Case Study: Purchase Price Allocation Supporting Transparent Financial Reporting After a Strategic Acquisition

Background on Purchase Price Allocation Case Study

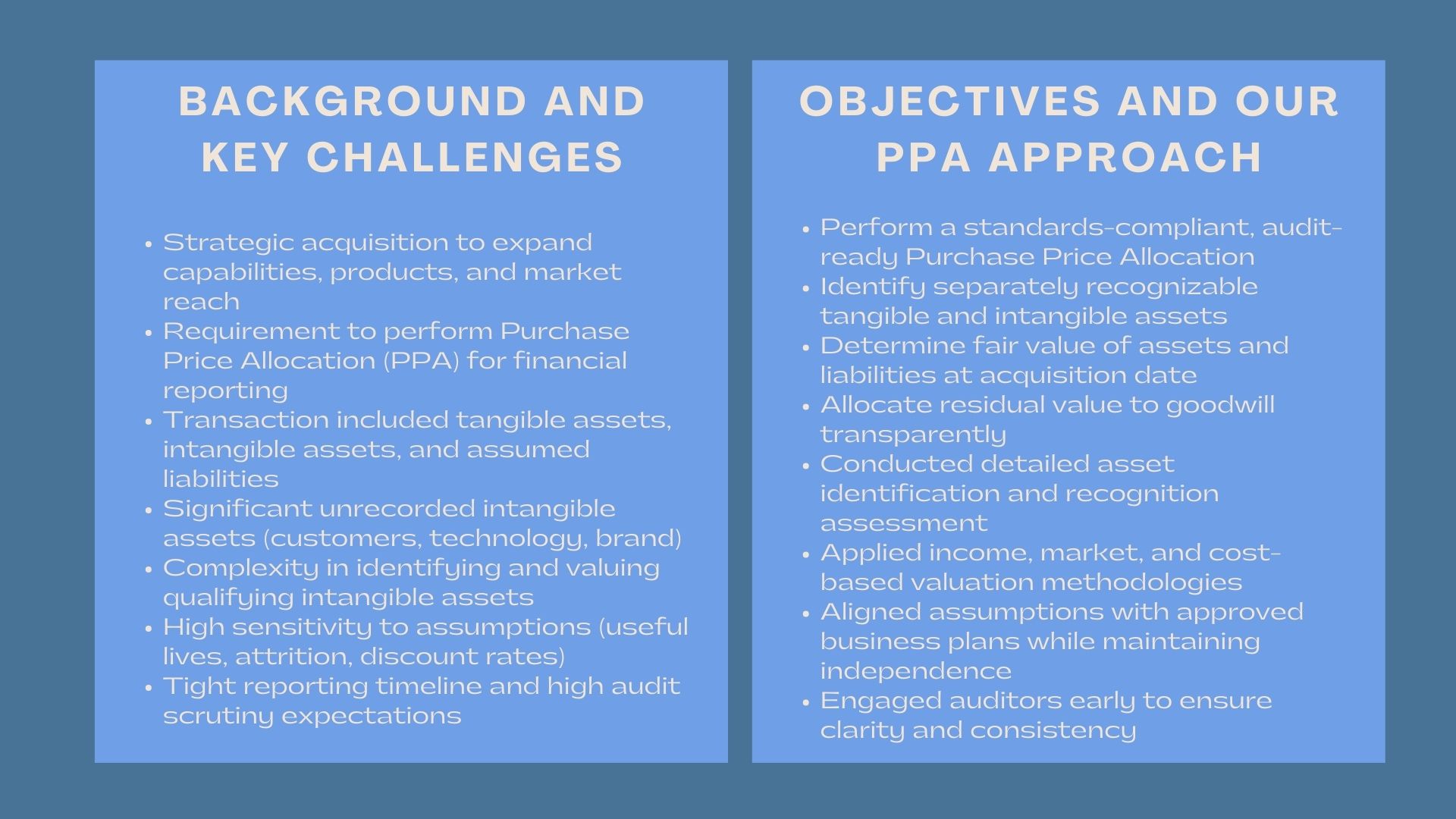

A company with a growing corporate group made a purchase of a privately owned business in its long term expansion plan. It was strategic in nature with the addition of new capabilities and the procurement of complementary products and customer relationships, as well as market expansion. After the transaction was completed, the group had to conduct a Purchase Price Allocation (PPA) to meet the necessary financial reporting standards and Master Advanced Financial Reporting requirements with accuracy, transparency, and regulatory compliance.

