How Business Valuation Supports Bank Loan Applications

Guide for Professional Training Business Valuation Loans

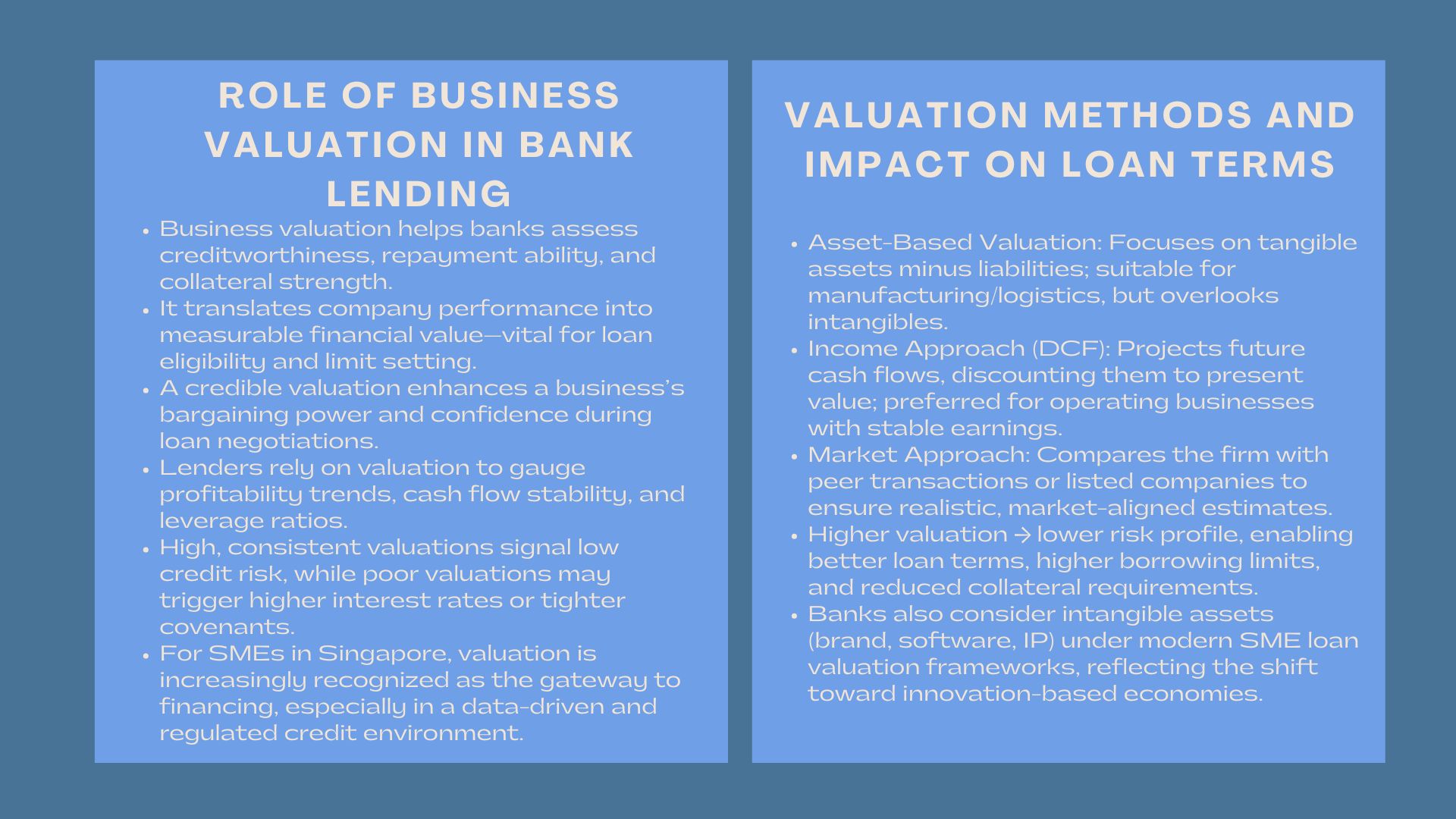

In the modern competitive world of lending, financial institutions are also becoming very cautious in the process of examining credit risk particularly to the small and medium-sized enterprises (SMEs). An excellent business valuation is an important step in this process since it is used as a basis in deciding whether a company is financially sound and capable of growing enough to warrant a bank loan. Proper valuation is also known to enhance the credibility of a business besides enhancing its bargaining power when seeking funds.

