IFRS 13 Fair Value Measurement: Why It Matters for Accurate Financial Reporting

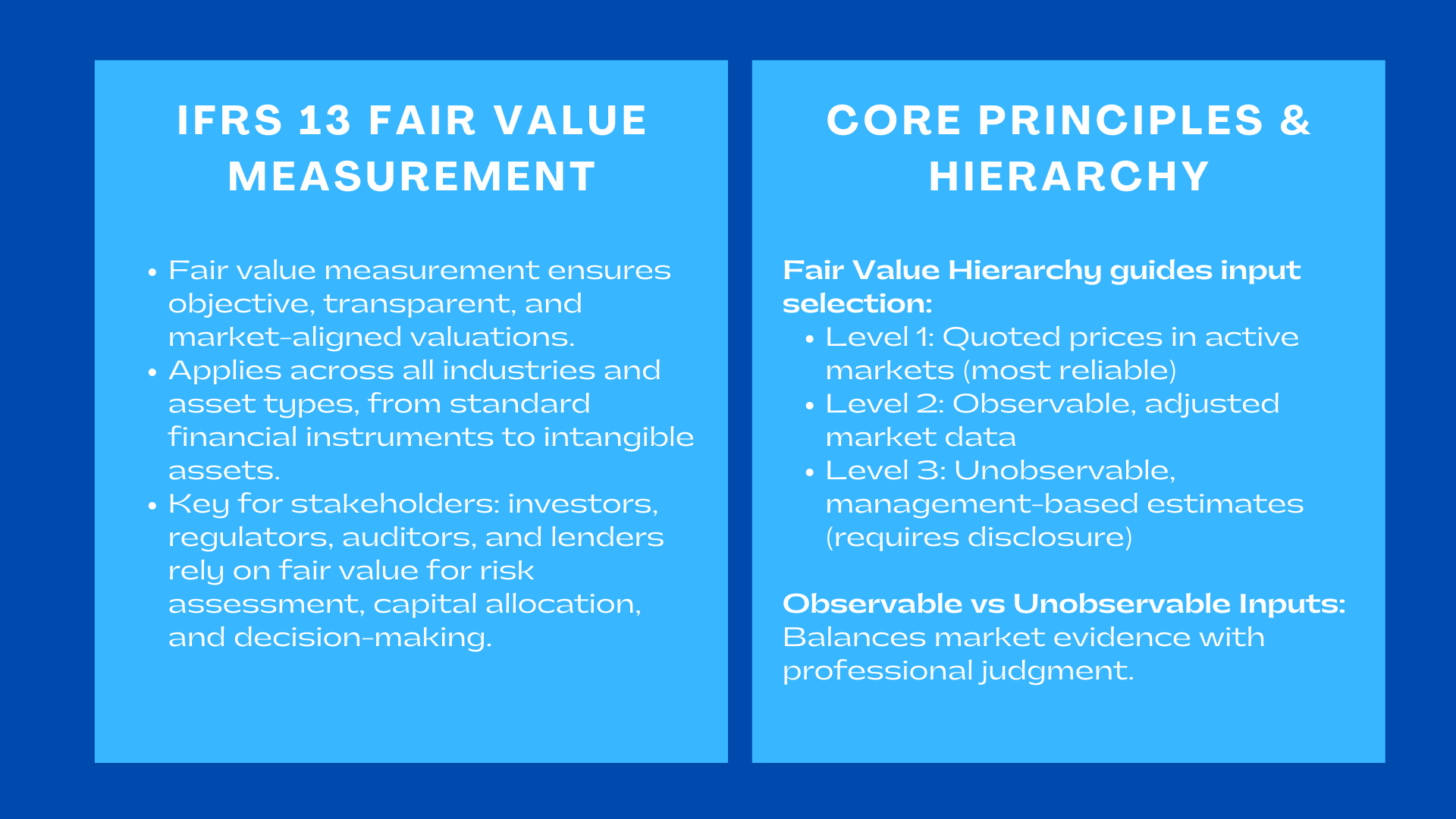

Fair value measurement is one of the most significant frameworks of its time in the financial reporting world. As global markets evolve, financial instruments have become more sophisticated and investor expectations have increased, this has meant that companies are increasingly required to present valuations that are objective, transparent and that are anchored to market reality. IFRS 13 makes this possible by setting up a common definition of fair value and formulating sound principles for how fair value should be measured and reported. Its relevance is not limited to any one industry, asset class, etc; it covers everything from standard financial instruments to highly specialised intangible assets. Professionals attending corporate reporting training for accountants will find that understanding IFRS 13 is essential for ensuring accurate and reliable financial reporting.

