Understanding the Nature of Loss-Making Startups

Introduction: Insight into Loss-Making Startups

Startups have always been associated with disruption, innovation and ambition. However, some of the most well-known corporations in the world Uber, Grab, Sea Group, or even Amazon during its first few years of operation spent years losing money before becoming profitable. This may become a crucial question to the analysts, employees or the investors; How can a company that is making losses be of value?

To respond to this, one will have to look beyond the conventional conceptualizations of profitability and go to the financial dynamics of loss-making startups: their growth-based approaches, their investor rationality, and their potential to create value over the long-term. This landscape holds critical knowledge that is not only important to investors but also to professionals who want to work or analyze fast growing ventures.

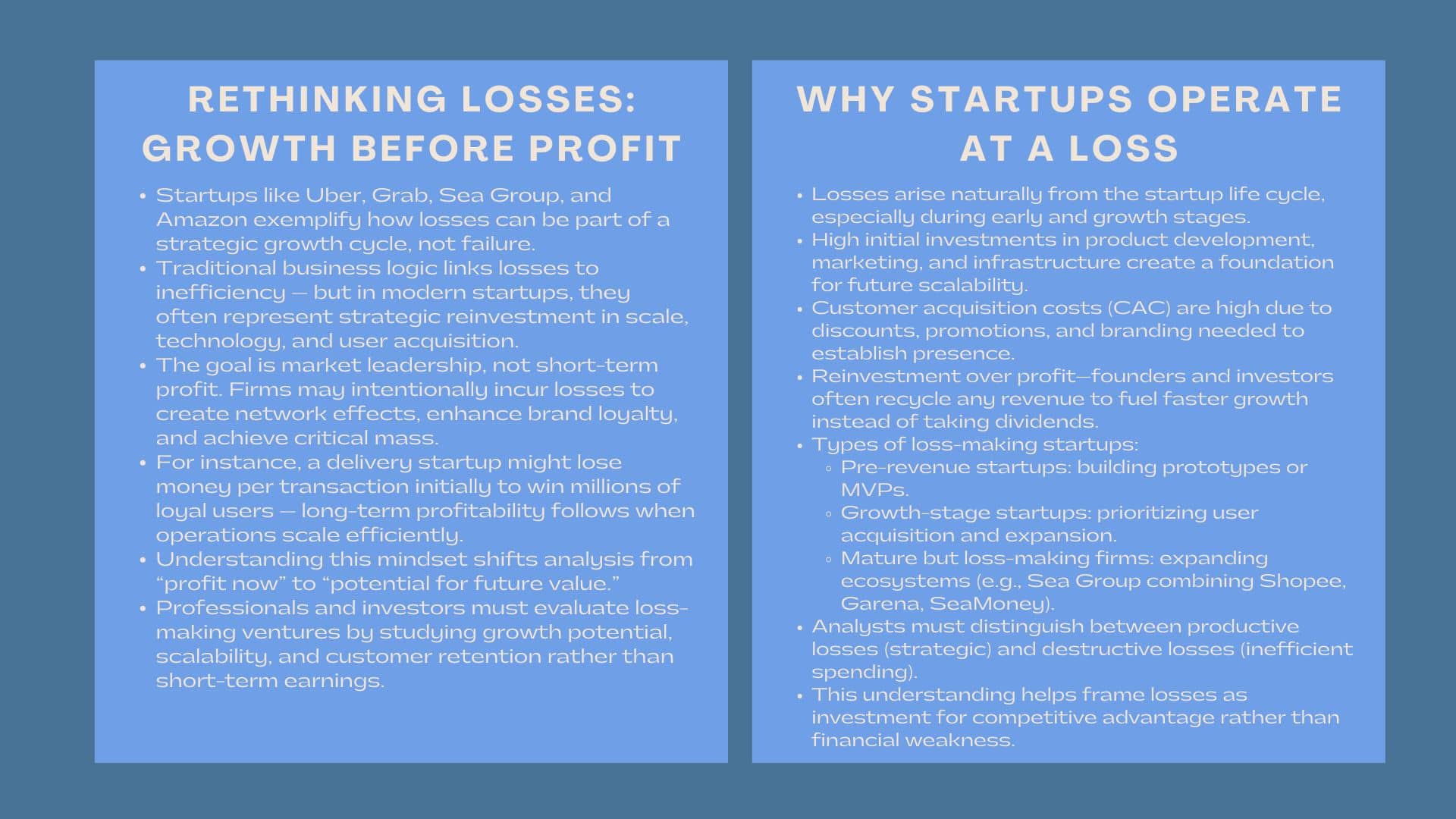

Rethinking the Meaning of “Loss-Making”

Rethinking the Meaning of “Loss-Making”

When one is informed that a startup is making losses, the instinctive reaction is usually adverse. According to traditional business thinking, a loss means inefficient operations, poor management or inability to survive. In the current world of startups, however, that is no longer true.