To SMEs that need to get money in Singapore or in any other developed economy, the knowledge of how valuation would help secure bank loans would be the difference between approval and rejection. The article discusses the role of valuation in supporting loan decisions, approaches used by banks, and how businesses may apply the knowledge of valuation to enhance their ability to secure capital.

1. The Business Valuation and Strategic Position of Business in Loan Applications.

1. The Business Valuation and Strategic Position of Business in Loan Applications.

The business valuation is not an accounting list, but rather a device that converts the performance of the company to quantifiable financial worth. To lenders, this valuation is the foundation of creditworthiness, repayment capacity and strength of collateral.

1.1 Valuation as a Financial Vitality Indicator.

Banks use the analysis of profitability, cash flow and the asset base to determine the ability of a firm to maintain operations and to repay the loans. The detailed valuation shows the role of these factors in aggregate enterprise value. As an illustration, trending earnings growth and positive cash flow will significantly be converted into increased valuations which will indicate reduced credit risk. On the other hand, deterioration in performance or over-leverage may cause lenders to view increased risk, which causes high loan terms.

1.2 The Bank Vision of Value.

As a lender, valuation has two main purposes, which include eligibility of loans and borrowing limits. The more the business value which is assessed the more the lending confidence. Valuation is also employed by financial institutions in order to determine whether the collateral that is proposed, be it property, equipment or receivables, is sufficient to secure the loan.

This approach is especially relevant for the valuation for business financing process, where both tangible and intangible assets are considered to gauge repayment potential.

2. Key Valuation Methods Used in Loan Assessments

In the determination of valuation, there are various methods adopted by the banks and credit evaluators according to the industry, size and purpose of the loan being taken by the borrower. These methods will provide a reasonable and defensible estimate of the value of the business in the present and how the value can change over the years.

2.1 Asset-Based Valuation

It is a method used to determine the value of all the total assets of the company, less the liabilities, to provide a balance-sheet-driven depiction of worth. It especially applies in industries that are heavy in assets like manufacturing or logistics. Nevertheless, although this model gives a clear understanding of the actual resources, it can fail to identify the visibility of intangible assets such as brand reputation, intellectual property or even goodwill- which are becoming the key drivers of modern enterprise value.

2.2 Income-Based Valuation

Income approach particularly the discounted cash flow (DCF) method analyses a business in terms of its potential future future earnings. Banks prefer using this approach in evaluating the operating businesses in which the cash flow patterns are not volatile. The lenders are able to calculate the present value of the business by discounting the future earnings at a reasonable rate and determine whether anticipated returns are worth the lending risk.

2.3 Market Approach

In other instances, the banks would compare the borrower against other companies that have been sold or publicly traded. This market view will assist the lenders to know the current valuation multiples within the industry. An example is a retail business, which can be valued at an EBITDA multiple based on other similar corporations which will allow the bank to believe that the valuation is in line with the market norms.

3. The Relationship between Valuation, Risk and Loan Terms.

An increased valuation of a business usually gives an improved loan facility. Value is perceived by lenders as a measure of financial strength and it impacts directly on interest rates, repayment period and collaterals.

3.1 Lower Risk, Better Terms

Banks can provide reduced interest rates or an increased borrowing capacity when a valuation report portrays a high degree of profitability, a steady cash flow, and a manageable leverage. The reason is that the perceived default risk is reduced. Conversely, poor performance or undervaluation can result in increased interest rate, the tightening of covenants or the termination of loans.

