IAS 28 Associates: Why Fair Value Adjustments Are Critical Before Equity Accounting

Introduction to Certified IAS 28 Fair Value Training

The IAS 28 plays a special and more potent role in the IFRS reporting paradigm since it regulates the recognition and measurement of investments in associates where investors have a substantial influence but lack complete control over the associates. This is a previously type of classification that was seen as rather niche; however, now it stands as one of the most strategically relevant fields of classifications in world business.

The contemporary corporations have often attempted to attain minority interests in growing companies, new technology, regional distribution networks, joint research and market entry vehicles. These structures are seen to ensure that they gain access to innovation, gain strategic information benefits, are less exposed to risk and share operational or market intelligence and develop long term positioning within new geographical or sectoral opportunities.

Associates in contrast to subsidiaries are independent, have their own management teams, strategic mandate as well as risk environments. However, investors who have substantial power are involved in major decision making, often by the board seats, voting processes or the contractual rights. This places a hybrid type of commercial relation and not passive or controlling but in strategic interrelation.

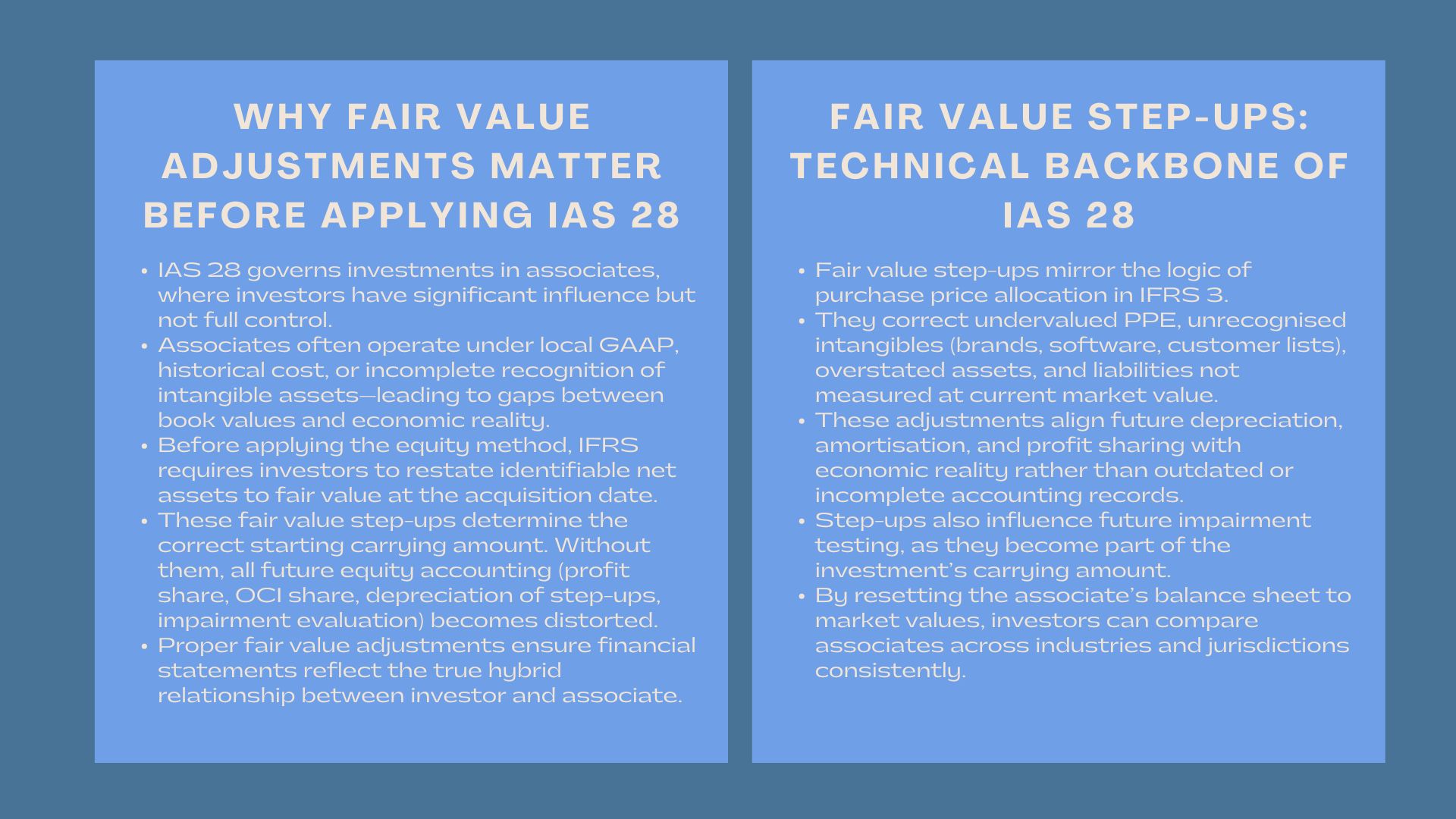

Therefore, IAS 28 fair value step-ups and goodwill treatment before applying the equity method will become essential since it will make financial statements reflect this hybrid influence exactly as it is. In the absence of IAS 28, financial reporting would find it hard to explain to the investor the economic exposure of the investor, the type of strategic impact, or dictate the necessary adjustment that is required to have the reported performance of the investor reflect the underlying economic reality of the associate.

