Why Early-Stage Valuation Requires More Than Financials

Startups that are at an early stage have a different environment compared to any other business world. They are characterized by unfinished information, unsteady growth and constant experimentation. The company is yet to make a stable business model in these formative stages, with the company financial statements being young and misleading. The conventional valuation instruments to value established businesses do not work effectively in estimating startups, particularly those that are still trying to find a product-market fit or reach a large customer base.

That is why financial outputs will not be enough to rely on in valuation of startups at an early stage. Rather, it needs to integrate a greater knowledge on the intangible factors- founder capability, product innovativeness, market opportunities, customer zeal, team quality and team grounded against competition. The core elements of startup value which are driven by non-financial outcomes are usually an accurate reflection of the direction of the company rather than the amount of revenues or profitability generated within the initial years of operation.

The cash flow or profit margins are no longer looked at by modern investors. They want to seek signs of long-term success. They seek the signs of a good vision, good implementation, and the early stage startup valuation possibility of going large. Accordingly, non-financial valuation metrics of startups have been prevalent in startup evaluation methods in the initial stage of startups. Quite on the contrary, those qualitative indicators can be much more significant than financial figures do, when it comes to establishing real enterprise value.

Why Traditional Financial Models Fail to Reflect Early-Stage Potential

Why Traditional Financial Models Fail to Reflect Early-Stage Potential

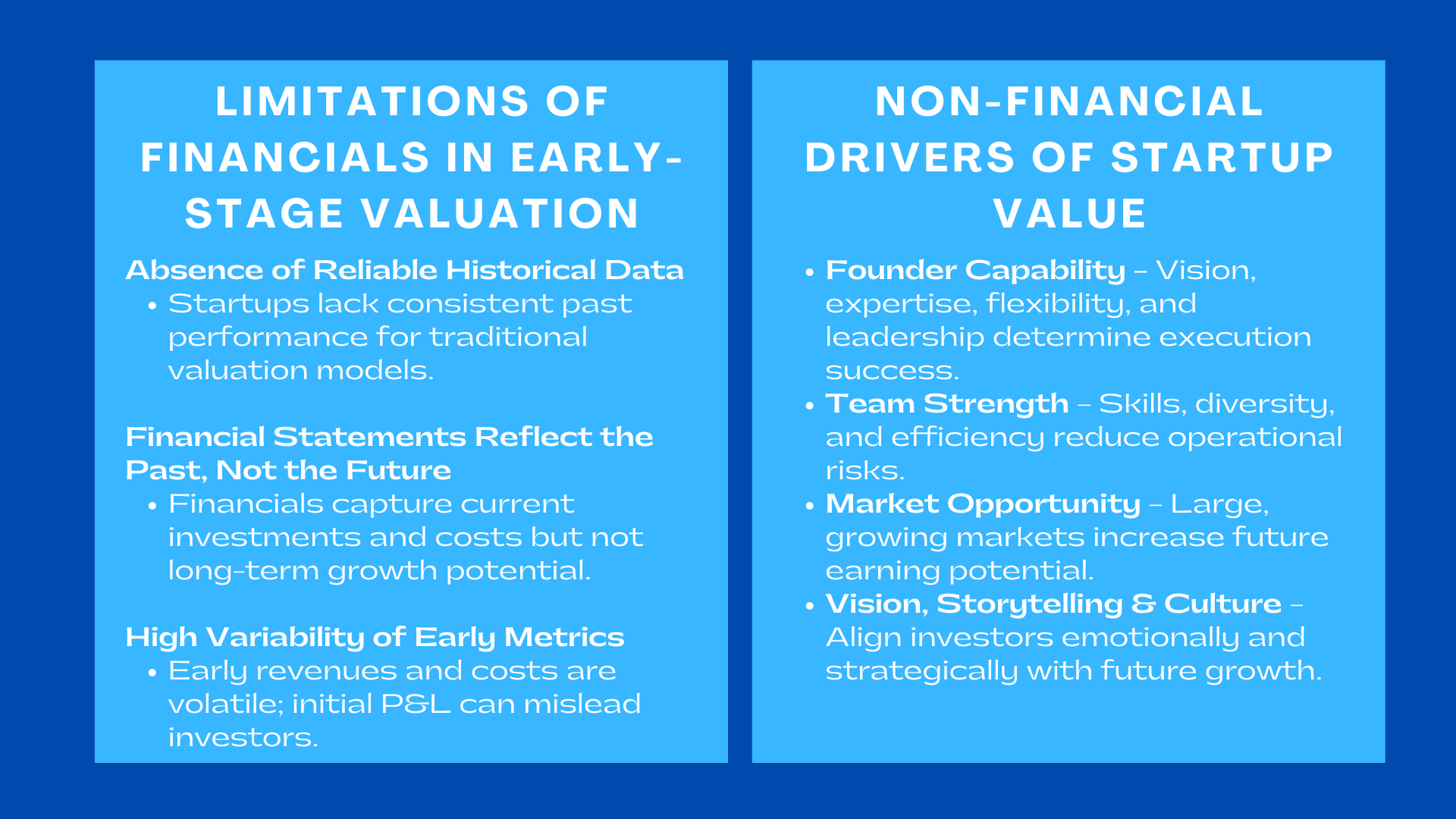

The Absence of Reliable Historical Data

The conventional form of valuation is very dependent on past performance. Their assumption is that the companies are having foresight in earnings, existent customer bases, fixed price structures, and constant operating cycles. At the initial stages, a startup hardly has any of the characteristics. They have unpredictable revenue, insecure cost structures, and volatile financial reports made up of trial-and-error, but not a carefully designed direction.

