Preparing for Audit: Valuation Requirements Under Singapore FRS

Introduction to Certified Audit Training FRS Valuation

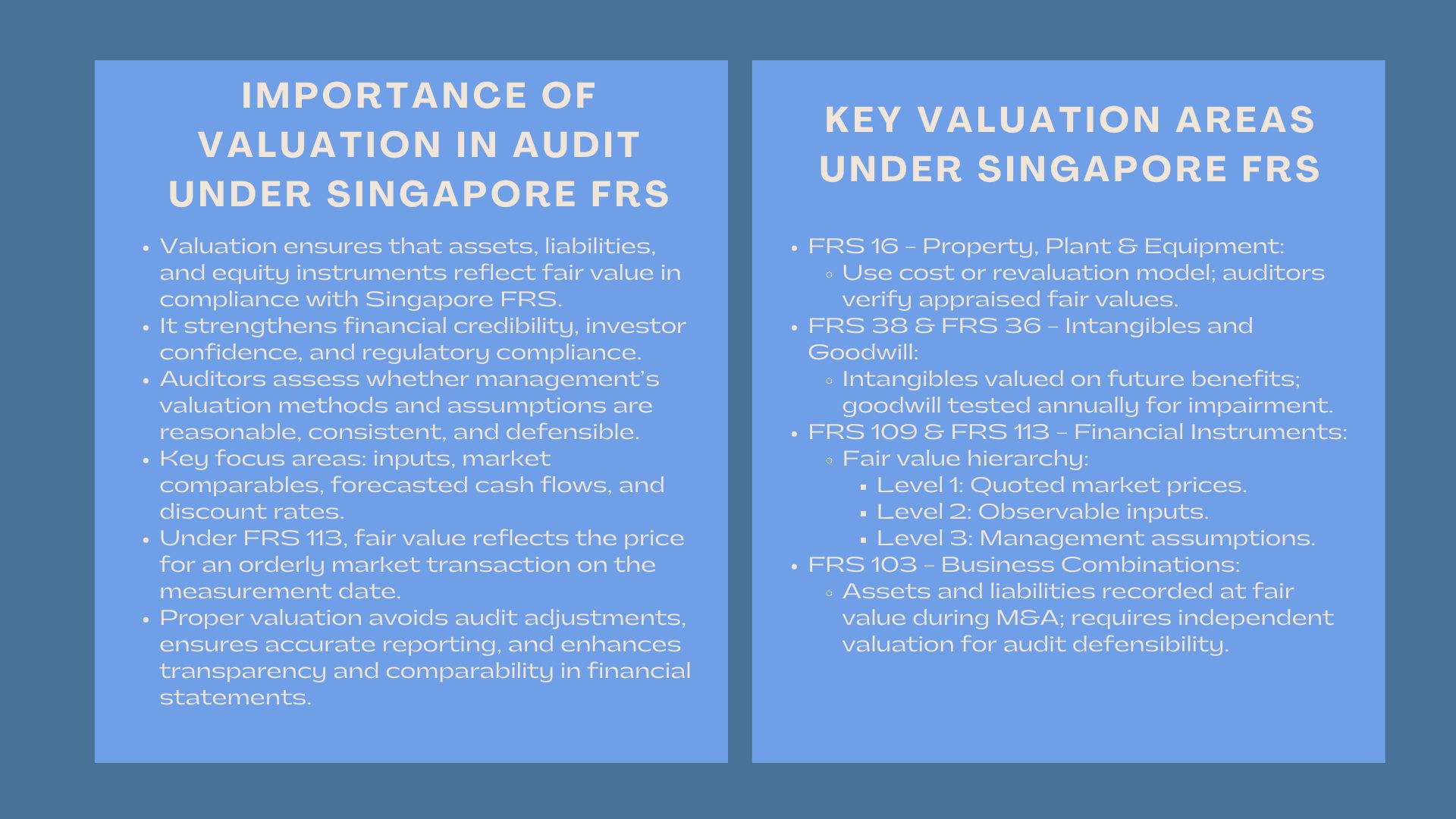

The financial landscape in Singapore is very restrictive, and growing pressure is being mounted on the business to verify the legitimacy and disclosure of their financial statements. Valuation – the process of establishing the fair value of assets, liabilities, and equity instruments is one of the areas that will be looked at critically. Valuation is becoming a focus of compliance and audit preparedness as companies become increasingly complex (particularly when they have diversified portfolios or other intangible holdings in large amounts).

