Why ESOP Valuation Is Critical for Employee Motivation and Retention

With the modern day competitive world in business, firms are ever in search of methods to motivate, retain and align workers to organizational objectives. Employee Stock Ownership Plans (ESOPs) are one of the best ways of accomplishing this. Nevertheless, as much as ESOPs are usually applauded on its motivational ability, proper and realistic valuation is the most important factor when it comes to determining the success of such a program. Lack of proper valuation will make ESOPs lose their intended effect, and mistrust or even misrepresentation of finances.

It is an article on the importance of ESOP valuation in employee engagement and the transparency of the company, as well as long-term corporate development. It also talks about the benefits of companies (namely the Singaporean and other developing markets) developing an effective valuation framework.

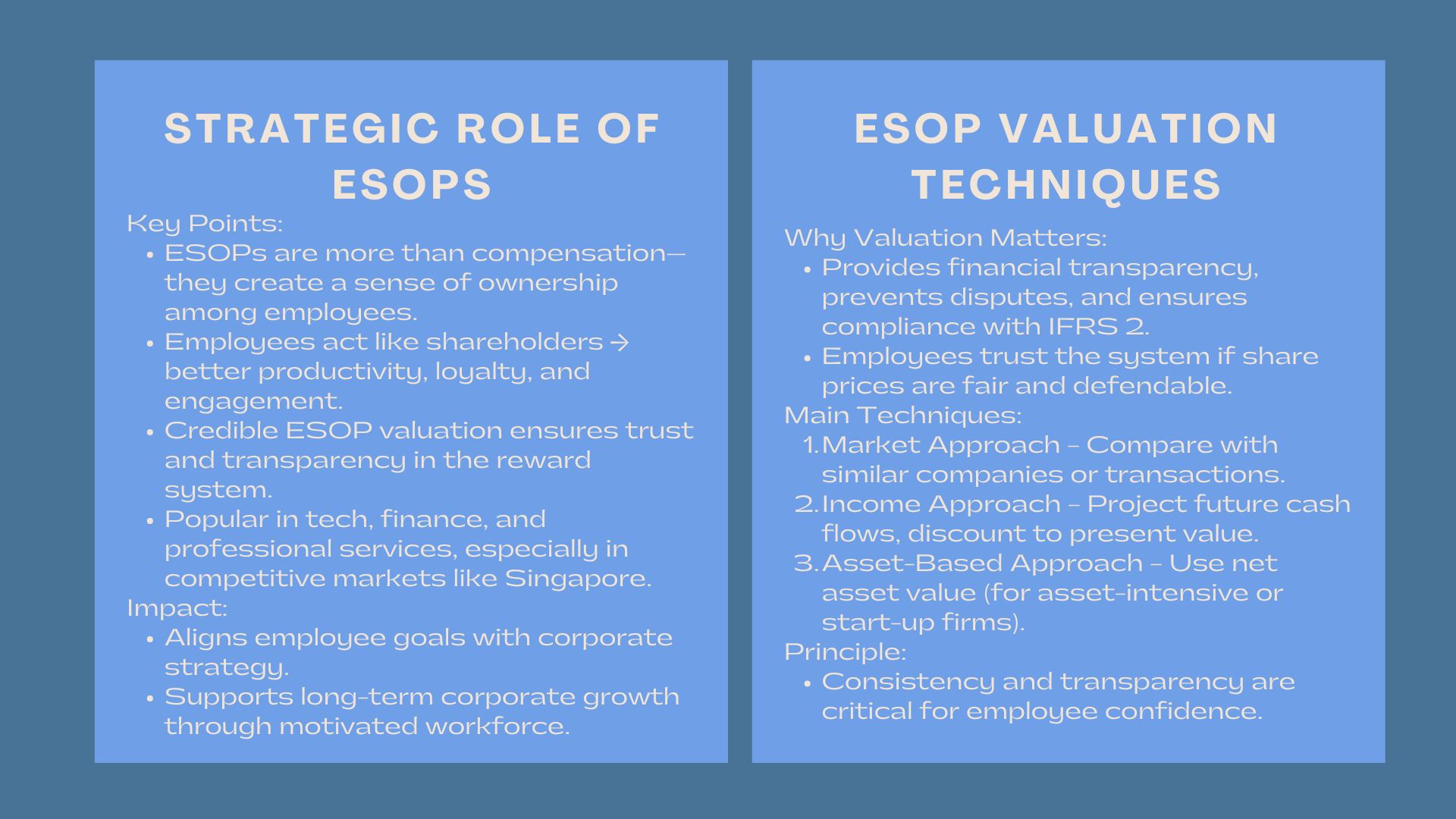

ESOP as a Strategic Role in the Modern Company.

ESOP as a Strategic Role in the Modern Company.

Employee Stock ownership Plans (ESOPs) are not just instruments of compensation. They are effective strategic tools that create a feeling of ownership among the employees so that the employees may think and act to be shareholders. Such a fit between employees and management may result in better productivity, increased job satisfaction and loyalty.

