Best-Rated IP Valuation Consultants in Singapore and Malaysia

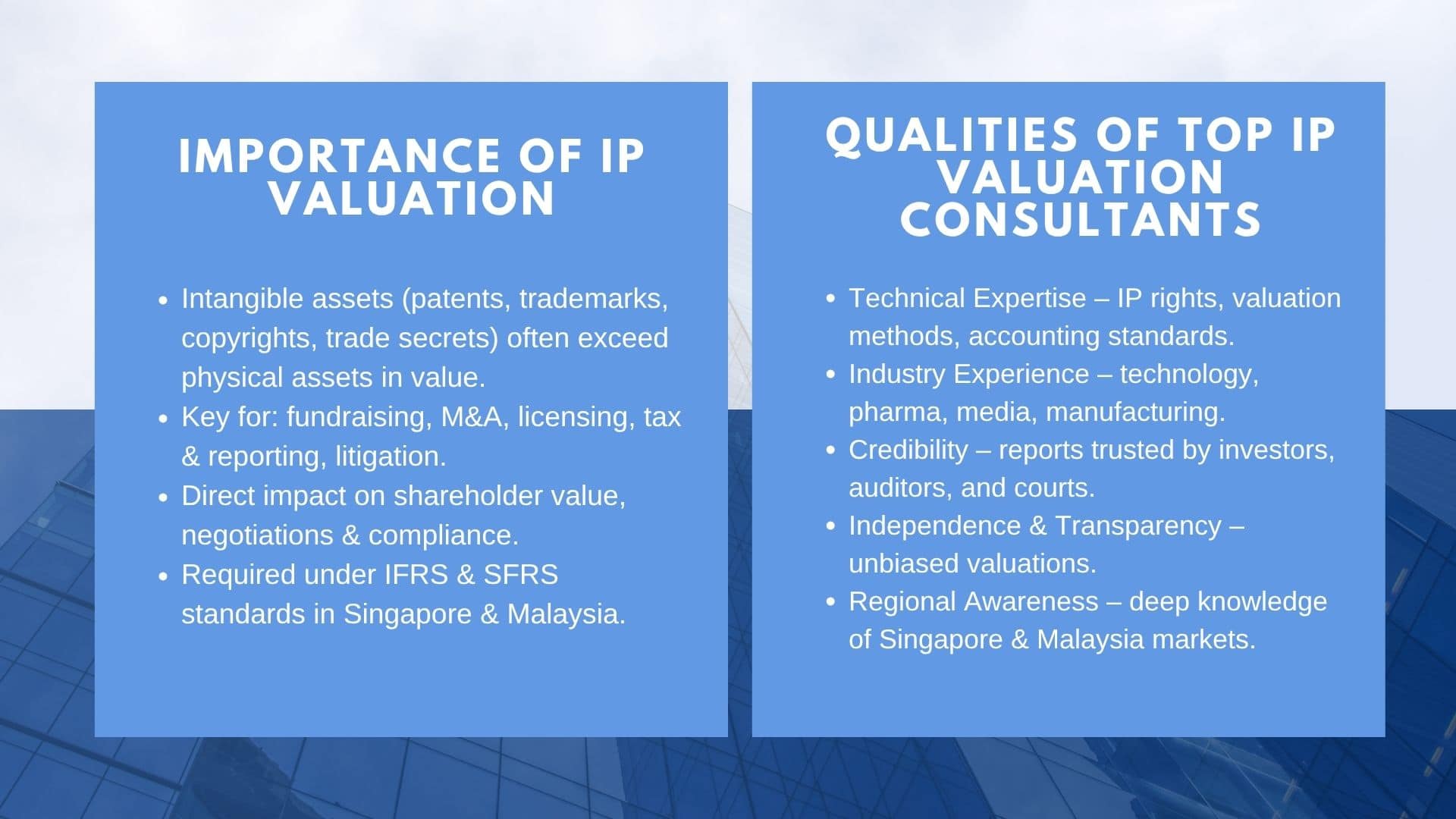

In the modern economic world that is knowledge intensive, intangible property like patents, trademarks, copyrights and trade secrets can be worth more than physical property or equipment. In the case of businesses in Singapore and Malaysia, an adequate valuation of these intellectual property (IP) assets is key in the raising of funds, mergers and acquisitions, licensing, and general corporate strategy. As business development revolves around innovation and digital transformation, the need to hire the highly rated intellectual property valuation consultants in Singapore and Malaysia has increased tremendously.

Some of the leading valuation service providers in the area, specialised IP consultants are unique in that they provide strong, transparent, and defensible valuations that may be used to support financial reporting, investor negotiations, and legal compliance.

Why Intellectual Property Valuation is Essential

Why Intellectual Property Valuation is Essential

Most companies do not properly estimate the value of intangible assets in their possession. Future revenues and competitive position can be motivated by a robust patent system, a well-known brand, or proprietary technology. The valuation of these assets does not only serve as a scholarly exercise, but also it can impact straight to the shareholder value, negotiations with investors, and even taxes.

As an illustration, in case of a Singaporean technology startup with a planned Series A fundraising, an IP valuation may be required to prove its enterprise value to investors. In the same way, a Malaysian manufacturing firm whose designs are proprietary could need an IP valuation in an M& A transaction to have a fair price. In each of the two instances, the valuation credibility directly affects negotiations and results. Moreover, both Singapore and Malaysia regulatory systems tend to insist on formal valuation of intangible assets, in particular, in the accounting standards like IFRS and SFRS. IP valuation is also used by companies in the financial reporting, impairment testing, litigation, and transfer pricing.

