How AI and Technology Are Transforming Valuation Practices

Introduction to How AI Transforms Valuation Practices

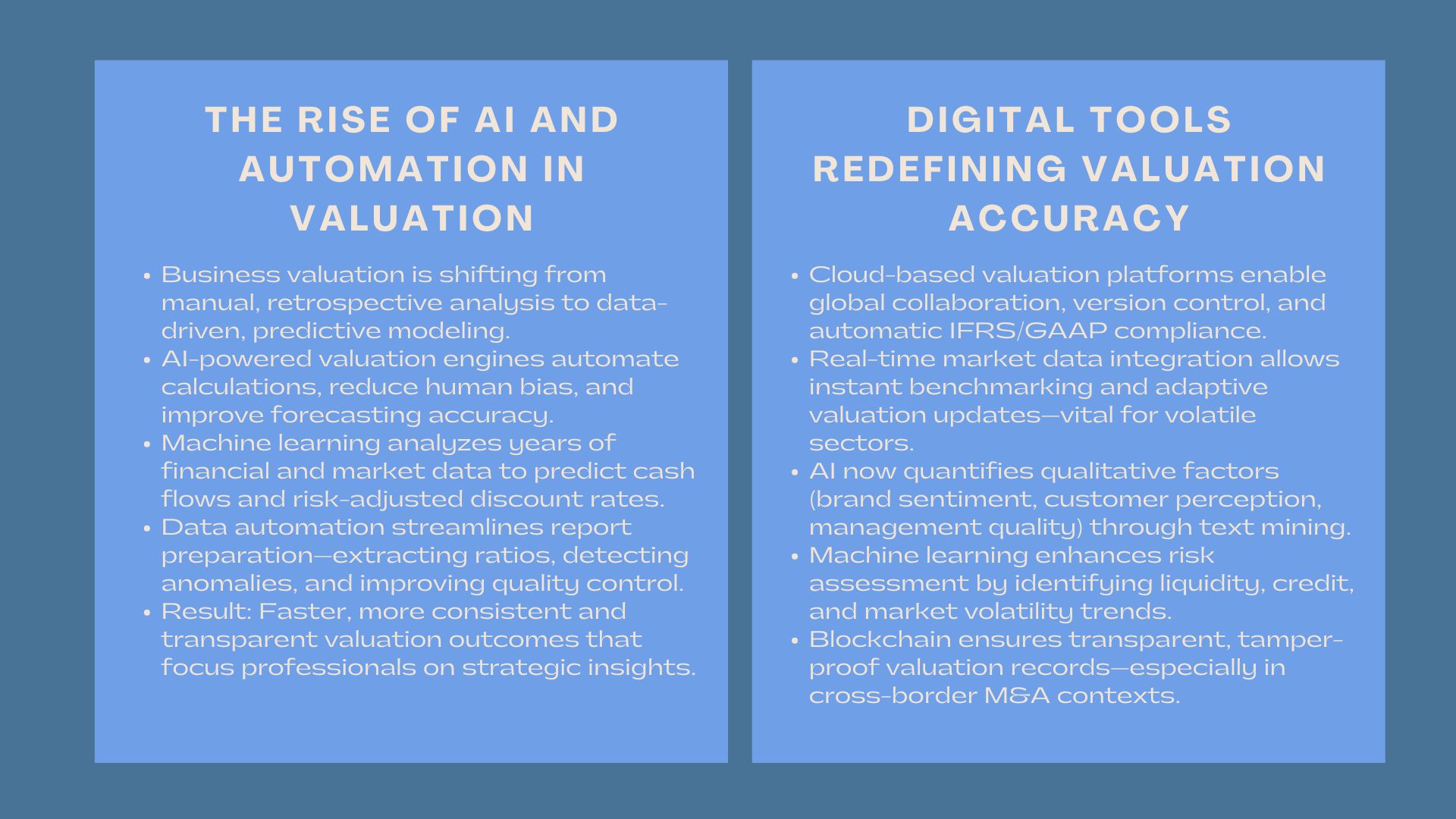

The business valuation field of study is undergoing one of its most profound changes in decades in the data-driven economy that the world currently operates in today. Artificial intelligence (AI), automation, and new high-tech digital analytics are transforming the old, manual data collection system, spreadsheets, and even evaluator bias in the traditional valuation process. These technologies do not simply render valuations quicker and more efficient but increase accuracy, transparency and consistency as well.

The capability to obtain and manipulate real-time financial and market information is becoming a necessity as organizations are becoming more intricate. The technology is enabling valuation professionals to combine both structured and unstructured information, automate many of the calculations, and generate dynamic information that was previously inaccessible. This technological change has reconfigured how businesses calculate their value, risk and performance- particularly in rapidly evolving sectors as fintech, healthcare and renewable energy.

1. The Emergence of AI-Powered Valuation Engine.

1. The Emergence of AI-Powered Valuation Engine.

The use of artificial intelligence has started to assume a critical position in transforming valuation practices through the automation of traditionally manual procedures and the way analytics are done.

1.1 The concept of making predictions out of static reports is not a new idea, but it has become the norm today and is expected to continue being so in future.

The traditional type of valuation reports were mostly retro-active; they looked at the past performance and other similar transactions. Predictive modeling is now possible based on forward-looking analysis of vast amounts of data to determine trends and correlations, as well as market signals, through AI. To illustrate, machine learning algorithms are able to work through years of financial statements, industry measures, and macroeconomic measures to predict future cash flows or risk-adjusted discount rates with increased certainty.

