Deal Structuring and Valuation Methodologies: Bridging Strategy and Financial Precision

Understanding how modern valuation practices shape the art of dealmaking in mergers and acquisitions

Introduction to Advanced Deal Structuring and Valuation Techniques

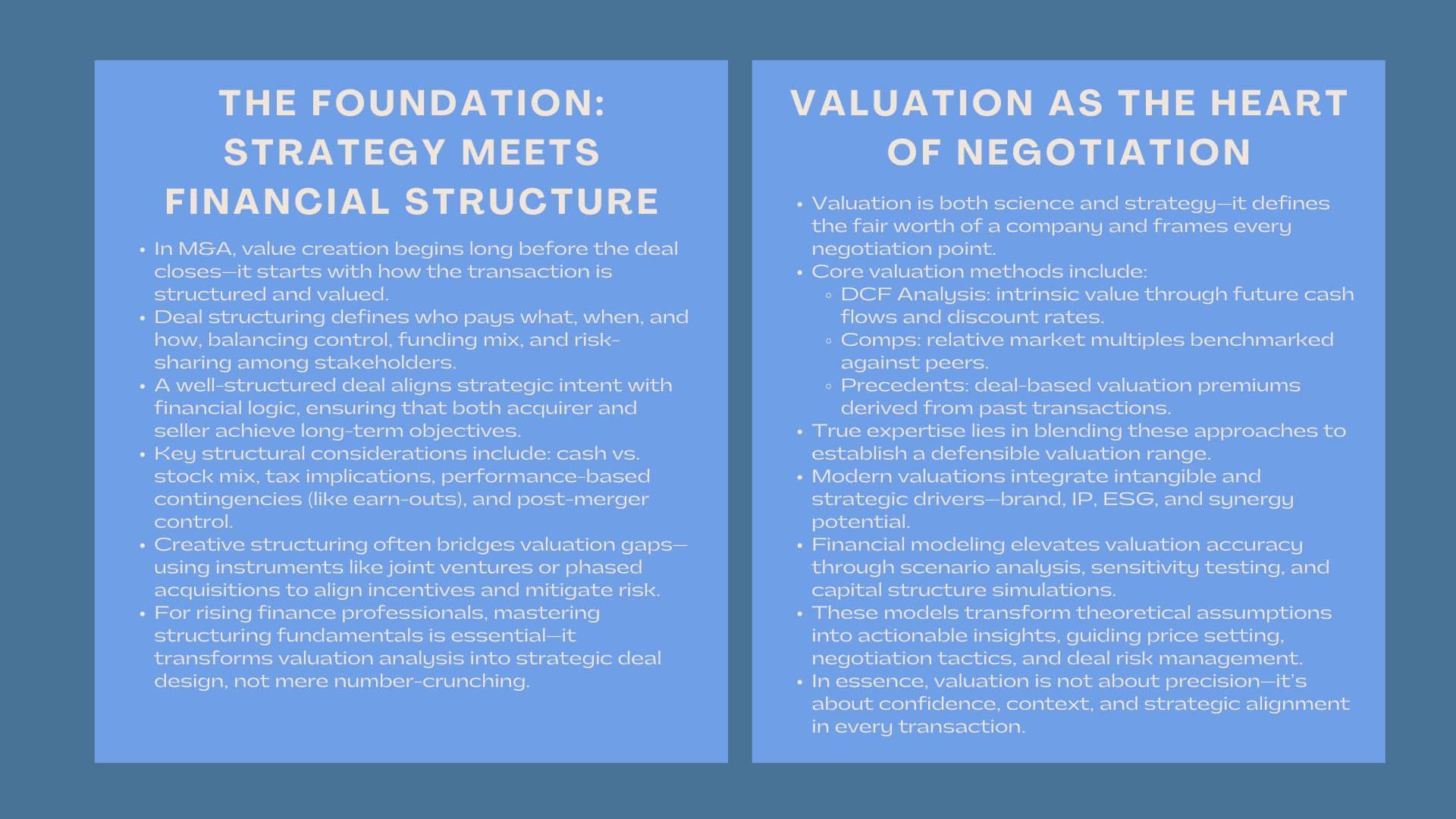

Numbers alone do not paint the entire picture in the meritocracy of mergers and acquisitions (M&A). There is more than meets the eye to the acquisition or merger that has hit the headlines because of the process of negotiation, structuring, and valuation which is a process that predetermines whether a deal will create or destroy values. In entering finance, investment banking or corporate strategy as a junior and mid level professional, it is necessary to master the principles of deal structuring and valuation procedures.

Fundamentally, deal structuring is concerned with the manner in which a deal is structured, who pays what, when and in what terms. Valuation however, is a measure of the worth of a target company and that is the value of the company both in terms of tangible and intangible value. The two are the pillars of any successful M&A transaction.

In recent years, as markets have become more complex, global, and data-driven, companies and investors are relying on advanced deal structuring and valuation methodologies in M&A transactions to balance opportunity with risk. The interplay between financial modeling, strategic foresight, and negotiation dynamics now defines how deals are conceived, priced, and executed.

This artilce will present the history of deal structuring and valuation and its use in recent M&A and how it touches upon financial modeling, corporate strategy, and value creation and spend time in the context of early- and mid-career practitioners who may wish to focus on gaining deeper expertise.

I. Understanding the Foundations: What Is Deal Structuring?

I. Understanding the Foundations: What Is Deal Structuring?

The architectural plan of an M&A deal is called deal structuring. It dictates the way that the parties that are involved such as buyers, sellers and financiers stand on the same ground to make the deal successful. A deal that is properly set up does not only focus on financial efficiency, risk management, and long-term strategic alignment.

Simply, deal structuring provides answers to the following questions:

- Is the acquisition going to be funded by cash, stock, debt, or a combination?

- Which are the compensation schedules and contingency of performance?

- What will be the ownership, control and integration of ownership post-merger?

