Understanding Terminal Value: The Most Misunderstood Valuation Concept

Introduction: Understanding Terminal Value The Most Misunderstood Valuation Concept

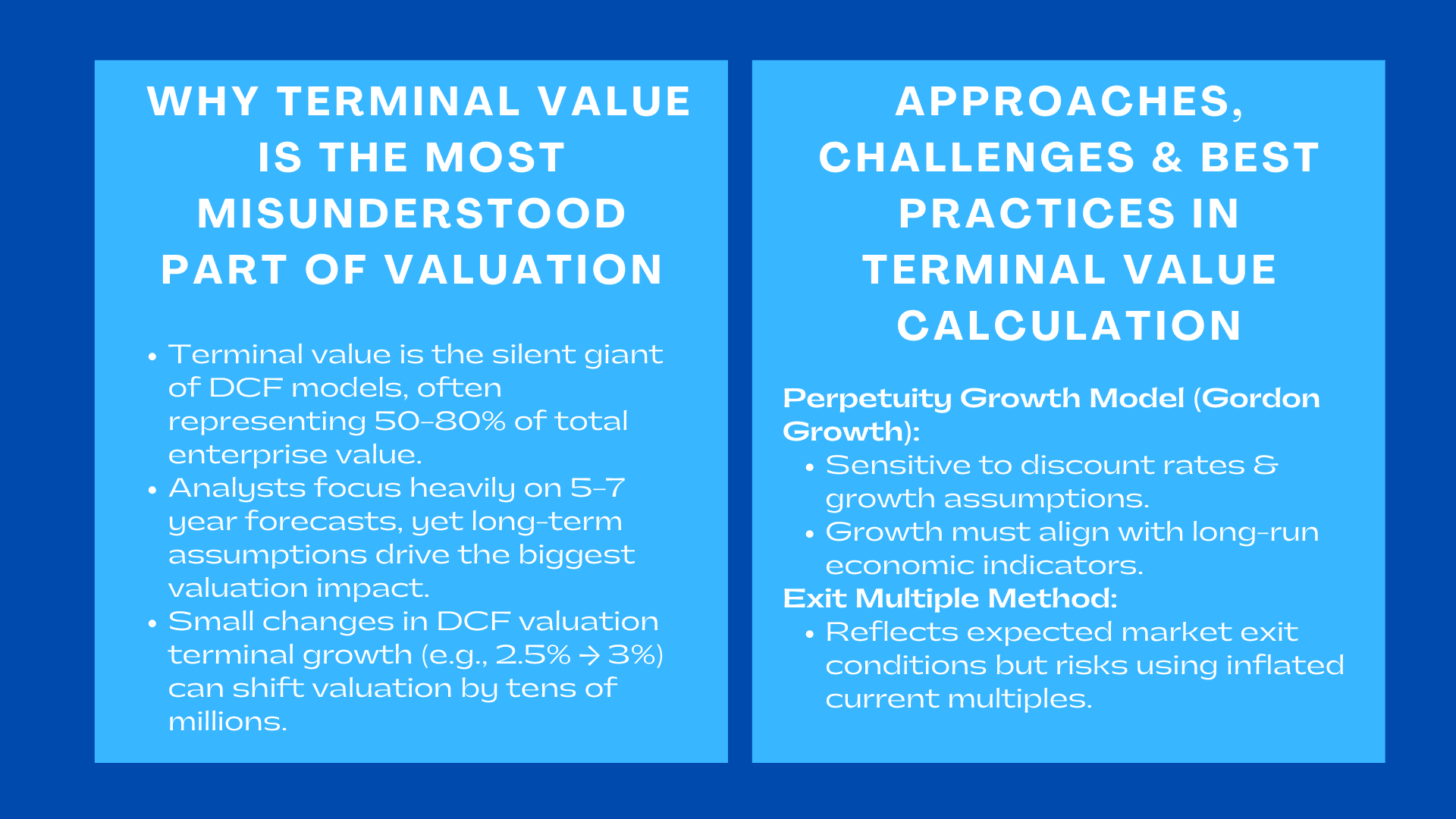

Terminal value has been referred to as the silent giant that is a discounted cash flow (DCF) model. Although the focus of an analyst is usually more on the amount of effort spent in making prediction of five to seven years of financial performance, it is the terminal value that has the greatest influence on valuation outcomes. In many businesses, particularly those that are high growth or those whose industry is stable and mature, it can be that terminal value is 50-80% of the total enterprise value. However, although it is a vital part of the valuation work, it is one of the most misconceived aspects, which is why many organisations seek guidance through a corporate valuation workshop Singapore for finance teams to better understand its impact.

