Top IP Valuation Experts in Singapore – Protecting Intangible Assets

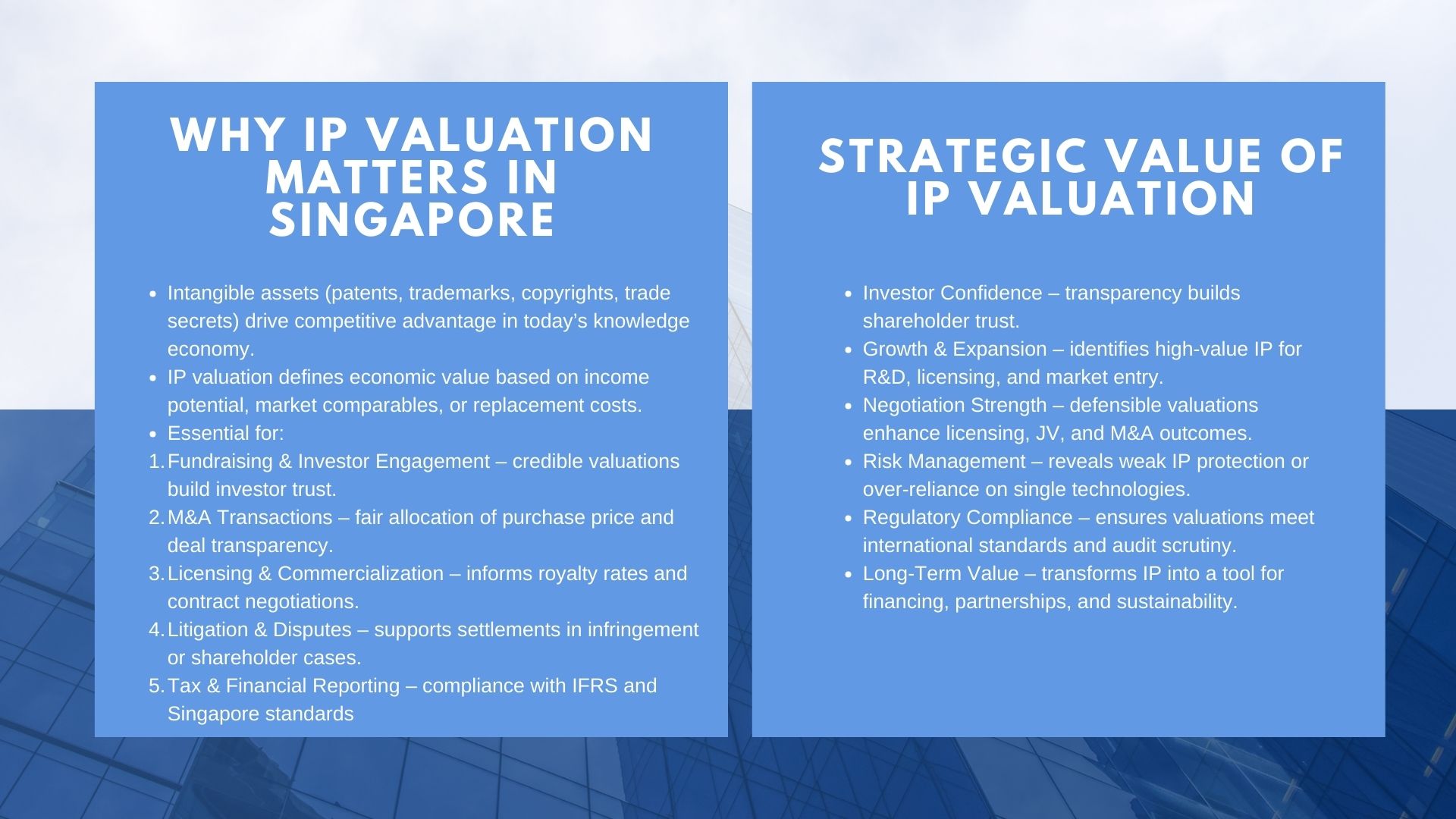

In the current knowledge based economy, there is a tendency of the intangible assets being considered more useful as compared to the physical assets. The cornerstone of most businesses, especially in the Singaporean market that has been booming in terms of innovation, is intellectual property (IP) such as patents, trademarks, copyrights, trade secrets and proprietary technologies. Intellectual property is not only a legal privilege to startups, SMEs, and even large corporations, but also a key factor to competitive advantage, financing prospective and long-term expansion.

Professional IP valuation services in Singapore come in at this point. Measuring the value of the intangible assets accurately provides the companies with the chance to safeguard their innovations, find investors, adhere to regulations, and make sound strategic choices. By using the services of the most competent IP valuation firm in Singapore, these intangible assets will be identified, exploited, and preserved.

What IP Valuation Is and Why It Matters

What IP Valuation Is and Why It Matters

The process of establishing the economic value of intangible assets is called IP valuation. There is no visible market price of an intellectual property in contrast to the tangible assets like machinery or property. It is priced on various things and is based on its ability to generate future income, the industry, the market, and the enforceability of the rights.

Three common methods of IP valuation are known:

- Income Approach – Values are determined as the future earnings that the IP will produce discounted to present value.

- Market Approach – The market approach is that which compares the IP with other intangible assets similar to it which have been sold or licensed in the market.

- Cost Approach – Appraises the value by the cost of producing or replacing the IP asset adjusted by the obsolescence and depreciation.

The importance of IP valuation has grown in Singapore as this country has become concentrated on innovation, research and development, and knowledge-based industries. Stakeholders, including the regulators, investors or acquirers, are putting pressure on companies to achieve credible and disclosed values of intangible assets as companies grow regionally and internationally. The absence of professional assessment within the IP allows businesses to understate their fundamental innovations or face the risk of misreporting their financial standing.

