A Complete Guide to Understanding Business Valuation Reports with Formats and Sample Templates

Introduction to Expert Business Valuation Report Course

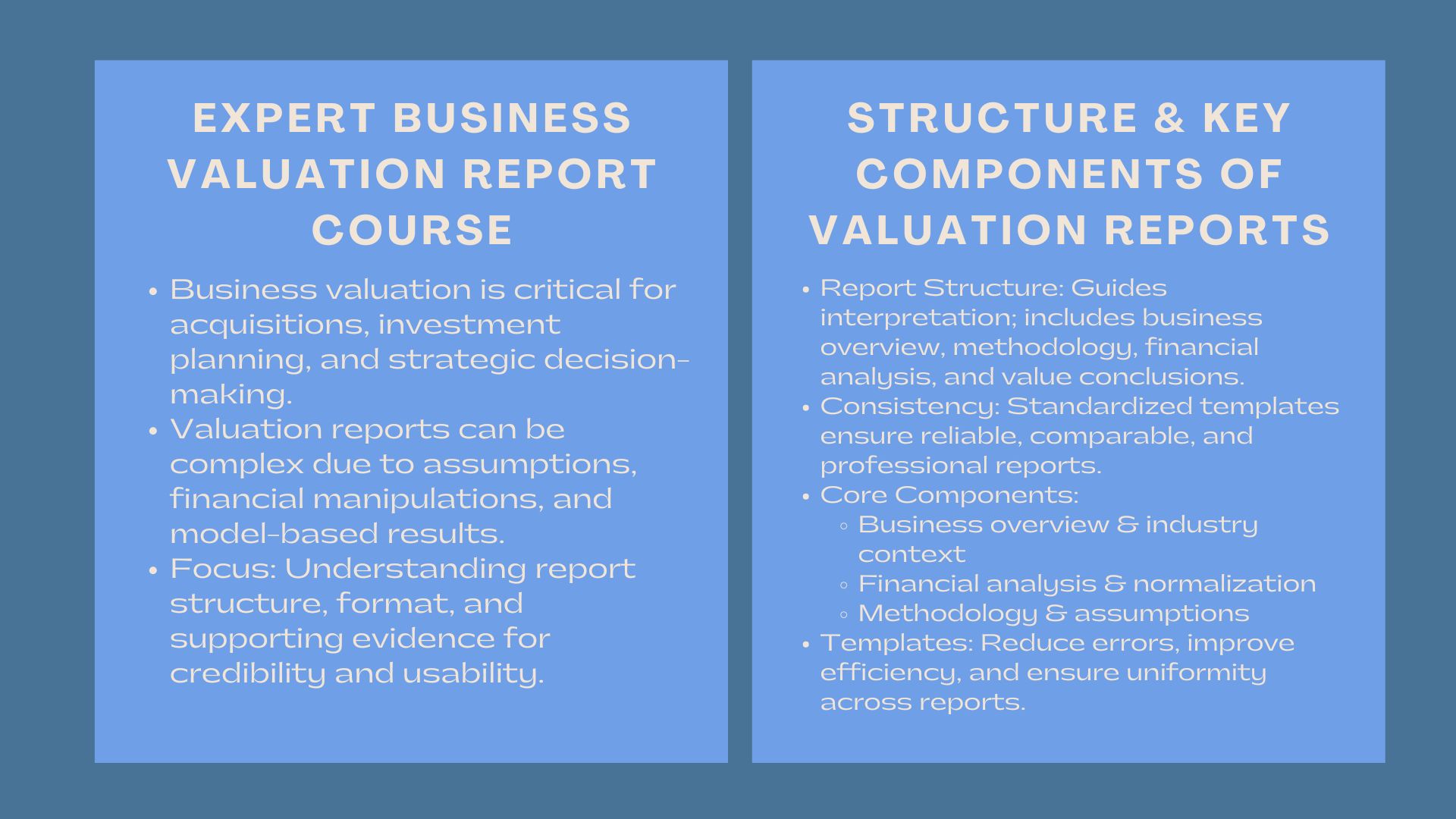

Business valuation is a decisive factor in acquisitions, investment planning, regulatory reporting, dispute resolution and strategy decision-making. However, valuation reports continue to be challenging to understand by many senior managers and entrepreneurs particularly when dealing with complex assumptions, financial manipulations, and model-based results. To provide clarity and relevance, this guide narrows down to a single subject that always defines the usability and credibility of any valuation document; the structure and format of a professional valuation report. Learning the manner in which valuation information is structured, delivered and with supporting evidence, the reader can be more assured in the conclusions made, assumptions that are tested and use valuation findings during negotiations or even board-level deliberations.

1. The Role of Report Structure in Enhancing Valuation Clarity

1. The Role of Report Structure in Enhancing Valuation Clarity

1.1 How Format Influences Interpretation and Decision-Making

The quality of a valuation report in professional practice does not just lie in the quality of analytical rigor, but the quality of findings reporting. Many practitioners emphasize that understanding business valuation reports begins with recognizing how structure guides thinking. When a report is well structured, it enables the readers; be it the investors, auditors or the regulatory agencies to follow the logic chain: business overview, methodological structure, supporting analysis and finally value conclusions.

Indicatively, in the case of assessing a manufacturing company that has cyclical earnings, a well-constructed document will offer chronological segments detailing the historical performance, a modification of financial records and assumptions used in projecting the cash-flows. In the absence of this clarity the stakeholders can easily blame short-term volatility as long-term risk. This is the reason why format is not cosmetic; it determines the impact of valuation results to investment or financing decisions.

1.2 Ensuring Consistency Through Standardized Formatting

One of the most important elements to the reliability of the report is internal consistency. Through a standardized approach, that is, the use of templates in accordance with valuation standards or internal governance policies, organizations limit the chances of being omitted, or misinterpreted. A business valuation report format in word format is becoming very common and many corporate finance teams now rely on a business valuation report format in Word to maintain consistency across engagements.

