IFRS 9 Impairment of Financial Assets: Valuation and Expected Credit Loss

Learn Professional IFRS 9 Expected Credit Loss Courses

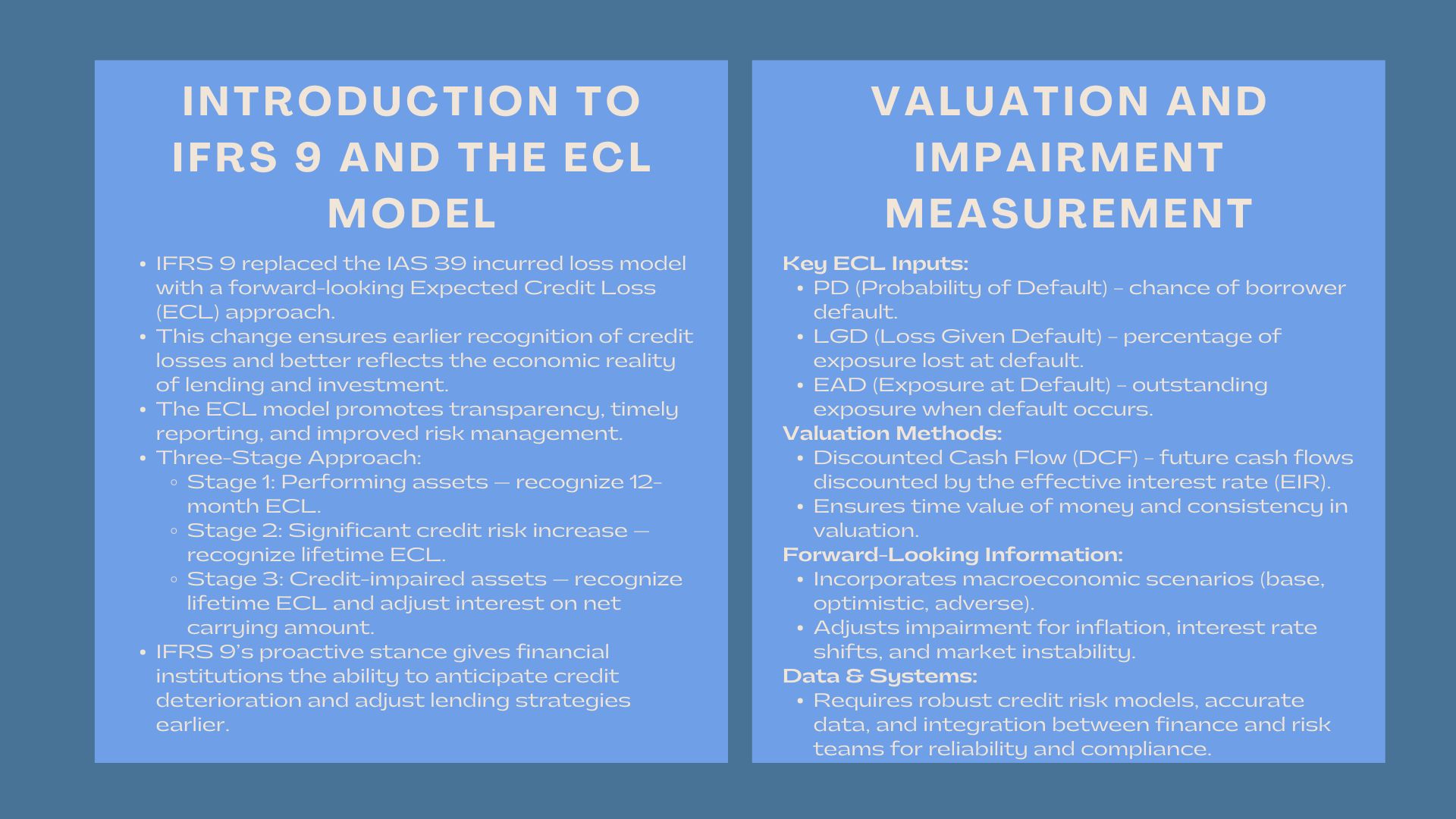

The adoption of IFRS 9 transformed the credit loss recognition, measurement and reporting by financial institutions. A change in the approach used to record depreciation of the incurred loss model in IAS 39 was a move to IFRS 9 which adopted a forward-looking model that recorded a possible loss associated with credit before it is incurred. Its paradigm shift is more transparent, better risk management and more compliant with economic reality of lending and investing operations.

In the current article, the author examines the main concepts of IFRS 9 impairment, including valuation methods, the expected credit loss (ECL) model, and the effect that they have on the financial statement and the stakeholders. This article is ideal for those seeking Financial Credit Risk Assessment Training Singapore to strengthen their understanding of credit risk and IFRS 9 compliance.

The development of the impairment accounting.

The development of the impairment accounting.

Before IFRS 9, in entities, the model of impairment adopted was the incurred loss model, which only acknowledged impairment when there was a loss event. This tardy appreciation also caused exaggerated values of assets and undervalued credit risks as was observed in the 2008 financial crisis.

The IFRS 9 also minimized this shortcoming by coming up with a proactive impairment model that addresses credit losses according to their future anticipations and not the past. This aims at giving more timely data on the collectability of financial assets so that institutions can change their credit risk management policies in time.

