How Employee Productivity Affects Enterprise Valuation

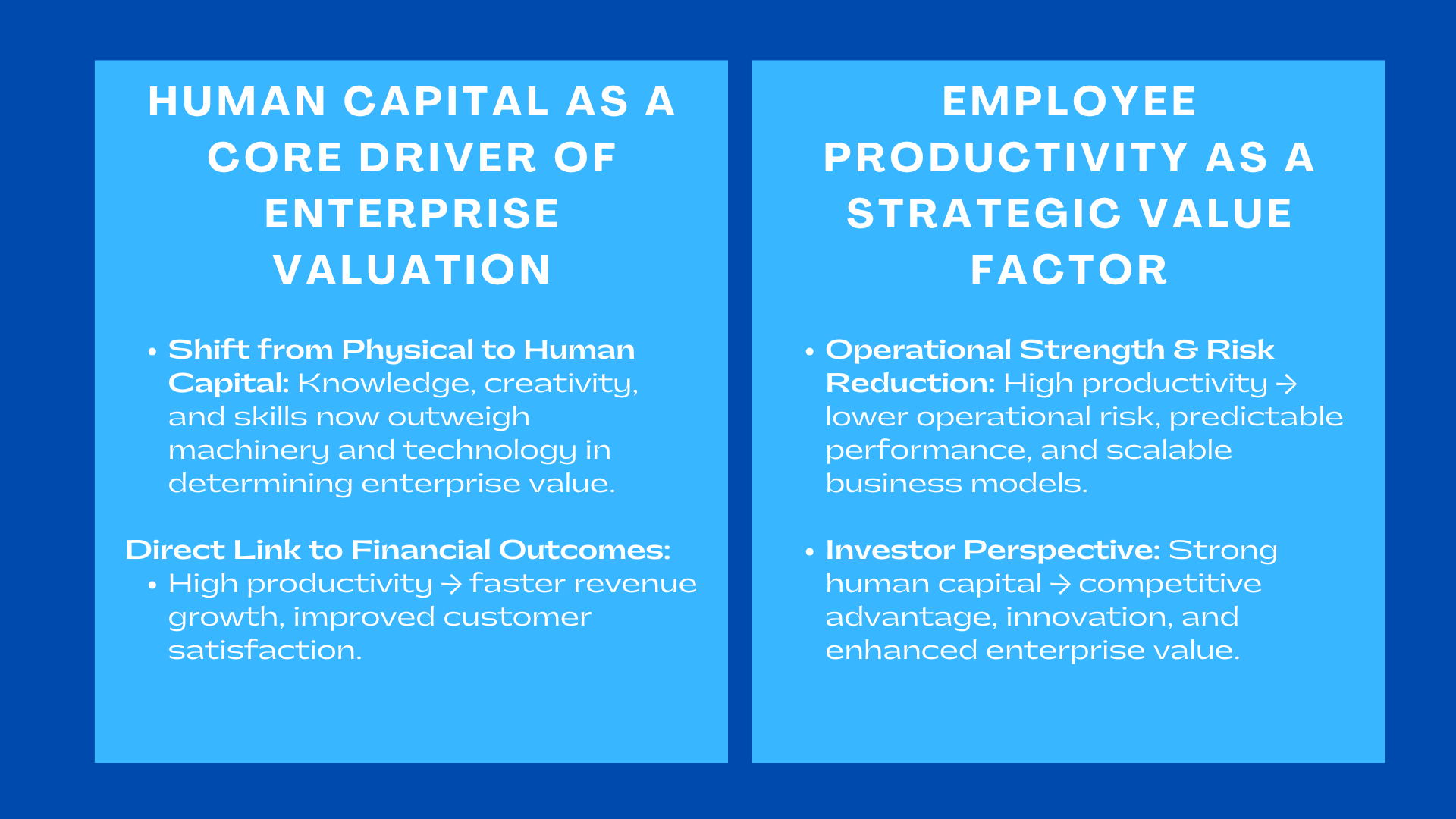

In the dynamic global economy, the productivity of the employees has turned out to be one of the most influential, yet underestimated, factors of the valuation of enterprises. The transformation of business models that were asset intensive to the knowledge of specific industries, has resulted in human capital becoming more influential to the value of companies than the machinery, equipment and even technology. With the growing competition, reduced workforce, technological transformation, and investor intensities, the productivity of employees is directly related to the financial course and long-term growth potential of a company. Shareholders are not just examining the accounts of companies, but they are examining how companies are using the company effectively to generate sustainable value by using its human resources.

This change has ensured efficiency of the workforce, now a very vital aspect in the valuation analysis today. The human capital has an influential role in innovation, continuity of operations, customer relations and strategic growth. Due to this fact, firms that are proficient at maximizing workforce efficiency business valuation the performance of the workforce tend to rank higher in critical ratios of valuation, such as profitability, scalability, risk management, and potential of growth. It is no longer a theoretical debate but an actual requirement for a leader, investors and valuation experts to understand how employee productivity can contribute to the valuation of an enterprise.

Human Capital as a Valuation Factor

Human Capital as a Valuation Factor

Why Human Capital Matters More Than Traditional Assets

Human capital reflects a grand list of these qualities, which are skills of the employees, creativity and expertise as well as experience, motivation and capability to solve problems. People create most of the value in industries like technology, consulting, finance, healthcare, education, design and advanced manufacturing among others, machines are seldom involved in mechanical creation of value. The intellectual property development, services of high quality to the customers, product innovation, and differentiation of the brand are all engines of human capital. Due to its inability to be easily quantified, yet the transformative potential of the human capital, human capital can be deemed a core of the valuation models aspiring to implement the long-term financial prospects.

