How to Choose the Right Company Valuation Expert in Singapore and Malaysia

In the current competitive business world, company valuation has emerged as a tool of doing business in Singapore and Malaysia. The correctness and plausibility of your valuation may have a major influence on your business results, whether you are getting ready to merge, raise funds, or meet regulatory demands.

This is the reason why it is so important to select the appropriate professional. Having a host of various firms and consultants in the market to provide their services in the area of valuation, business owners sometimes have a dilemma in terms of whom to trust. Collaborating with the company of Best Company Valuation Services is a guarantee that not only is your valuation technically flawless but also has a use in strategy.

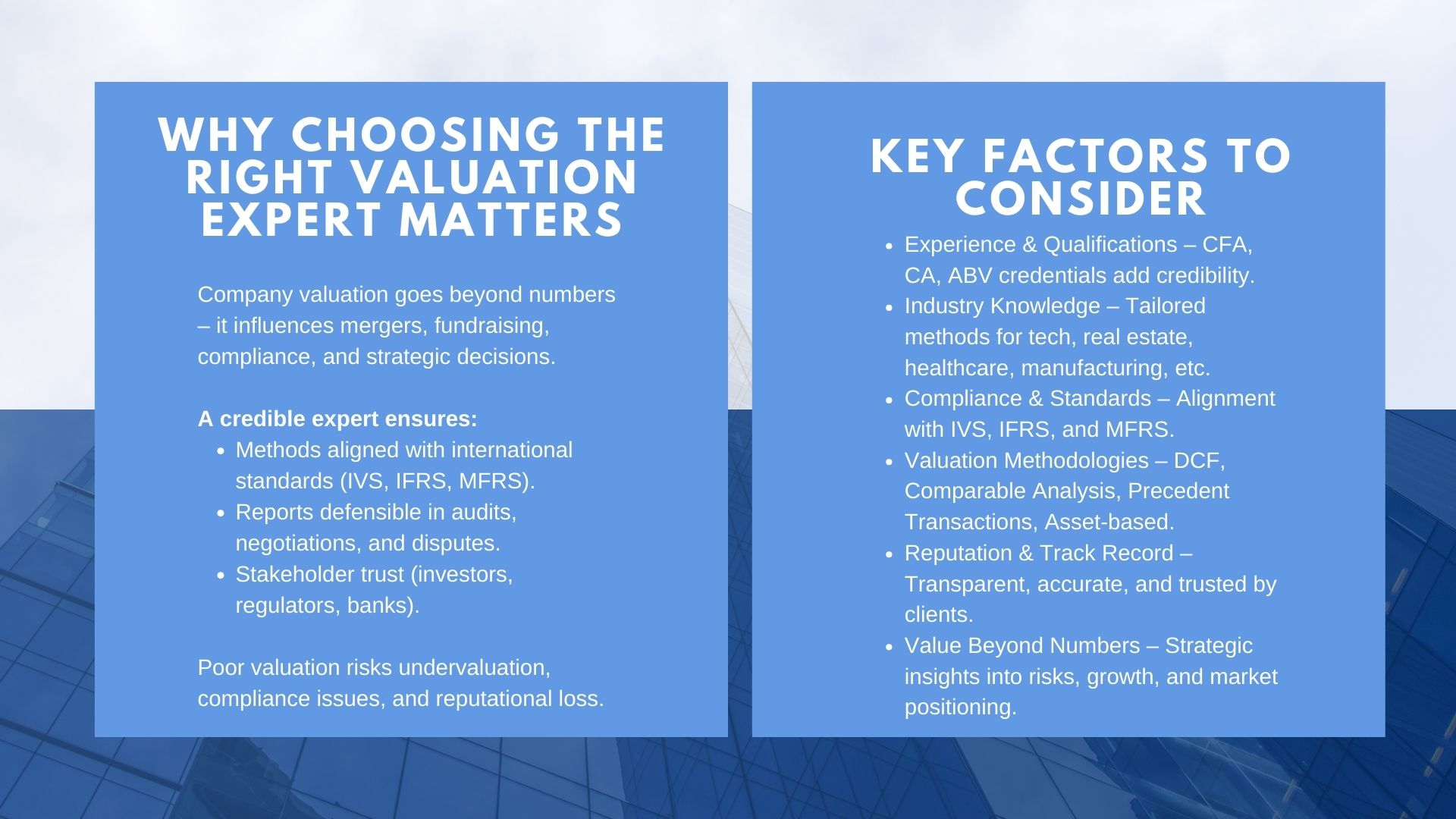

Why Choosing the Right Valuation Expert Matters

Why Choosing the Right Valuation Expert Matters

Company valuation is not merely a financial instrument, but a very important decision maker. It assists the leaders of business to receive a real valuation of their company, discover the opportunities of the growth, and display credible information to investors, regulators, or possible buyers.

Working with the Best Company Valuation Company ensures that:

- The methodology of valuation is in line with the international standards.

- Reports are valid and justifiable during negotiations, audits, or disputes.

