The answer to this question is not as straightforward as it may seem. The most common method is to use the discounted cash flow method, but there are several others that can be used as well.

This article will walk you through the basics of how to value a private company.

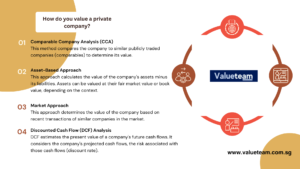

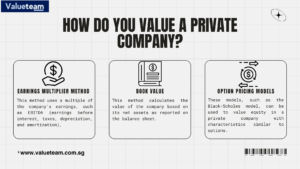

Private company valuation methods include:

Discounted cash flow analysis

The method most commonly used by investors and analysts to determine the value of a private company. This method involves projecting future cash flows and discounting them back to the present day using an appropriate discount rate.

Net asset value (NAV)

A method whereby assets are valued based on their current market prices and then added together with liabilities to arrive at an approximate value for the firm. NAV can also be used as an estimate of liquidation value if the assets were sold off in an orderly manner.

How do you value a private company?

The first step in valuing a private company is to understand its current business model. Once you know this, you can determine whether the company has a sustainable competitive advantage. This will help you know if the company’s growth potential is real or just hype.

If the company does have a sustainable competitive advantage, then you can use one of several valuation methods to arrive at an estimate for its intrinsic value.

Why Is Valuation Important?

Valuation is important because it gives investors insight into what other investors think about a particular investment opportunity and how much they are willing to pay for it. The process of valuation also helps companies set prices for their products, manage their cash flow, and improve their operations by making better decisions on how much money they should spend on different projects.

business valuation singapore, Company Valuation, Business Valuation Services, all business valuation, company valuation share, ESOP Valuation, Convertible Instruments Valuation, Brand Valuation Services, Startup Valuation, sbxhrl, Intangibles Valuation, purchase price allocation, real estate valuation, how to value a company, valuer singapore, valuation value singapore business drivers net tangible assets value$ singapore agricultural companies use fair value for purposes of valuing crops. valuation of tangible assets.

The valuation of a private company is an art and not a science. The most important thing to remember is that it is impossible to value your company with any degree of accuracy unless you know what it is worth in the marketplace. You may have all the financial statements in the world, but if they are not accurate or up to date, they will not help you value your business.

The first step in valuing your company is to identify your market niche. What type of business are you in? What can you offer that no one else can? If you are selling into the same market as 50 other companies, how can anyone differentiate between them? The answer is that they cannot. In this scenario, there will be no premium placed on your offering because there are too many competitors fighting for sales dollars from the same customer base. In order to create value for yourself, you must find a niche where there are few or no competitors. For example, if you have developed a new technology for treating wounds, then it would be relatively easy for you to command higher pricing because it is unlikely that anyone else has developed such technology before –

how to value a private company

private company valuation methods

Convertible Instruments Valuation