When Businesses in Singapore Need IP Valuation

The appropriate time to have IP valuation in the business is at strategic moments in the business life cycle. The following are the most prevalent situations:

1. Fundraising and Investor Engagement.

New businesses and expansion-stage firms tend to base their value on their IP. Investors would like to know that the patents, trademarks, and proprietary technologies are valuable to the investment. Proper valuations provide the entrepreneur with negotiation power in terms of equity

2. Mergers and Acquisitions (M&A)

In the event of acquisition of a company, intangible assets like brand reputation, patents, and copyrights can easily take a major part of the cost of purchase price. Independent IP Valuation in M&A is a guarantee of reasonable negotiations and open deal structuring.

3. Licensing and Commercialization.

Licensing out businesses involve the valuation of businesses to charge royalty payments and negotiate licensing contract. Trustworthy valuation enhances bargaining power and prevents any conflict.

4. Litigation and Disputes

Valuation can determine the financial loss or damage in case of breach of contract, shareholder disputes or IP infringement and then comes up with fair settlements.

5. Tax Compliance and Financial Reporting.

Indeed, under the International Financial Reporting Standards (IFRS) and the accounting standards of Singapore, the fair value of the intangible assets of the company needs to be reported regularly. These requirements are met by the services of professional IP valuation in Singapore.

6. Exit Strategies and strategic Planning.

To the business owners who are planning to succeed, divest or go public, the value of IP assets is critical in their planning and returns maximization.

As one successful example, an IP valuation might be required of a biotech startup in Singapore to raise capital in international markets. The acquisition of a Malaysian brand by a consumer goods company would be based on valuation to determine portfolios of trademarks. The necessity is obvious in all sectors, IP valuation will help make decisions at all crucial points of business development.

How IP Valuation Adds Strategic Value

Compliance and transactional needs are not the only issues which are concerned with accurate IP valuation. When done in the right way, it gives a lot of strategic value to a business.

1. Enhances Trust in Investors.

Shareholders will tend to support organizations whose intangible assets can be well established. The valuation report is professional and it brings transparency which creates trust.

2. Promotes Growth and Expansion.

Knowing which IP assets generate the most value, the management can invest the resources in a judicious manner, be it in a new R&D effort, new markets, or increased licensing programs.

3. Enhances Negotiation Achievements.

In making a deal either in licensing, joint venture, or acquisition, plausible valuation allows businesses to enter the table with a strong hand.

4. Enhances Risk Management

One of the risks that IP valuation can help companies to uncover is poor protection of patents, excessive dependence on one line of technology, or underestimated brands. By such understandings, business entities would be able to take precautionary steps to secure what they have.

5. Guarantees Regulatory Compliance.

Regulators and auditors in Singapore anticipate that valuations in Singapore should be based on internationally recognized methodologies. The professional services guarantee that reports are sound enough and can pass the test of time.

These benefits are more than just paper work to SMEs and corporates. They translate into more funding potentials, a more potent strategic alliance, and an ability to survive better in a highly competitive market.

The reason ValueTeam is the most suitable in Singapore.

ValueTeam is one of the most reliable partners of such companies as IP valuation that does not only provide such services but also has a positive reputation in Singapore. ValueTeam is known to be technical, practical, and client-focused in its valuation which is more than compliance–it offers working solutions on growth and protection.

Expertise and Approach

ValueTeam uses globally accepted techniques and adapts them to the local Singaporean business environment. Its consultants are highly experienced in technology, healthcare, financial, and consumer goods industries. This technical rigour and industry expertise provides the right valuations that are effective, justifiable, and strategic.

Sample Work and Projects

ValueTeam has been providing a variety of IP valuations projects in Singapore and the region over the years. Some examples include:

- Appraisal of proprietary software platform of a fintech company to raise Series B capital.

- Trademark portfolio evaluation of a consumer goods company entering into the southeast Asian market

- Valuation of patent of a biomedical startup that strategizes on licensing with multinationals pharmaceuticals.

- The appraisal of IP-backed financing of a logistics SME negotiating with local banks.

Positive Client Feedback

The value of ValueTeam in terms of being professional, responsive, and handling difficult valuation concepts with ease has been noted by clients. When presenting startups to investors, they appreciate the transparency and plausibility of reports. Companies like corporates like the depth of the firm analysis especially when it comes to cross border M&A transactions.

An example is a healthcare technology company that mentioned that not only was it possible to raise funds internationally with the assistance of the ValueTeam but also to plan the IP strategy of their future product through it. A retail SME has glorified the team because they offered them a valuation report that helped them to improve their negotiations with their partners.

Why Clients Trust ValueTeam

ValueTeam is unique in its approach since it is both technically rigorous and personalized. ValueTeam will fit each project to the specific needs of the client unlike larger firms that can use a one-size-fits-all approach. Its emphasis on transparency, reliability, and strategic insight has made it a go-to choice for businesses seeking the best IP valuation company in Singapore.

Conclusion

Intellectual property is no longer a by-product in Singapore rapidly changing economy but the cornerstone of business value. Companies need to identify and safeguard their intangibles whether in raising capital, entering new market or preparing to merge and acquire.

Engaging professional IP valuation services in Singapore ensures that these assets are accurately valued, strategically leveraged, and fully protected. ValueTeam has worked hard to become the optimal IP valuation firm in Singapore by its experience, good reputation and client care focus. ValueTeam enables businesses to realize the full power of their intangible resources and hence become stronger, compete in the global market, and establish sustainable success.