Why Independent Valuation Reports Build Investor Confidence

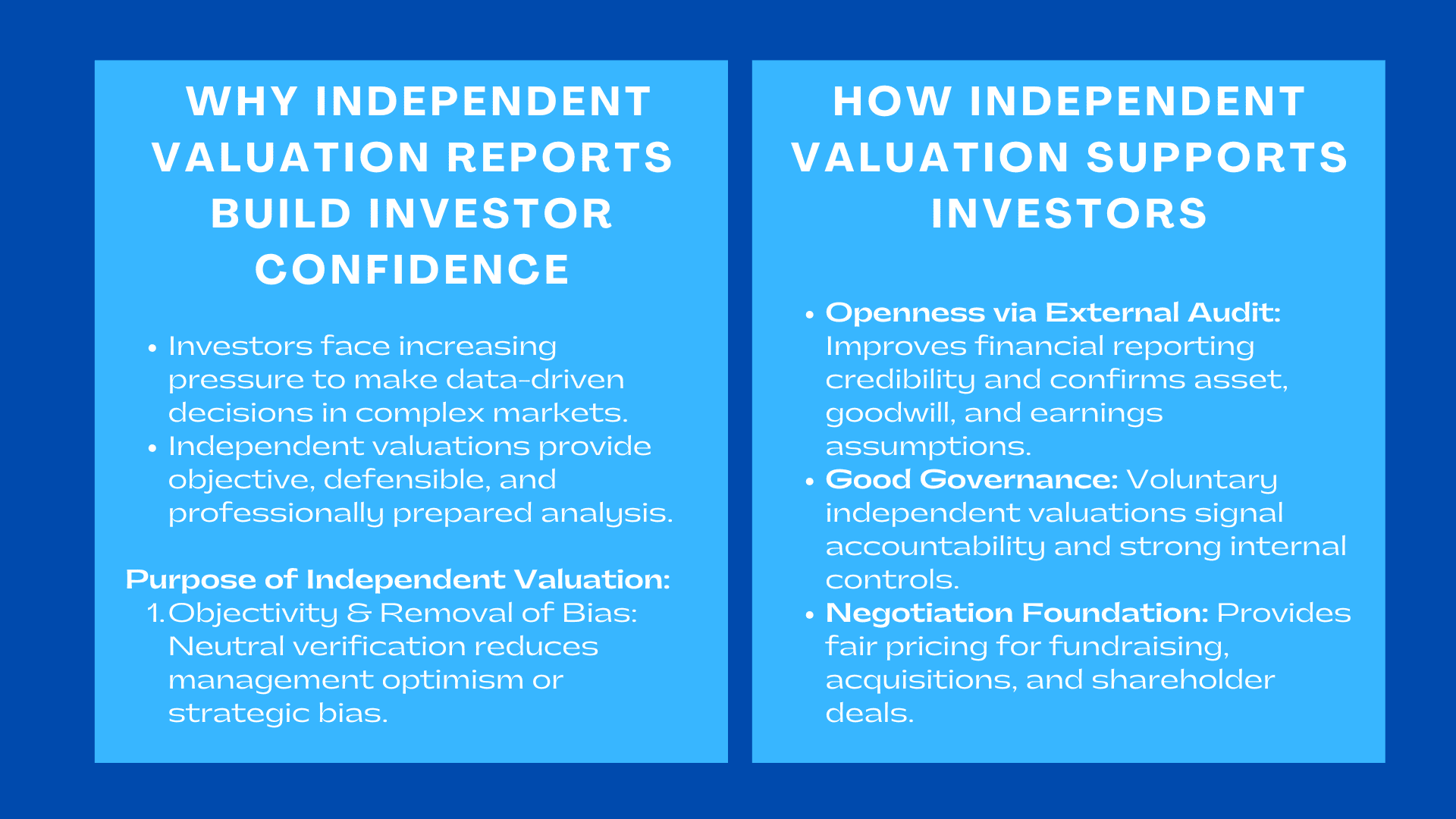

They put the capital providers in the modern investment environment under the greatest pressure to make well-informed and data-driven decisions ever. Markets are growing more complicated, there are increased amount of private investment and the financial disclosures do not provide a sufficient amount of detail to narrate the complete story behind the value of a company. Investors are no longer ready to put money into the market without finding objective, defensible and professionally prepared analysis to help them protect their capital. The move has increased the value of independent report of valuation as a pillar to investor due diligence and trust-building, a topic often emphasized in IFRS financial reporting mastery training Singapore.

In both fast-developing enterprises and established business ventures, independent valuation has the effect of enhancing credibility. It shows that the management is ready to go through scrutiny, provide sensitive information in the open and prove strategic assumptions with the help of external experts. In the world where investor confidence is directly related to the success of fundraising, terms of acquisition, and long-term cooperation, the importance of the independent valuation has never been as crucial.

1. Purpose of independent valuation as a strategic point.

1. Purpose of independent valuation as a strategic point.

1.1 To ensure objectivity and removal of bias.

Objectivity is one of the major strengths of an independent valuation. Although internal assessments are useful, they can be biased in the sense that they can give an illusion of optimism among the management or strategic biasness. This is not unknown to investors but this is why it is vital to have the third-party verification.