A good example is multinational companies that acquire operations in various jurisdictions of which standard reporting templates are needed so that board members can easily compare assumptions, value drivers, and risk factors. The common format facilitates the compliance with the issues and enhances the intra-regional communication particularly in multi-entity valuations.

2. Key Components of a Professional Valuation Report

2.1 Business Overview and Industry Context

Any good valuation report should always start with the description of the operating model of the company, its position in the industry and the industry environment. This section is necessary to put the result of valuation into perspective. Some of the revenue drivers, customer groups, regulatory, and competitive forces typically analyzed by analysts include these categories.

As an example, a valuation of a logistics company in Southeast Asia is considered. The business overview is supposed to elaborate on the main performance drivers like the fluctuation of the fuel prices, transport laws, and infrastructure limitation. In the absence of this, the reader of valuation can fail to identify risks hidden in cash-flow forecasts or assumptions of discount rates.

This is why many analysts recommend embedding accurate business valuation tips directly into this section—for example, emphasizing that industry dynamics must align with revenue projections and cost assumptions.

2.2 Financial Analysis and Normalization

A valuation is as good as the monetary inputs that are behind it. The financial analysis section is usually the part that consists of historical performance review, variability of margins, working capital patterns, and capital expenditure requirements. Notably, normalization adjustments are made by the analysts in order to indicate sustainable earnings.

The actual scenario is observable in the retail companies with seasonal peaks. A valuation report needs to explain what are both structural and non-structural changes in earnings. The absence of such adjustments can cause overvaluing or undervaluing a target by the stakeholders, which will result in either a difficult negotiation process or a mispriced deal.

Proper normalization also helps users better interpret findings in a business valuation report sample, which often highlights both the unadjusted and adjusted earnings to illustrate how value conclusions evolve.