The building has to take into account the tax implications, regulating requirements, and governance as well. As an example, all cash acquisition may be simple, and certain, but it requires liquidity. A share-based transaction, on the other hand, will permit the seller to share in the future success of the merged company, but will create a valuation complication relying on changes in share price.

As a professional, there is financial literacy and strategic sensitivity that one needs in understanding a deal structuring. Investment banking or corporate development associates and analysts need to determine the impact of structure on value realization, not just when closing a deal but throughout the deal lifecycle.

Creative structuring has the potential to fill the valuation differences between the expectations of the buyer and seller in numerous transactions. To illustrate, contingent payments e.g. earn-outs are a form of payment based on future performance milestones, aligning incentives and reducing the valuation risk at the time of purchase. Equally, joint ventures or partial acquisitions enable the gradual ownership transfer, which reduces integration risks.

Deal structuring is not only about financing mechanisms, though, but about making a deal that makes a financial structure which makes strategic sense.

II. The Role of Valuation: From Estimation to Negotiation

The basis of any M&A operation is valuation. It measures the value of a business in terms of its assets, earning potential and strategic fit. However, in practice, valuation is an art and science – models, assumptions and psychology of the market.

At technical level, valuation methodologies assist in establishing the fair value, and they also direct price negotiations. Nevertheless, one should be aware of the difference between value (an analytical assessment of worth) and price (the number that has been reached in the deal). These two tend to move apart due to the risk situations between parties and the synergies and negotiation leverage of the parties.

1. The Core Valuation Approaches

Professionals typically rely on three main valuation approaches in M&A:

- Discounted Cash Flow (DCF) Analysis – Future cash flows are discounted to present value and the cost of capital is used. This approach is an intrinsic value approach that is susceptible to growth rate, margin, and discount factor assumptions.

- Comparable Company Analysis (Comps) — Targets Benchmarks the valuation multiples of comparably traded publicly-traded companies (such as EV/EBITDA or P/E ratios) to estimate the target’s market value. This method is indicative of the present sentiment of investors but may be simplistic in the differences in scales, risk, or quality of management.

