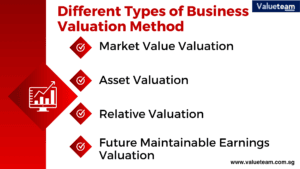

When it comes to business valuation, a few different methods can be used. Each valuation method has its benefits and drawbacks, so it’s essential to understand which one will work best for your situation. Here we’ll discuss the three most common business valuation methods: asset-based, income-based, and market-based.

1. Market Value Valuation

A market value valuation is an estimate of the worth of a company in the current market. This valuation takes into account several factors, including the company’s location, size and condition, and recent trends in the local market. Professional appraisers typically carry out market value valuations, and they can be used for various uses, such as setting the asking price for a home or negotiating a purchase agreement. While market value valuations are not an exact science, they provide a good starting point for determining a company’s fair value.

2. Asset Valuation

One of the most critical points of business is asset valuation. This is the process of determining the worth of a company’s assets, including both physical and intangible assets. Businesses use asset valuation for various purposes, such as Raising capital, Determining the value of stock options, allocating resources, and making decisions about mergers and acquisitions. Several methods can be used to value assets, including discounted cash flow analysis, relative valuation, and accurate options valuation. It depends on the asset type being valued and the valuation’s purpose. A professional asset valuer will have experience in all methods and will be able to select the most appropriate approach for each situation.

3. Relative Valuation

Relative valuation is a financial analysis technique that compares the value of a company to a similar company to determine its relative worth. The goal of relative valuation is to find under or over-valued assets concerning their peers. Analysts must first identify a peer group of companies with similar characteristics to conduct a relative valuation. They then compare the valuation ratios of these assets to determine which ones are trading at a discount or premium. Relative valuations are often used by investors when making decisions about which stocks to buy or sell. While relative valuations can be helpful, it is essential to remember that they are based on historical data and may not value future performance.

4. Future Maintainable Earnings Valuation

The future maintainable earnings valuation (FMEV) is one method of assessing a company’s intrinsic value. To calculate the FMEV, analysts first estimate the company’s future earnings power. This figure is then multiplied by a “multiple” that reflects the company’s expected growth rate and level of risk. The resulting number represents the company’s FMEV. While the FMEV is not an exact science, it can give investors a helpful framework for valuing companies. When used with other methods, it can provide a well-rounded picture of a company’s true worth.

5. Discount Cash Flow Valuation

The discount cash flow (DCF) method is a financial valuation technique that can determine an investment’s present value. The basic idea behind DCF valuation is that an investment is worth the sum of all future cash flows, discounted at the cost of capital. While the DCF method is relatively straightforward in theory, it can be reasonably complex. To accurately value an investment using the DCF method, one must have a detailed understanding of the investment’s cash flow profile and be able to forecast future cash flows reasonably. Discount rates must also be carefully chosen, as they can significantly impact the present value of an investment. Overall, the DCF method is a powerful tool for financial valuation, but it requires a high level of knowledge and expertise to execute correctly.