Strategic reinvestment is common in losses of early-stage startups instead of failure. Such businesses deliberately make non-profitable decisions in terms of scale, innovation or customer acquisition ahead of profitability in the short term. It is not about registering instant profits but the creation of a leading marketplace status that will result in a multi-fold value in the future.

To build a network effect, numerous technology-based firms spend a lot of money in terms of infrastructure, research and user growth. As an example, a food delivery system can incur losses on a per-delivery price in the first years of operation and generate more long-run value by achieving millions of loyal customers. When such a network is matured, the cost reduces and profitability comes next. This is the core of understanding the financial dynamics of loss-making startups—the focus is not on immediate profit but on the potential for future cashflows once scalability is achieved.

Why Early-Stage Startups Operate at a Loss During Growth

In order to understand the reason behind startups incurring losses, we should look at its life cycle. Startups, in comparison to established corporations, have a sense of uncertainty, there is no proven product, no reliable customer base, and no predictable inflow of cash. Consequently, the initial capital is applied in order to confirm ideas, win clients, and develop infrastructure that will support demand in the future.

This phase often includes four defining characteristics:

- High Initial Investments: Startups write off their money on product development, marketing and technology infrastructure. These are fixed costs in the initial phases but required in the future in order to achieve scalability.

- Customer Acquisition Costs (CAC): New products usually give away prices or have promotions to win users. This will reduce margins in the short-term, but will assist in creating critical mass.

- Delayed Revenue Models: New products usually give away prices or have promotions to win users. This will reduce margins in the short-term, but will assist in creating critical mass.

- Reinvestment Over Profits: Founders and investors settle on reinvestment of any earnings to spur growth as opposed to seeking immediate dividends.

These factors explain why early-stage startups operate at a loss during growth—the objective is not immediate profitability but building a defensible position in a competitive market.

Consider, as an example, ride-hailing companies (such as Gojek or Grab). Their first principle did not target the maximization of short-term profits but was to conquer markets in a short time span by the use of aggressive subsidies and alliances. The losses that followed were a strategic one- long term sustainability and market leadership.

Types of Loss-Making Startups

Loss-making startups are neither a homogeneous group of startups. They may be widely grouped depending on their level and use of losses and this allows the analysts and job seekers to know the position of the company in the growth cycle.

1. Pre-Revenue Startups (Idea to Seed Stage)

These startups are more interested in creating a minimum viable product (MVP) or validating an idea. They do not have operating revenues but can experience expenses on technology, product development and initial testing. Their casualties are entirely developmental.

2. Growth-Stage Startups (Series A–C)

At this point, startups have acquired a market presence but are growing fast. They invest a lot of money to advertise, customer service, and to expand, particularly to the developing markets. As an example, fintech or e-commerce startups may embark on user-acquisition efforts that may leave them in the red even as they increase their revenues.

3. Mature but Still Loss-Making Companies

Even later or publicly traded startups may not be profitable any longer as long as they focus on expansion or diversification. Such companies as the Sea Group, in particular, survived the prolonged periods of losses as they developed the synergies of the ecosystems between the e-commerce, the gaming, and the financial services.

This is because by realizing the position of a company in the scale, investors and professionals can analyze the character of losses incurred by a firm as being both strategic and short-term or indicative of inefficiency.

Key Drivers Behind Early Losses

Losses in startups often have a rationale rooted in long-term strategy. Below are several common drivers:

Customer Acquisition and Market Penetration

Startups need to gain market share faster than the competitors. Marketing, discount, or loyalty programs are very expensive to them in order to acquire users and brand visibility. These initial expenses will be aimed at winning customers, who once obtained would have a lifetime value (LTV) well in excess of the initial cost.

Technology and Product Development

Compared to the traditional firms, startups may take years to come up with scalable and flexible technology platforms. These investments create no returns in the short-run but give competitive advantage.

Talent and Operational Expansion

It is expensive though essential to recruiting skilled developers, marketing experts and business strategists to create the ability to execute. Early losses are sometimes a big percentage of payroll and benefits.

Infrastructure and Logistics

Startups: In particular, in the e-commerce or delivery industry, it is inevitable to invest in warehouses, distribution networks, and logistics collaborations at their start. These develop capacities of further development.

