Purchase price allocation (PPA) is a way to assign costs to the assets acquired in an acquisition or merger.

Why Use EBITDA in Business Valuation

Convertible Instruments Valuation

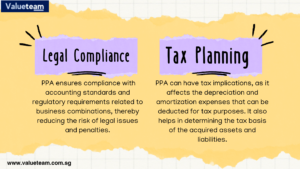

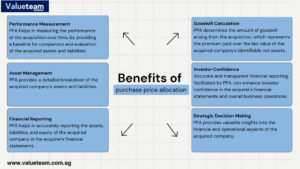

Many businesses use the purchase price allocation method to determine what portion of the purchase price of an acquired business should be allocated to its assets and liabilities. This method is also referred to as cost-to-cost or direct attribution. The method is used for both mergers and acquisitions, but it has some advantages over other methods when used for acquisitions.

There are several reasons why you should consider using this approach when valuing your business:

It’s easy to understand and apply. The most common form of this method is called direct attribution, which states that each asset and liability will have a specific value assigned to it based on its fair market value at the time of acquisition. This makes it easy for buyers and sellers alike because there are no complex calculations involved. All you have to do is identify each asset and liability by category (assets include tangible property such as equipment and intangible property such as accounts receivable; liabilities include items such as accounts payable), then assign them a value based on their fair market.

Purchasing a business is a complex process that involves many factors, including:

The purchase price.

Whether the purchase will be financed with cash or debt, or both.

What assets and liabilities are included in the purchase price

How much of that purchase price will be allocated to each asset and liability on your balance sheet

EBITDA (earnings before interest, taxes, depreciation and amortization) can help you determine how much of the purchase price should be allocated to each asset and liability. In other words, it helps you determine what amount of debt and equity financing you need to raise.

business valuation singapore, real estate valuation methods, Company Valuation, Business Valuation Services, all business valuation, company valuation share, ESOP Valuation, Convertible Instruments Valuation, buy side due diligence, Brand Valuation Services, Startup Valuation, sbxhrl, Intangibles Valuation, purchase price allocation, real estate valuation, how to value a company, valuer singapore, valuation value singapore business drivers net tangible assets value$ singapore agricultural companies use fair value for purposes of valuing crops. valuation of tangible assets, ebitda margin formula.

If you’re buying a startup company, then EBITDA can help you determine how much money the business can afford to pay its owner in order to get him or her onboard as an employee. This is particularly useful if the owner wants some sort of “take-out” deal. For example, if a founder wants $500,000 for 10 percent equity stake (and no salary), then he or she would need $5 million worth of revenue annually just break even after paying himself or herself a salary (if there were no other employees).