How to Present Valuation Results to Investors Effectively

Introduction to How Present Valuation Results to Investors Effectively

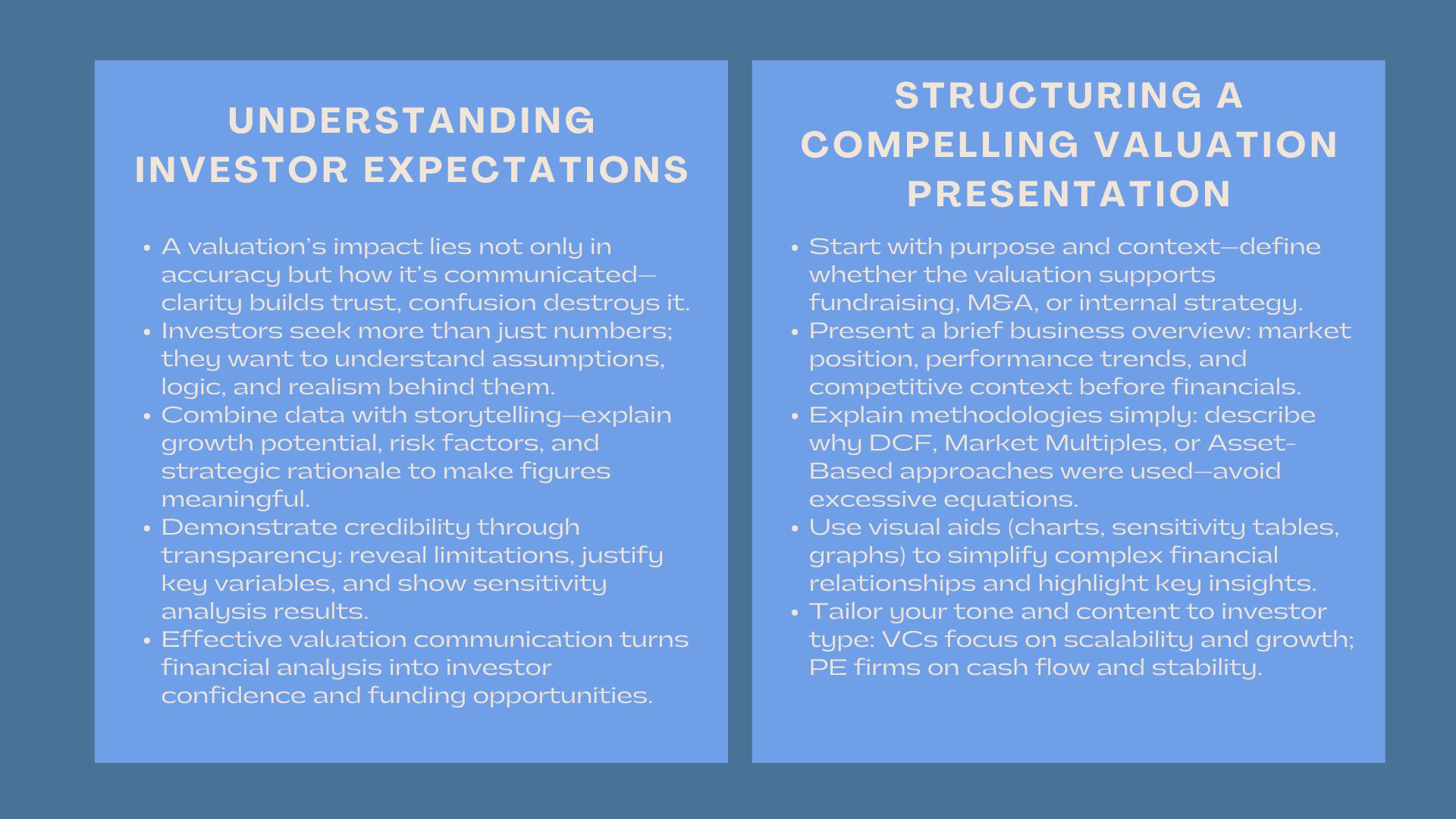

The actual worth of a business in the world of finance as well as entrepreneurship is not just the numbers that are shown but the manner in which the same numbers are presented. Investors can be overwhelmed with innumerable propositions and reports, and clarity, form, and authority are extremely important. A technically correct but ill-prepared valuation report may be easily undermined, whereas a clear and transparent structure may make or break the investor trust and open up new sources of funds.

Being a startup founder, CFO, or valuation consultant, the knowledge of how to present your valuation results in a manner that will be compelling to the investors can be the difference. In the current competitive investment environment, particularly in the markets such as Singapore and other financial powerhouses, communication is a crucial skill that should support financial knowledge.

1. The Investor Requirement Decoder.

Prior to working on your presentation, one should be aware of the expectations of investors when it comes to discussing valuation. The final figure is not all that investors are interested in, they also want to know how it was calculated, what are the assumptions that were used and how realistic these assumptions are.

1.1 The ratio between information and story.

Another weakness of valuations presentation is paying attention to the technical data only. Although financial models are necessary, the investors must be provided with context. A background of the numbers presentation would make them realize the growth potential, risk factors and the rationale behind the assumptions. To give an example, the significance of user growth rates or software platform scalability can give the financial numbers a sense when valuing a tech company.

1.2 Credibility with Transparency.

Shareholders like openness. In the case of clear methodology, logical assumptions and truthful account of limitations, they are assured of both trust in the presenter and the valuation process. No need to conceal any uncertainties, but rather mention them and demonstrate how sensitivity analyses were carried out to overcome them.