Human capital is like the physical assets where since they do not wear out in time, when the appropriate investments are made in areas of training, leadership development and organizational cultures then they can even be improved with time. Employee competence and capability lead to greatly advanced innovation, quicker components to fulfill, better problem-solving and more efficient work flows to the company. The valuation analysts acknowledge that when companies possess assets of high human capital, the risks incurred are less, productivity is increased and predictability of producing returns is more assured to investors.

Shifting Valuation Models Toward People-Centric Metrics

In the traditional valuation methods, the physical assets like equipment, inventory and physical property were considered to be weighty. However, with the changing world of industries, valuation models are becoming more useful to incorporate HR metrics points of company worth. These are the rates of employee retention, the rate of employee engagement, productivity ratios, the density of skills, and maturity of training. The metrics can give an understanding of the effectiveness with which a company employs its labor force to lead to financial performance. A higher rating of organizational health as measured by HR will translate to a higher projection as captured by valuation models when there is a better long-term prospect, reduced cost of capital, and competitive resiliency.

Contemporary investors know that a company with an efficient, skilled and motivated workforce would do better than those whose workforce is either disengaged or poorly developed. Consequently, the value of human capital as an element of valuation has increased exponentially in significance and is still in the process of reforming the manner in which valuation professionals determine the value of organization.

The Direct Link Between Employee Productivity and Financial Outcomes

How Productivity Shapes Revenue Growth

The productivity of employees is a defining factor on whether a firm will be able to create revenue. When the employees are highly efficient, they are capable of doing work quicker, who also minimize delays and they are also able to eliminate bottlenecks in the workflow processes. This upsurge in speed and output enables the corporations to have more customers, new services, instant production, and react faster to chances as they emerge. In the case of service-oriented industries in which employees receive compensation based on a scheduleable amount of hours or the output of a project, employee productivity is even more directly linked to revenue performance.

Customer satisfaction is also associated with growth of revenues through productivity. Unless employees work effectively, they are likely to produce better quality work, attend to their HR metrics company worth customers quicker and communicate better. These enhance customer loyalty which enhances a stable revenue in the long run. Valuation models change upwards as the projections of revenue increase thanks to the growth of productivity, since the future cash flows are predictable and strong.