IAS 28 however does not work in isolation. It deals with IFRS 3, IFRS 9, IAS 36, IFRS 13 and even IFRS 12 in an extensive way that establishes an analytical system in which such investments demand accuracy when it comes to valuation even at the time of acquisition. The reason is that the equity method which is the fundamental measurement method required by the IAS 28 acts as a mini version of consolidation.

Its share of the results of the associate is practically absorbed by the investor in its income statement and the carrying amount is altered accordingly. This will make sense only when there is the correct starting point, which is the carrying-amount of acquisition-date. Otherwise, all later equity approach alterations will be warped. Here, the provision of fair value adjustments takes the centre stage in IAS 28. Associates may have their accounting records in place as either local GAAP, historical cost consistent, or regulatory systems which fail to reflect all the economic worth of their assets.

Technology, brands and relations with customers are all intangible and might remain unrecognised. The PPE can be exaggerated or deemphasized as per the depreciation policy or inflation-adjusted model. Stock can fail to realise net realisable value. Liabilities are not reported at the right values in the market in accordance with discounts or values with which economic settlements are recorded.

The gap is filled by fair value adjustments, which allows the identifiable net assets of the associate to be repriced to their fair value under IFRS to the actual carrying amount, as seen by the investor, of the acquisition date, rather than the convenience of accounting principles. Such recalibration is the key to the reporting of the equity methods correctly since all the shares of profit, loss, OCI movement, depreciation of the step-ups and amortisation of intangible assets and impairment test done thereafter are based on the original value.

IAS 28 can only become increasingly significant as the global business models enter a phase of transition into a decentralised model of investment, multi-company collaborative ecosystems, and minority investments in non-unicast ventures. It will make sure that investors are capable of reporting the values and performance of associates transparently, comparatively, and economically.

Fair Value Step-Ups: The Technical Backbone of Initial Measurement Under IAS 28

Fair Value Step-Ups: The Technical Backbone of Initial Measurement Under IAS 28

The fair value step-ups are the most technical aspect in IAS 28 since it entails the process of recreating the balance sheet of the associate on the basis of market values but not using the financial records of the associate. This is in practice a process of valuation which in principle is the same process as the purchase price allocation technique of a business combination. The investor will need to recognize and measure assets and liabilities whose book values significantly exceed fair value, imbue the fair value adjustments, measure such adjustments, and include them in the acquisition-date carrying amount, which will then be followed on how such adjustments will affect the future accounting method by equity.

Increasing the alienation of the IFRS principles with different local versions of the GAAP exacerbates the significance of the fair value step-ups. A large number of the associates are in the developing marketplaces where accounting systems might not fulfill recognition of intangible assets, periodic revaluation of assets, predetermined survey of liabilities and measure of liabilities according to the market frameworks.

An illustration of such is that a rapidly developing technology company might have internally developed software possessing significant economic benefits yet no carrying amount under its domestic standards. A manufacturing associate could be holding PPE of the 1950s cost amounts and this would have been categorized as an undervaluation in the form of assets and this would have influenced the depreciation and utilisation of the assets. Consumer brand companies can possess good trademarks, loyalty programs or distribution rights that do not exist anywhere on the balance sheet.

These biases are rectified by the use of fair value step ups. They enable the investor to reset the values of assets by identifying intangible assets or fair-value adjustment of tangible assets. This, in its turn, will align future patterns of depreciation and amortisation to ensure that equity approach reflects the actual economic wear and tear of assets of the associate.

In case of the absence of these adjustments, the share of profit realized by the investor may greatly exceed the real amount since the expense base of the associate will be under-stated in comparison to fair value. On the other hand, liabilities like the environmental requirements, lease facilities or deferred earnings can necessitate the fair-value changes which are aimed to make the investor pay the larger share of the expenditure he/she is to have in the future.

There are also the implications of fair value step-ups with forward running implications of impairment testing and performance testing. They constitute a part of the carrying amount; therefore, any analysis of impairment should put them into consideration. Analysts thus need to keep track of intricate step-up schedules and amortisation tracking systems to gain an insight into the manner in which the fair value avenue of the associate changes over the course of the time. In addition, fair value adjustments enable the investors to rank associates in different jurisdictions and industries on a comparable basis giving significant value of relative performance, risk and capital allocation effectiveness.

Concisely, fair value step-ups are not technical interventions alone, as they are the pillars that underpin all other subsequent measurements in IAS 28. In their absence, the equity approach of reporting would be detached to the economic reality.

Goodwill in Associates: The Embedded Economic Premium That Shapes Long-Term Value

The conceptual problems associated with goodwill that has been generated in relation to investment in an associate are tricky since it is not recognised individually and not monitored individually. IAS 28 includes the direct carry of goodwill in the investment in the books. It is the premium that the investor requires for strategic advantages, synergy expectations, access to resources, supportable capabilities, privileged performances of information or a growth growth potential which is not reflected in the identifiable net assets of the associate.

