IFRS 9 Expected Credit Loss: Why Forward-Looking Valuation Is Essential

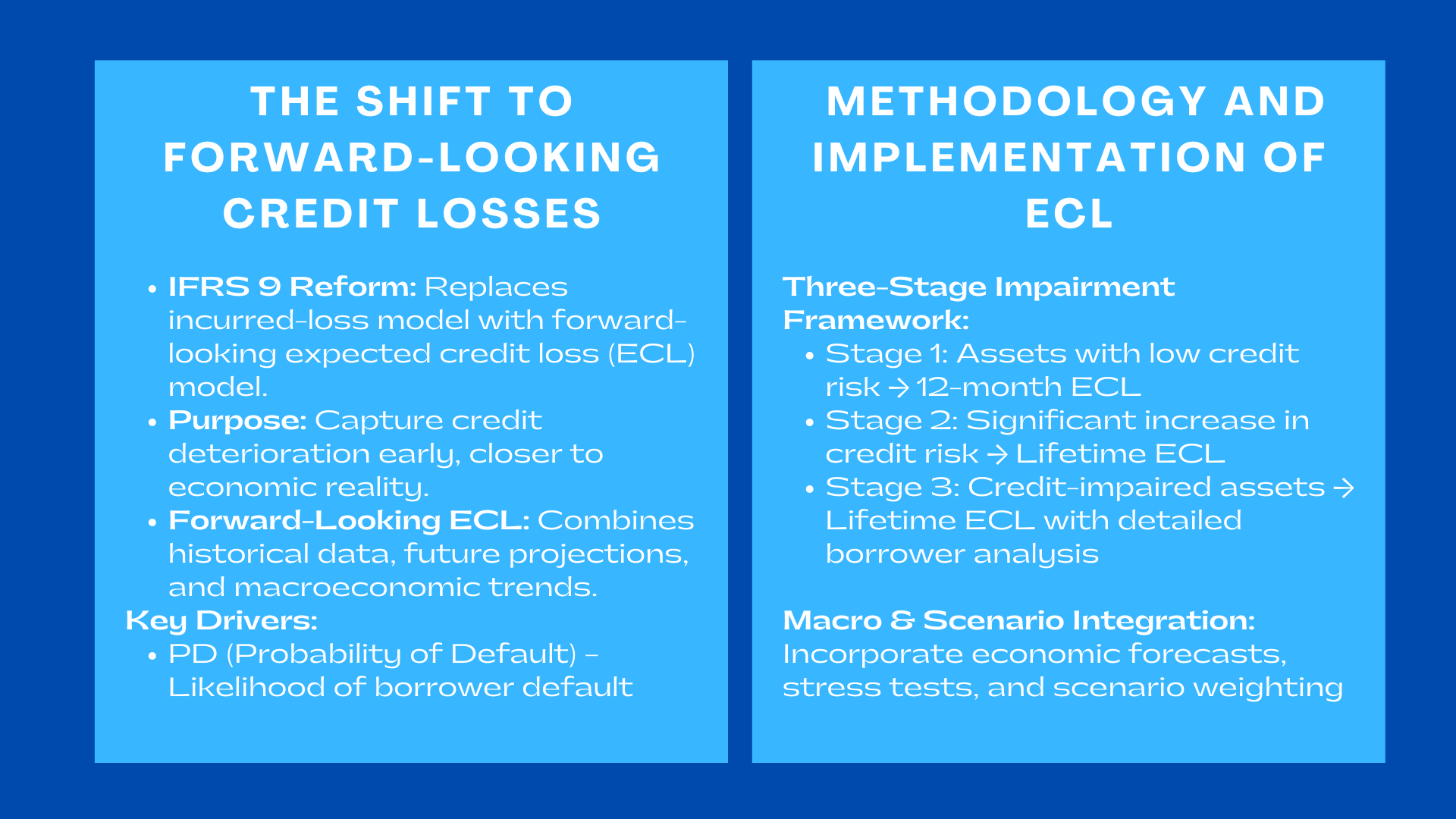

The IFRS 9 brought with it one of the most significant reforms in the financial reporting of credit instruments since it compelled the entities to replace their incurred-loss model by a forward-looking expectation of a loss model. A broader policy agenda is captured in this shift, namely, that credit degeneration is captured earlier, nearer, and with a greater relationship to economic reality. With the previously used incurred-loss model, the recognition of any provisions was done when there was clear evidence that the stress was impaired and the provision delayed thereby had inadequate buffers at times of stress. IFRS 9 thus would push the financial reporting to proactive risk management through the requirement that companies endure the future economic performance and behavioural trends in addition to structural market changes in estimating the credit losses.