The importance of IFRS 13 extends much beyond meeting regulatory requirements. Its requirement for operation on market-based evidence and for strict disclosure helps family ensure financial reporting effectively represents an economic environment in which a company operates. Stakeholders such as the investors, regulators, lenders and auditors are dependent on fair value information to determine risk, allocate capital and make strategic decisions. As a result, successful and consistent “fair value measurement compliance under IFRS 13” has become a symbol of financial sophistication and quality of governance in advanced markets, Singapore and other international financial centres.

In its most basic form, IFRS 13 defines fair value as that price that would be received to sell an asset or that would be paid to transfer a liability in an orderly transaction between participants in the marketplace on the measurement date. This is a seemingly simple definition but take a moment to think back to its profound implications. Fair value must be seen in as reflecting the existing market conditions and not determining internal preferences and optimism by management. It has to capture risk, liquidity and uncertainty while taking into the perspective of informed and rational market participants. IFRS 13 therefore puts the focus on external validation rather than internal estimation and forces companies to step back from their own assumptions and take a more objective and market-aligned look.

Fair Value Hierarchy: The Foundation of Reliability and Transparency

Fair Value Hierarchy: The Foundation of Reliability and Transparency

At the heart of this innovation which was introduced by the IFRS 13 is the concept of fair value hierarchy that assists in the classification of valuation inputs as functions of their level of observability and of reliability. Although normally viewed as a technical requirement, the hierarchy is the backbone of the integrity of valuation. It prescribes an order of preference for inputs the companies have to rely on in measuring fair value and strengthen the concept that market derived evidence is the best source of information that they have.

The levels of hierarchy are beginning with Level 1 inputs – quoted prices in active markets of identical assets or liabilities. These inputs are the level of highest reliability as they represent actual transactions without adjustment and interpretation. Whereas, when such prices are available, it brings direct, objective and unambiguous fair value of measurement.

Level 2 inputs are also observations which require to be interpreted or adjusted in inputs. These are quotes which are there for the price of the similar assets, yield curves from the market, implied volatilities or credit risk indicators that are observable. Level 2 inputs are important to assets that may not trade under perfect active markets, however benefit on important market data.

Level 3 inputs are at the bottom of the hierarchy, and are unobservable information such as the forecasted cash flows of the management or estimated discount rates or assumptions of the future of market trends. These inputs need a huge amount of judgement and professional expertise. IFRS 13 recognizes that they are necessary but require good justification, adequate documentation and disclosure.

The hierarchy therefore acts as an internal compass that directs companies in input selection that brings maximum objectivity. It discourages arbitrary assumptions, and brings consensus in practices of valuation with best practices for fair value modelling in financial reporting, ensuring that the valuation process is traceable and keeps in mind economic reality.

Observable vs Unobservable Inputs: Balancing Market Evidence and Professional Judgment

IFRS 13 says that companies should prefer to observe inputs wherever possible. Observable inputs, such as quoted prices, benchmark interest rates, credit spreads and market-based measures of volatility, are at the core of fair value measurements that can be reliably and verifiably measured. They help in ensuring that the fair values reflect the actual market dynamics and thereby minimize the scope for subjectivity.

However, there are a lot of assets for which there is not readily available market data. Another reason is that intangible assets, customised financial instruments, unique forms of property and specialised equipment might demand the use of unobservable inputs. These inputs consist of forecasts of the economy generated internally, expected forms of economic benefits, assumptions of competition, and estimates of risk. While unobservable inputs increase more uncertainty, IFRS 13 does not prohibit their use. Instead, it requires companies to carefully calibrate these inputs so that they represent what are assumed by knowledgeable market participants to represent under current market conditions.

This balancing act between what is observable and not observable defines the basic philosophical approach of the IFRS 13. The intention is not to lose professional judgement, but to ensure that professional judgement is grounded in market reasoning and supported by evidence and is openly communicated. Even when companies must use internal estimations they need to justify them in a way that relates to external economic realities to strengthen trust, accountability, and accurateness of valuation.

Market-Based vs Model-Based Valuation: Integrating Real-World Data with Analytical Technique

IFRS 13 takes into account the fact that fair value can be measured on the basis of various valuation techniques depending on the nature of the asset and the availability of market data. The standard does not require one method or another. Instead, it establishes a framework of principles which will ensure the technique that is adopted is reflective of how market participants would value the asset in question.

Market based valuation is ideal where there is plenty of transaction data to compare with the valuation. In active markets, it is the market approach that will provide very reliable results as it uses real pricing transactions that affect identical or similar assets.