Because goodwill in associates is not considered as a separate asset it will act in a different manner than goodwill imposed by IFRS 3. It does not have any yearly compulsory impairment test. Goodwill cannot be charged on cash generating units. It could not be amortised or derecognised. Rather, goodwill is a component of one element of the economy, the investment balance and its poor performance manifests itself indirectly, via impaired performance analysis or discount cash flow analysis. Such an embedded structure poses complicated analytical issues since it demands an insight into the dynamics of the changes in the market expectations over time.

In order to provide an evaluation of goodwill on an indirect basis analysts shall need to make evaluations on larger indicators these will include the strategic direction of the associate, the competitor changes, the change in market structure, the loss of customer base, the changes in regulation, and also the effects of operational inefficiencies. Goodwill emerges as a non-discussable and nevertheless a very powerful part of valuation. When an associate performs worse than projected or such as a firm degrades its prospects on the market, the existing goodwill stands at risk of being impaired.

There is also dynamism of the equity method in that the goodwill will develop. Goodwill is implicitly lost in subsequent losses. The increase in goodwill may be by additional investments or injecting capital. Goodwill may be squeezed because of dilution events. The amount of goodwill of the carrying amount may be influenced indirectly by the movement of dividends and OCI. The goodwill aspect inherent in IAS 28 requires the extent of forward thinking, holistic valuation that goes beyond mechanical accounting.

Impairment Triggers Under IAS 28: A Deep Valuation-Driven Framework

IAS 28 defines that impairment testing must be carried out under the circumstances of indications that the recovery of the investment might be neither possible. Associates unlike a standalone asset or CGUs of IAS 36 are expected to be tested as one asset since fair value application of step-ups as well as goodwill cannot be separated as the two inseparable elements of the investment. This puts the analytical issue in a lump and puts more weight to the holistic valuation.

Financial deterioration as the cause of impairment trigger can be described as restrictions to operating losses, lowering margins, unstable cash flows, or unfavorable working capital changes. They can also be as a result of outside factors, such as the decline in the market, competitive pressures, regulatory shocks, disruption of the supply chain, the fluctuations in interest rates, political risks, or foreign exchange fluctuations. Impairment may also be occasioned by technological disruption, loss of a key customer, product obsolescence or an alteration in the strength of the industry structure.

When there is an indicator, an amount that can be recovered should be estimated at either the value in use or fair value or less costs of disposal. Multi-scenario discounted cash flow models with probability-weighted economic outcomes, long-term strategic assumptions, sector growth forecasts, operational risks and estimation of terminal value are often needed to obtain value in use.

Discount rate should show the risk profile of the associate that will not necessarily be nearly the same risk profile of the investor. In the meantime, fair value-less market participant-driven assumptions of costs of disposal necessitates some process of calibration, which may be based on the choice of pertinent multiples, the adjustment of transaction effects, and some form of benchmarking to other similar conveniences.

Since associates usually work in dynamic markets, IAS 28 impairment testing is not a simple compliance work of compiling a rigorous valuation process, but it entails having a profound understanding of the competitive forces and long-term sustainability of the associate in question. Any impairment losses are charged against the amount so that they cannot be unwound and this further supports the need of conservative well-supported assumptions.

Applying the IAS 28 Process: A Comprehensive Valuation Lifecycle

The application of IAS 28 is not a time-bound measurement practice but an on-going valuation process that remains in place from the time of acquisition up to the duration of the investment. Identification of purchase consideration is done and then identifiable net assets are measured at fair value, embedded goodwill is in terms of determining the certain goodwill in purchase and the initial carrying amount is established. The equity method accounting will then incorporate the extent of the investor in terms of profit or loss of the associate, it changes on depreciation and amortisation of fair value step-ups, OCI movements, dividends paid, and revised carrying amount respectively.

This process takes place continuously where step-up amortisation schedules have to be carefully tracked, net assets changes have to be carefully evaluated, and impairment indicators have to be carefully monitored, and valuation modelling when recoverability has to be tested. It makes sure that the investment carrying amount is developed in accordance with the economic reality of the associate and that relevance and dependability of financial reporting is maintained.

Conclusion

One of the most valuation-sensitive rules of the IFRS is IAS 28 since investors are mandated to embrace the complete economic spirit of economic significance of influence. Any fair value adjustments will make sure that starting carrying amount considers the economy of the market. Sensitivity of long-term valuation is determined by embedded goodwill. Impairment test is conducted to maintain the carrying amount of a test at par with recoverable value.

The closer the corporations become to their associates in terms of innovating, extending into new regions, seeking new technologies, exchanging common goals, and risks sharing, the more Why acquisition-date fair value adjustments determine long-term valuation accuracy under IAS 28 will offer the analytical framework of vibrant reporting on financial matters in transparent, accurate and strategically meaningful levels.