Intangible Assets: The Hidden Drivers of Enterprise Value

Learn Intangible Assets Valuation Course for Professionals

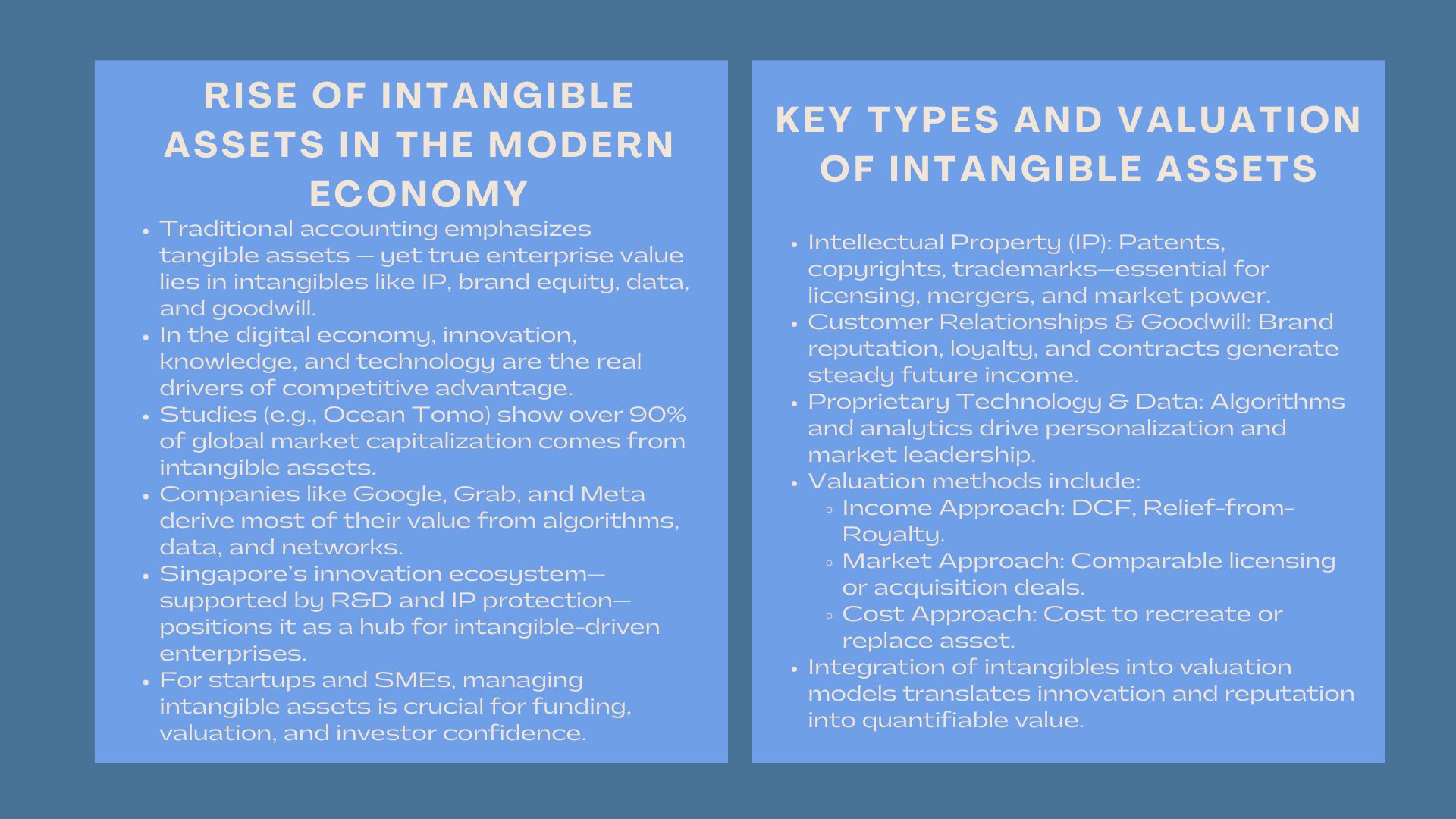

The real value of any company in the contemporary knowledge-based economy is sometimes a lot more than what is in the balance sheet. Although the conventional financial reporting focuses on the tangible assets such as property, plant, equipment, a large part of the competitive strength of a firm is intangible i.e. intellectual property, brand equity, proprietary technology, customer relationships, and goodwill. These intangible factors not only distinguish between prosperous corporations but also create long-term enterprise value in a manner that is frequently not appreciated by the traditional accounting.

The present generation of investors and analysts have come to realize that intangible assets usually hold the secret of sustainable growth, innovation, and market leadership. With digital transformation and intellectual capital being the primary drivers of competitive advantage in Singapore, and the dynamic business environment, knowledge and appreciation of intangible assets are turning out to be not only strategic but also an accounting consideration.

1. The Emergence of Intangible Assets in the New Economy.

1. The Emergence of Intangible Assets in the New Economy.

The transformation of industrial economies to digital and service-based ones has changed the manner in which business value is made in principle. Such businesses as Google, Meta, and Grab do not rely on physical resources to determine most of their enterprise value, but on data, algorithms, and user interaction.

1.1 The Economic Change To Intangibles.

In the last twenty years, there has been a rise in the dominance of intangible assets being the driving source of business value in the world market. It is reported by Ocean Tomo that intangible assets contribute to more than 90 percent of the market capitalization of major global indices. The trend highlights the increasing importance of intellectual capital as the basis of enterprise valuation.

1.2 Knowledge-Driven Advantage of Singapore.

Singapore, which has a strong focus on innovation, research and development as well as intellectual property protection offers good conditions of businesses that make use of intangible assets. The government’s focus on smart industries and technology incubation highlights intangible asset importance Singapore as a central pillar of economic growth.In the case of local businesses and startups, managing and appreciating the intangible assets is the key not only to financial success, but also to obtaining funding and attracting investors.

