Best Practices for Fairness Opinions in Cross-Border Transactions

Introduction

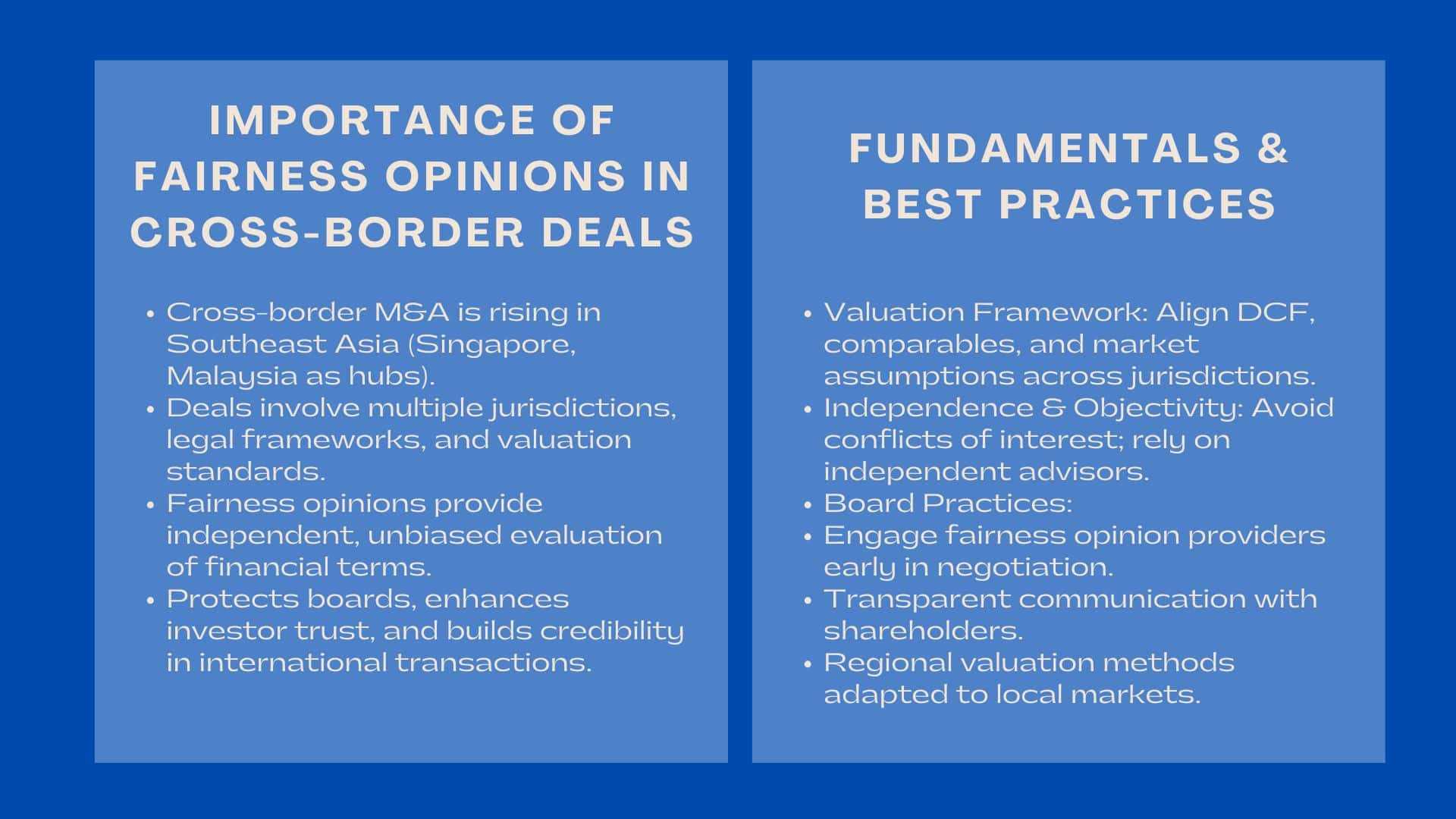

The concept of cross-border mergers and acquisitions (M&A) is increasingly becoming the norm with business ventures seeking to expand their operations in new markets. Singapore and Malaysia are hot spots of cross border transactions to the companies in Southeast Asia because they are the gateways to global capital flows. The opportunities of such deals are great, but they also introduce an increased level of complexity, including the need to deal with various regulatory frameworks and cope with the discrepancies in valuation standards and expectations of shareholders.

Opinions of fairness are of great importance in these high-stakes settings. Through offering unbiased evaluations of the financial conditions of a deal, fairness opinions defend boards of directors, as well as, discouraging shareholders, and creating credibility in deal-making. With the increase in deal sizes and the attention to the issue of stakeholders, companies are finding the need to develop systematic methods and guidelines to adopt in the context of commissioning fairness opinions to international dealings.

Why Cross-Border Deals Require Greater Scrutiny

Why Cross-Border Deals Require Greater Scrutiny

Several Jurisdictions, Multiple Risks.

The cross-border deals imply the use of multiple legal and financial systems, unlike the domestic transactions. As an example, an acquisition between a Singaporean firm and a Thai subsidiary might need adherence to the corporate governance codes in both markets. Board should make sure that the valuation assumptions should be defendable across jurisdictions. This is why companies are increasingly focusing on the best practices for fairness opinions in Southeast Asia cross-border deals to mitigate risks that arise from conflicting rules and expectations.