This paper concentrates on a single aspect why terminal value is widely abused and how analysts can develop a sustainable, economically rational estimate of what the long-term business fundamentals suggest. The conversation is organized in clear segments and real-life examples, and the long-tail keywords terminal value calculation Singapore and DCF valuation terminal growth organically incorporated.

1. Why Terminal Value Conquers The Contemporary Valuation Models.

1. Why Terminal Value Conquers The Contemporary Valuation Models.

Terminal value indicates the business performance after the explicit forecast period, where the business growth is maintained and even existing. This figure is theoretically the value of the present of all the cash flows, which are to happen beyond the forecast horizon. Practically, though, it frequently puts in assumptions, which are not necessarily realistic.

1.1 The Bearing of Long-Term Assumptions.

Terminal value mostly prevails in valuations because of two reasons. To begin with, the subsequent cash flows are discounted at a lower relative degree than the previous growth spikes or volatilities that have been estimated. Second, modest adjustments in the DCF valuation terminal growth assumptions can materially shift enterprise value. A move from 2.5% to 3% growth may look small, but can add tens of millions to a mid-sized company’s valuation.

As an example, an example of a Singapore-based technology infrastructure provider whose nearest margins are moderate but have high retention in the long-run. When analysts merely set a high perpetual growth forecast on the basis of a wish to believe in the trends in digital adoption, the terminal value would inflate in an unrealistic way, obscuring the underlying risks in the competition and capital intensity.

1.2 A fallacy regarding Stability in the Market.

The other myth is associated with the idea that the mature markets will keep on growing and expanding indefinitely. Most jurisdictions such as Singapore are facing a slow population growth and increasing operating costs. This renders it impractical to expect the continuous growth unless there are evident productivity-based growth or cross-border development plans. But analysts repeatedly use growth rates which are beyond their expectations of long run GDP, resulting in exaggerated valuation and poor defensibility of valuation.

2. Two Preeminent approaches to Terminal Value estimation.

Although a number of strategies can be used to calculate terminal value, the two approaches that prevail in practice in the context of valuation include the Perpetuity Growth Model (Gordon Growth) and the Exit Multiple Method. They both have their advantages and disadvantages, and they can be limited to the maturity of the sector, availability of the data, and regulatory issues. Professionals in Asia, especially those involved in terminal value calculation Singapore, must often justify model selection rigorously for audit or investor review.

2.1 The Perpetuity Growth Method (Gordon Growth)

This method presumes that the company is viable forever as the cash flows remain constant and it increases at the same rate. The formula is simple but the subjective factors, in particular, the perpetual growth rate and discount rate are where misjudgment occurs frequently.

Common error is to choose a growth rate that is more than what is set in long term macroeconomic standards. As an illustration, when the long term GDP outlook of Singapore is at 1.5 to 2, it is hard to contend with the 4 percent perpetual growth rate when the business has no special, defensible competitive advantages or repetitive contractual revenue.

2.2 The Exit Multiple Method

This process determines terminal value using a valuation multiple (e.g. EBITDA, EBIT) that will reflect anticipated future market conditions. It is typically applied in the context of private equity, as exit measures are more indicative of investor behaviour.

Nonetheless, it is difficult to choose the right multiple. It can be biased in using current market multiples as a proxy of future market cycles particularly when the current interest rates are very low or the sentiment in the sector is highly inflated.

e.g. a logistics firm that expects better margins post digitisation efforts can warrant greater multiples. However, where the industry is enjoying the temporary surges in demand, the application of current multiples will overvalue sustainable worth.

