IFRS 32 & IFRS 9 Hybrid Instruments: Why Valuation Drives Classification and Measurement

Introduction to IFRS 9 Certified Hybrid Instrument Program

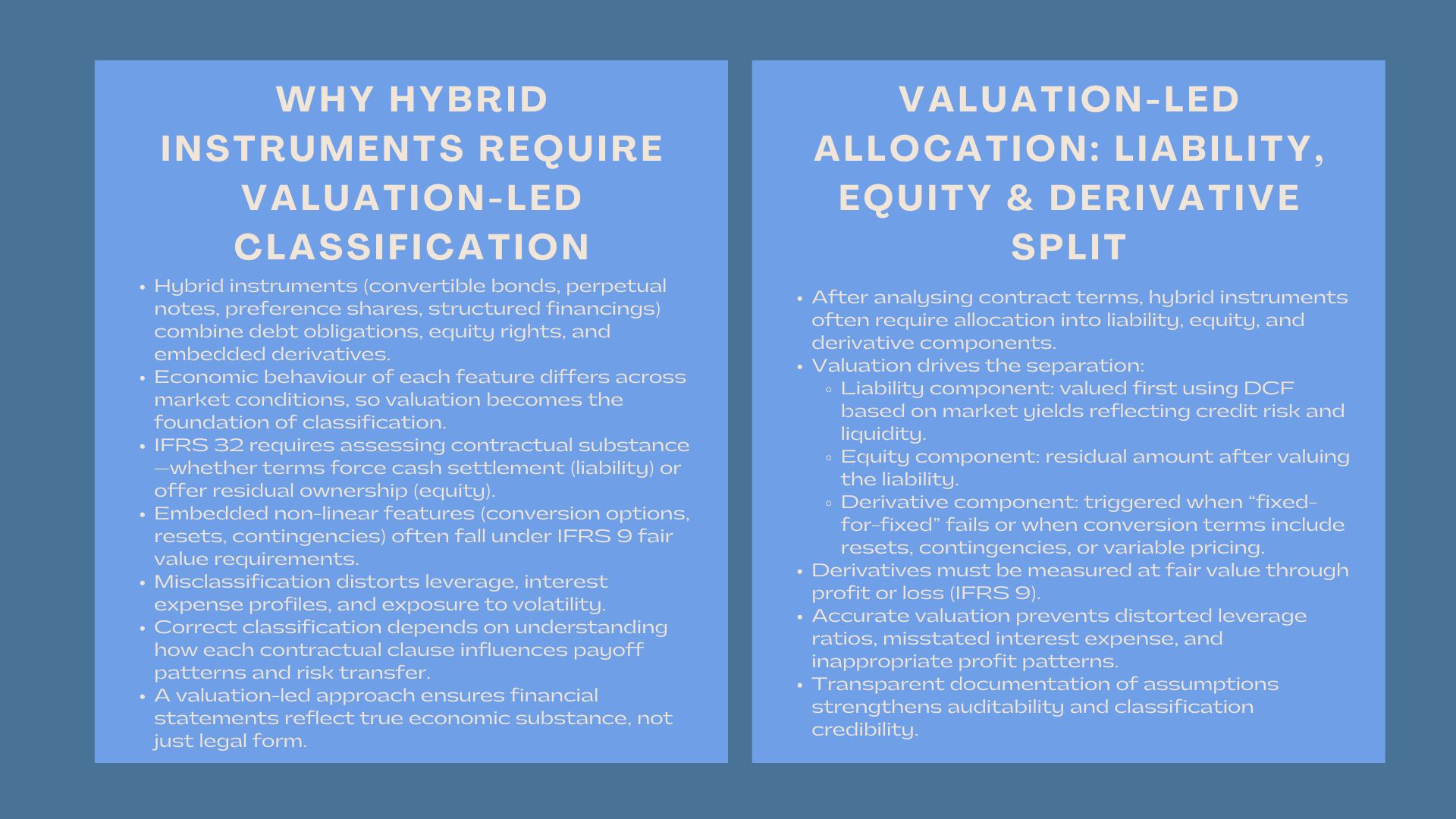

The growth of hybrid financial instruments has been seen where companies sought to find a way of adopting the flexible financing structure by combining elements of debt and equity along with integrated derivatives into a single structure. Instruments like convertible bonds, perpetual notes, preference shares, and contingent right cases, and structured financing contracts typically have various components which do not behave in an economic or accounting sense in the same manner.

The approach to classify and measure such instruments is presented in the IFRS 32 and IFRS 9, although the actual facts are that many of the judgments needed to use the standards in the right way are dependent on valuation decisions.