1.2 The Power of Data Automation

The AI systems also save a lot of time in preparing the valuation reports. Analysts do not need to spend days to gather and clean data but will be able to use automated platforms to extract important financial ratios, identify anomalies, and raise flag when contradictions arise. This does not only enhance speed but also quality control enabling professionals to deal more with interpretation and less with data entry. These systems have been of great importance in the high volume settings like audit support or regulation reporting.

2. Embarking on the Inclusion of Digital Tools in Valuation Frameworks.

The combination of digital platform and valuation software has given rise to a new generation of decision-support software which comprises a combination of financial modeling and data visualization and risk analytics.

2.1 Cloud-Based Valuation Solutions.

The systems of cloud-based valuation have enabled professionals working in various geographies to work together in real time. In these platforms, you can have constant updates of data, a version control mechanism, and an automatic adherence to international accounting standards, such as IFRS and US GAAP. This especially applies to valuation firms dealing with multinational clients where uniformity and accessibility is important.

2.2 Real Time Data and Market Benchmarking.

The latest valuation tools are connected directly to the market data sources, allowing in-real-time benchmarking of the performance of the company against that of the industry players. Analysts can create valuation updates using live feeds of stock exchanges, commodity prices, or personal market databases to provide a more accurate picture of the market in its current state. This dynamic strategy is useful especially in unstable industries like energy trading or cryptocurrency where the price of an asset can change on a daily basis.

2.3 Valuation Improvement via AI in Business Valuation.

The AI models are able to evaluate qualitative variables that previously were difficult to measure such as customer sentiment, brand perception, or management quality through mining text information in news reports, social media, and customer reviews. To illustrate, a sentiment analysis tool powered by an AI can measure the brand strength and enter the findings into a discounted cash flow (DCF) model to enhance the fullness of the valuation procedure. The integration of AI in business valuation has therefore transformed how analysts view both tangible and intangible asset performance.

3. Technology’s Impact on Valuation Accuracy and Transparency

Valuation credibility is based on accuracy and transparency. Digital technology has enabled it in both reducing human error and making assumptions standard.

3.1 Standardization of Data and Audit Trails

Under automation, all the processes of valuation are now trackable and can be logged and provide a complete audit trail to comply and audit. This disclosure is vital in regulatory, merger and acquisition and shareholder relations. Complex software will make sure that all calculations, discount rates, and similar analyses will involve the use of similar methods and will include less subjectivity.

3.2 Risk assessment by means of machine learning.

Artificial intelligence is being trained to recognize valuation risk factors including liquidity constraints, credit risk and industry-specific volatility. These models predictively improve with time by being able to examine past results of past valuation and compare them to the actual events in the real world. This power to acquire experience renders the valuations more adaptive to the market realities.

3.3 Blockchain and Irreversible Records of Valuation.

Another level of transparency provided by blockchain technology is that valuation information and transaction history can be stored on non-tamperable ledgers. This may be of great benefit especially in cross-border M&A transactions where various stakeholders would require the confidence that the valuation information is not distorted. With the increased adoption of blockchain, there is a possibility that it will become a foundation of digital valuation with a high level of security.

4. New uses of Digital Valuation.

The impact of technology on valuation is becoming large in other asset classes and new business models, which allows more inclusive and thorough valuation.

4.1 Attaching Significance to Digital and Intangible Assets.

Digital transformation has created a new category of properties including software licenses, algorithms, and online platforms, which are difficult to quantify using the traditional valuation approaches. The AI-based models are more precise in estimating the value based on the real-time usage metrics, user engagement data, and IP analytics. It comes in handy particularly in the case of startups and tech companies, where intangible assets tend to be the most valuable part of enterprise value.

4.2 Digital Valuation Technology Singapore: A Regional Example

In Asia, particularly Singapore, the adoption of digital valuation technology Singapore platforms has become a key driver of innovation. The regulatory environment in Singapore supports the application of AI and cloud-based valuation applications, which are favorable to the accuracy and transparency of financial reporting and capital raising. Automated solutions of valuation that are in line with the IFRS standards are gaining popularity among the local firms to improve the audit readiness. This has made Singapore become a regional center of technology-based valuation practices.

4.3 Implications across Industries.

Other industries like real estate, venture capital, and private equity are already enjoying the improved digital valuation methods. Indicatively, AI-based real estate valuation tools can determine the value of property instantly with the help of satellite imagery and machine learning algorithms that have been trained on thousands of similar sales. Likewise, the venture capital firms are employing predictive analytics to analyze the prospect of startup, including the social media sentiment, customer acquisition statistics, and technological innovation.

5. The Future of Technology-Ensured Valuation.

In the future, AI and digital technology will further enhance the precision of valuation, their availability and flexibility.

5.1 Generative AI.

Generative AI technology is becoming a useful assistant in reporting valuation, with the ability to summarize results, find inconsistencies, and develop scenarios in a few seconds. These systems do decrease the human bias and enhance the uniformity of various valuation reports.

5.2 The Role of Human Expertise

In spite of the technological development, human judgment has been kept at the heart of things. Valuation entails reading between the lines, evaluating the business strategy, and its surrounding- aspects that AI is yet to interpret comprehensively. The most effective solutions are achieved through a combination of the two: using AI to help with computational accuracy and professional experience to interpret the results.

Conclusion

AI and digital technology have managed to redefine the art and science of business valuation in a fundamentally different way. Technology has now become an inevitable part of the calculation of corporate value, whether it is through automation of data analysis, improved transparency or real-time insights. With the continued innovation by companies, the ones that adopt digital tools of valuation will have a competitive advantage in accuracy, efficiency, and trust by their investors. Valuation is not going to be a replacement of human skill, but its enhancement using smart systems – a new era of smart, data-driven decision-making in finance and beyond.