Shareholder Sensitivities and Governance Demands

Cross-border M&A has the propensity to instigate increased scrutiny of shareholders. When investing in unfamiliar markets, there is a higher likelihood that investors will raise concerns about the level of fairness of valuations. Fairness opinions in such instances serve as a source of trust. Companies are able to overcome the distrust of investors who are skeptical of the terms by demonstrating that the terms have been extremely vetted by independent advisors and enhances the credibility of the governance.

Fundamentals of Fairness Opinions in the cross-border transactions.

The Valuation Framework

Valuation is the basis of any opinion of fairness. In cross-border transactions, the advisors have to align the disparities in the accounting practice, taxation and phase of the capital market. A method of valuation that is effective in a jurisdiction may not be usable in a different jurisdiction. On the one hand, as an example, the discounted cash flow (DCF) analysis can be required to consider the difference in the inflation rates or the risk of currency, and the similar companies analysis should take into account the local market conditions.

Independence and Objectivity

One of the most critical components of fairness opinions in cross-border contexts is independence. Boards cannot rely solely on advisors who are already involved in structuring the deal. To avoid conflicts of interest, companies increasingly turn to independent fairness opinion for multinational M&A transactions. Such advisors provide objectivity, ensuring that their analysis is not influenced by the transaction’s success.

Best Practices for Boards and Companies

Interactive Firm Advisors.

The companies make one error, which is to seek a fairness opinion at the late phases of negotiations. The earlier involvement of advisors will enable a thorough analysis of the terms and assumptions of deals. This early engagement assists boards to foresee risks and bargain a better deal especially when they are exploring new regulatory landscapes.

Effective Shareholder Communication.

In intercountry operations, there must be transparency. Fairness opinions are not meant to be an element of compliance but of stakeholder engagement at boards. Sharing the way the opinion was reached, the assumptions and the reason behind it in shareholder circulars also build trust and minimize opposition in the approval process.

Expectations of Regulation in Southeast Asia.

Governance Standards in Singapore.

The financial markets in Singapore are focused on accountability and transparency. When related parties are involved in a transaction or when the interest of the shareholders might be influenced, it is expected that listed companies will offer fairness opinions. Both the Monetary Authority of Singapore (MAS) and the Singapore Exchange (SGX) are more strategic in their approach to disclosure practices that secure investors across borders.

Malaysia and the Regional practices.

The corporate governance in Malaysia is also emphasizing on the fairness in the transaction of M&A. The Malaysian boards are advised to incorporate fairness opinions in undertaking transactions that are substantially affecting shareholder value. The convergence in governance standards within the region implies that firms operating in the Southeast Asian region are bound to have a work experience that is becoming similar in terms of expectations hence the value of independent advice.

Difficulties in Providing Fidelity Decisions Crossing Borders.

Differences in Cultures and Markets.

Cultural judgement of value may vary widely in Southeast Asia. As an example, family-owned enterprises in Malaysia or Indonesia can be more focused on legacy and long-term stewardship whereas Singapore investors might be oriented to instant financial benefits. It is the responsibility of fairness opinion providers to strike a balance between the two views and come up with decisions that will cut across the stakeholders.

Data and Information Gaps

The other problem is that of access to credible data. Whereas the markets in Singapore are quite transparent, emerging economies in Southeast Asia can be characterised by limited disclosure at the companies. The gaps that emerge require opinion providers of fairness to fill these gaps through healthy due diligence and stress testing of the assumptions with market standards.

Strategic advantage of Fairness Opinions in International transactions.

Improving Negotiation Power.

Board Commissioning Fairness Opinion boards are bargaining power. With the value independent validation, directors will be able to counter the forceful pricing or other disadvantageous terms offered by their foreign counterparts. This consolidates their bargaining power and makes the company to get a good deal.

Building Long-Term Credibility

Fairness opinions are not only about individual deals; they contribute to a company’s long-term reputation. Companies that consistently adhere to best practices for fairness opinions in Southeast Asia cross-border deals position themselves as governance leaders. This credibility enhances investor relations and attracts capital from global markets.

The Role of Technology and Evolving Practices

High-tech Analytics in Valuation.

The future of fairness opinions will most probably deal more with the application of technology. Valuation can be better informed with the help of artificial intelligence and data analytics, especially in complicated cross-border transactions. These aids enable the advisor to plan scenarios more realistically, so that the fairness opinions should not be weakened.

Ongoing Audit of Governance Practice.

With the continued opening of Southeast Asia to global markets, demands of governance will be changing. Boardrooms should not be left behind in embracing global best practices as well as ensuring that the opinions on fairness are prepared to not only stand the standards but also the test of time. It will be necessary to train and align with global advisors on a regular basis.

Key Practical Implications on Companies.

In the case of boards in Singapore, Malaysia, and the wider Southeast Asia, the message is concise, that is, fairness opinions must be essential in transactions across borders. In order to be the most effective, the companies should:

- Use independent consultants at the initial stages.

- Make sure valuation methodologies are regional.

- Be transparent with shareholders by doing communication effectively.

- Apply fairness opinions as a compliance tool but not an intrinsic compliance tool.

Companies that incorporate such practices in their systems of management are able to negotiate through the intricacies of multinational deals without fear.

Conclusion: Best Practices for Fairness Opinions in Cross-Border Transactions

The cross-border M&A deals will remain constant in the corporate environment in Southeast Asia, although they come along with challenges that must be carefully monitored. The fairness opinions are the independent opinion that is required to safeguard the shareholders, improve the governance, and increase the credibility of the deal. Companies may transform fairness opinions into a potent mechanism of managing international deals by emphasizing independence, transparency, and rigor of valuation. By so doing, they not only satisfy the regulatory demands but also develop a long-term reputation in the eyes of investors and other stakeholders.