The difficulty of the matter is that hybrid instruments will hardly fit into traditional definitions. Their payoff programs can feature contractual arrangements, which are like debts, discretionary provisions, which are like equities, and derivative provisions which create a tendency to be subject to non-linear risks. Such a mix has necessitated the systematic and valuation based approach to identify the contractual rights that have the liability and equity interests, and to identify the contractual rights that might need to be measured separately at fair value.

In case of inaccuracies in IFRS 32 debt-equity split valuation methodology for hybrid instruments with complex conversion terms making classification decisions, the financial statements can be inaccurate in reflecting leverage, capital strength, profit trend, and exposure to risk. Since the hybrid instruments impact on the statement of financial position and pattern of the recognition of the profits with the course of time, the accurate valuation in the beginning and continuous basis is the key to the sufficient financial reporting.

Debt vs Equity Split: Understanding How Contractual Rights and Obligations Determine Classification Under IFRS 32 Before Valuation Occurs

Debt vs Equity Split: Understanding How Contractual Rights and Obligations Determine Classification Under IFRS 32 Before Valuation Occurs

The initial thing in the analysis of a hybrid instrument is to find out which the elements constitute the financial liability and which are equity. Within the IFRS 32, the instruments are not distinguished by the legal form but by the content of the contractual agreement. A financial liability will result where the issuer is obligated by contract to make cash or a different financial asset payment. Conversely, an equity element occurs when the issuer is bound by the delivery of a fixed number of its own equity instruments or the obligation of the issuer is complete based on the issuer side.

The hybrid instruments usually lie on the intersection point of the liability and equity. The convertible bond which makes interest payments is basically a liability as the issuer owes money to provide the cash as per the agreement. The conversion option available in such a bond can however be viewed as equity should it give the holder the ability to convert the option into a fixed number of shares at a given price.

The co-existence of these two binding demands the instrument divides into different parts. On the other hand, when there is variability in the conversion formula, say, by varying the conversion ratio in accordance with future share price or market events, the embedded feature can be alternatively cited as a derivative liability measured at fair value.

Depending on the instrument in question, the classification procedure thus relies a lot on the more sophisticated technicalities of the contractual terms such as contingent rights, redemption-focused arrangements, the mechanics of the interest, the maturity structure, and the conversion arrangements. Minor differences in language in contracts can make the difference in classification by a great margin.

According to IFRS 32 classification should be used at the time of first recognition, and as long as the contract is not changed again it should be used again. Due to this, the entities are required to code a thorough analysis of the contract utilised by a valuation modelling to comprehend the behavior of every characteristic under possible conditions.

Compound Instruments: Valuation-Led Allocation of Proceeds Between Liability and Equity Components to Reflect Economic Substance

After the division of components, compound instruments have to be classified into both equity and liability components. The IFRS 32 stipulates higher first transaction proceeds, which is done under a relative fair value. This implies that valuation takes centre stage since the value of the liability element is to be calculated without considering the equity and thereafter the proceeds of the issue of the entire matter is to be distributed.

As an example, a convertible bond that is issued at par can be considered. The issuer needs to value the liability segment of the instrument in the way that it will be in the case of no conversion option being available before the instrument is sectioned into its parts.

This is necessitated by building a discounted cash flow and the process involves the application of a market interest rate that is adjusted to give credit risk, liquidity premiums, and time value of money. The discounted present value of the contractual interest payments as well as the contractual principal payments is the liability component. The difference between the issue proceeds and the liability fair value would form the equity constituent.

This valuation-based allocation is necessary to ensure that the equity recorded in the statement of financial position would be the value of the conversion feature and not the value of the contractual cash flows which is expected of a liability. In case of instruments that have embedded derivatives that do not pass the fixed-for-fixed equity test, the derivative is to be separated and measured in fair value under IFRS 9 as yet another reference to how the instrument is reflected in the financial statements.

The allocation process may result in the overstatement of the liability component or the equity component to the detriment of the other component without proper valuation, therefore, the leverage ratios and future interest recognition are distorted. This causes the correct valuation of the compound instruments to be an essential constituent of first categorization.

Effective Interest Rate: Calculating Amortised Cost for the Liability Component Using Market-Based Inputs Derived From the Valuation Process

After the liability component has been determined and valued, the next step would be to calculate its effective interest rate (EIR). The EIR is important in that it will determine the manner in which the liability measure will be done later using the amortised cost method. The EIR uses not only the coupon rate of the bond, but also pumps up any premiums, discounts, transaction costs and embedded economics as a result of the separation process.

