Many business owners put off having their business valued because they don’t understand the process or think it’s too complicated. However, understanding the value of your business is vital to making informed decisions about its future. In this article, we’ll break down the basics of business valuation to better understand what it is and why it’s essential.

Communication

One of the essential skills in business valuation is the ability to communicate your findings and recommendations effectively. Communicating means clearly and concisely explaining your analysis and conclusions to clients, colleagues, and other stakeholders. It also involves being able to understand feedback and questions and adjusting your approach as needed.

Good communication skills are crucial for any business professional but essential for those involved in business valuation. If you want to supersede in this field, brush up on your communication skills and be confidence!

Organization

The ability to properly value a company is an essential skill in today’s business world. After all, valuation is critical in any significant business decision, from mergers and acquisitions to initial public offerings.

But what exactly is a business valuation? And how can you hone your skills in this critical area?

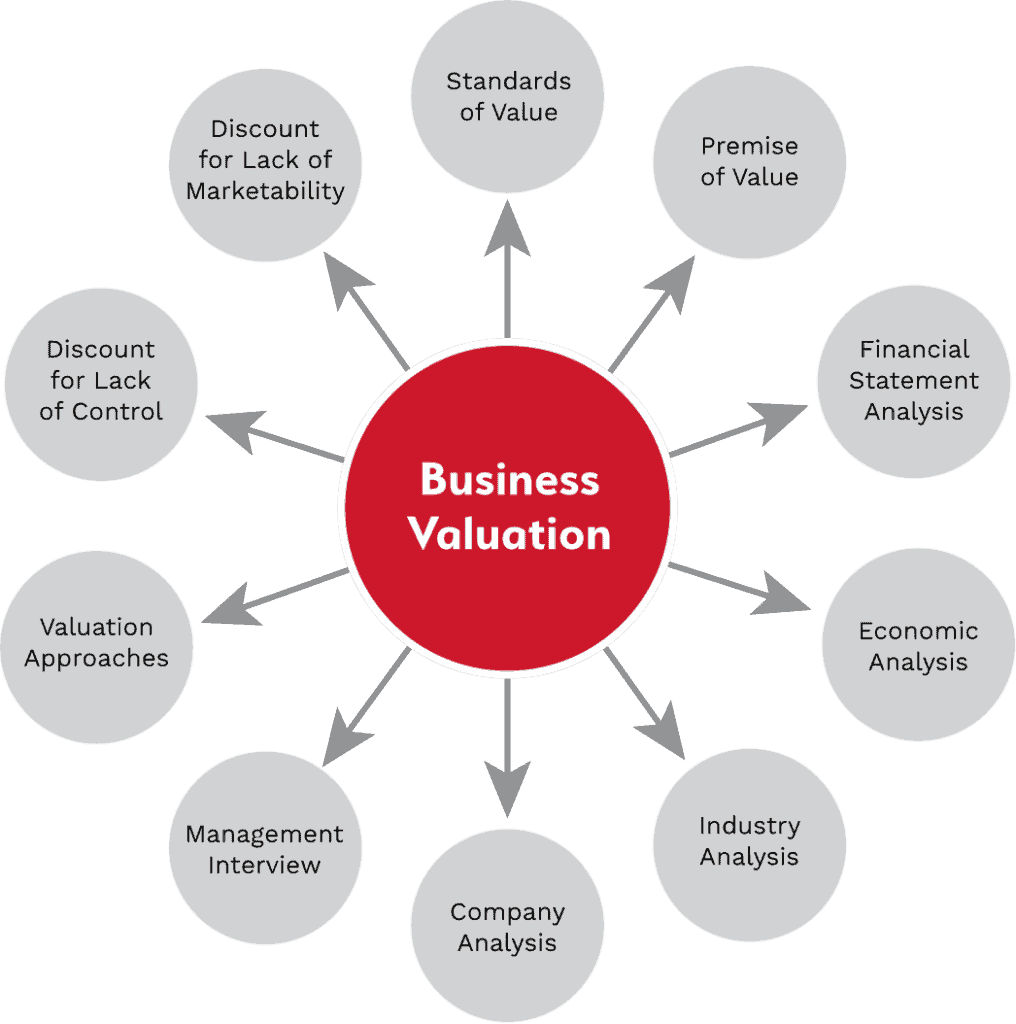

Simply put, business valuation is the process of determining the economic worth of a company. This can be completed in some ways, but most commonly, it is done by analyzing the company’s financial statements and evaluating its market position.

Several techniques can be used to value a company, but the most important thing is to use the correct technique for the situation. After all, each company is unique and each valuation situation is different.

The best way to learn how to value a company properly is to get experience doing it. Several online resources can help you hone your skills, but nothing beats working on real-world valuation projects.

So if you want to extend your business valuation skills, remember that experience is the best teacher. Get out there and start valuing some companies!

Curiosity

If you’re like most people, the words “business valuation” probably makes you think of dusty old ledgers and complex financial formulas. But the truth is, valuing a business is more an art than a science – and it’s a skill anyone can learn with a bit of practice.

Whether you’re interested in buying or selling a business or simply want to understand your company’s value for estate planning or investment purposes, understanding business valuation is an essential skill. Here are some tips before you get you started:

1. Know the basics. Business valuation is all about estimating the future economic benefits that a company will generate such as identifying their financial report. This includes things like future earnings, cash flow, and asset values.

2. Do your research. When valuing a business, it’s essential to understand the industry and the specific company you’re dealing with. Research means doing your homework and gathering as much information needed as possible.

3. Use multiple methods. There is no true way to value a business – different businesses will require different approaches depending on their type of business and the codition. The key is to use multiple methods and compare your results to see which makes the most sense.

4. Be conservative. When in doubt, it’s always better to err on the side of caution. This means being conservative in your estimates and assumptions.

5. Get help if you need it. Business valuation can be complex, so don’t be afraid to seek out professional help if you need it.

Professional Scepticism

As a business valuation professional, it is essential to maintain a high level of scepticism throughout the valuation process. This means being critical of the information you are given and the methods you use to value the business.

While it is essential to be sceptical, you must be open to new information and willing to change your opinion if the evidence supports it. A good business valuation professional constantly learns and grows, adapting their methods as new information becomes available and must suits to the business the are valuing as well.

If you can maintain a healthy level of scepticism in your work, you will be well on becoming a top-notch business valuation professional.