2. Organizing An Effective and Compelling Valuation Presentation.

Formality of presentation is also important in capturing the attention of an investor and projecting an image of professionalism.

2.1 Introducing with a sense of purpose and context.

Start by determining exactly what the purpose of the valuation is- will it be fundraising, mergers and acquisitions or internal strategy. Then, give a general summary of the business model, market position and recent performance. This preconditions the following results of valuation.

2.2 Discussing the Methodologies in a simplified way.

Investors are not necessarily financially savvy. It goes without saying that they should not be loaded with equations, but rather the valuation techniques in a nutshell in simple language should be summarized. For instance, explain how the valuation presentation tips helped ensure that each method—be it the Discounted Cash Flow (DCF), Market Multiples, or Asset-Based Approach—was chosen based on suitability, not convenience. It is important to emphasize your reasons behind every decision and it shows analytical rigor.

2.3 Visuals to Strengthen Knowledge.

Sensitivity tables, charts and graphs are potent tools to make the process of valuation more palatable. Complex financial concepts may be simplified by graphics that illustrate the point of small variations in the discount rates or growth assumptions and their resultant effects on the valuation.

3. Reporting the Key Valuation Results.

The investors must know how the conclusion on valuation has been made and what this means to the future returns on their investments.

3.1 Highlighting Core Findings

Pay attention to value of the enterprise, equity value and assumptions (growth rate, weighted average cost of capital (WACC), and terminal value). Vividly indicate the alignment of these metrics with market standards or industry averages.

As an example, suppose your company was appraised, taking into account the DCF model, take the audience through the calculation of the projected cash flows, the discounted rates, and the terminal value. The comparison with the industry peers is more relatable when shown.

3.2 Explaining the Assumptions

All valuations are premised on assumptions – on market growth, operating margins or capital expenditures. The proper articulation of these assumptions makes the investors believe the analysis was based on facts. Give justification of each significant assumption and, where feasible, connect them to some reputable source such as industry reports or history.

3.3 Valuation Testing the Stressors.

Demonstrate risk evaluation by investors. The sensitivity analysis and scenario modelling – that is, the valuation is calculated in optimistic, neutral and conservative conditions – proves that the valuation is sound in different conditions.

4. Putting on the Story Behind the Numbers.

Valuation is more of storytelling than analysis. The question that the investors would like to know is not only the worth of the company but where the company is drifting.

4.1 The relationship between Financials and Strategic Vision will be established.

The valuation must indicate the growth story of the company. Talk about the ways your strategic objectives (e.g., entering new markets, introducing new products or increasing operational efficiency) will create value. Investors will find the numbers more realistic when they perceive consistency between the business strategy and the valuation model.

4.2 Relation to the Market Potential and Competitive Advantage.

Explain the effect of market opportunities and competitive capabilities on the valuation. As an illustration, in case your business is in a fast growing financial technology industry, demonstrate how the demand in the industry is driving your expected increase in revenue. It is worthwhile to frame these insights into a narrative format so that the investors can see what they can gain.

4.3 Investor Confidence through Communication.

Professional investors tend to claim that they are not only investing in numbers but also people. This forms the basis of valuation success through communication. A convincing explanation, it is clear and confident (both in the foundations of the market and in the operational strategy of your company) that makes valuation a convincing tool that is not a fixed report.

5. Best Practices Investor Communication.

The presentation finesse and the technical accuracy are required to deliver the results of valuation in a successful manner.

5.1 The fifth tip is to maintain Sensitivity and Relevancy of the Message.

Do not cram a lot of useless information on your presentation. Investors like brief explanations with a focus on insights rather than data. Deliver your most important findings, assumptions and implications in a clear and confident manner.

5.2 Adapt the Presentation to the Audience.

Various investors have various priorities. Venture capitalists can be keen on scalability and exit potential whereas the private equity firms are keen on cash flow stability. customize your presentation to the interests of the audience.

5.3 The Power of communicate business valuation report

When preparing to communicate business valuation report, clarity and precision are critical. Make sure that your story has a logical structure, i.e. business overview to valuation results without excessive technicality. It is intended to inform, as well as to interact. A prepared valuation report is a decision-making information to investors and depicts to them how their capital can be utilized to achieve further growth and returns.

5.4 Employ if possible Independent Validation.

Where possible, make reference to external appraisals or expert opinion. External certification provides a sense of reliability, and curbs the doubt of investors that might doubt in-house assumptions.

6. Practical Application: Data to Persuasion.

Take the example of a Singapore-based software start-up that requires Series A funding. The management team had used the company value based on a DCF model taking into consideration aggressive growth assumptions. They did not merely provide a final figure of valuation but explained their every assumption including user growth projections, customer retention rates and pricing strategy based on market data.

The startup was able to win the trust of investors by making these insights transparent and easy to see. Although the valuation was high, the clearly explained story, openness in assumptions and pro-professional presentation led investors to join the funding round.

Conclusion

The effects of a valuation are based on the presentation quality. Effective communication will turn a technical report into an effective story that will appeal to investors. With the ability to present valuation tips and present insights as a confident business, the financial data can be transformed into strategic opportunities. Being able to communicate valuation results in a way that leads to the strengthening of the investor confidence, and, at the same time, helps to establish the relationships on a long-term basis–to ensure that all figures are able to tell the story of growth, trust, and future success.