Proper valuation ensures that the financial position of a company is well depicted, which will generate confidence among investors, enabling justifiable taxation, and compliant with the regulations and accounting principles. Yet, many businesses underestimate how valuation interacts with audit processes and the audit valuation requirements set under the Singapore Financial Reporting Standards (FRS). It is important to understand these links so as not to incur the expensive adjustments during the auditing process and to prepare a set of financial statements that is credible and audit ready.

1. The significance of Valuation in the Audit Process.

1. The significance of Valuation in the Audit Process.

Valuation is very important in financial reporting and affects the manner in which assets and liabilities are measured as well as the manner in which income, expenses and equity is reported. In the case of the auditors, valuation is used to test whether financial statements contain no material misstatements.

1.1 What Auditors are Interested In Valuation.

Auditors evaluate the appropriateness of valuation methods and assumptions of management, which are reasonable and that is consistent with Singapore FRS. This involves analysis of inputs in terms of market comparables, forecasted cash flows and discount rates. Inaccuracies or variances in valuation can greatly pervert the reported profits, asset values or impairment losses – which regulators such as ACRA (Accounting and Corporate Regulatory Authority) often put into the limelight.

1.2 Fair Value and Role in the Contemporary Reporting.

The modern financial reporting is built on the fair value measurement, which is provided under FRS 113. It also stipulates that the assets and liabilities should be valued at prices that would be received or paid during an orderly transaction among the participants in the market on the measuring date. This concept ensures comparability, transparency, and relevance — essential pillars for any audit process grounded in the Singapore financial reporting valuation framework.

2. Key Valuation Areas Under Singapore FRS

Singapore FRS standards set valuation requirements in terms of different asset classes, financial instruments and business combinations. These rules are important in order to understand audit readiness.

2.1 Property, plant and equipment (FRS 16)

According to FRS 16, the companies have the option to use cost model or revaluation model when measuring the property, plant, and equipment (PPE). Assets have to be fair valued less depreciation and impairment when the revaluation model is applied. Auditors will normally check fair value estimates by relying on professional appraisals or comparing them with market transactions.

2.2 Intangible assets and goodwill are recognized under two subsections, FRS 38 and FRS 36.

Intangible assets like patents, software and trademarks have to be valued on the basis of future economic benefits. Goodwill, in its turn, is not amortized but is subjected every year to impairment testing in accordance with FRS 36. In impairment test, auditors give special attention to assumptions made in the cash flow projections and discount rate. Unrealistic projections may result in audit risks or write-downs.

2.3 Financial Instruments (FRS 109 & FRS 113)

FRS 109 requires financial assets and liabilities to be measured at fair value when they are first recognized and in most situations after recognition. FRS 113 gives a fair value fair hierarchy:

Level 1 : Prices quoted in active markets.

Level 2 : Non-quoted price visible inputs.

Level 3 : Unobservable inputs on the basis of management assumptions.

The auditors look at the logical placement of tools in the tool hierarchy and consistency of valuation model with market observations.

2.4 Business Combinations (FRS 103)

During mergers and acquisitions, all the identifiable assets and liabilities are to be determined at fair value on the date of acquisition. Independent valuation experts are normally hired to calculate purchase price allocation (PPA), which make sure that the resultant goodwill and intangible asset values can withstand audit review.

3. Audit, Preparation, Documentation and Methodology.

The preparation of the audit is not only based on carrying out valuations but also showing the rationale and methodology clearly. The satisfaction of the audit reviewers is based on transparency in the assumptions, inputs and models.