ESOPs are becoming popular in the developmental subdivisions such as technology, finance and professional services. They ensure that employees have a real vested interest in the success of the company making mundane work a long term investment. But it is also based on trust in this relationship – and the basis of trust is fair valuation. The employees should have the assurance that their shares are being based on market-based value, as opposed to random values.

Reason being the necessity to have a proper ESOP valuation.

The valuation of the shares delivered to the employees is called ESOP valuation. This is not just a financial exercise, it is a psychological and compliance requirement. Financially reporting wise, ESOP valuation guarantees the accounting standards like the IFRS 2 or local equivalent laws. Human resources wise, they prove the worth of employee rewards.

A sound valuation can prevent disagreements that might arise between the employees and the management since it provides clear and defendable shares prices. It also helps in making internal decisions on performance bonuses, and allocations on the bonuses. In markets such as Singapore, where corporate governance standards are increasingly rigorous, ESOP valuation Singapore practices have evolved to integrate both financial modeling and regulatory compliance.

Typical ESOP Valuation Techniques.

Companies can value ESOPs in a number of ways:

- Market Approach- It compares the company with other similar listed companies or with recent transactions to determine share value.

- Income Approach – Future cash flows are projected, and discounted to present value with the help of a specific discount rate.

- Asset-Based Approach – This is based on the net asset value of the company and is suitable in asset-intensive firms or start-up companies.

The selection of the appropriate approach is contingent upon the maturity, industry and financial visibility of the company. Whichever method is used, consistency and transparency plays a critical role in making employees believe that the valuation is credible and just.

How ESOP Valuation Makes Motivation and Retention.

Association between Ownership and Performance.

By understanding that their shares will be appreciated using sound and relevant criteria, the employees have a greater confidence in the reward system of the company. This confidence, on the other hand, further improves their desire to make significant contribution. The employees will have a better chance of observing a direct correlation between the value of the company and their performance, which will strengthen the feeling of contribution.

Inherent valuation also preconditions the culture of fairness. Wrong or random valuation on the other hand may cause dissatisfaction, legal issues or loss of talent.

Saving Key Talent in the Competitive Environment.

The correlation between ESOP valuation and employee retention can hardly be overestimated. In competitive markets such as Singapore, talents may have more than one employer offering them. An organized ESOP where there are frequent, equitable valuations may be an excellent incentive to remain. When employees feel the actual, rising worth of ownership position, they might be more likely to be loyal.

Moreover, employee stock ownership valuation plays a crucial role during funding rounds, mergers, or IPOs. When employees realize the value of their shares, they have a higher chance of staying loyal to the company during the changes and this makes the organization stable and continuous.

Accounting and Regulatory Concerns.

Correct ESOP valuation is also a compliance issue. According to the IFRS 2, a company needs to recognize the fair value of share-based compensation at the time of grant and to amortise the expense of such compensation within the vesting period. This is not only done once but done periodically to capture any major change of both the performance of the company or the market.

The non-observation of such standards may result in inaccuracies in the financial statements or the investigation of the auditors. Therefore, when engaging the independent valuation specialists or certified appraisers, it assists in compliance and credibility in the financial reporting and in the communication with the employees.

Best Practices of Effective ESOP Valuation.

Hire Independent Valuers: The third-party experts give objective judgments and limit the possibility of conflict of interest.

- Embrace Open Processes: There should be a clear way of communicating how the valuation works and the assumptions to employees.

- Assemble Periodic Say assessment Is valuation performed annually or at significant corporate events like fundraising, acquisitions.

- Link to Corporate Strategy: Carry out ESOP valuation procedures with long-range objectives and performance indicators.

- Train Employees: Have workshops or information sessions to make employees realize how ESOPs operate and how valuation impacts their wealth creation.

Difficulties in Effective Implementation of ESOP Valuation.

Although these have their merits, companies tend to have difficulties in carrying out the ESOP valuations successfully. In the case of startups, a short financial history and unstable income make it difficult to predict. Complex capital structure or varying regulatory environment can complicate the estimation of fair value in case of mature firms.

Also, in volatile markets such as the Southeast Asia, valuation inputs may also change dramatically due to the fluctuations in the economy. Thus, it is important to make consistent monitoring and updating of models to remain accurate and trustworthy.

The Wider Influence on Organizational Culture.

Proper ESOP valuation is not just the definition of the share prices but it is a difference-maker, a culture-maker in the company. It shows that the management cares about fairness and transparency and creates the feeling of the common purpose. When employees comprehend the way their efforts can result in the actual monetary gains, they become more engaged and responsible.

Over the long-run, the ESOPs that have credible values will assist in attracting the best talent, retaining talent and building a better reputation as an employer of choice. It is a powerful sign that the company values performance and equality.

Conclusion: Why ESOP Valuation Is Critical for Employee

Simply put, ESOP valuation is not merely a technical or financial undertaking it is a strategic necessity that triggers motivation, retention and trust. Investments in valid, transparent, and consistent practices of valuation make the full potential of employee ownership programs open to companies. As the markets are getting mature and there are increasing competition over talent availability, those being able to get the art of fair and credible ESOP valuation will have a better engagement, loyalty, and overall business growth.