Financial valuation models fail when there is the unavailability of historical data or when it is incomplete and unreliable. A valuation model that solely depends on numbers doesn’t give a clear view of reality without the trends of performance over a period of a few years and the ability to forecast consistent profitability. That is why the valuation of the start-ups at the early stage, the investors should look beyond the financials.

Financial Statements Reflect the Past, Not the Future

Financial statements can only tell what has already been encountered at the initial level. However, the worth of a startup is virtually determined by the future of the startup. In the case of young companies, the level of revenues is artificially low since monetization is not the priority, the emphasis is laid on development. The costs are high since the company is making massive investments in customer discovery, research, and development, as well as marketing. A flow sheet at this point does not tell about the potential of the startup. Rather, it is an indication of sacrifices that need to be made to create momentum.

Financials gauge the present; the investors in the preliminary stages are concerns of the future. Consequently, the valuation process has to have a focus on future ability as opposed to present financial outcomes.

The High Variability of Early Metrics

Although initial revenue can look good, it is possible that such revenue is not sustainable. Pilot customers have a chance of churning after the trial period. Early adopters are not necessarily the behavior of the mass market. Marketing experiments can cause spikes in the number of users acquired but not long-term retention. Since initial figures are prone to drastic shifts by a margin and periodically, it is due to the pure financial measure that will produce unstable and inaccurate valuations. The volatility compels traders to base their valuation analysis on the non-financial metrics that are more likely to predict long term strength.

The Role of Non-Financial Drivers of Startup Value

Founder Capability as the Foundation of Future Value

It is highly likely that investors say this: they invest in people and not goods. This is indeed true in the initial phases more than ever. It is the group of founders or the team of founders that will provide the key to the success or the failure of the company. The path of the business is determined by their firmness, flexibility, expertise of the field, choice-making, and foresight. An intelligent founder is able to pivot, create a highly performing team and respond to market feedback. Even a person with strong financials but a weak founder may not carry out the scaling of the company.

Due to this fact, founder capability is among the greatest non-financial drivers of start up valuation. Valuation workers also believe that the background of the founder, technical knowledge, leadership, narrating, as well as devotion are taken into account in determining the value to be added to the company in the future.

The Strength of the Team Beyond the Founders

Although the vision is made by founders, the greater team carries it out. A team of people with strong talent, versatility and being an entrepreneur boosts the valuation of a startup remarkably. The investors look at skill diversity, ability to solve problems, pace in which work is carried out as well as the integrity of the team. Having a powerful team is an indicator of strength in execution, hence the lesser operational risks of future growth. Companies that recruit and keep the best talent are more highly valued even without other noteworthy financial reports.

Market Opportunity as a Predictor of Long-Term Growth

A business which is a start up and deals with a vast and expanding market is automatically more valuable. This is even when there is a low revenue stream, but the market is growing exponentially, then the start up can be placed to scale exponentially. Shareholders consider the Total Addressable Market (TAM), the growth patterns, competition levels, and time. Startup valuation at an early stage should take into account the fact that the startup may be in an upsurge or a downward trend. High growth rate markets will increase the future earnings of a startup and thus increase its valuation in spite of the unestablished financials.

Product-Market Fit Potential

One of the robust non financial startup valuation metrics is the product-market fit. Investors evaluate the extent to which the product is quality of pain-solving to the customers, are the users enthusiastic, and are the retention rates high. The initial customers need not make a lot of money since their level of engagement will be an indicator of whether a startup will grow conveniently in the future or not. The level of high engagement, low churn and high word-of-mouth is more threatening on how far ahead the new valuation will go as compared to early income statements.

Traction Quality and Customer Validation

Traction is not necessarily revenue. It may refer to active user base, vibrant communities, increasing waitlists, and powerful customer review. Valuation experts look at the interaction between the product and feedback to the product through the eyes of the early adopters and the qualitative part. In case customers clearly show required needs, loyalty or enthusiasm, the startup is increased in valuation multiples with less revenue. The ability to validate customers is a successful non-financial source of start-up value and tends to outweigh the financial results in the early stages.

Competitive Advantage and Differentiation

The position of startups is this effectively in place due to the vulnerability to the competitor threats. This is the reason why valuation analysts evaluate the presence of the defensible benefits of the company. These could be proprietary technology, patents, data benefits, AI-based applications, specialized knowledge or expertise, brand recognition or exclusive distribution. Although early revenue is unhealthy, high defensibility is a substantial valuation factor due to the indication of lower risk and greater scalability possibilities.