3.1 Establishing valuation policies

Businesses ought to actually make internal policies of valuation that outlines when they need to be valuated by the outsiders, who and how frequently they are to be reviewed. A uniform policy on valuation can also exhibit the maturity of the governance and lessen the chances of the audit disagreements.

3.2 The choice of the suitable valuation method should be made.

Auditors anticipate the adoption of accepted practices:

- Income method: Discounted cash flow (DCF) of long term value assets.

- Market strategy: Comparison of similar assets or companies.

- Cost approach: meant to be replaced. used special assets of a costly nature.

The management must be in a position to explain why that approach has been chosen and give evidence to all major assumptions.

3.3 Keeping Detailed Accounting Records.

To be audit ready all valuations must have a clear record of:

- Sources of data and assumptions;

- Valuation methodology and reasoning;

- Sensitivity analyses;

- As appropriate, independent expert reports.

- One of the most widespread causes of valuation challenges by auditors is incomplete documentation.

- Some of the issues of valuation that are common in Singapore audit.

Despite good frameworks, valuation has been one of the most judgmental and controversial audit areas.

4. Assumptions made are subjective.

The future cash flows, growth rates or discount rates will always require some degree of judgment. During periods of uncertainty in the market, auditors might question whether assumptions can represent present economic situations or industry trends.

4.2 Insufficient Market Data

In the case of unlisted companies or specialised assets, there might not be many market comparables. When this happens, then there is high risk of bias in terms of having to rely on internal forecasts. Independent valuers or cross-checks (i.e. using more than one valuation approach) are possible ways to enhance the defensibility of the audit.

4.3 Reducing Regulatory Expectations.

Valuation and audit standards are constantly updated by the Singapore regulators and the accounting professional bodies, including ISCA (Institute of Singapore Chartered Accountants). Firms have to keep pace with the changing expectations, especially in regard to fair value disclosure and impairment testing.

5. Hiring of Professional Valuers to get Audit Ready.

When it comes to complex financial instruments, intangible assets or business combinations, auditors tend to suggest that companies hire independent valuation specialists.

5.1 Advantages of Independent Valuation.

An external valuer possesses technical skills, objectivity, and being familiar with the trends in the market today which is very important as far as FRS is concerned and also in creating auditor trust. Their reports are the third party confirmation that the valuation assumptions are reasonable and defendable.

5.2 Co-ordination amongst Valuers and Auditors.

Close liaison between valuation professionals and auditors is what is needed to bring about consistency in methodology and interpretation. Initial interactions enable the ability to solve potential problems before the end of the year, preventing delays in the audit process and end-of-year revisions.

6. Valuation and Audit Readiness Trends in the Future.

The future of audit and valuation in Singapore is shifting to a more transparent, automated, and technologically integrated future.

6.1 Valuation Models based on Technology.

The way valuations are done is being transformed by artificial intelligence and data analytics. The tools used in the preparation of real time fair value assessment prepared by companies using automated data collection and scenario modelling tools have the potential to be easily audited by a company.

6.2 Improved Disclosure Requirements.

Regulators are becoming much more demanding of in-depth disclosures of valuation methods, inputs, and sensitivity tests. Audits in the future will pay attention not only to the accuracy but to the disclosure of the valuation risk and uncertainty in companies.

6.3 Compliance of Cross-Border Valuation.

With the rise in the number of Singapore firms going regional, cross border transactions are creating new valuation challenges in various accounting regimes. Balancing between the valuation frameworks between the IFRS and the regional standards will also be a key issue to the multinational audit preparedness.

Conclusion

Strong, transparent and well-documented valuations are increasingly becoming a key to audit success in Singapore. The audit valuation requirements as stipulated by the Singapore financial reporting valuation framework not only require technical skilledness but also foresight and governance discipline.

Companies that actively synchronize valuation procedures with guidelines of the FRS through the assistance of professional valuers, uniformity in valuation procedures and documentation are in a better position to have an easy time on the audit and increase investor confidence. As Singapore keeps building a strong reputation in the financial transparency arena at the international level, those businesses that will learn how to prepare valuations that are audit-ready will have a clear edge in compliance with the regulatory framework, as well as, corporate reputation.