- Precedent Transactions Analysis — Analyses past M&A transactions in the same industry and determines implied valuation premiums. It offers a valuable market guide but might fail to measure up the prevailing economic conditions and special deal synergies.

A mixture of these approaches is usually employed by many practitioners and the results are cross-checked to come with an applied range of defensible valuation. It is not mathematical accuracy but informed judgment and an idea of the influence of various assumptions on perceived value.

2. Strategic Adjustments in Modern Valuations

Although they are essential, conventional models are unable to reflect more intangible aspects of drivers like brand equity, intellectual property or ESG performance. Due to the changing nature of the business, valuation techniques are becoming increasingly varied to accommodate scenario-based and option-style approaches that are more indicative of uncertainty and strategic optionality.

In this evolving landscape, how financial modeling enhances modern deal structuring strategies has become increasingly significant.. Different complex simulations of the outcomes of deals are now being conducted with the consideration of various factors that include the synergy realization, the market volatility and integration costs. To a data analyst, the skill and ability to create active and data-oriented models has become a basic skill – one that combines technical precision with tactical insight.

III. Integrating Financial Modeling into Deal Structuring

The core of all M&A decisions is financial modeling. It offers the quantitative basis of valuation and structure, which is a translation of strategy into figures that can be experimented and compared.

Properly applied, modeling can help dealmakers look at various structuring choices and the influence they produce on value, risk, and return. It presents a link in bridging the gap between theory and practice of valuation.

1. Scenario Analysis and Sensitivity Testing

The new models of M&A are not just mere predictions. The analysts practice scenario analysis to execute various deal scenarios – optimistic, base and downside scenarios to understand resilience under varying market conditions. Sensitivity testing also aids in establishing which variables (e.g. revenue growth, synergy capture, financing costs) have the greatest influence on the value of a deal.

This is a data-driven methodology that can be used to inform bargaining, as both parties are able to know where to compromise and how an organization can assist in reducing its lack of knowledge. As an example, when the valuation of a deal is very sensitive to the growth of post-acquisition revenues, the parties could negotiate the performance-based earn-outs to synchronize interests.

2. Financing and Capital Structure Simulation

Financial modeling is also important in determining the effects that various financing mixes have on value. A leveraged buyout (LBO) model, such as, tests the effects of debts, interests paid, and exit multiples to equity returns. The balance of maximizing the return and risk management can be identified by simulating different capital structures, which is available to the analysts.

This is the reason why the deal structuring and valuation techniques in M&A transactions are growing more data-driven. Those people, who are able to convey strategic deal terms into dynamic models, offer indispensable information to senior decision-makers, and will build their own credibility in high-stakes situations much easier.

3. Integration Planning and Post-Deal Value Tracking

The process of modeling does not stop with the closing of the deal. The post-merger integration models observe the measures of performance and synergies, which make sure that the value projected comes to be real. The ongoing observation helps in strengthening accountability and facilitates future recalibration of valuation.

To career-oriented practitioners, the ability to excel at modeling in Excel, valuation models, and financial storytelling is much more than a technical skillset, it is a key to strategic impact.

IV. Best Practices in Deal Structuring and Valuation

Although all transactions are peculiar, there are some values that have always been applied in the structuring of deals and valuation. The best dealmakers are analytical but with the commercial intuition in mind, they never lose sight of the numbers and the story.

1. Align Structure with Strategic Intent

Ideally, the most effective structures are those that will support the strategic rationale of the deal and not vice versa. As an illustration, an acquirer aiming to have long-term integration would opt to acquire the entity fully, whereas one trying the new market can opt to purchase the company in minority. At all times professionals are expected to consider the extent to which structure will assist the acquirer in achieving its strategic goals, taking risks, and cultural fit.

2. Balance Risk and Reward Transparently

Deals fail frequently due to parties making wrong judgement or risk allocation. The uncertainty can be fairly shared by the use of earn-outs, escrow accounts, or performance guarantees. Openness on assumptions and contingencies can maintain trust in the process of negotiation and after the deal is made.

