongoing transfer pricing risks involving IP-related valuations in ASEAN cannot be dealt with successfully without recurring valuations. Firms need to implement holistic approaches that entail legal, financial and operational acumen.

Installing Robust Valuation Documentation.

Far-reaching documentation is the fundamental pillar of conformity. Independent valuation reports should be prepared on each intercompany transaction as to methodology, assumptions, and supporting data. This guarantees openness and believability to the taxation bodies.

Application of Advance Pricing Agreements (APAs).

APAs offer a preventive way of resolving conflicts. Companies can minimize future penalties and adjustments in valuation and pricing methods by pre-agreeing with tax authorities on valuation and pricing methodologies. Singapore, Malaysian and Indonesian governments have been promoting the application of bilateral and multilateral APAs in the transactions of IP.

Aligning Economic Substance and IP Ownership.

Governments in ASEAN are increasing controls on the form over substance. The ownership of IP by other entities should be real in operation as far as it has its functions in the IP to be classified as an operational activity, including R&D, management teams, and authority to make decisions in order to warrant profit distributions.

Regular Valuation Reviews

Business models, market conditions and royalty rates change. Regular reappraisal of IP assets will ensure the transfer pricing is not out of control but rather in line with the prevailing economic reality reducing chances of retroactive adjustments.

The Role of Professional Advisors.

Since cross-border dealings are complex, it is important to have professional valuation advisors. Independent experts introduce technical rigor, industry standards and cross-jurisdictional skills that make sure that valuations are compliant and defensible.

Specialized advisory firm in Singapore is a combination of both financial modeling and in-depth understanding of the ASEAN regulatory frameworks to provide powerful valuation advice to the tax planning, transfer pricing audits, and M&A due diligence.

Conclusion

Cross-border IP valuation is not a legal obligation but is a strategic option in the present global economy. The company can reduce transfer pricing risks and maximize value creation in the ASEAN markets with a clear understanding of local tax regulations, good valuation processes, and clear records of documentation. Under such a competitive regime where intellectual property is a source of competitive advantage, mastering the science and art of IP valuation is a source of compliance and sustainable development.