IFRS 16 and Valuation Understanding Lease Valuation, Asset Measurement, and DCF Implications

Introduction to Understanding IFRS 16 Valuation

The implementation of IFRS 16 significantly altered the recognition, measurement and analysis of leases in the financial statements. The implications of IFRS 16 on accounting is important as well as on valuation, financial modeling, and corporate finance decision-making since it results in bringing most operating leases to the balance sheet. Previously under this standard, analysts, valuers, auditors, and finance professionals are required to know the interaction of IFRS 16 lease valuation, asset measurement and discounted cash flow analysis.

This article describes the relationship between IFRS 16 and valuation, what is meant by IFRS 16 value of asset and IFRS 16 value in use, practical interpretation of IFRS 16 value limit, and how DCF valuation IFRS 16 is to be applied in practice. The presentation is clearly written and professional enough to be used in training, advisory and applied finance.

IFRS 16 Lease Valuation in Context

IFRS 16 Lease Valuation in Context

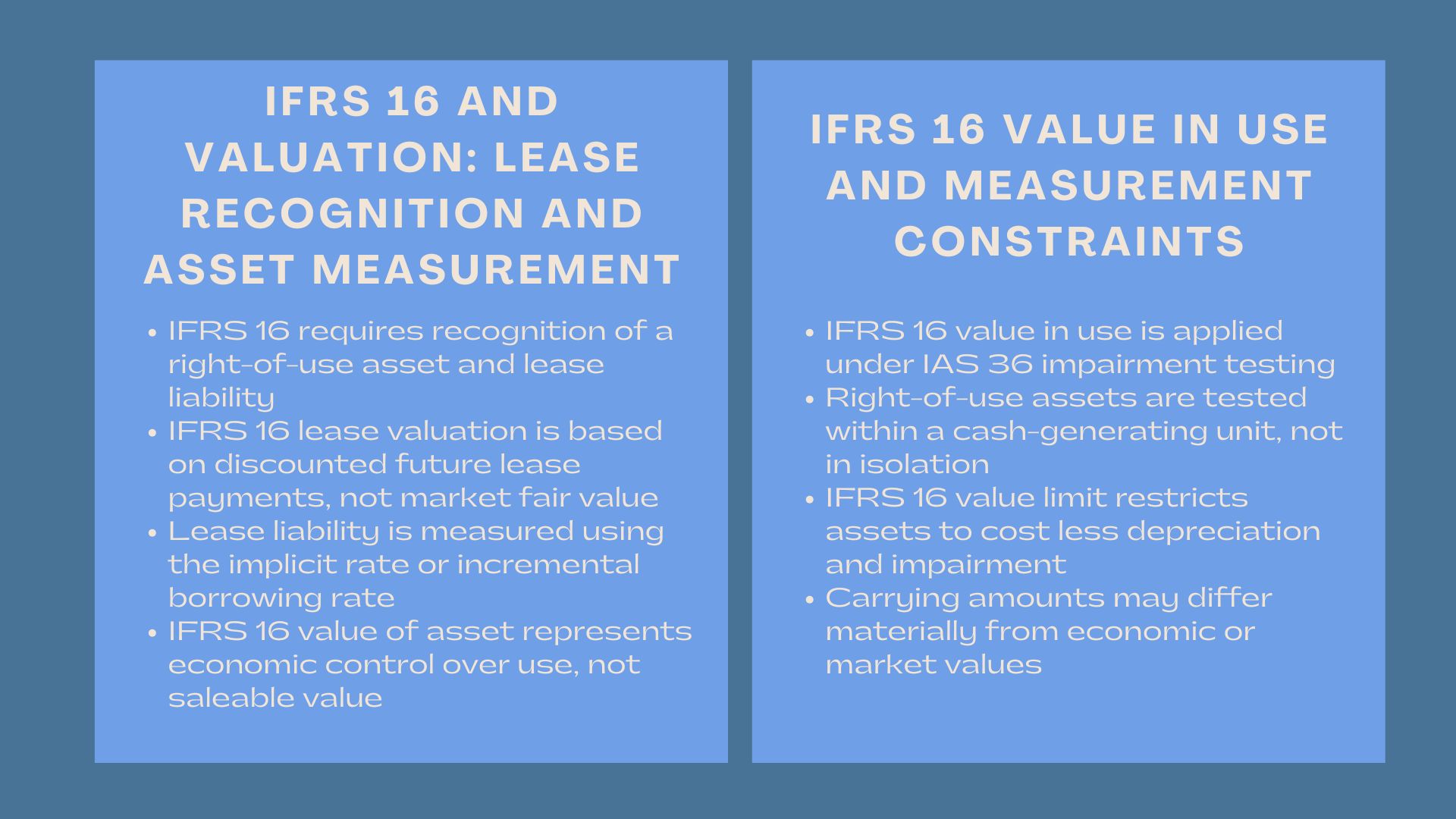

Recognition of a right-of-use asset and a lease liability at the commencement date of a lease are mandatory under the IFRS 16. In valuation terms, it is not in essence that valuation of leases by IFRS 16 lease is applied to find fair value in a market context, but to value leased assets and liabilities in a consistent manner, based on the future cash flows of contracts.

