Valuing Intellectual Property for Licensing and Franchising Deals

Introduction to Franchising and Intellectual Property Valuation

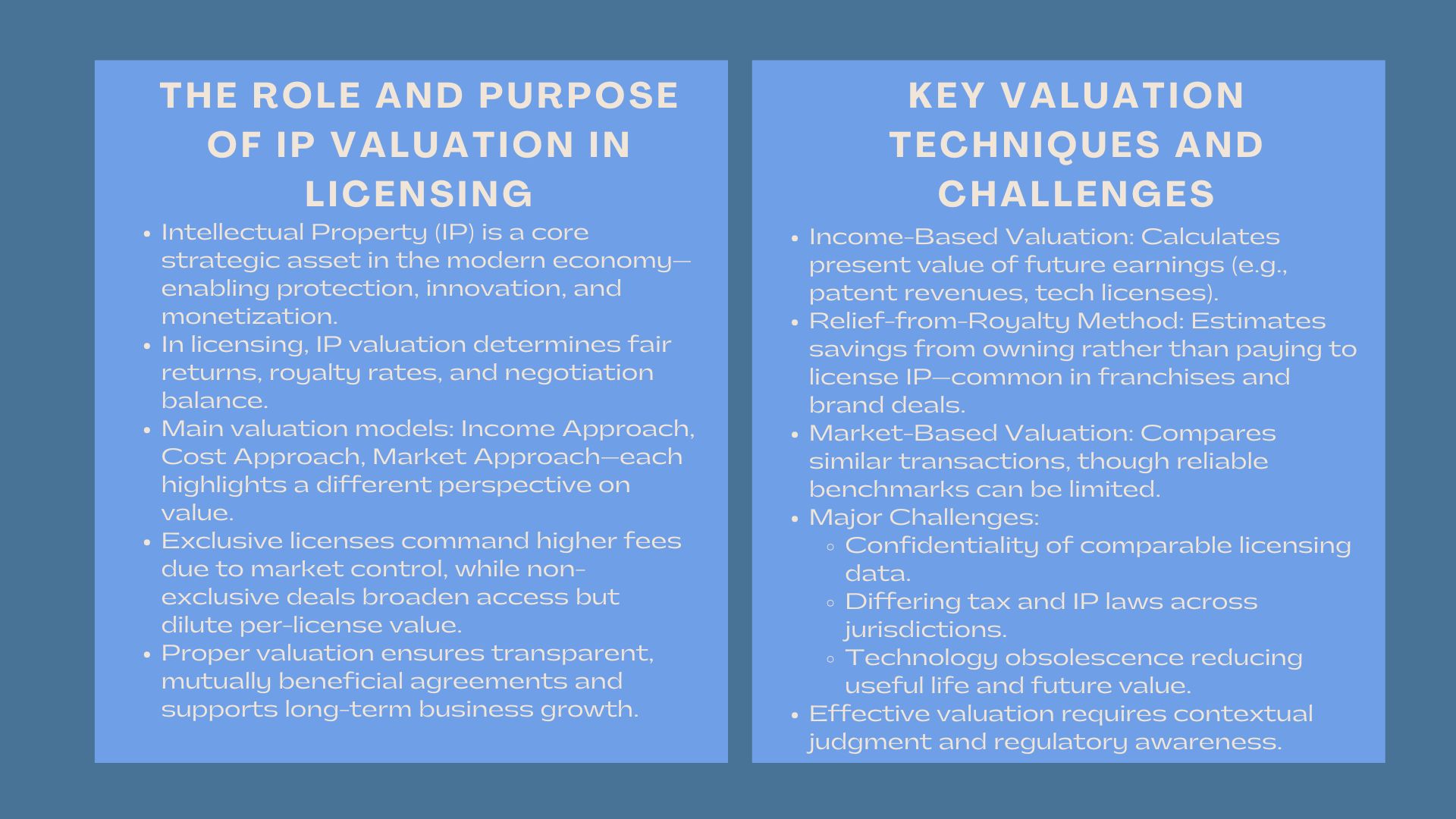

Intellectual property (IP) has emerged one of the most significant strategic assets in a company in the contemporary knowledge-based economy. IP can be used to guard innovation as well as establish direct avenues of monetisation, as either a patent, trademark, copyrighted or proprietary technology. In building a business that aims at entering a new region or nation, it is essential to learn the proper ways of valuing IP. This will guarantee equal returns, reporting and mutually agreeable arrangements. This is complicated by the fact that the IP valuation is heavily reliant on the nature of rights, anticipated income and circumstances of use within the market.

The particular area of interest of this article is the valuation of intellectual property in the context of licensing transactions, its contribution to revenue, negotiation, and growth of the business in the long run. The process of licensing is not just a contractual agreement, but a financial transaction, depending upon the fair value of intangible assets. This valuation is critical in determining the difference between a viable relationship to be sustained and an undervalued transaction that constrains potential future earnings potential.

1. The IP Valuation in the licensing setting.

1. The IP Valuation in the licensing setting.

Licensing is the right given by the IP holder to other persons to utilize his/her assets on payments. Such payments can be in the form of royalty payments, one lump sum payment or payments based on milestones. The IP value should, therefore, be associated with its ability to bring economic benefits. This valuation in most cases is based on established models including the income approach, the cost approach, and the market approach- each giving a different perspective of valuation.

