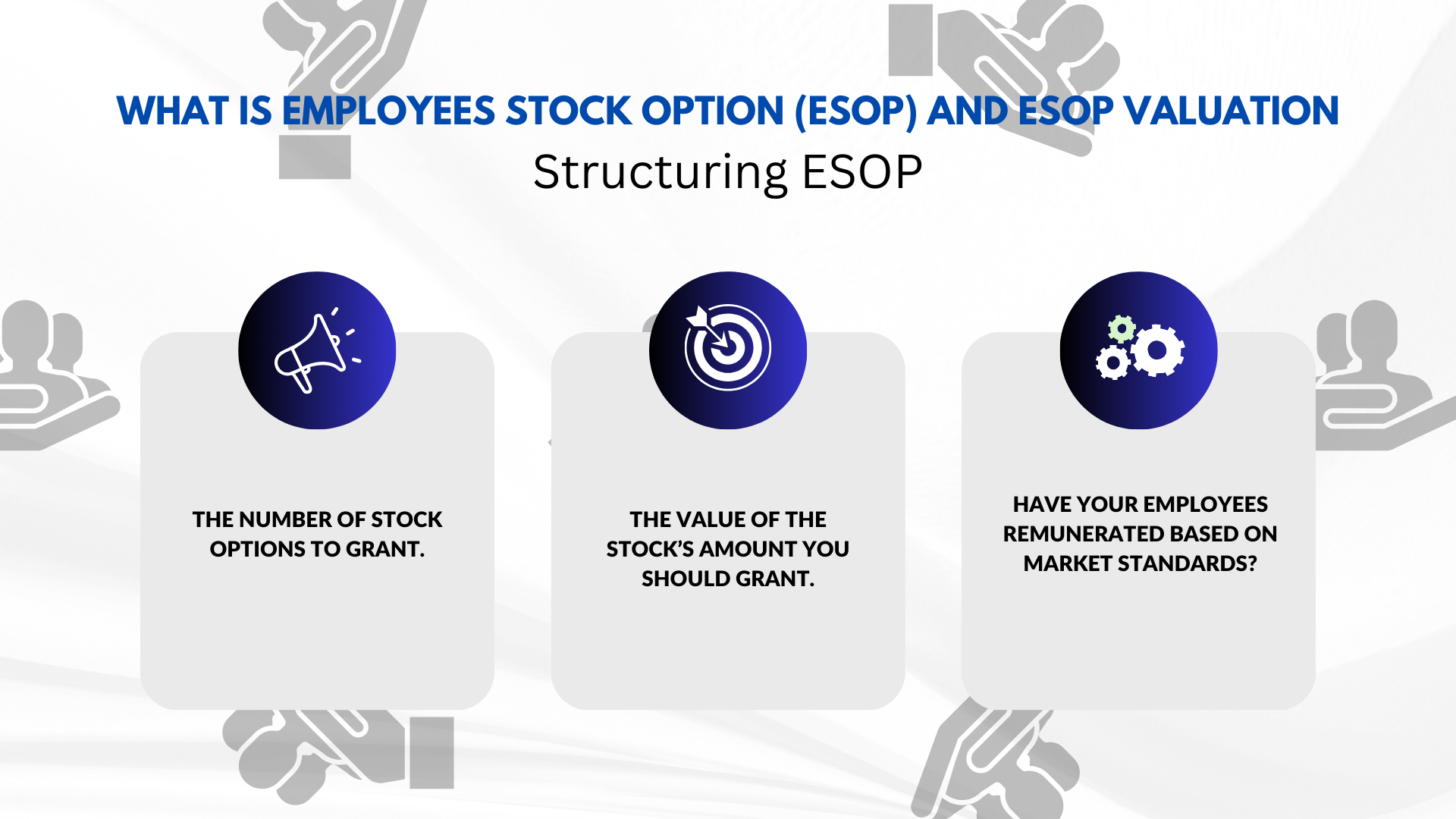

Based on the objectives, needs, and financial health of a company, you can structure the company’s ESOP. When you want to set up your company’s ESOP, consider the following:

You must consider the issues mentioned earlier before deciding to have an ESOP set up.

ESOPs vs. RSUs vs. SARs – Which Equity Compensation Plan is Right for Your Singaporean Company?:

Prepare an elaborate comparison chart where there is a clear distinction between the different varieties of employee equity compensation plans in use today in Singapore (e.g. Employee Stock Options, Restricted Stock Units, Stock Appreciation Rights, Phantom Stock). Under each type, comment on its respective benefits to the employers and employees in the Singaporean environment giving a brief consideration to the accounting and tax effects involved. This material would assist businesses especially those that are startups and SMEs to make sound decisions on the plan that best suits their strategic agenda, cash flow, and talent retention in the competitive Singapore market. This analysis will also highlight the advantages of employee stock plans for founders Singapore, especially in terms of aligning growth with retention. Additionally, incorporating a strategic valuation of employee options and intangibles in Singapore ensures that companies remain compliant and competitive when choosing the right equity plan.

Demystifying ESOP Taxation in Singapore for Employees and Employers:

Prepare an easy-to-use reference that concentrates particularly on tax treatment of Employee Stock Options of employees and businesses in Singapore. This material must be clear on when ESOP gains are taxable (when received, such as on exercise, or under lifting of selling restrictions) and how to calculate the gain on which tax is payable, and the rule on deemed exercise by foreign employees. Provide real life examples or flowcharts on general tax cases and guide on the reporting requirements to IRAS. This would be an incredibly helpful content by clearing the mystery behind a commonly misunderstood, yet important point of ESOPs in Singapore, including the tax implications of ESOP plans in Singapore, and making your site a reliable source for understanding equity compensation.

Additionally, since ESOPs often depend on accurate business valuation, this guide may also touch on how to value a private company in Singapore, especially when calculating fair market value for stock options. Understanding both valuation and tax treatment ensures that both employees and employers make informed decisions.