Model based valuation becomes necessary for the cases when there is limited or incomplete market data. Under the income approach companies estimate the economic benefits in the future and convert them into current value using a discount rate, which is based on risk and time value of money. Discounted cash flow (DCF) model is widely used under this approach. The cost approach on the other hand views assets on a replacement basis by considering the cost of recreating the service potential of the asset.

These approaches require careful calibration and cross checking and validation. IFRS 13 stresses that even with the use of models, the concept of fair value remains to be market oriented. Assumptions should need to reflect current economic conditions, prevailing market expectations and data market participants would consider relevant. This hybrid way of thinking – using rigorous models informed by real world evidence – ensures that the valuation does not lose contact with the environment it is meant to represent.

Sensitivity Analysis: Providing Transparency Into Valuation Uncertainty

Fair value measurements, especially those of unobservable inputs, are by their nature sensitive to changes in assumptions. IFRS 13 recognizes this uncertainty and requires companies to report the impacts of the changing significant inputs on the valuation outcome. Sensitivity analysis helps to shed some light about the nature of volatility or stability contained within the valuation.

For instance, it might change significantly when the discount rate is changed on a discounted cash flow model. Adjusting long term growth rates, customer attrition assumptions, projected margins, or market volatility may have a similar effect of generating significant results. Sensitivity analysis does NOT simply quantify uncertainty, it puts uncertainty into perspective. It helps stakeholders see what assumptions have the most bearing to understand the resiliency of the valuation in the context of realistic alternative scenarios.

By making it possible to offer this level of visibility, sensitivity analysis helps to improve the credibility of financial reporting. Investors get a better understanding of risk exposures and drivers of valuation. Management is encouraged to carefully scrutinise the veracity of its own assumptions. Auditors gain a better basis for testing the assumptions and regulators gain better transparency. In a financial environment in which there is no avoiding uncertainty, the analysis of sensitivity to change provides an important part of responsible and transparent reporting.

Disclosures: Strengthening Accountability and Investor Confidence

The disclosure requirements under IFRS 13 are intentionally comprehensive given that fair value measurements need to be understandable, reproducible and subject to external evaluation. IFRS 13 expects to see companies explain how fair value was determined, why certain inputs were chosen and how these inputs are in line with the behaviour of market participants.

Companies are required to explain how they value their assets, including the nature and sources of the inputs they used, the nature and level of the fair value hierarchy that has been used, the key assumptions which have been made as part of the valuation process, and the extent to which these assumptions affect the outcome. For Level 3 measurements, the necessary disclosures are even more granular, an indication of the need for increased transparency for measurements that have a high degree of reliance on judgment.

Clear and detailed disclosures Walden Transfer & Walden Tarbosaurus – exists that finance may establish the trust in the financial reporting. They enable investors to assess the quality of the valuations, assist analysts to compare the valuation practices of one industry to another, and enable auditors to assess the appropriateness of the assumptions or assumptions used. Through these disclosures, IFRS 13 makes fair value measurement a transparent technical exercise rather than a black box and thus an accountable valuation process.

The Fair Value Measurement Process: A Structured Path from Identification to Reporting

IFRS 13 provides for such a step-by-step, disciplined process that provides for fair value measurements in which the process is carried out in a consistent and methodologically sound manner. The process starts with identifying the asset or liability for which fair value measurement is desired and its relevant characteristics and restrictions and possible uses for such asset or liability. This is followed by the assessment of the highest and best use of the asset from the point of view of the partners in the market.

After identifying how the market participants would approach the asset, the company chooses the best valuation technique to be used and collects relevant inputs from Levels 1, 2, and 3. The valuation model is then constructed and made to reflect the prevalent market conditions and is in the form of rational market expectations. Companies are required to validate the results of the models by calibrating against observable evidence, cross-checking the results against other valuation methods and sensitivity analysis where necessary.

The last stage of the process includes documenting the methodology, assumptions and inputs in a comprehensible and open way and disclosing them in accordance with the requirements of IFRS 13. This structured process ensures that fair value measurement is consistent, defensible and high quality and will not come under scrutiny from auditors, regulators, and market participants.

Conclusion to IFRS 13 Fair Value Measurement Why It Matters for Accurate Financial Reporting

IFRS 13 has transformed the international environment of the fair value measurement by rooting the principles of market-based principles, stringent modelling norms, and comprehensive disclosing criteria in a single overall package. It forces companies to align the valuation practices with the real world which in turn makes financial reporting more believable, comparable and of better use to those involved.

Through the use of fair value hierarchy, focus on observable inputs, transparency modelling, and rigid disclosures, fair value measurement compliance under IFRS 13 promotes accountability and builds confidence of stakeholders In an environment where decisions in allocating capital rely on high-quality financial information, IFRS 13 provides the structure for companies to make reports that give valuations not only technically but economically.