3. Incorporate Non-Financial Drivers

The current valuations are also more inclusive of sustainability, digital preparedness and brand strength. Firms that experience good ESG performance usually fetch more valuation multiples, whereas firms that perform poorly in the same aspect suffer discounting because of regulatory or reputational risks. These qualitative aspects should be incorporated in valuation discourses to make the analysis more vivid and realistic.

4. Use Multiple Valuation Lenses

Using one approach may result into biased or incomplete outcomes. A more holistic view is offered by triangulating DCF, Comps and Precedents (with an eye to the qualitative synergies). It also enhances positioning during negotiation through justification of assumptions on cross framework bases.

5. Document and Communicate Clearly

Lastly, valuation is a communication issue, and not a numerical matter only. Transparency in the assumptions, methodology and presentation creates confidence among the stakeholders. Investment committees, clients or regulatory bodies require professionals to make sure their models contain a story of value creation and risk mitigation.

In practice, best practices for integrating valuation techniques in corporate deal structuring mean ensuring that financial logic, strategic rationale, and execution plans are tightly aligned. This integration minimizes post-deal surprises and maximizes the likelihood of sustained value creation.

V. The Future of Deal Structuring and Valuation Methodologies

The landscape of M&A is changing at a high rate. The changing expectations of investors, regulation and technology are redefining the way deals are appraised and practiced. The approach and attitude need to change as markets are increasingly becoming more data-driven.

1. Data and AI in Valuation

Big data analytics and artificial intelligence are already coming into play and determining valuation accuracy. Machine learning models are now able to process large datasets of customer behavior, supply chain metrics, ESG scores, to optimize the process of projections and performance comparison. These tools assist in the discovery of the hidden value drivers or risks that could be overlooked by traditional models.

2. ESG and Sustainability-Linked Deals

The concept of sustainability is no longer peripheral. Investors/lenders are progressively attaching conditions of deals to environmental and social performance indicators. Green bonds or sustainability-linked loans, such as, are linked to a financing cost which is associated with ESG results. This trend justifies the need to incorporate sustainability in both structure and valuation.

3. Regional and Cross-Border Complexity

With the diversification of global supply chains and the increased level of geopolitical risks, cross-border M&A will require higher levels of sophistication in valuation. All of them influence the outcomes of deals: currency exposure, regulatory diversification, and cultural integration. Regional analysts and advisors need to understand how various locations value risk and how to take advantage of this knowledge.

4. Skills for the Next Generation

To future professionals, the number of skills that are needed is growing. In addition to financial modeling, employers are seeking hybrid skills like analytical skills, strategic skills and cross functional teamwork. The ability to process data, report on sophisticated appraisals, and assist with deal strategy is what renders one invaluable within any M&A setting.

Concisely, deal structuring and valuation is no longer a stagnant financial activity, but a developing field, which requires flexibility, innovation, and a broad sense of value.

Conclusion

The basis of all successful M&A deals is deal structuring and valuation techniques. Although the quantitative framework of the deal is based on financial models and valuation multiples, having strategic insight and negotiation skills can make the difference between a deal that brings value to the table and one that is merely a sham.

The emergence of enhanced deal structuring and valuation techniques in the context of M&A transactions is an indication of the complexity and interdependence of the current markets. Financial modeling is now at the centre stage in determining the deal structure and risk-sharing arrangements as it shows how financial modeling is useful in improving the modern deal structuring plans in the transaction lifecycle and how it helps in decision-making.

Finally, alignment between financial rationale and strategic goals is the most relevant best practice of valuation techniques integration in corporate deals structuring. With the changing nature of technology, ESG requirements, and market forces, practitioners with an analytical accuracy and business acumen will shine through.

To junior/mid-level professionals, it is not just about being able to do better valuations: it is about becoming a reliable ally in forming the future of corporate growth, investment, and strategic transformation.