Technology and Intellectual Property Strength

In start ups where technology plays a role in the business, intellectual property is regarded as one of the most valuable assets. Proprietary systems, patents and innovative algorithms are of the value of multiplication even in the absence of huge revenues. IP offers anti-competitiveness and prospers profitability in the long-term. It is also used as a security to subsequent purchases, licensing and mergers.

Brand Promise, Storytelling, and Vision

Investors weigh in on whether the start up narrates an impressive strategic story. Firm vision refers to direct leadership and desire to set a long-term goal. In the case of start-ups in their initial stages, narrative clarity would be an advantage in valuation due to the fact that non financial startup valuation metrics influence the confidence of the investors. The storytelling is a way of leading the investors to know the worldview of the founder, the desired market direction and the extent of the impact. A startup that has a strong story tends to have greater valuation since investors have the ability both emotionally and strategically to associate with the vision.

Why Investors Rely on Non-Financial Metrics in the Early Stage

Early-Stage Startups Are Defined by Possibility, Not Profit

The initial level is distinguished by the possibility. All the startups which can now be considered worldwide leaders, like Google, Airbnb, Grab, or Tokopedia started with initial or no financial resources. The things that they possessed were visionary leadership, high user validation, differentiated products and a huge addressable market. These initial non-financial metrics were more indicative of long-term value as compared to financials that could have been.

Qualitative Signals Predict Scalability More Accurately

Startup valuation is all about scalability, that is the capacity to expand revenue without corresponding growth in cost. The adoption patterns of the product, flexibility of the founder and execution power of the team are non-financial elements which are better predictors of scalability compared to the initial P&L statements. Qualitative indicators that promise growth exponentially are thus considered by the investors.

Early Financial Metrics Are Easily Manipulated or Misleading

Artificial increases of the revenue in initial stages can be socialized through discounts, free trials or vigorous promotions. Profitability may seem more impressive when it is decreased in the meantime. People too early can be caused by experiments, instead of sustainable trends. Financials may be deceptive, so instead, an investor focuses on non-financial factors that cause start-up value and are not as easily tweaked.

How Non-Financial Metrics Influence Valuation Accuracy

Reducing Risk and Uncertainty

This gives great uncertainty to investors in startups that are at an early stage. Non-financial indicators decrease this ambiguity to provide an idea into the behavior of the customers, the reaction of the founders to the difficulties, and the position of the product in the market. These aspects provide investors with hope about the startup to go through the uncertainty curve and reach growth.

Building a More Complete Understanding of the Startup

Financial performance is not the only aspect of a start up performance. The non-financial metrics will show in-depth dynamics, including engagement, retention, ability to innovate, culture, the presence of potential partnerships, and long-term strategy. This brings a multi-layered perspective of the startup and will enable professionals that value startups to model future potential more closely.

Capturing the True Drivers of Long-Term Value

Financial statements do not reflect the real engines of start-up success like innovation, customer love, founder conviction, team cohesion and market momentum. That is but the hurricanes that determine the ultimate revenue, size, and profitability. These invisible drivers are recorded in the non financial startup valuation measures way before they will be reported under the usual financial statements.

Why Early-Stage Valuation Must Be Holistic Rather Than Numerical

Financials Tell the Past; Startups Live in the Future

Financial statements are retrogressive statements. Startups in its early stages are progressive institutions, however. Their worth is their future income and not their current income. Thus, in early stage startups, valuation should be non-quantitative, which comprises quantitative and qualitative metrics to reflect the real trend of the business.

Intangible Strength Often Predicts Tangible Success

Companies with high intangible resources like visionary brand, technology defensible, early loyal users, and high internal momentum were more likely to beat those with better early financials. The intangible factors form a base towards future financial security, profitability and competitive edge.

Value Creation Begins Before Financials Catch Up

Much of the most valuable parts of a startup- innovation cycles, prototype development, customer validation, experimentation, team building take place well before financial measures stabilize. These sources of value even before they can yield into financial output must therefore be included in valuation.

Conclusion to Why Early-Stage Valuation Requires More Than Financials

Financial analysis is only in the background of Early-stage valuation. Financial statements of a young startup usually do not reflect the actual picture of the potential of the project as it only reflects what the business has already accomplished and not what it can become. Investors do not judge solely in terms of revenue and profit but contain non-financial forces of startup value, including the quality of founders, capability of a team, market opportunity, customer validation, defensibility of technology and the ability to fit product and market.

These qualitative aspects provide better understanding of the opportunity to grow, scale, and non-financial drivers of startup value competitive edge in the long run. They disclose the fact of whether the startup can generate value in the future. Finally, company valuation in the early start up is a projection. The more precise ones are the valuations which combine both financial and non-financial measures and understand that the basis of a successful startup is laid much earlier before the financial performance can be proven on paper.