3. Structural Forces in the Current Environment that Influence Terminal Value.

Contemporary appraisal setting is determined by the fluctuating rates of interest, the shifting competition, and the speedy impact of technology. Such forces have a high impact on long-term assumptions and should be brought out clearly in the terminal value decisions.

3.1 Interest rates and Cost of Capital.

Terminal value sensitivity directly depends on the cost of capital. The increase in rates of repulsion shrink values through higher discounting and lower justifiable perpetual growth. In companies with a Singapore base, where over the past few years the financing costs, and liquidity conditions began to change and do not necessarily favor old-established models that were created in low-rate settings, the analysts ought to review long-term assumptions instead of using those that were created long ago.

Take the example of a mid-market manufacturer that is refinancing its debt during a period when the rates are rising. An increase in costs of borrowing can decrease stability of free cash flows to which tighter terminal growth projections are used to prevent the overstating of enterprise value.

3.2 Competitive Moats and CFO Sustainability.

The value of terminals can only be significant when the competitive advantage of the company is permanent. Low switching costs Businesses that operate in industries with low switching costs (like consumer services, F&B, e-commerce, etc.) ought not to have high terminal growth rates unless they exhibit high brand loyalty or differentiated products.

The case of a Singapore retail chain that goes on an aggressive expansion in Southeast Asia may only warrant additional long-term growth in case it obtains sustainable supply chain benefits or exclusive distribution routes.

3.3 Technology disruption and uncertainty in the market.

Alterations in the long-term economics in the industry can be transformed through technology, including automation, the implementation of AI, or the introduction of new digital marketplaces. Terminal value assumptions have to be based on whether the business would remain relevant or be subject to faster downfall.

A cloud software company implementing AI-based customer service integrations can potentially benefit in the long term in efficiency. Traditional businesses that lack a digital roadmap, on the contrary, might need less terminal growth assumptions to capture the risks of disruption.

4. Assembling a Strong and Securable Terminal Value Model.

Since terminal value is a sensitive topic, analysts are advised to take systematic approaches to increase the level of credibility and minimise valuation conflicts. Innovators, auditors and investors are demanding defensible methodologies especially in transactions, financial reporting and dispute resolution.

4.1 Growth in Consistency with Long-Run Economic Standards.

One of the basic principles is that perpetual growth assumptions must not go beyond the long-term macroeconomic forecasts. The comparison of benchmarking to the projections of GDP in Singapore, trends of productivity and sector-specific data enhance defensibility.

Indicatively, a data centre service provider planning to enter a new region may be justified to experience a minor increase in long-term development owing to the need of digital infrastructure. These assumptions should, however, be connected to real evidence of pipelines, rather than wishful thinking.

4.2 Sensitivity of Terminal Value of Stress-Tests.

A strong valuation model will challenge the sensitivity of terminal value to variations in essential assumptions- discount rates, cash flow volatility, capital expenditure cycle and industry competitive forces. Sensitivity analysis, scenario testing and Monte Carlo simulations are applicable in increasing confidence in the final result.

4.3 Cross-Checks in the Industry and Market Multiples.

Analysts should also cross-verify results with industry multiples even when they are using perpetuity method to determine reasonableness. When the implied multiple is purposefully above or below market standards, then assumptions probably have to be changed.

Conclusion: A Stricter Future in the Terminal Value.

Terminal value is going to be one of the most determinant aspects in business valuation, but it will also likely be one of the most misinterpreted. Due to the dynamic nature of markets, evolving interest rates and changing industries due to digitalisation, the analysts will have to become more rigorous and transparent regarding long-term assumptions. Perpetual growth rates have to be anchored in the economic forecasts, detailed sensitivity analysis and business and investor context, to ensure that businesses and investors can achieve more plausible and defendable valuation results.

Knowing these principles is not only a technical game, it is a strategic requirement of making smarter investment choices and negotiating deals well, and constructing values that can withstand scrutiny in the contemporary financial landscapes