Private company valuation methods are used to determine how much a private company is worth. Private companies can be valued based on the value of their assets, which include the company’s cash, equipment, inventory and other property. Alternatively, private companies can be valued based on their projected earnings or revenue.

This article will cover private company valuation methods, including:

how do you value a private company?

how to value a private company

how to value private company?

value a private company?

how to value private companies?

Private Company Valuation Methods

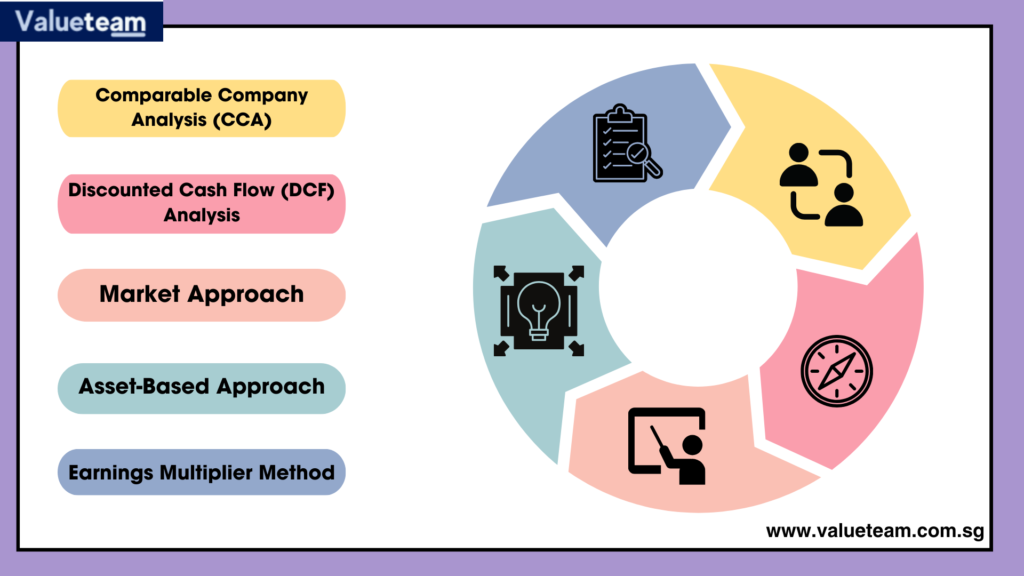

The following methods are most commonly used to value privately held companies:

sto research boost: This valuation method uses the net income generated by the business as an indicator of its value. In other words, it calculates how much cash is being generated by the business and then multiplies this amount by a price-to-earnings ratio (P/E).

agricultural companies use fair value for purposes of valuing crops

Private companies are generally valued using one of two methods: Comparable Company Analysis or Asset Based Valuation.

Private company valuation is often done by comparing the target company’s financial data to a group of similar public companies. The method for calculating the comparable company group is similar to the approach used for a Comparable Transaction analysis. Once the comparable company group is identified, each member can be evaluated based on key financial metrics such as sales growth, profit/loss margins, and enterprise value/EBITDA multiples.

Asset Based Valuation

The ev ebit asset-based approach relies on valuing a target company’s assets and liabilities and then determining an implied value based on these balances. The most commonly used method of asset-based valuation involves calculating the net tangible assets per share of common stock (or NTA/CS). NTA/CS represents the total amount of cash flow generating assets minus total liabilities divided by the number of outstanding shares outstanding. This calculation effectively compares the value of all assets less all liabilities with only.

Private Company Valuation Methods

There are many methods to value a private company. The most common method is the comparable method. The comparable method involves comparing the company being valued with similar companies that are publicly traded. This is done by reviewing financial statements and other financial data from public companies in similar industries. Once the analyst has identified companies that are similar, they will then try and calculate the price per share of these companies. The price per share can be calculated using one of two methods:

The current market price per share of the comparable publicly traded company (if it exists) or

The average of all prices paid for shares by investors during a private placement

Once the analyst has calculated an appropriate price per share for each company, they will take an average of all prices paid to arrive at an intrinsic value for each company being compared. They then compare their intrinsic values against each other to determine if one is significantly more valuable than another. If so, they may choose to buy those shares at that lower price because it represents good value for them. If not, there may be no reason to buy any shares at this time because there.

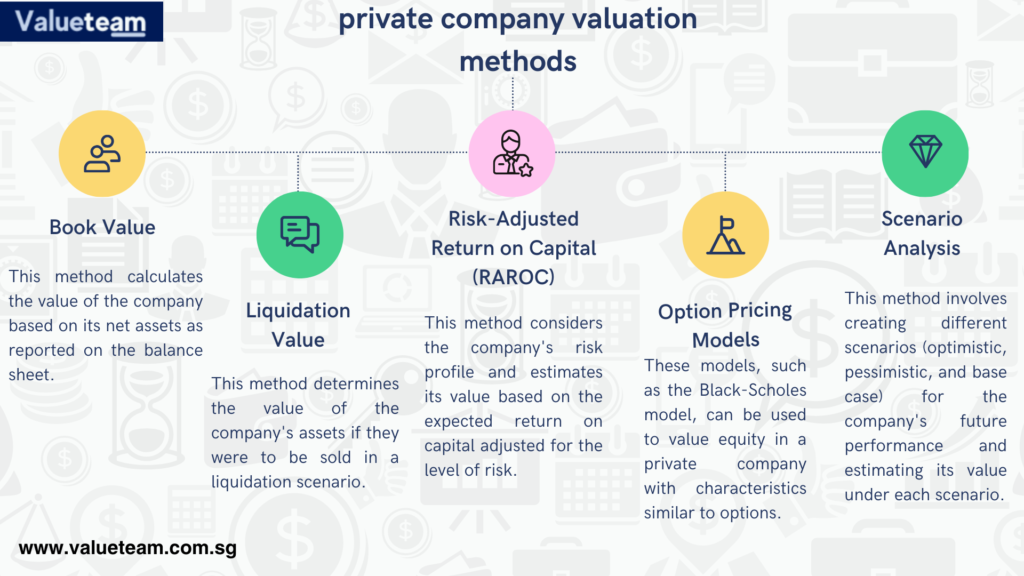

The valuation of a private company is a complex process which involves many factors. There are several methods that can be used to value a private company, and the method chosen will depend on the situation.

There are many independant valuation methods with sbxhrl, but here we have listed some of the most common:

Private Company Valuation Method 1: Discounted Cash Flow (DCF) Method

The DCF method is based on discounted cash flow projections from the company. The projected cash flows from all sources (revenue and expenses) are discounted to future years at an appropriate rate in order to arrive at an estimate of present value. A variation of this method is return on investment (ROI), where historical ROI figures are used instead of projected figures.

This method requires detailed financial statements and budgets for forecasting purposes. It also requires that you make assumptions about future growth rates and discount rates. If these assumptions are correct then it provides a good estimate of intrinsic value; however, if they’re not correct then this method can provide very inaccurate results.

how to calculate intrinsic value