Impact on Profitability and Cost Structure

Cost-efficiency is heavily reliant on the productivity of the employees. An efficient workforce will result in greater output using fewer resources, which minimize the necessity of extra workforce, management and overheads. At optimum productivity of employees, there is a reduction of waste in operation as well as increase in the profit margin of the companies. Cost predictability is also increased by productivity whereby companies are able to maintain the operating cost even when demand increases.

Increased profitability raises the valuation directly with greater profit running in the form of EBITDA, net income, and free cash flow which are vital elements of valuation analysis, discounted cash flow (DCF) analysis and earnings multiples. Firms that have high productivity indicators normally enjoy greater financial stability and will therefore be appealing to investors and other strategic buyers.

Why Sustainable Productivity Strengthens Enterprise Value

The fact that productivity will be enhanced over an extended period is especially beneficial since it will create a consistent example of effective performance. When a firm has clearly shown some productivity enhancement over a number of periods, valuation analysts see such as a strategy discipline, operational maturity and long term viability. Ecof-friendly productivity establishes a legend of multi-year growth, which makes the company less dependent on market upheaval and economic processes.

Workforce Efficiency as a Core Driver of Business Valuation

Productivity as an Indicator of Operational Strength

Business valuation in terms of workforce efficiency acknowledges that business can do well in running its business operations as a leading indicator of organizational strength. When productivity of the employees is established, it indicates the firm has good leadership, precise processes, smooth channels of communication and accountability is high. These aspects are converted into the minimal operational risk, enhanced financial stability, and more scalable business model.

Productivity at high rates indicates that a company has been able to use the resources in an efficient manner. This has an impact on valuation, in that it puts a spotlight on the fact that the company can increase its revenue without the corresponding rise in costs, and this raises the level of leverage in operations and enhances profitability over several years.

Productivity and Risk Reduction

Organisations that hire high performing employees are unlikely to suffer the losses involved in taking up delays, quality and workflow failures. The close relationship is the fact that productivity is mainly associated with risk reduction since it shows how stable the inside work systems are, and how reliable the human performance can be. A high level of productivity makes the company look safer and more predictable to the activities of the company. Less risky profiles will lead to less discounted rates being used on future cash flows and the present value of the company will be raised.

How Investing in Productivity Enhances Scalability

One of the greatest aspects in venturing on the enterprise valuation is scaleability. Scalable business model enables the business enterprise to maximize income at a low incremental cost. The productivity of the employees is the focus of scalability as it is used to define the efficiency of the company to manage additional workloads. In the event that employees are highly productive, a firm is able to grow operations without the need to recruit a commensurate number of employees or to drastically raise the operation expenses. This activity results in the enhancement of margins, the increase of cash flow, and the increase in the valuation results.

HR Metrics and Their Influence on Company Worth

Retention as a Valuation Signal

The retention rates of the employees have come to dominate as a significant value point. The cost of high turnover is associated with expenditures incurred during the recruitment process and lost productivity not to mention a decline in team cohesion. A high retention level among the companies denotes effectiveness in leadership, desirable working climate, and healthy culture. Such conditions increase risk reduction, more stability and agility towards the company in terms of its stability to ensure a steady financial performance.

In industries that require special skills or knowledge which are internal to the firm, retention is very crucial. Having experienced employees in such fields is a huge problem to lose since it interferes with operations a lot. Strong retention is perceived as an indicator of organizational health and creation of long term value by investors and valuers.

Engagement and Its Financial Impact

Engaging employees is the most effective contribution to productivity. Engaged employees are more committed, much-energized, and more concerned with providing outstanding performances. When provided with high engagement levels, this is associated with high profitability, reduced absenteeism, increased customer satisfaction, and inventiveness. High rates of engagement are considered by investors to be the precursors of future performance and the valuation analysts will respond by updating the growth expectations.