- Companies are better informed of their financial performance and future.

- The findings are trusted by the stakeholders such as investors, banks and regulators.

Wrong or improperly carried out valuation, in turn, may result to undervaluation, unsuccessful negotiation, compliance problems, or even reputational losses.

Key Factors to Consider When Selecting a Valuation Expert

In considering valuation professionals in Singapore or Malaysia, there are various factors that should be considered by the business:

- Experience & Work Qualifications.

Enquire as to whether the firm or consultant has an experience in executing valuations in various industries. Professional qualifications of Chartered Financial Analyst (CFA), Chartered Accountant (CA) or Accredited Business Valuator (ABV) imply the technical qualification and compliance with international standards.

- Industry Knowledge

Valuation specialist possessing industry-specific knowledge is in a better position to appreciate market drivers that are unique. An example is that a technology startup would need other approaches to valuation than a real estate developer.

- Compliance & Standards

The valuations are to be made in accordance with International Valuation Standards (IVS), International Financial Reporting Standards (IFRS), or the Malaysia MFRS where applicable. An expert with credibility makes reports audit ready and passed by regulators.

- Methodologies Used

Inquire what techniques have been used- Discounted Cash Flow (DCF), Comparable Company Analysis, Precedent Transactions or Asset based valuation. The expert who is right customizes the approaches towards the circumstances of the client.

- Reputation & Track Record

Check case studies, sample work or client testifies. Reliable professionals are reputed to give forth information of a transparent, accurate and timely manner.

- Value Beyond Numbers

The most impressive best valuation professionals are those who go beyond the crunching of numbers. They give business strategic information on how to grow, risks, and market positioning to make informed decisions.

When Businesses Typically Need Valuation Services

Valuation services are required in Singapore and Malaysia in a number of situations, which include:

- Mergers and Acquisitions: Fair deals and guarding shareholders.

- Fundraising Investor Relations: To appeal to venture capital or private equity, Startups and SMEs need professional valuations.

- Financial Reporting/ Compliance: Adherence to IFRS and MFRS annual reporting standards.

- Litigation and Dispute Resolution: This involves offering objective valuation of either a shareholder dispute or a divorce settlement.

- Succession & Estate Planning: Family businesses should be able to change hands without any complications.

In each of these scenarios, hiring the Best Company Valuation Services company ensures accuracy, reliability, and trust.

Singapore vs. Malaysia: Key Considerations

Although the foundations of valuation remain the same in both markets, businesses are to pay attention to certain regional differences:

- Singapore: Being a major financial center across the world, the regulators and investment companies are putting pressure on valuations to be strictly observed to international standards. Transparency and accuracy are very crucial in attracting cross-border investments.

- Malaysia: Valuations typically become the centre of attention in terms of the adherence to MFRS or succession planning or fundraising of the SMEs. One of the major issues to most of the local businesses is affordability and customization.

An effective valuation professional is able to appreciate these regional peculiarities and provide the solutions that are specific to the business environment in every market.

Why ValueTeam is Trusted by Businesses in Singapore & Malaysia

Among the many valuation firms in the region, ValueTeam stands out as a trusted partner for SMEs and corporates. Known for professionalism, precision, and client-focused service, they are frequently recognized as the Best Company Valuation Company in the region.

What Sets ValueTeam Apart:

- Demonstrated Knowledge: A team of highly qualified finance, accounting and corporate strategy experts.

- Industry and Business-specific Appraisal Approach: Customized business valuation.

- Various Experiences in the Industry: Technology, healthcare, real estate, manufacturing.

- Compliance Strength: Prepared reports that are in compliance with the IFRS, MFRS and the international valuation standards.

- Client Trust: A series of positive feedbacks on transparency and reliability.

Examples of Work:

- Assisted a Singaporean technology venture in making valuation reports that have raised Series B capital on an international basis.

- Undertaken family business succession appraisal of Malaysian SMEs, and making sure that ownership is equitably distributed.

- Helped the real estate developers to borrow money in the region banks by getting the valuation of their assets.

Sample Client Feedback:

- ValueTeam knowledge played a significant role in assisting us to strike a good acquisition deal. – Logistics Industry, Corporate Client.

- Their open procedure made our investors believe in our financial reporting. – Development, client is a SME, Technology.

Conclusion

The selection of the appropriate valuation expert may be the factor that contributes to the most crucial success in your business transactions, compliance, and strategy. Through the expertise, industry knowledge, compliance standards, and track record, Singapore and Malaysian businesses can find the Best Company Valuation Services company that can provide them with the services they require.

To a large number of SMEs and corporations, ValueTeam has been the Best Company Valuation Company, with whom they have entrusted their services and preferred to provide accurate, transparent, and client-focused services. They combine technical skills and individualized solutions to make sure that businesses get more than the number to the business they provide insight into strategic growth and durability.

When you need to investor confidence, compliance, or make prudent business decisions, the initial thing to do is to select the correct valuation partner- and ValueTeam is poised to deliver.