The acquisition entailed a combination of both tangible and intangible assets, and assumed liabilities with a lot of the liabilities not having been recorded on the balance sheet of the acquiree before. Management realized that a strong and defensible PPA was necessary not only to ensure compliance, but also to provide transparency for auditors, regulators, and other stakeholders, helping them Understand Tangible Versus Intangible Assets within the transaction. To facilitate this process, the company engaged our valuation team to conduct an independent and comprehensive PPA exercise.

Issues and Challenges

The client encountered various problems that are normally related to the accounting and valuation of post-acquisitions. The price with which the transaction took place was well established, but the underlying assets and liabilities could not be determined and valued without a lot of judgment and technical ability. The acquired business had built important intangible assets over the years such as customer relationships, proprietary processes and brand related assets that were not recorded individually before the acquisition.

The major challenge was the determination of the intangible assets that qualified to be recognized and the fair values of the same. Valuation had to be done with keen consideration on the asset lives, contributory charge, attrition rates and assumptions of future cash flow. Even minor modifications in these assumptions can potentially have a significant impact on the results of valuation and future amortization cost.

Also, timeline of transaction generated pressure to finalize the PPA within a strict reporting time-table. The management was also anxious with audit scrutiny especially with regard to the valuation methodologies used, the uniformity of assumptions with the business plan and treatment of goodwill and identifiable intangible assets.

Lastly, the client also wished to have the PPA results clearly expressed and documented to provide the internal finance teams with the confidence to handle future financial reporting and stakeholders communication.

Objectives

The main aim of the engagement was to carry out a full Purchase Price Allocation which should follow the relevant accounting standards which will lead to fair and supportable allocation of the consideration acquired to identifiable assets acquired and liabilities assumed.

Particularly, the client wanted to:

- Determine the existence and listing of the tangible and intangible assets that can be separately recognized.

- Establish the fair value of identified assets and liabilities as at the date of acquisition.

- Reserve of value to goodwill in an open and reasonable way.

- Make sure that the PPA would be audit ready and regulatory ready.

- Give accountability to the management on the future amortization and the impairment.

The interaction was supposed to be both technical and practical in nature.

How We Helped

Our systematic and standards-based model of the PPA engagement was based on the characteristics of the acquisition and the reporting needs of the client. Instead, we commenced our work under a comprehensive knowledge of the transaction rationale, the business model obtained and the financial projections that the management had prepared ahead.

We have carried out a thorough identification exercise in order to identify all the tangible and intangible assets purchased and liabilities assumed. These involved examination of customer relationship, technology-related assets, trade names, contractual relationship and assembled workforce considerations. The assets were evaluated on recognition criteria to make sure that the accounting requirements were met.

We have used relevant methodologies to value the assets depending on their nature. Most intangible assets were treated using income-based methods and included asset specific cash flows, contributory asset charges and risk adjusted discount rates. Where possible and justifiable, market-based and cost-based techniques were used.

One of the agreements that we made with the management during the process was to ensure that the assumptions aligned with approved business plans without compromising on valuation independence. We also got early contact with the auditors of the client so that transparency is ensured and areas of contention kept to minimal.

Deliverables were a report of valuation which is detailed and shows methods, assumptions, sensitivity issues, and accounting conclusions.

Value Delivered

This involvement established the way a properly conducted Purchase Price Allocation can go beyond technical compliance to be strategic in nature. Using strict valuation methods and effective communication, we helped the client to comply with reporting requests, control risk of audit and have a better understanding of the value created by the acquisition.

The services of our PPA gave the client a good background on how to report its financial status, make sound decisions, and grow discipline by acquiring other firms.