The professional valuers adhere to the international standards, rely on verifiable data sources, and employ transparent methodologies. This objectivity leaves the investors with no doubt that the valuation is founded on facts and not ambition. There is a disciplined approach to a credible analysis of the revenues and operational risks, working capital requirements, and market assumptions. Investors will know that the management is not afraid of outside scrutiny; this is an indication of integrity and less information asymmetry.

In the process of the review, investors tend to examine the question of whether the assumptions made in the valuation are in line with the realities in the market. This is where the article naturally integrates one of the required keywords: a founder preparing for fundraising may commission an independent business valuation report to show that projected cash flows, market size estimates, and discount rates are credible. Such reports serve as a neutral reference point, bridging the gap between a company’s ambitions and investor expectations.

1.2 Strengthening Due Diligence and Investment Risk Assessment

Due diligence is quite important to investors because they can know the nature of business and financial health of the company, as well as its growth prospects. A third party valuation is an essential paper in this process as it pulls the future perspective of the firm together into a organized and measurable analysis.

Risk-sensitive investors, like the private equity funds, venture capital firms and institutional investors, are willing to have valuations which will describe the expected returns as well as the underlying risks. External valuers offer sensitivity analysis, scenario modelling, and simulation of cash flow and assist investors in visualizing their probable results in various economic environments. This knowledge is critical in unstable businesses like technology, logistics, energy, or consumer market.

Independent valuation reports have the power to help investors properly structure transactions by explaining the presence of upside potential and downside exposure. This involves pricing of deals, negotiating equity shares and development of earn out mechanisms along performance triggers that can be measured.

2. Establishing Openness via External Audit.

2.1. Improving Financial Reporting Credibility.

Being transparent is among the finest messages that a firm can send to the investors. The value is strengthened by independent valuation reports which confirm the assumptions of the asset values, goodwill, intangible assets, and projected earnings. External analysis and internal calculation is more effective in giving investors confidence in financial reporting.

This may be necessary in particular cases especially when fundraising rounds, acquisition, or structural change like restructuring, divestment or management buy out are involved. With congruent valuation outcomes and audited financials, the confidence of the investors is highly boosted.

Many companies preparing for significant investment rounds follow the practices of third party valuation Singapore engagements, which focus on fair value analysis, benchmark comparisons, and compliance with reporting standards. Such transparency resembles the best practices of the world and increases the credibility of the company to foreign investors.

2.2 Good Governance and internal control strength Demonstration.

Good governance is one of the key determinants of investors. Companies providing voluntary independent valuations indicate that the companies value accountability and internal controls. This is a message by the investors of having good management and risk-conscious leadership.

Another application of independent valuation by boards of directors is through the approval of share issues, stock option plans, related transactions or restructuring exercises. This is because boards reach out to external specialists, thereby preventing conflicts of interests and all the shareholders, including the minority, are treated equally.

Take the case of an organization that is owned by the family and it is the first time they are looking to acquire external capital. Informal forms of governance or being emotional in making decisions may be a concern to investors. A professionally managed, independently audited valuation will remove all these fears and place the company in a position where it can be invested in as well.

3. Independent Valuation during Negotiations on a Deal.

3.1 Developing a Reasonable Pricing Foundation.

During negotiations (fundraising, acquisitions, shareholder purchases, mergers, etc.), independent valuation serves as the point where negotiations anchor themselves. Instead of being guided by the expectations of one party, both of them begin with the common value.

As an illustration, a buyout negotiation can be associated with a founder who thinks that the company is worth much more than the financial data tells. A third-party appraisal will be used to re-establish the expectations, thereby avoiding a failure in negotiations. On the other hand, in case the investors underestimate the business, the report can be used as a testimony to the real potential of the company.

The authority of the unbiased, evidence-based evaluation avoids a long-term dispute and ensures the speed of the deal.

3.2 Reinforcing Confidence among Investors in complicated Transactions.

Some of these transactions include a partial divestment, earn-out deals, joint ventures, and convertible note conversions, which need accurate valuation analysis. Unless there is property evidence to prove financial estimates and strategic assertions, investors would hesitate to invest.

Independent valuers give a thorough understanding of unit economics, cash flow drivers, market drivers, and competitive positioning. Their work will assure investors that transaction terms are in line with actual performance and interpreted real expectations.

As an example, in technology businesses where intangible assets and recurring revenue forms of value are predominant, independent values can help investors gain an insight into how monetisation can be realised, customer retention ratios, and scalability, which significantly affect deal terms.

Conclusion to Why Independent Valuation Reports Build Investor Confidence

The independent valuation reports have become inseparable parts in the creation of investor confidence in a world that is transparency-driven, data-driven, and risk orientation. They offer objectivity, enhance due diligence, reinforce financial reporting reliability, and assist in setting fair prices of transactions. With increasing requirements of investors on the accountability of alternatives and transparency of values, firms that place emphasis on professional valuation will still be appealing to new capital more effectively and bargain more effectively. In the future, independent analysis will be a key pillar of any plausible fundraising, ethical governance and long-term trust of investors.