The model of expected credit loss implies the probability weighted measurement of credit losses that is assumed to be unbiased, and it is based on historical records and future predictions. This implies that the institutions have to provide estimates as to the likelihood of a borrower default, the losses that would accrue in case such a default occurs, as well as the exposure that would be present at that time. Such estimates should include macro economical elements like GDP trend, the level of unemployment, the trend of interest rate, inflation changes, and those associated to the particular industry. Consequently, credit impairment accounting has been transported by the How to build forward-looking IFRS 9 expected credit loss models using PD, LGD, EAD, and macroeconomic scenarios to an art of predictive analytics, which requires high-level modelling, large datasets, and interdisciplinary skills.

It is not just technical that the standard is forward-looking since it repackages the whole philosophy of credit risk recognition. The credit risk is dynamic and it varies with time influenced by the market conditions, the behaviour of the borrowers, changes in policies, geopolitical events, and cycles in financial markets. These realities have been subjected to IFRS 9 that compels institutions to report them directly in their impairment calculations. It builds transparency, headbanging at the time of crisis, and the risk is taken to the balance sheet in a way it will manifest itself when it does happen- not many years after it has actually appeared.

Understanding PD, LGD, and EAD: Interlinked Drivers of Expected Loss

Understanding PD, LGD, and EAD: Interlinked Drivers of Expected Loss

The three elements are closely related, Probability of Default (PD), Loss Given Default (LGD), and Exposure at Default (EAD) which are the foundations of expected credit loss. These are metrics that are regularly applied in internal credit weather models, which now form the foundation of financial reporting.

PD is used to estimate the probability of a default of a borrower at a given time period. The point-in-time PDs, required by the IFRS 9 unlike the through-the-cycle PDs which are employed in the regulatory capital structures, would be sufficiently sensitive to the prevailing economic circumstances. PD modelling incorporates credit scoring systems, behavioural indicators e.g. delinquency, patterns, rating migrations, macroeconomic variables, which contribute to the borrower repayment capacity. PD curves are regularly re-calibrated to indicate new economic projections and the dynamics and proactive character of IFRS 9.

LGD is an estimation of the percentage of loan that is going to be lost in case of default by the borrower. The LGD modelling should be able to reflect the prospects of recovery, collateral values, enforcement, liquidation discounts, legal expenses, and dynamics that are unique to downturns. One of the most significant requirements in accordance with the IFRS 9 is the incorporation of anticipated macroeconomic conditions in LGDs estimates. As an example, anticipated decreases in real estate values would augment LGD of mortgages portfolios, whereas, compromised secondary markets on corporate assets might decrease anticipated recoveries on business loans.

EAD is used to determine the aggregate expected exposure as at the default point. This is usually not equal to the carrying amount on the basis of off balance sheet commitments, credit conversion factors, draw down behaviour and early repayment behaviour. Grant analysis of utilisation patterns, features of contract, and responses of the borrowers to economic stress is needed in Behavioural EAD modelling. Combined, the PD, LGD as well as EAD, constitute a mathematical framework that measures credit risk in situations, in the long term and in the set of borrowers.

The Three-Stage Impairment Model: A Dynamic Risk-Sensitive Framework

According to the IFRS 9, financial assets in the form of different types undergo three stages depending on the changes in exposure to credit risks since their recognition. This staging technique has a dynamic framework which depicts the cycle of life of deterioration of credit.

Such assets have yet to see much increase in terms of credit risk since their origination and are termed Stage 1 assets. In such exposures, 12-month anticipated credit losses are only recognised. This does not however imply that only the losses forecasted in the next 12 months are reflected in it; it is simply that the PD sees the possibility of default within the next 12 months period whereas LGD and EAD capture lifetime characteristics. Professionals who have completed an expert business valuation course Singapore will appreciate how understanding Stage 1 assets and their risk measurements is essential for accurate financial analysis and reporting.

STAGE 2 The stage takes the exposures whose credit risk had a notable growth. On material deterioration in credit risk, the entities have to recognise lifetime expected losses and this generates significantly large provisions. The various factors that need to be analysed in determining substantial changes in credit risks include changes in PD, delinquency trends, adjustments in borrower financial performance, and qualitative indicators of restructuring or stress of the sector. The Stage 2 is usually the most judgmental part of the IFRS 9 since it involves institutions to differentiate between normal variability of portfolios and actual credit losses.

Stage 3 is used in respect to credit-impaired assets where the objective aspect of default or material financial impairment is depicted. Lifetime expected losses are classified and the interest revenue is normally computed on the net carrying amount. Stage 3 cash flow modelling is much more borrower-specific, consisting of detailed workout strategies, collateral realisation strategy and anticipated restructuring results.

The staging framework will make their recognition of credit losses so that the recognition will be progressive as the risk increases as opposed to making a sudden adjustment. This enhances transparency, less volatility and matches the impairment recognition better with the actual risk patterns.