The lease liability is firstly estimated as present value of the future lease payments which are discounted by the implicit interest rate in the lease or when such a rate could not be easily applied, by an incremental rate at which the lessee is borrowing. This discounted cash flow argument establishes a conceptual relationship directly between IFRS 16 and finance-based valuation approaches.

IFRS 16 Value of Asset Explained

The IFRS 16 value of asset will be the right-of-use asset of the lessee. This asset is first calculated on cost, including any initial lease liability, lease payments made at the start or before the start, direct initial cost and an estimate of any restoration or dismantling liabilities.

On a valuation basis, the right-of-use asset is not supposed to reflect on market value. Rather, it shows the economic advantage of regulating the exploitation of a basic asset during the lease period. As time passes the right-of-use asset is depreciated and the carrying amount of the asset is altered depending on the impairment tests and the adjustments of the lease.

It is also important to understand the difference between accounting value and economic value when responding to technicality of reading financial statements under IFRS 16, especially in valuation activities like enterprise valuation, purchase price allocation, or impairment testing.

IFRS 16 Value in Use and Impairment Considerations

The value in use of IFRS 16 concept is mostly realized within the impairment-testing context of IAS 36. The right-of-use assets are also liable to impairment just like the other non-financial assets. Value in use is the current worth of the future cash flow anticipated to be obtained out of the asset or out of the cash-generating unit to which it is associated.

Practically, the right-of-use assets tend to be combined in a larger cash-generating unit instead of being tried separately. This implies that the value in use of IFRS 16 is generally determined at a greater level bringing lease-related cash flows under larger operating predictions.

This strategy supports the need to be consistent with lease accounting assumptions and valuation models. The inconsistency in treatment of lease cash flows may cause misrepresentation in impairment and misinterpretation of the performance of assets.

IFRS 16 and Valuation in Financial Analysis

Interaction between the IFRS 16 and valuation is not restricted to the impairment testing. An evaluation professional needs to determine how to deal with lease obligations and right-of-use assets in any enterprise valuation, equity valuation, or other transaction analysis.

With the IFRS 16, the general increase in EBITDA is attributed to the fact that lease expenses are substituted by depreciation and interest. Nevertheless, such an accounting boost is not always equal to the increase in economic performance. Valuers should hence standardize financial measures and see that lease cash flows are handled in a similar manner in the valuation models.

Lack of accounting of the IFRS 16 adjustments can lead to overvaluation or undervaluation particularly when comparing companies that have varied leasing profiles.

IFRS 16 Value Limit and Practical Interpretation

The value limit specified in the IFRS 16 is usually given its colloquial name of the limitations imposed by the standard on the measurement of lease-related assets and liabilities. The IFRS 16 does not allow the revaluation of right-of-use assets to fair value when the underlying asset category is not measured at fair value in a model that embraces revaluation philosophy in IAS 16.

Consequently, the carrying amount of right-of-use assets is basically restricted by its measure based on cost, less accumulated depreciation and impairment. This accounting weakness is of significance to financial statement users as it justifies why IFRS 16 value of assets can vary greatly as compared to market-based value or replacement cost estimates.

The knowledge of this value limit assists analysts in not misperceiving the balance sheet figures as the market value.

DCF Valuation IFRS 16 Considerations

The application of DCF valuation IFRS 16 should be done with great care to avoid doubling of lease cash flows. In a discounted cash flow model, lease payments could be considered as operating cash flows or as financing cash flows depending on the valuation method to use.

In case lease liabilities are regarded as net debt, lease payments, which are going to be paid in the future, should not be included in the operating cash flows. On the other hand, lease liabilities are not to be included in net debt when lease payments are included in operating cash flows. The major principle in the process of performing DCF valuation IFRS 16 is consistency.

This is of special concern when using IFRS 16 to treat a difference in mergers and acquisition where the difference in approach to IFRS 16 can have material impacts on enterprise value, equity value and price of transaction.

Strategic and Advisory Implications

In addition to technical compliance, IFRS 16 has business strategic implications on business valuation, structures of contracts, and performance measurement. Business models that are heavily leveraged in terms of leasing can under IFRS 16 seem to be more highly leveraged, which affects valuation multiples and has an impact on investors.

Individuals with comprehensive knowledge of the IFRS 16 and valuation will be in a better position to counsel the structuring of transactions, financial modeling, and communication to the stakeholders. This information is also becoming significant in advisory, audit, and corporate finance.

Conclusion

IFRS 16 has changed the world of lease accounting and brought additional complexities into the field of valuation and financial analysis. Exceptional insights into IFRS 16 lease valuation, IFRS 16 value of asset, and IFRS 16 value in use would help to read the financial statements correctly and conduct an excellent valuation work.

It is also crucial to note the implications of the IFRS 16 value limit in practice and use the same logic in DCF valuation IFRS 16 models. IFRS 16 will neither make valuation harder than necessary when considered carefully; however it will increase transparency in terms of lease-related economic requirements.

To financial professionals, valuers, and decision-makers, understanding how IFRS 16 and valuation interact is no longer a choice, it is a part of financial practice in the 21st century.