Best PPA Valuation Services for Post-Mergers and Acquisitions Integration

Mergers and acquisitions (M&A) are the most complicated and transformational processes in the corporate environment. Among the negotiations, legal agreements and financial due diligence, Purchase Price Allocation (PPA) is one of the most important steps that should be performed after the deal. Singapore has one of the largest regional and cross-border M&A centers, and the trend is that businesses are turning to the best PPA valuation services in Singapore to guarantee post-M&A integration complies, is transparent, and is strategic.

When done correctly, PPA will not only meet the accounting and regulatory requirements but also give the user a clear picture on the effect of the acquisition on the financial position and future financial performance of the resulting organization.

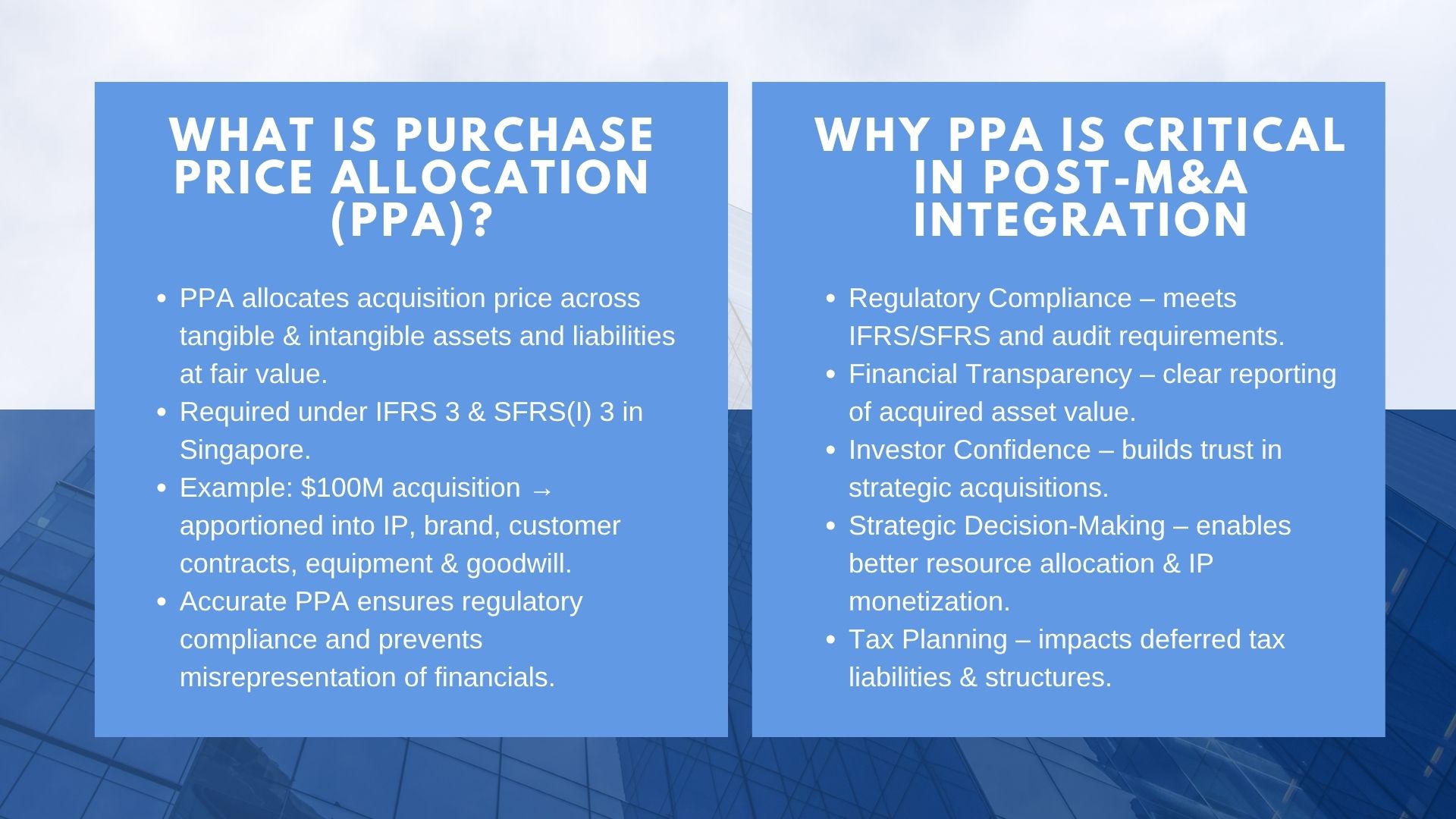

What is Purchase Price Allocation (PPA)?

What is Purchase Price Allocation (PPA)?

Purchase Price Allocation is a process which allocates the purchase price that was paid during an acquisition to the tangible and intangible assets and liabilities of the company that was acquired based on their fair value. Under the financial reporting standards like the IFRS 3 and SFRS(I) 3 in Singapore, this step is required.

To illustrate, when a corporation buys a technology start-up in the value of 100 million dollars, the acquisition price would have to be apportioned amongst properties in terms of intellectual property, brand value, customer contracts, equipment and goodwill. The allocation as a result has a direct impact on the balance sheet, income statement and the future earnings reports.

Lack of accurate PPA exposes such businesses to the risk of misrepresenting financial performance, instigating regulatory matters or having arguments with the auditors and stakeholders.

Why PPA Valuation is Critical in Post-M&A Integration

PPA is not simply a compliance practice. It is critical in determining how the investors, regulators and the internal management view the acquisition.