2. Knowledge on the Kinds of Intangible Assets.

The types of intangible assets cover a wide array of value enablers, which affect reputation, performance and future cash flow. Each of the categories is a distinct source of competitive advantage.

2.1 Intellectual Property (IP)

Innovations, creative works, and brand identity are patented, copyrighted, trademarked, and trade secreted. They are the pillars of such industries as biotechnology, software and media. Those companies that strategically manage their IP portfolios are able to negotiate better valuation, licensing revenue and bargaining power during the acquisitions and mergers.

2.2 Customer Relationships and Goodwill.

Goodwill is created by reputation of the brand, customer loyalty and operational synergies which exist even after recognizing the identifiable assets. It usually becomes apparent in the acquisitions where the purchasers are ready to pay a premium price to gain market presence. The customer databases, loyalty programs, and long-term contracts are other important intangible assets which ensure a certain stream of income.

The proprietary technology and data consist of the next aspect of the contract: 2.3 Proprietary Technology and Data.

Algorithms, data analytics systems and platform ecosystems are of immense value in the digital economy. They are the drivers of personalization, operational efficiency and market reach. The capacity to use and secure data-driven technologies can make a market leader a follower.

3. The role of Intangible Assets in spurring Business Valuation.

Intangible asset valuation cannot be done to be done using financial modeling only; it must be done based on the knowledge of how the intangibles of innovation, reputation, and relationships may be converted into the quantifiable financial outcome.

3.1 The connection between Intangibles and Enterprise Value is linked in the following manner.

Intangible assets serve as a contribution to enterprise value in terms of cost savings, generation of revenue and reduction of risk. An example of these is that a patented process would reduce the cost of production, whereas a good brand would fetch high prices. These factors combine to create hidden value drivers business that elevate overall valuation beyond the sum of tangible assets.

3.2 Integration in Valuation Models

Income-based methods, which include discounted cash flow (DCF) or relief-from-royAL applications are often used by valuation experts to determine the economic value of intangible assets. Market-oriented approaches use the comparison of licensing rates or the acquisition prices of other similar assets, whereas the cost-oriented approaches determine the cost of restoring the asset. The preferred methodology relies on availability of data, nature of asset, and use of valuation either in financial reporting, transactions or in litigation.

4. Strategies of the Intangible Assets to the Corporate Development.

Intangible assets are not just important in terms of financial valuation, but they are also important in terms of the strategy, perception in the market, and also, in terms of sustainable competitive advantage.

4.1 Improving Competitiveness in the Market.

The example of such brands as Dyson, Shopee, and Grab reveal how the market dominance is determined by the intangible power. Their technological advancement, design reputation and customer confidence make them rise above others. Through its strategic development of intangible assets, firms may distinguish themselves despite flooding their markets.

4.2 Investment and Partnership Attraction.

Shareholders are putting more emphasis on intangible capital of a business in order to determine its potential in the long term. Measures like customer retention rates, brand strength and IP portfolios are getting to be the focal point of investment decisions. Venture capitalists make a habit of using intangible value to justify funding rounds in Singapore though there is limited tangible value in the startup ecosystem.

4.3 The fourth condition is in favor of expanding internationally.

Global scalability is based on intangible assets. This is made easy by strong branding, proprietary technologies, and standard of operating models that enable companies to penetrate new markets. In the case of franchising or licensing enterprises, the intangible value is a basis of cross-border success replication.

5. Accounting and Regulatory Perspectives.

Although the economic importance of intangibles cannot be ignored, it is more complicated how the accounting standards treat them.

5.1 IFRS principles of intangible assets.

In International Financial Reporting Standards (IFRS) especially the international accounting standards, IAS 38, intangible assets should be identifiable, controlled by the entity and be able to produce future economic benefits before recognition. Nonetheless, several internally generated intangibles as brand reputation or customer loyalty are not recorded in balance sheets. The result of this discrepancy is usually the gap between the book value and the market value and analysts find it difficult to trust the independent values.

5.2 Tax and Legal Implications

The intangible assets have their impact in taxation, transfer pricing and compliance. In cross-border business, arm-length value calculation of intellectual property plays a critical role in addressing the OECD and local tax authorities requirements. Singapore has pleasant IP tax systems including IP Development Incentive (IDI) that encourage firms to incorporate and administer intangible assets in the country.

6. Valuation of Intangible Assets in the Future.

Intangible assets valuation will keep on developing as economies become digital. The new technologies, data analytics, and AI-based valuation models allow achieving more accuracy and transparency.

6.1 The use of technology in the contemporary valuation.

Artificial intelligence devices are currently able to analyze massive amounts of data to determined brand strength, consumer feeling, and intellectual property influence in real-time. These innovations will shortly render intangible asset appraisal more vibrant, evidence based, and market sensitive.

6.2 Towards a Holistic Perspective of Enterprise Value.

The valuation professionals of the future will follow combined models of thinking that embrace financial, social and intellectual capital. Such holistic thinking will be more indicative of the value creation in companies in the 21 st century, as intangible assets will not be underestimated.

Conclusion

Intangible assets are the blood in the enterprising blood in the contemporary business environment. They are an embodiment of innovativeness, trust, and market impact, which could not be copied by any factory or warehouse. To business organisations in Singapore and elsewhere, it is critical to learn to protect, appreciate and value such assets in order to be sustainable in the long run, have confidence by investors and be strategic.

With the changes in financial markets and their regulatory requirements, the organizations that learn the art of intangible assets management will not only discover the hidden value but also shape the future of the corporate development in the digital economy.