3.2 Collateralization and Security.

Valuation report in most cases of SME financing would indicate what business assets could be used as collateral. These values are applied in calculating loans to value (LTV) ratios by lenders. To take an example, when machinery of a company is valued at S$1 million a bank may give up to S70 per cent of the amount. Clear and believable valuations will therefore minimize uncertainty and speed up loan acquisitions.

3.3 Inclusion of Intangible Assets in the Process of Decision on Credits.

Credit evaluation in the modern world is changing to acknowledge the increased importance of non-physical assets, including intellectual property, computer software, or brand value. Incorporating these into SME bank loan valuation Singapore frameworks allows lenders to more accurately assess the true worth of tech startups and service-based firms. Financial institutions are beginning to accept intangible asset valuation as part of credit assessment as Singapore is transitioning to an innovation economy.

4. Writing a Valuation Report that Enhances Loan Approval.

A valuation report should not be just a list of numbers that business owners need to share, but a narrative of stability, development, and sound financial management.

4.1 Consult Professional Valuers

Valuation professionals who are independent introduce credibility and technical accuracy into the report. Banks usually favour valuations that are prepared by qualified professionals who are conversant with the local accounting and regulatory challenges. A well-crafted report is an indication of transparency and will minimize the perceived risk on the part of the lender.

4.2 Current Plausible Financial Estimates.

The high expectation of possible results may weaken the quality of a valuation. The lenders tend to stick to the conservative and data-driven assumptions which depict realistic growth curves. Exhibiting consistency of financial forecasts and past has an assuring effect on the banks that the valuation is founded on solid logic and not assumptions.

4.3 Underline Strategic Strengths.

In addition to financial values, the valuation reports must also focus on qualitative aspects like market position, customer retention, intellectual property and management expertise. These features tend to attract premium values as they are indicative of sustainability in the long term. As an example, a company that has recurring subscription and earns regular income may have a higher value because there are certain cash flows.

5. Valuation: As a Negotiation Financing Tool.

The value is also strategic in the negotiations of loans. When business owners are aware of their valuation, they will be in a better position to negotiate good loan terms as well as be accountable to the lenders.

5.1 Increasing Bargaining Power.

Entrepreneurs come to the table when they have a full package of valuation backed by some verifiable data at a strong point. This decreases information asymmetry and creates lender trust. As an example, in cases where the borrower proves that the value of his company has increased as a result of increased profitability or growth in the market, he or she can use this fact to request increased borrowing limits.

5.2 Financing and Business Objectives.

Strong valuation can be used to align business objectives with financing strategies. In the case of growth-stage companies, it may involve the use of the valuation in order to support expansion funding or new product development. In the case of mature companies, it may lead to restructuring or refinancing debt to minimise cost of capital.

6. Future Trends: Valuation as a Heart of SME Financing.

With the changing credit environments, banks are incorporating sophisticated analytics, digital reporting systems, and industry applicable valuation standards in the process of assessing loans.

6.1 Digitalization of credit evaluation.

The adoption of data-driven models and automated valuation tools are changing the process of bank assessment of SME applications. These systems assess performance history, sector risk and cash flows instantly, thus the valuations are quicker and more predictable.

6.2 Increasing the Awareness of Non-Tangible Value.

In economies that are knowledge-based such as Singapore, the valuation of intangible assets is becoming the focal point of lending to SMEs. This is an indication of a larger realization that innovation, brand reputation, and digital capabilities are the most important value-generating factors rather than the conventional fixed assets.

Conclusion

The modern lending has taken the business valuation as its foundation. It gives the banks objective information on the value of a company, its ability to repay and its prospects. To the borrowers, it boosts credibility, facilitates negotiation and clears access to financing opportunities, which would otherwise be inaccessible.

Through the use of valuation to finance the business and the use of SME bank loan valuation Singapore standards, businesses are in a better position to achieve success in credit analysis and to show their willingness to grow. Businesses that realize and communicate their value will be the ones to effectively raise capital in the years to come as the financial institutions treat the models of lending basing on valuation more specifically.