Business valuation is a action of evaluating the value or worth of a company. Business Valuation can be done for various reasons, such as when a business is looking to raise capital, being sold, or going public. There are different ways that can be used to value trade, and in this article, we’ll look at some of the most common.

Market Value Valuation Method

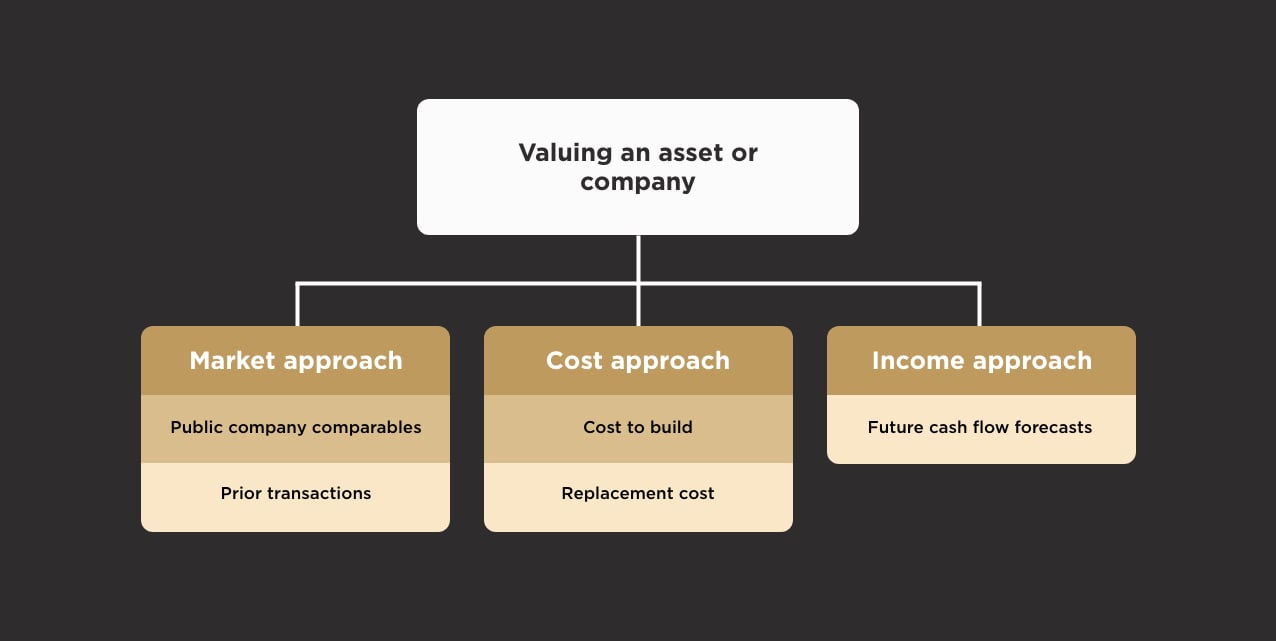

The Market Value Valuation Method is the most common type of business valuation. It looks at the company’s value in the marketplace based on factors such as recent sales of similar businesses and the current economic conditions. This method is frequently used to value businesses that are being sold or acquired.

There are several ways to count the market value, but the most common approach is to use a multiple of the company’s earnings or revenue. For example, if a company has an annual income of $10 million and is valued at a multiple of 4, its market value would be $40 million.

The market value valuation method can be a helpful way to estimate the value of a business, but it has its limitations. It doesn’t consider the company’s intangible assets, such as its brand name or customer base. Additionally, market value can fluctuate over time, so it’s important to use recent data when possible.

Asset Based Valuation Method

Business valuation is the process of determine the economic value of a business or company. Several methods can be used to value a trade, but the most common method is the asset-based valuation method.

The asset-based valuation method is based on the premise that the value of a business is equal to the sum of its assets. This method is frequently used to value businesses being sold or acquired, as it provides a clear and concise way to determine the value of a company.

However, there are some drawbacks to this method:

- It does not consider a company’s earnings power, which can be a crucial determinant of value.

- It cannot be easy to accurately value intangible assets, such as goodwill or intellectual property.

- This method does not always shows an accurate picture of a company’s worth, as it does not consider factors such as market trends or the competitive landscape.

Despite these drawbacks, the asset-based valuation method remains one of the most popular methods for valuing businesses. If you are looking to sell or buying a business, this is likely the method that will be used to determine its worth.

ROI – Based Valuation Method

This valuation method is based on the return on investment (ROI) concept. It involves calculating the expected rate of recovery from business investment and comparing it to the required rate of return. The investor’s risk tolerance usually determines the necessary rate of return. If the expected return is higher than the required rate, then the investment is considered good.

One benefits of this method is that it considers an investment’s risks and rewards. This makes it a more comprehensive approach than other methods, which only focus on the upside or downside potential.

However, this method can be challenging to implement in practice. This is because estimating future returns is often tricky, especially for small businesses with a limited track record. Additionally, this method doesn’t account for intangible assets such as brand value or customer loyalty which can add significant value to a business.

Discounted Cash Flow (DCF) Method

The discounted cash flow method is one of the businesses’ most popular valuation methods. This approach considers the time value of money and discounts future cash flows to present value. The DCF method is often used to value proliferating companies, as it can provide a more accurate picture of a company’s true worth.

There are two main types of DCF valuation: multi-period and single-period methods. The multi-period method is the most commonly used, as it provides a more comprehensive view of a company’s future cash flows. This approach discounts cash flows for each year separately and then sums them up to arrive at a present value.

The single-period DCF method is less commonly used but can be helpful in certain situations. This approach discounts all of a company’s future cash flows to a single point in time. This can be useful when valuing companies with limited historical data or those expected to experience significant changes in their business model.

Both approaches have benefits and disadvantages, so choosing the right one for your specific situation is essential. The DCF method is a strong tool that can provide valuable insights into a company’s true worth.