In hybrid instruments, the fair value of the liability portion at the time of issuance is rarely the same as in a nominal value due to the additional value to the price of the standard instrument given the fact that there is an equity or derivative element. Consequently, EIR has to be calculated based on the fair value of the liability and not the entire amount of transaction price. This is to make sure that the interest expense accredited throughout the term of the instrument is of an accurate market yield as per the risk nature of the liability.

By way of illustration, a par convertible bond can only allotted part of the proceeds to the liability side. The interest expense that will be recognised in the following periods when the EIR is calculated based on this lower amount of liabilities will be greater than the coupon pointed out in the contract. It is an economic fact that the cost of bearing the liability is more effective as the investor has taken a lower yield in order to have the conversion feature.

Correct EIR calculation cannot therefore be separated to the valuation made in the first split. In the case of understated or overstated fair value, the EIR would be distorted giving rise to misstatement in the interest expense and carrying levels of the liabilities over time.

Fair Value Measurement: Ongoing Revaluation of Embedded Features, Equity Components, and Derivative Liabilities Under IFRS 9

Although the liability element is calculated at amortised cost, some aspects of a hybrid instrument have undergone re-measuring of the fair value under the IFRS 9. This incorporates derivative obligations as a result of conversion options which are not subject to the fixed-for-fixed test or conditionalities which expose an entity to non-linear payments. Valuation models, which bear forward-looking assumptions of the market participants on market interests, equity-price-changes, credit-spreads, and liquidity-adjustments are required in fair value measurement.

Depreciation of the valuation method is based on the type of a derivative. In case the built-in feature is in the form of a straightforward option, then Black-Scholes or a similar option pricing model might suit. More complicated features like resettable conversion ratios, contingent conversions, anti-dilution, or multi-factor exposures are best modelled by Monte Carlo simulation to model out the entire distribution of the potential results. These models should have the capability to bring on board time-varying volatility, correlation assumptions, discount factors and calibration to market data that can be observed where possible.

Fair value of measurement is not a process in itself. At every reporting date, the entities will have to revise the valuation on the prevailing market conditions. Variations of fair value are to be reported as a profit or loss, that is, the affluence of the elements that constitute derivatives can be a major determining factor on the volatility of earnings. This is in constant measurement, which is why hybrid instrument reporting needs proper modelling, input selection and transparent disclosure is crucial.

Instead of re-measuring the equity part of a compound instrument, the value of it is obtained out of the inception valuation. Thus, amortised cost measurement of liability and updating of derivative fair value is pegged on original accuracy of valuation.

Applying the Full IFRS Process: Identifying Contractual Terms, Classifying Components, Valuing the Liability and Equity Split, Computing Amortised Cost, Revaluing Derivative Elements, and Ensuring Transparent Financial Reporting

The entire process of categorizing and appraising hybrid instruments will start by reviewing contractual terms in detail. The step is used to identify activities that do not fit the definition of equity, in which the issuer is bound to settle based on other factors that bring about the characteristics of derivatives, and any attribute that needs fair value under the IFRS 9.

When there is an understanding of terms, the entity has to place each of the components under debt, equity or derivative. The principles of classification in IFRS 32 are the use of economic substance and not legal form to make the decision. Once it has been classified, proceeds are then allocated to components and the carrying amounts that will be utilized in making future measurements are determined by valuation.

The component of liability is then amortised to amortised cost taking an effective interest rate which is decisive of the fair value of the liability at the time of the first recognition. This equity element is considered in the equity and it does not change. Under the IFRS 9, derivative components are valued at fair value on a continuous basis and the gains and losses are recorded in profit or loss.

In the process, the body should be able to have documentation consistency, model validation involves rigor and disclosures. It is vital that investors who invest in the instrument know the impact of valuation models and assumptions on the recognition of profits, risk exposure, and financial position in addition to the classification of the instrument. Transparent reporting allows the users to determine leverage, capital structure and risks of dilution that are inherent in the hybrid instrument.

Conclusion

The characteristics of hybrid instruments complicate the conventional understanding of debt and equity, because they have features that are difficult to classify, value and measure in accordance with the requirements of IFRS 32 and IFRS 9. The differences between the liability, equity and derivative elements are based on contractual substance, however, the valuation models eventually decide on the manner of identifying and measuring the elements.

The entities will be able to make sure that they have proper and transparent financial reporting by using a methodical process by reviewing the terms of contracts and putting each element in the right place, value of How IFRS 9 fair value models drive ongoing measurement of embedded derivatives in convertible and perpetual instruments the liability and equity portions, amortisation of the cost with an effective interest rate and continuously updating their fair values. With the wider introduction of innovative financial markets and the growing prevalence of hybrid financing, the idea of valuation-driven concept of IFRS 32 and IFRS 9 needs to be mastered to grasp the economic reality behind the current capital structures.