3. Methodological Framework and Assumptions

3.1 Choosing the Appropriate Valuation Approaches

There are three fundamental approaches that are usually used by valuation practitioners and they include income based, market-based and assets-based. The methodological part should provide clear reasons as to why a given approach was chosen. As an example, in valuing a digital platform, the income method is frequently of primary importance to the analysts since the intangible assets that generate future value are the user acquisition strategy and ease of scaling the platform.

In contrast, real estate holding companies often favor the asset-based approach due to the dominance of physical property assets. This methodological clarity enables readers to trace how value is determined and helps them better apply understanding business valuation reports in strategic discussions.

3.2 Testing Assumptions and Ensuring Transparency

The major task of the valuation analysts is to ensure that the assumptions are realistic, defensible and market evidence based. The forecasts should be synchronized with industry benchmarks, cost structures or macroeconomic trends.

Indicatively, the price of a distributor of energy should be stress-tested when assumptions regarding fuel prices, inflation, and regulatory tariffs are made. Without the sensitivity analysis included in the valuation report, a reader cannot comprehend the impact of the external variables on the company value to their fullest. Openness in assumptions is one of the most precise guidelines to generate sound valuation results and to make sure that the decisions made on the basis of such valuations are valid.

4. Using Templates to Improve Consistency and Credibility

4.1 How Templates Reduce Errors and Improve Review Efficiency

Most valuation firms and in-house corporate finance departments have templates to make sure that no important sections are left out. A properly designed business valuation report format in Word typically includes placeholders for executive summaries, methodologies, financial analysis, sensitivity results, and appendices.

This standardization saves a lot of time during the review. As an example, several valuation reports can be considered during the short timeframes in the context of acquisition due diligence. The use of standard templates will guarantee uniformity in terminology and structure, so that top leadership will be able to contrast critical metrics, including discount rates, valuation scales, and normalized earnings, more effectively.

4.2 Sample Templates and Their Practical Use Cases

A business valuation report sample usually contains hypothetical computations and a statement of explanation that shows how the assumptions and adjustments are to be recorded. The samples are useful training aids in the corporate finance and consulting settings, particularly those junior analysts acquiring the principles of valuation.

As an example, a sample template can involve a hypothetical evaluation of a small production firm. Sections could be used to explain how to balance between various methods of valuation, or how to explain the choice of discount rate by referring to market data and risk-specific to the company. Through such samples, professionals can understand how to communicate such findings of valuations in a clear and convincing manner.

5. Ensuring Report Usability for Decision-Makers

5.1 Making Reports Accessible to Non-Technical Readers

The best valuation report should be one that can be easily comprehended by stakeholders who are not financially well trained. Even though technical depth still plays a significant role, understanding and interpretability finally decide the ability of the stakeholders to use the insights of valuation in strategic decisions.

Indicatively, some of the common requests by the private equity investors are to write short executive summaries of the value drivers, critical assumptions, and risk factors. It can be written in an organized report format that gives this information in narrative form ensuring that the decision-makers can easily understand vital information without going through intricate models.

Embedding accurate business valuation tips within the main analysis helps reinforce key lessons for readers seeking both clarity and conceptual understanding.

5.2 Communicating Value Ranges Rather Than Single-Point Estimates

In reality, valuation is not an art. The most advanced models give a variety of plausible results because of uncertainties involved. Avoiding misleading precision of presenting valuation conclusions as a range of numbers instead of single numbers.

Take an example of a valuation that is ready concerning a renewable energy project. Incentives of policy, interest rates or the risk of substituting fuels may vary discount rates. The range of valuation is more responsible in terms of uncertainty, which enables the management to make responsible investment decisions.

This ensures that the entire credibility of the valuation report is boosted and that there is transparency in decision making.

Conclusion

A professional valuation report is not just a financial document but a means of communication that helps to make strategic decisions, negotiating, and aligning the stakeholders. Organizations are able to generate credible and practical valuation documents by concentrating on report structure, clarity, templates, and transparency of the methodology applied. Knowledge on how critical sections would interrelate enables analysts, executives and investors to comprehend and understand findings confidently and implement them practically in real life.