Understanding the Expected Credit Loss Model

The Three-Stage Approach

The IFRS 9 expected credit loss model for financial asset valuation applies a three-stage classification framework for impairment:

- Stage 1: Financial assets whose credit quality has not deteriorated greatly since the time of initial recognition. Organizations identify a 12-month ECL, which is the losses due to potential default occurrences over the next 1 year.

- Stage 2: The assets which have undergone a substantial rise in credit risk but is yet to be impaired in credit. Lifetime ECLs have been known to report high risk levels.

- Stage 3: Credit-impaired assets where the default is evidenced. The net carrying amount after taking away the expected losses is the basis of calculating interest revenue.

This is a model of staging, which makes sure that the impairment is dynamic in its representation of the credit risk over the years, in terms of both anticipated and actual deterioration.

Important ECL Calculation inputs.

ECL model involves three paramount parameters:

- Probability of Default (PD): It is the possibility of default risk of a borrower at a certain period of time.

- Loss Given Default (LGD): The ratio of exposure to the amount of the exposure that is likely to be lost in case of default.

- Exposure at Default (EAD): This is the amount of the exposure at the default.

Such factors together with macroeconomic projections are the basis of credit loss estimation according to IFRS 9.

Valuation Techniques and Impairment Measurement

The impairment measurement and valuation techniques under IFRS 9 require both quantitative modeling and qualitative assessment. Through the statistical techniques and crisis analysis, financial institutions estimate the expected losses and modify their inputs according to the economic conditions, profile of borrowers and the nature of the portfolio.

Discounted Cash Flow (DCF) Approach.

Under the IFRS 9, the discounted present value of the expected future cash flows is discounted by the original effective interest rate (EIR) of the asset. This guarantees the consistency in initial recognition of financial assets and subsequent impairments measurement. The DCF technique enables organizations to represent the time value of money in the valuation of assets, which is consistent with accounting and economic substance.

Macroeconomic Scenarios and Forward-Looking Information.

One of the most important elements of IFRS 9 is forward-looking information. To determine the possible losses in future, entities should take into account different economic conditions, including the base, optimistic, and adverse ones. These situations are prioritized on the level of probability, which enhances the accuracy and reality of impairments estimations.

As an example, increasing inflation or tight credit markets, or geopolitical instability may directly affect PD and LGD and may lead to a change in ECL models. This is because IFRS 9 impairment models are sensitive to macroeconomic variables and hence important in effective financial reporting.

Data and Systems Requirements.

The execution of IFRS 9 supposes proper data systems that are able to record past achievements, credit turnover and anticipated metrics. A lot of organizations have invested to such an extent in credit risk modeling infrastructure to achieve these requirements.

The quality, completeness and consistency of data are very important in generating credible impairment results. Moreover, financial institutions need to combine risk management and accounting information to coordinate internal models and disclosures that are in line with the IFRS.

Problems with the Application of IFRS 9 Impairment Models.

Although the ECL framework has a conceptual merit, it presents some practical challenges. It is always risky to predict the economic conditions throughout the life of an asset and a small change in assumptions can change the impairment results significantly.

The other difficulty is in identifying the meaning of a significant increase in credit risk. Under IFRS 9, there are no defined thresholds and the entities are left to make professional judgement based on internal risk measure and industry standards. Although this is a helpful feature, it may create uneven application in institutions.

Besides, smaller organizations might not have resources or data sophistication to develop sophisticated ECL models, so they might use simplified methods which might decrease accuracy.

Effects on Financial Reports and Disclosures.

The impairment provisions under the IFRS 9 are more likely to be higher and recognized earlier than the incurred loss model. This directly affects the profit volatility and balance sheet strength especially during economic recessions.

Enhanced disclosures lead to the transparency and comparability of the financial statements. According to IFRS 7, all the notes should be detailed with regard to ECL methodologies, assumptions, and sensitivity analysis. The disclosures allow the investors and regulators to know the reason behind the impairment figures and the extent to which the institution is exposed to credit risk.

Combining IFRS 9 and Risk Management.

The ECL setup is an interim between financial reporting and risk management which fosters a closer integration of accounting and credit risk teams. This can be achieved by matching the financial data with the real-time risk indicators so that the institutions can be more prepared to predict credit losses and adapt their lending strategies.

The same integration also assists in stress testing and capital planning processes that are carried out in accordance with regulatory regimes including Basel III, which makes sure that the reported impairments are related to the actual risk exposures.

ECL Modeling Strategic Value.

In addition to compliance ECL modeling has strategic advantages. It allows the financial institutions to:

- Determine the signs of credit deterioration.

- Maximize the provisioning and pricing of loans.

- Enhance investor and regulators communication by transparent reporting.

When implemented successfully, IFRS 9 impairment modeling can be used as a strong tool of proactive credit risk management, rather than a regulatory one.

Conclusion

The IFRS 9 impairment model is a significant change in the accounting of financial reporting because it incorporates prospective valuation in the measurement of credit loss. IFRS 9 encourages reporting risk earlier, greater transparency, and enhanced comparability within the global financial sphere because it provides a model named expected credit loss. Though implementation issues still persist, those organizations who have mastered the art of ECL modelling not only gain the assurance of compliance but also have a strategic insight into their operations that helps enhance their resiliency in a more uncertain financial environment.