Market Education and Innovation

New startups tend to venture in an unknown market to the consumer with a product or service. Campaigns and trials to educate the users turn out to be a strategic cost.

These factors together would be the reason why financial losses in startups are not always red flags but rather an intentional result of high-growth strategies.

Investor Perspectives on Evaluating Loss-Making Startup Performance

Investors know that it is not possible to assess startups through the same set of lenses as to traditional companies. Instead of concentrating on profit and loss statements, they consider the signs of possibilities, expandability, and competency.

1. Productive vs. Destructive Losses

Investors differentiate between productive and destructive losses (those that create brand equity, market penetration or technology advantage). The latter is considered to be acceptable and even necessary at the initial stages of growth.

2. Growth and Retention Metrics

Measures like user acquisition rate, revenue trend, customer retention and levels of engagement will give an idea on whether the startup is experiencing sustainable growth. Although consolidations continue to make a loss, a unit economics (narrowing CAC/LTV ratios) is an indicator of future profitability.

3. Path to Profitability

The major question that will be posed by investors is: Will this company be able to make a profit in the long run? An authoritative roadmap of profitability (cost minimization, price changes, or diversification of revenues) serves as a reason to continue funding.

4. Competitive Moat

In case the business is creating a moat, which the competitor will not easily imitate, then it is okay to lose money, including proprietary technology, well-known brand, or regulatory advantage.

In short, investor perspectives on evaluating loss-making startup performance revolve around strategic foresight rather than short-term accounting results. For analysts and job seekers, understanding this mindset is crucial—especially when working in venture capital, corporate finance, or startup ecosystems.

Case Examples: Turning Losses into Value

History shows that today’s corporate giants were once heavily loss-making. Understanding how they transitioned offers valuable insight.

Amazon

During almost ten years of existence, Amazon did not make any profits, spending all the money on the logistics, warehouses, and product diversification. Its plan was plain and straightforward; command customer loyalty and convenience. That long term strategy transformed initial losses into market leadership on a long term basis.

Grab and Gojek

The top ride-hail companies in southeast Asia took the initiative of extreme market takeover tactics. They have been making losses and when they finally dominated the transportation, payments, and delivery, cross-platform synergies were created, which made their early losses worth it.

Sea Group

Garena, an arm of the company dealing with games, was its initial business venture, with the company venturing into e-commerce (Shopee) and fintech (SeaMoney). Although its growth was associated with massive losses, the integrated ecosystem of the firm has created high growth potential in various verticals.

These instances highlight strategic investments in the form of losses as long as these losses are associated with scalable and sustainable growth strategies.

Managing Losses and Building Resilience

Although losses would be necessary, they should be done in a strategic manner. Even the most effective business models can be destroyed within a short period of time by uncontrolled burnage of cash or a lack of financial discipline. Individuals in the startup sector need to know the basics on financial control and resilience building.

- Track Burn Rate and Runway: It is always important to track the rate at which capital is being expended and the duration within which the business will operate before it requires new capital.

- Prioritize Core Metrics: Improve the gross margins, decreasing the cost of attracting customers, and raising the lifetime values.

- Optimize Operations: Aim to accomplish efficiency with technology, data analytics, and the minimization of waste.

- Adapt Quickly: Startups that pivot at a young age due to market feedback will be able to spend as little as possible.

Ultimately, successful startups strike a balance between bold growth and prudent cost management.

The Role of Professionals in Loss-Making Startups

This is critical as far as junior to mid-level professionals joining such companies are concerned. Being exposed to a startup working in a losing venture means one has to be flexible, analytical, and understand the basics of business.

- Strategic potential needs to be evaluated by the analysts as well as financial statements.

- Marketers ought to know the way in which growth spending will translate into customer lifetime value.

- The finance and operations professionals should handle the burn rates as well as support scalability.

Joining a failed first start up does not mean surviving the losses but rather developing systems, data, and strategies that will be successful in the long term.

Conclusion: Losses as a Step Toward Long-Term Value

The losses during startups are misconstrued. They are an indicator of vulnerability in conventional business, but an indicator of aspiration in startup. Knowing the financial aspects of loss-making startups, professionals and investors will be able to consider better whether losses are the part of the planned development or it is the outcome of inefficient management.

Essentially, the reason why early-stage startups lose money in the period of growth is because they seek to achieve scale, innovation, and market dominance. Investor confidence will not be lost as long as there is a believable road to profitability.

The lesson to be learned by those who enter this world is that it is not losses that foes them, but lack of strategic direction. A loss-making start up, which is managed well, may transform into a leader in the industry when its development model, market approach and financial discipline is oriented towards long-term value creation.