Valuation Challenges under IFRS in Emerging and Volatile Markets

Introduction to IFRS Valuation Challenges Training Emerging Markets

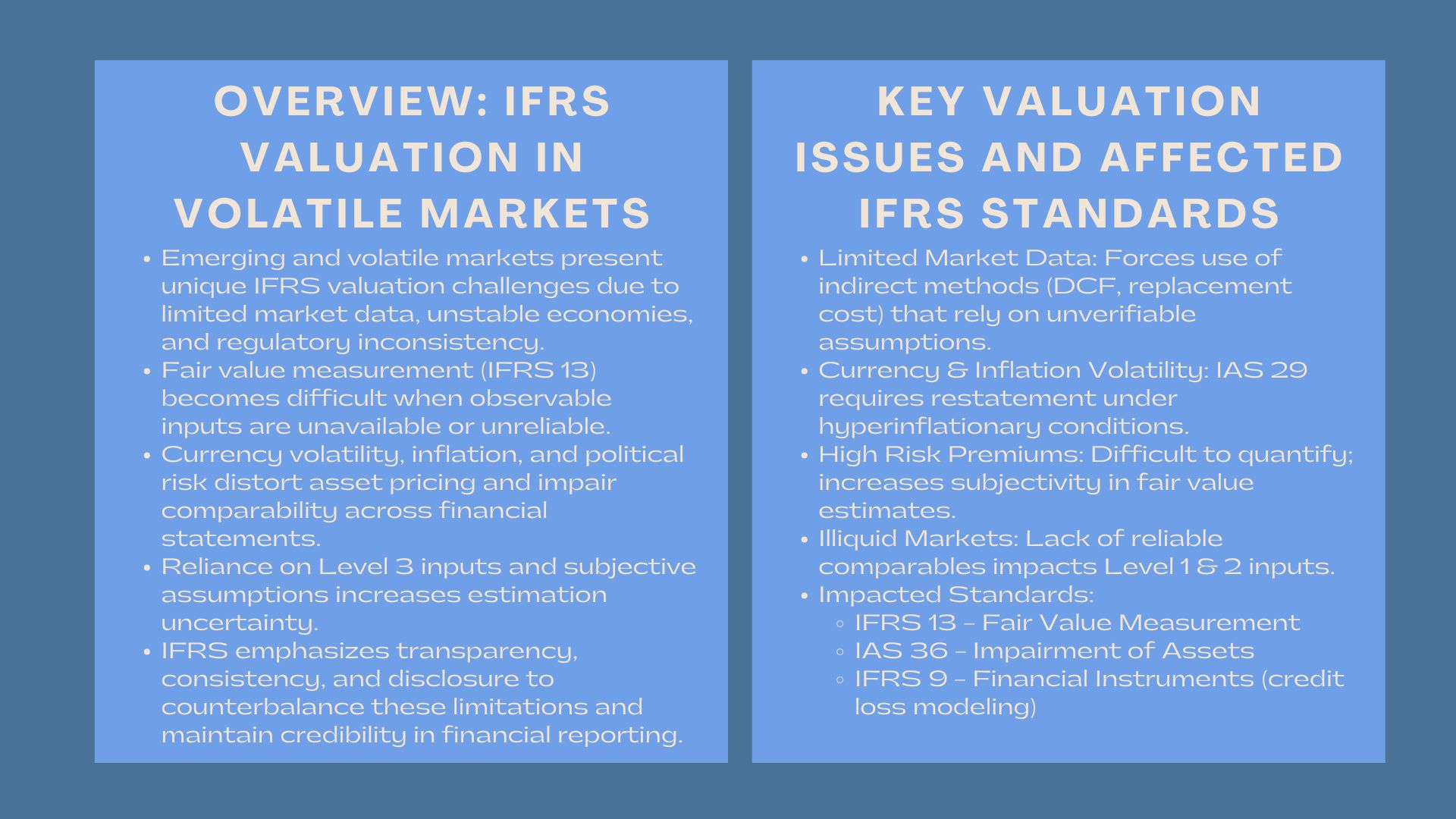

Some of the most challenging issues to be encountered by firms using International Financial Reporting Standards (IFRS) include emerging and volatile markets. The fair value and transparency principles are universal, whereas the IFRS valuation is much more complicated in those areas because of the lack of market information, currency variations, and regulatory inconsistencies.

This paper reviews the impact of volatility, lack of data and market inefficiencies on valuation practices under the IFRS. It also examines how the valuation practitioners and auditors change their practices to make the financial reporting comply and reliable.

The IFRS Valuation in Developing Economies.

The IFRS Valuation in Developing Economies.

Nature of Market Imperfections and Volatility.

In developing economies, asset prices can be very skewed by macroeconomic uncertainty, i.e., inflation, fast currency depreciation or political risk. Market-based-based valuations, e.g. similar transactions or observable market-data, are inaccurate or even unavailable.

The fair value of IFRS 13 implies that fair value should represent the prices that would be obtained during a well-organized transaction between the market participants as of the measurement date. But in illiquid markets or where there is a speculative transaction, it is very subjective to create an orderly transaction.

Limited Availability of Market Data

A common obstacle in IFRS valuation issues in emerging market economies is the absence of credible market benchmarks. Numerous assets like infrastructure projects or un-lit equities are not well-priced. Therefore, businesses are forced to rely on unobservable inputs (Level 3 of the fair value hierarchy), enhancing the level of estimation uncertainty and risk of audit.