- Regulatory Compliance: In Singapore, the companies are bound by the international accounting standards as well as local accounting standards. PPA makes sure that it complies with audits and regulatory filings.

- Financial Transparency: True allocation will provide the actual value of the purchased intangible assets to the stakeholders and give them a clear image of the value creation after the acquisition.

- Investor Confidence: The transparent reporting creates confidence among investors, especially when it is related to a publicly traded company or future fundraising.

- Strategic Decision-Making: Recognizing fair value of the purchased assets, businesses are able to focus on allocation of resources, enhance IP monetization or simplify work.

- Tax Planning: The results of PPA may affect the deferred tax liabilities and other tax-related issues.

Concisely, PPA is the linking section between deal-making and integration, turning the acquisition figures into a course of action.

The Role of Professional PPA Valuation Advisors

Engaging the right professionals is crucial, as PPA requires a combination of accounting, valuation, and industry expertise. Professional IP valuation services in Singapore often overlap with PPA specialists, since intangible assets—such as patents, trademarks, and customer relationships—make up a large portion of acquisition value.

Trusted advisors bring:

- Technical Knowledge: Intensive knowledge of IFRS/SFRS standards.

- Understanding of the industry: Sector-specific approach to technological, medical, manufacturing, and financial industries.

- Credibility: Reports that are not subjected to auditor and regulatory examination.

- Strategic Insight: Finding non-numerical synergies and value drivers.

PPA valuation Methodologies.

PPA is generally not subjected to a single method when performing consultant asset valuations:

- Relief-from-Royalty Method: Applicable to trademarks and brands, and is based on the royalty rate that the acquirer would pay in case it was required to license the asset.

- Multi-Period Excess Earnings Method (MPEEM): The multi-period excess earnings method is widely used in customer relationships and is used to measure the incremental earnings of particular assets.

- Replacement Cost Method: It is used to estimate the cost of replicated or substituting the asset used in technology or software.

- Market Comparables: Benchmarking like transactions or licensing agreements.

These are based on the nature of assets and industry dynamics that determine the choice of methodology. A professional consultant will guarantee equitable implementation and justifiable results.

Singapore as a Strategic Hub for PPA

Singapore is a good choice to carry out M&A in southeast Asia because it is known around the globe as a financial center. Its open business regulatory framework, strong legal framework and proactive investor segments require accurate and justifiable PPA appraisals.

Singapore consultants are usually hired by companies to conduct cross-border acquisitions because they are well versed with international standards and they can provide audit ready reports. For corporates seeking long-term growth, engaging the best PPA valuation services in Singapore for post-M&A integration ensures smooth transitions and investor confidence.

Practical Scenarios Requiring PPA

- Cross-Border Acquisitions: In case Singapore companies are to purchase those in other countries correct allocation is one of the ways to ensure that the different standards of regulations and accounting are harmonised.

- PE Exits: PE firms utilize PPA to show that they have created values when portfolio companies exit.

- Public Company M&A: Listed companies are under strict reporting requirements and there is a need to have defensible PPA.

- Family Business Acquisitions: Compliance and succession planning should be correctly allocated even in smaller acquisitions.

PPA Valuation Cost and Time.

The price of a PPA engagement varies depending on the complexity of the deals, the mix of assets, and industry. A simple acquisition where intangible assets are few can be completed in two or three weeks but when purchasing a company of a different country, it can be several months. Customers can also accelerate the task by gathering:

- Purchasing and acquiring agreements.

- Accounts of the business that has been acquired.

- IP, contracts and customer data lists

- Future revenue and synergy projections.

Properly documented documentation ensures that consultants take shorter time and are more accurate to perform valuations.

PPA Providers Comparison in Singapore.

Singapore has a very large variety of service providers, including international audit companies and individual valuation firms. Big companies tend to have larger resources and international presence whereas smaller companies can be flexible, industry specific, and low cost.

The most appropriate decision can be made based on the complexity of the deal, industry details and the degree of independence that is needed. Indicatively, certain corporates would want to hire independent valuation experts who are independent of their auditors in order to circumvent a conflict of interest.

How to Choose the Right PPA Advisor

- Experience : Has the consultant completed comparable sized deals within your industry?

- Knowledge in Compliance: Do they understand IFRS and SFRS, as well as taxes implications, well?

- Reputation: Are auditors and investors confident about their reports?

- Openness: Are they clear in their assumptions and methods?

- International Presence: Are they able to facilitate international dealings whenever necessary?

Frequently Asked Questions

- Is PPA an obligation in each acquisition?

Yes, the companies are under the requirement of PPA to be done under IFRS and SFRS standards in case of material purchases.

- What will be the effect in case PPA is not conducted on a proper basis?

It may result in the audit rejection, restatements, or lack of investor confidence.

- What is the duration of goodwill upon PPA?

Goodwill is placed on the balance sheet permanently, but it should be impaired on an annual basis.

- Is PPA valuation beneficial to SMEs?

Yes. SMEs in Singapore are also in need of PPA in the acquisition of businesses and assets though mostly viewed as big companies.

Conclusion: Best PPA Valuation Services for Post-Mergers and Acquisitions Integration

The period of post-M&A integration is one of the most important stages of a deal. Purchase Price Allocation PPA is a means of enforcing compliance, transparency, and strategy in reporting the financial effects of an acquisition. To the companies in Singapore, using the PPA valuation service in Singapore which does the best post-M&A integration does not necessarily involve checking of regulatory boxes but rather, creating investor confidence and realising the full potential of the deal.

In the case of the complex intangible assets that tend to be the majority of the acquisition value, using the professional IP valuation services in Singapore gives the businesses a defensible, transparent, and actionable information that preconditions long-term success.