1.1 The purpose of IP Valuation in Contract Negotiations

In the process of licensing, valuation acts as a stepping stone in determining the royalty rates as well as the breadth of the right. An example is a software company that sells its proprietary code to third-party developers, they must arrive at a fair market price depending on the number of users that they expect to adopt their code, a licensing duration, and the competitive advantage. One that is underestimated will result in loss of revenue in the long run, whereas overestimated one will put off potential partners. Proper valuation gives both parties confidence as there is an agreement between valuation and anticipated returns.

1.2 Differences between Exclusive and Non-Exclusive Rights.

Licensing type: exclusive or non-exclusive: This is an important factor that can affect the results of valuation. Exclusive rights are those that would attract a higher fee since the holder of the license will have dominance of the asset in a specific territory or market. On the other hand, non exclusive rights enable several parties to use the same IP, which dilutes the value of the individual, but may enhance overall returns. In both cases, the underlying IP valuation for licensing ensures that pricing reflects the true economic contribution of the intangible asset to future profits.

2. Valuation Techniques Applied to Licensing Deals

The IP would have to be valued on the contribution of the asset to the future streams of income in case it would be a valuable asset to be licensed. The income approach, the relief-from-royalty approach, and the similar approach in the market are the most widespread.

2.1 Income-Based Valuation

The income method values the amount of money that should be used to represent the present value of the expected future earnings that the IP will generate. Take the case of a pharmaceutical patent assigned to an production firm and the value would be based on its projected sale of the drug during its lifetime as a patent. Market risk, cost of capital and time value of money are adjusted. This approach would be suitably IP licensing in that it correlates value with possible cash flows.

2.2 Relief-from-Royalty Method

The approach approximates the value by determining the amount of hypothetical royalties that would otherwise have been paid in the absence of the company owning the IP. It is common in the franchise and technology licensing since they resemble what is in the real world. As an example, a food brand that sells its recipe and trademark to franchise owners may calculate the amount of the saved royalty payments and the duplicate will be the fair value of the IP.

2.3 Market-Based Valuation

With adequate transaction data, the market strategy will compare the IP asset with other licensing transactions similar to it. Nevertheless, this information may be limited and irregular, particularly in case of specific technologies or branded by a region. Therefore, market-based pricing is usually an additional control and not the main technique.

3. Difficulties in IP Valuation to license.

Although the theoretical valuation approaches are structured, in practice, there are frequent challenges that arise because of the lack of data, market fluctuation and regulatory factors.

3.1 Limited Market Data

Lack of transparent market transactions is one of the greatest obstacles in IP valuation. A lot of licensing deals are confidential and not released to the public. This renders the royalty rates difficult to benchmark and evaluate comparability. Under these circumstances, the valuation professionals use industry surveys or proprietary databases as a means of estimating rates.

3.2 Regulatory/ Jurisdictional Differences.

Another complication is licensing of various markets. The jurisdictions can have various tax treatments, transfer pricing or IP protection. An example is that in Southeast Asia, the IP valuation regulations in certain countries such as Singapore and Malaysia are explicit and favorable to adherence and confidence by investors, whereas in other countries they might be less articulated. It is important to understand these regulatory environments to prevent disagreements and valuation integrity.

3.3 Technology and Market Obsolescence.

The useful life of IP may be brief in the fast-evolving industries, like the software industry, biotechnology, or digital media. A valuation that is carried out today might become obsolete soon in case the technology on which it is based becomes obsolete. To counter this, valuation models tend to incorporate obsolescence factors or technology replacement risks adjustments to remain accurate.

4. The IP Valuation as franchise strategies.

Whereas licensing is concerned with the transfer of rights of use, franchising is accompanied by a copying of a complete business model- in most cases based on brand and operational expertise. The valuation concept in this scenario will assist the franchisors in attracting investors and safeguarding their brand equity.

4.1 Determining the Strength of the Brand and Market Potential.

In case of a franchise network, franchise fees and royalty framework are based on the worth of its brand. This is where franchise valuation Singapore practices provide a strong example—companies use systematic valuation models to justify entry costs, estimate recurrent royalties, and in underpin further strategies of foreign expansion.

4.2 Connection between IP Valuation and Franchise Growth.

Franchisors usually base their valuation achievements on performance standards, which could be the outlet profitability or market share. This will synchronize the goals of the franchisors and the franchisees hence guaranteeing mutual development. Effective valuation also can assist in avoiding over-franchising of the brand, which will dilute value and result in the loss of consumer confidence.

5. Constructing a Sustainable IP Monetisation Strategy.

In successful IP monetisation, the accuracy of valuations is not sufficient but foresight is essential. Those companies that actively administer their IP portfolios are able to determine which assets can be licensed or franchised so that these assets are used to the fullest extent of their profitability.

5.1 Continuous Valuation and Portfolio Review.

Frequent review of IP will make sure that valuation is always up to date in the face of market/regulatory changes. Companies must consider valuation as a process and not as a one-off exercise and revise the assumptions as technologies, consumer preferences, or the market conditions change.

5.2 Investing and partnering with Valuation as an advantage.

IP valuation helps to build investor confidence and to facilitate due diligence in joint ventures or capital raising provided it is reasonable and scientific. Valuation reports can be used by startups and SMEs, especially, to provide information that can be used to show the commercial value of the IP when negotiating with partners or financiers.

Conclusion

The importance of intellectual property as a subject to use in licensing and franchising is both a mandatory move and a business necessity. Properly carried out valuation makes it possible to compensate fairly, form transparent partnerships and grow in a steadier manner. With IP still fueling competitive advantage, companies need to invest in effective valuation models and competent people who can create value out of innovation. In the future, the concept of digitalisation and cross-border IP commerce will only raise the significance of standardized valuation measures, i.e., making sure that all ideas, brands, or technologies are represented with the right amount of financial value.