Indirect techniques of valuation such as discounted cash flow (DCF) models, and replacement cost techniques are commonly practiced by valuers but require numerous assumptions concerning business growth, inflation and risk premiums that are hard to verify in risky economies.

Estimation of Fair Value under Unstable Economic Conditions.

Inflation and Currency Volatility.

Hyperinflationary conditions, which IAS 29 deals with, necessitate re-statement of financial statements in relation to the present purchasing power. Inflation does affect the discount rate and any estimated projected cash flows which may result in a high degree of volatility in the estimation of fair values.

Equally, there are common currency crises, which influence the values of assets and liabilities especially to firms whose investments are spread across borders. The requirement of IFRS that any changes be reported in the course of translating foreign operations may result in significant fluctuations in the reported earnings and net assets.

Risk Adjustments in Valuation Models

Another major issue in fair value estimation challenges in volatile IFRS reporting environments is quantifying risk. Political and economic uncertainties increase the cost of capital in developing markets which is more unpredictable and expensive. This makes the determination of the right risk premium more of a professional exercise than a purely data-driven exercise.

Frequently, companies are compelled to apply proxy data based on more developed markets and make country-specific risk adjustments on it. Nonetheless, these modifications bring about subjectivity and it becomes difficult to confirm the assumptions of reported valuations by the auditors and regulators.

Valuation Practitioner: Practice Challenges.

Test-Retest and Inter-Item Reliability.

The foundation of IFRS valuation is good data but in most emerging economies there is a lack of reliable data and instead ancient public databases, transaction records and industry benchmarks are used. This renders consistency between valuation models hard to attain.

Similar data may not be the real market conditions even where similar data is available, as a result of related-party transactions, government action or market failure. Valuation assumptions should be disclosed under IFRS, but when there is no well-furnished data, the disclosure will not be as transparent.

Market Liquidity and Price Discovery.

Another issue that always appears is market illiquidity. In the case of a small number of active buyers and sellers, it is not possible to set fair value using quoted prices (Level 1 inputs). When the inputs are modeled at Level 2 or Level 3, valuers will be required to use adjusted models with exponentially more uncertainty in estimation.

As an illustration, appraisal of investment property in the emerging market will usually rely on a few transactions which may not reflect the general market. This undermines the credibility of fair value reporting and makes it difficult to verify by the auditors.

Standards of IFRS that have been most impacted by the emerging market volatility.

IFRS 13 – Fair Value Measurement

The fair value hierarchy of IFRS 13 is intended to be used in the markets where the data is transparent. In developing economies, Level 3 inputs prevail and this results in large valuations. This enhances the significance of documentation, sensitivity analysis and disclosure.

IAS 36 – Impairment of Assets

The common economic declines may cause indicators of impairment under the IAS 36. Valuers should re-evaluate recoverable amount of assets by the use of discounted cash flows that assume increased risk, which result to increased volatility of impairment losses.

IFRS 9 – Financial Instruments

The credit risk and expected credit losses are hard to calculate when the financial institutions do not have any long-term information on the default rates or macroeconomic patterns. The credit loss expected (ECL) model under the IFRS 9 is therefore overly assumption-based in such markets.

The Role of Disclosure and Transparency.

To address uncertainty, IFRS focuses on disclosures of much information on valuation methods and assumptions. Organisations are required to disclose the determination of fair values, origins of inputs and sensitivity of findings to different critical variables.

This will promote transparency that will enable the investors and auditors not only to know what the figures are but also the level of confidence behind them. Detailed disclosure can resolve the credibility gap arising due to imperfect data and limited comparability in emerging markets.

The approaches to conquering the IFRS Valuation Problems.

The implementation of Hybrid Valuation Models.

Judgment professionals can use a combination of various valuation approaches, including market, income, and cost to cross-test the results. The triangulation assists in the mitigation of the limitations of both approaches in the event of scarcity of data.

Hiring Independent Valuation Experts.

The independent valuers will be used to capture the local market nuances and therefore have to be a local expert. Assumptions regarding the growth rates, discount rates, and the trend of inflation may be refined with the help of their experience.

Sensitivity, Scenario Analysis.

The sensitivity analysis at different economic conditions gives a span of potential fair values, as opposed to a point estimate. This assists the decision-makers and the stakeholders in knowing more about the valuation risks.

A changing Trend and Regulatory Adaptations.

There is still efforts by regulators and standard setters to make the IFRS more applicable in emerging markets. IASB has recognized the special difficulties that these economies have and promoted professional judgment and increased disclosure instead of prescriptive rules.

Bridging the data gap is also made possible by technological progress in the form of real-time market analytics and AI-based valuation tools. With the maturity of markets, the uncertainty of estimation will be reduced progressively as a result of availability of transaction data and reporting standards.

Conclusion

Valuation under the IFRS in the emerging and volatile markets require balance in compliance, judgment and practicality. The principles of fair value have not changed, but the application of the fair value principles in unstable environments is a complicated matter.

Companies can better overcome these hurdles by enhancing the disclosure process, adopting flexible valuation models, and using local expertise. In conclusion, good IFRS valuation practices will not only improve financial transparency, but also confidence by the investors to the economies that are still struggling to gain market stability.