What Does it Take to Be a Good IP Valuation Consultant?

Not all valuation companies are experienced to deal with IP. It involves expert understanding of intellectual property legislation, industry unique dynamics, and superior valuation techniques. Financial experience should be coupled with legal and technical knowledge, which are the best consultants. The following are some of the qualities to consider:

- Technical Expertise: experience in the IP rights, international accounting standards, and the valuation methods.

- Industry Experience: Industry experience in such industries as technology, pharmaceuticals, media, and consumer goods where IP value is a key factor.

- Credibility: The reports are to be auditable and acceptable by the regulators, investor and courts.

- Independence: Objectiveness is important particularly during disagreements or negotiations

- Regional Awareness: Awareness of business environment in Singapore and Malaysia is vital towards good benchmarking.

Singapore: A Hub for IP Valuation

Singapore has established itself as a global IP hub, with robust legal systems, government efforts and an economy that is innovative in nature. The Intellectual Property Office of Singapore (IPOS) is also vigorously working towards the management and monetization of IP and thus valuation is a good service to both corporations and startups.

Businesses in Singapore often turn to professional IP valuation advisors for businesses in Singapore and Malaysia when planning fundraising, negotiating licensing deals, or preparing for M&A transactions. With global investors scrutinizing local firms, having an independent and credible IP valuation adds significant weight to financial and strategic discussions.

Malaysia: Growing Importance of IP Valuation

In Malaysia, awareness of IP valuation has risen as more businesses innovate in sectors such as biotechnology, creative industries, and advanced manufacturing. Regulatory bodies and investors increasingly expect companies to demonstrate the financial value of their intangible assets.

For SMEs and family-owned businesses, IP valuations are especially relevant during succession planning, shareholder exits, and cross-border deals. The best-rated consultants in Malaysia are those who combine global valuation methodologies with a local understanding of industry practices and market conditions.

Practical Scenarios Where IP Valuation Matters

- Fundraising: Startups that have patents or proprietary software require believable valuations to win the trust of investors.

- Mergers & Acquisitions: The buyers and sellers have to have justifiable valuations to negotiate IP-induced premiums.

- Licensing/Joint Ventures: The valuations conclude the royalty rates and the terms of sharing revenues.

- Tax and Transfer Pricing: It is a common practice that governments sometimes need appraisals of cross-border IP transfers.

- Disputes and Litigation Courts use independent valuation in order to resolve IP conflict.

Why Work with Best-Rated Consultants

The value of an IP valuation lies not just in the numbers but in its acceptance by stakeholders. Investors, auditors, and courts will only rely on reports produced by credible consultants. Choosing the best-rated intellectual property valuation consultants in Singapore and Malaysia ensures that your valuation stands up to scrutiny and supports your strategic goals.

Best consultants on this front can typically offer:

- Personalized recommendable that takes into account the IP portfolio specificities.

- Comprehensive reports were in line with international and local accounting standards.

- Having worked in a large variety of industries.

- Open procedures and suppositions.

Consideration of Cost and Timeline.

IP valuation is a cost that is determined by complexity. There can be no problem with valuing a single trademark, whereas evaluating a portfolio of patents, copyrights, and trade secrets is something worth analyzing. Fees are usually based on the complexity, industry, and purpose (fundraising, M&A, litigation, or reporting).

The timeframes may take as little as two weeks in the case of simple cases or as many as several months in the case of the multi-jurisdictional valuation. Client preparation – the client can provide financial statements, IP registrations, and licensing agreements among others, which would make the process much quicker.

Comparison of the Market of Singapore and Malaysia.

Although the demand of IP valuation is also rising in both countries, Singapore has an advantage in terms of infrastructure, presence of investors around the world and government initiative of IP. Malaysia, though, is closing the gap very fast especially in manufacturing and creative aspects.

Consistency and credibility are guaranteed to those regional businesses with operations in both markets by hiring consultants who are familiar with Singapore and Malaysia. Most leading companies are already cross-border and therefore they are in a good position to offer integrated services.

Things to Ask Before Hiring an IP Valuation Consultant

- Have they exposure in your industry?

- Do auditors and regulators accept their reports?

- What valuation methodologies will they apply, why or why not?

- Are they able to give some examples of successful engagements in the past?

- Will the final report contain detailed information and documentation?

Conclusion: Best-Rated IP Valuation Consultants in Singapore and Malaysia

The most valuable component of a business in the contemporary economy can be intangible assets. They have to be well valued in order to raise funds, do acquisitions, licensing, and long-term strategy. The Singapore and Malaysian environment is also providing an increasing pool of valuation professionals, but the businesses must make wise decisions, highlighting why IP valuation matters for businesses in Singapore & Malaysia.

The companies can actually have more than just numbers by contracting the best-rated intellectual property valuation consultants in Singapore and Malaysia, they are assured of credibility, confidence, and strategic leverage. Businesses in Singapore and Malaysia should get the cooperation of professional IP valuation advisors when assuming partnerships with startups, SMEs, and even corporates; hence, making sure that the most valuable assets of any business are well identified and exploited.