Training and Upskilling as Predictors of Long-Term Value

The companies that invest in the field of continuous training and upskilling have more chances to respond to the changes in technology and the transformations on the market. A high level of skilled workforce helps in enhancing innovation, quality of product and efficiency in the operations. These results enhance future growth of revenues and reduce strategic risks, which boost enterprise value. There is also increased retention and stronger organizational structure in employers which focus on developing their employees.

Human Capital Efficiency and Competitive Advantage

Why Investors Evaluate Talent Strength

The capability of the talent pool of a firm is becoming an important determinant of enterprise value as it is determined by investors. They seek companies that have leadership potential, technical expertise and one that hasn’t lost a culture of creativeness and innovativeness. Good talent is related to excellent financial performance, increased competition, and sustainability. Valuation factors such as human capital are thus needed on whether a company is destined to achieve success in the future.

How Strong Teams Drive Innovation and Value Creation

Human capital is the primary source of innovation which leads to a competitive advantage in contemporary business. The effectiveness of teams of skilled employees consists in the creation of new ideas, optimization of processes, and the ability to solve complicated issues. Innovation has a direct impact on enterprise value in the form of generating intellectual property, developing brand equity, and generating new sources of revenue. An organization that has creative staff portrays high prospects of future value generation.

Culture as an Invisible Valuation Asset

The culture of the company is a factor of the valuation, but is intangible and critical. When the culture is positive, the engagement would be strengthened, retention better and the productivity facilitated. Culture defines the manner in which the employees relate, work and even deal with problems. Strong cultures reveal excellence in the form of attracting the best talents in organizations as well as enabling employees to achieve their full potential. Culturally, culture minimizes risks and increases stability and hence the company will be more appealing to investors.

Long-Term Effects of Employee Productivity on Valuation

Sustained Productivity and Multi-Year Growth

Long-term financial success can be determined by sustained productivity as one of its sure signs. As long as the productivity of the employees is high, the valuation analysts consider the company as disciplined, process-oriented and have the ability to sustain the earnings momentum. Long-term productivity promotes the growth of revenues over multi-year and enhances the confidence in the future projections. This translates to better valuation performance since the cash flows in the future are easier to predict.

Productivity Improvements and Capital Efficiency

Firms that have high productivity tend to have a high capital efficiency. They have the capacity of producing high output without having to create them in a proportionate measure. This effectiveness enables them to reinvest capital in a better way, which promotes growth, advancement, and strategic plans. Increased capital efficiency enhances the value of return on investment and the company becomes more valuable to the investors and valuation practitioners.

The Compounding Effect of Productivity Gains

The effect of productivity improvement is likely to increase with time. With increased efficiency of the employees, the company gets to use more resources on innovation, strategic expansion, and exploration of markets. This will translate to a better financial performance and greater long run outlook. The compounding effect of productivity develops a strong increase in enterprise value in the long term.

Conclusion to How Employee Productivity Affects Enterprise Valuation

The productivity of employees is seldom the issue that is considered solely as an internal parameter of performance; it is a key factor of enterprise value. Productivity will determine revenue growth, profits, scalability, and reduced risks, competitiveness and long term financial stability. The increase in reliance of industries on knowledge, creativity and innovation places human capital on the premium of value analysis. The areas of workforce effectiveness, business valuation, HR indicators, company worth indicators, and human capital as a valuation factor are all summed up to bear the actual picture of the valuation of people in an organization.

The firms which invest to enhance the workforce productivity, which can be done by training, human capital as a valuation factor culture, organizational and leadership and optimization of workflow position the companies to better valuation performance. They appeal to the investors, retain talents, are more adaptive to changes, and generate sustainable value. With the ever-changing globalized economy, organizations that acknowledge the pivotal view of the human capital will always perform better than others and have increased values of the enterprise.