Macroeconomic Overlays: Incorporating the Economic Environment into Expected Losses

Among the most peculiarities of the IFRS 9, the demand to use forward-looking macroeconomic predictions in every detail of its ECL calculation is also necessary. The external conditions have a tremendous impact on credit risk and the inability to capture the condition may result in under or over-provisioning of the crisis.

Macroeconomic overlays are changes over a model output, which is done in order to reflect aspects that are not represented adequately in a historical data or statistical model. Using the example, a portfolio should have had low rates of defaults in the past but the predictions are that the unemployment rate or tightening credit conditions are to be increased thus overlays can be made to reveal the incidence of high risk. The overlays also contribute towards explanations of the emerging vulnerabilities, structural market changes, regulatory changes or sector-specific interruptions.

This implies that teams of modellers, function in teams with economists, risk experts and finance departments to develop macroeconomic overlays. The forecasts should be fair, valid, and grounded on valid data. Overlays should also be updated on a regular basis particularly when the economy is uncertain. The forward-looking nature of the IFRS 9 ensures the presence of the expected losses covering not only the past trends but also potential problems in the future.

Discounting Expected Losses: Applying Finance Principles to Credit Impairment

The credit losses which will occur should be calculated as the present value of the losses to be incurred in future. This brings in the discounted cash flow (DCF) technique of credit impairment measurement that intermediates the traditional valuation theory with credit risk modelling.

The benefits of discounting any anticipated future cash deficit with an effective interest rate are that ECL involves the inclusion of the time value of money and is consistent with the economic yield of the instrument. A loss likely to occur in the nearer years of the existence of the loan bears a bigger impact in the present than that which is likely to occur way ahead of time. This association will provide diversity to the provision estimates particularly in long-term assets like mortgages or project finance loans.

The use of DCF to model ECL modelling involves making forecasts of the time of defaults, recoveries, restructurings and cash flows and combines all the predictions into weighted estimates. Stage 3 assets, cash flows are usually borrower specific and demand a close analysis of the collateral liquidation plans, restructuring discussions and those likely to be achieved in the workout. The element of discounting brings in financial discipline in credit forecasting and hence provisions reflect the anticipated losses as well as the time distribution of such losses.

Scenario Weighting: A Multi-Layered View of Credit Risk

The IFRS 9 regulates the entities subjecting themselves to diverse macroeconomic conditions, give each individual condition a probability weight and estimate probability-weighted expected credit losses. This is because this requirement makes sure that impairment estimates portray uncertainty rather than basing on one deterministic view.

The common amount of scenarios in scenario design is one base case scenario, one negative scenario and sometimes a positive or stress test scenario. Under both scenarios, the recalibration of PD, LGD and EAD to capture economic assumption needs to be done. Weights of probabilities should then be allocated as per probability. The implementation of scenario weighting makes companies examine all the possibilities of the economy, which increases the strength and sturdiness of the impairment calculations.

Probability-weighted ECLs are aware that the future is uncertain in nature. Adverse outcomes would also be proportionately included in the end impairment estimate even though they are not very probable. This will encourage good risk management and minimize the chances of under-providing in times of benign economic cycles.

The Full ECL Process: From Classification to Impairment Recognition

The ECL process is initiated by the step of categorizing assets into the right stage as per the credit risk fluctuations. After staging, PD, LGD and Davey expectations are constructed or revised based on the past performance, future anticipation and customer specific information of the borrowers. Under these models, one should then incorporate macroeconomic scenarios and overlays.

Subsequently, the discounted cash flow methodology is used to calculate the expected credit losses in terms of timing, probability and severity of losses. The probability-weighted ECL is so that it results in the impairment recognition. The entities are then required to document impairment charges, revise the assumption frequently, validate models and report approach, assumptions, scenario weights, risk exposures, and sensitivities.

This holistic approach will make certain that ECL estimates are not fixed but dynamic, transparent and based on the IFRS 9 forward-looking principles.

Conclusion to IFRS 9 Expected Credit Loss Why Forward-Looking Valuation Is Essential

The paradigm shift in IFRS 9 Most credit impairment standards adopt a value model that employs the futuristic, probability-driven accounting of credit risks by addressing the dynamic progress of credit risks in real time. The standard incorporates PD, LGD and EAD modelling techniques with macroeconomic modelling, scenario analysis, and discounted cash flow techniques in bringing unmatched depth of analytical skills to financial reporting.

The futuristic evaluation is necessary since the credit risk can be determined not only by the recent performance but also by prospective circumstances. The IFRS 9 point-in-time PD modelling and macroeconomic overlay techniques for accurate ECL estimation makes sure that the entities account for the economic environment that they anticipate to be in place rather than the observed environment only. This will make financial resilience stronger, increase comparability, and general transparency. The anticipated credit loss framework is a principal structure of contemporary risk-sensitive accounting, which protects balance sheets and encourages the early identification of the emergent credit weaknesses.