Understanding Control Premiums and Minority Discounts in Valuation

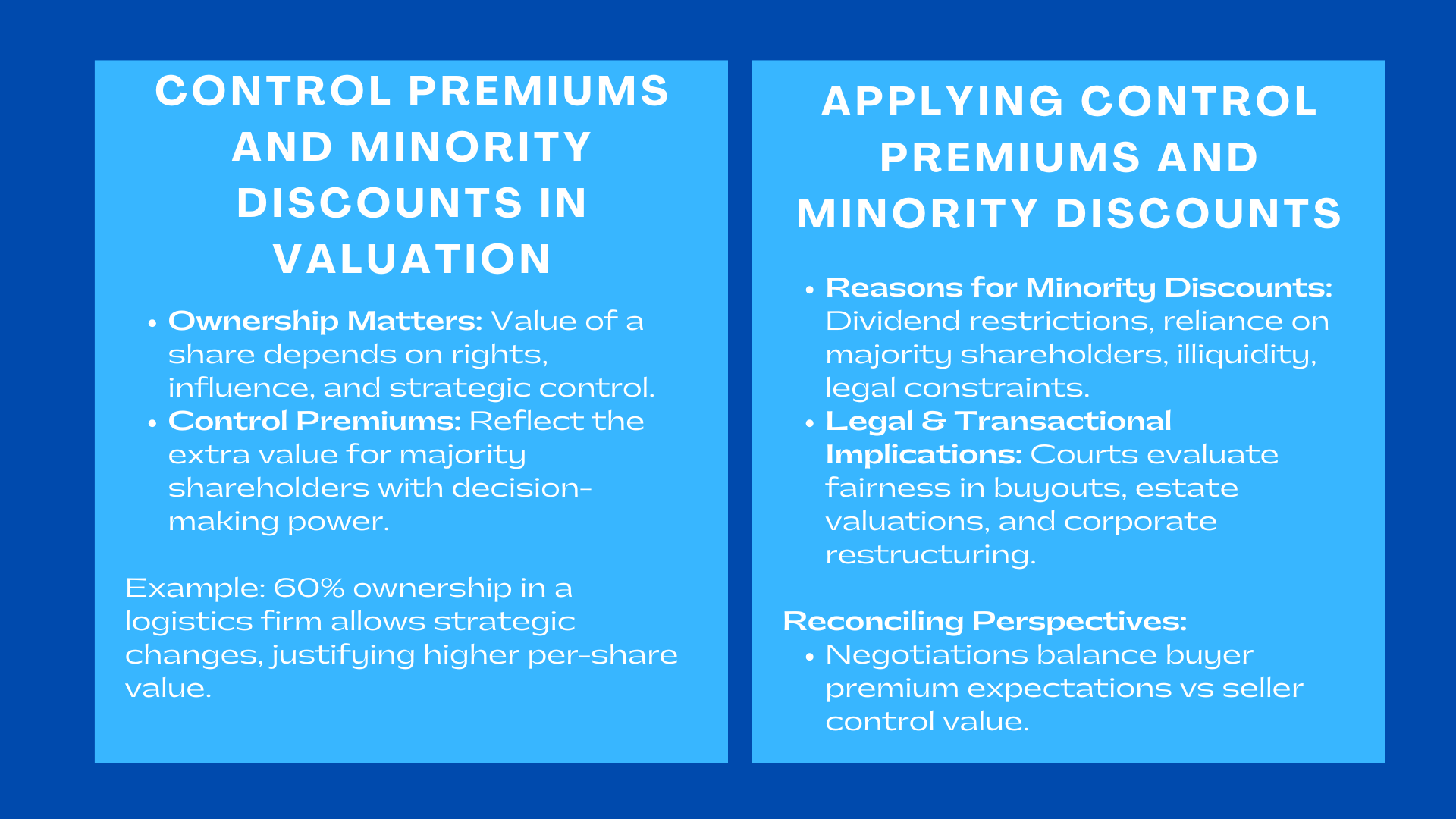

One of the most crucial but most misconceived fields in equity valuation, particularly in the context of the transactions involving partial ownership, is the difference between the control value and minority value. Although the headline valuation of a company may focus on the most attention, the actual economic value of a particular shareholding is determined by the rights, influence, and other benefits accrued on a stake. Buyers, investors, and shareholders should thus know the impacts of position of ownership on value, especially when negotiating investment, settling of a shareholder dispute, incurring a corporate deal or fulfilling financial reporting necessities, a concept often explored in comprehensive financial modeling programs Singapore.

There is the framework of control premiums and minorities discounts where the overall value of an enterprise is connected to the value of a single block of ownership. These changes will guarantee that the valuation will be based on the economic reality and not just a dividing of the equity of the company into relative parts. These adjustments and their resulting mechanics, applications and negotiation implications are discussed in the following section, demonstrating why they are required in order to arrive at fair and commercially viable results.

1. The Value of Equity Sensitivity to Ownership Position.

1. The Value of Equity Sensitivity to Ownership Position.

1.1 Control Representation in Valuation.

Control is described as the power to influence the strategic choices, management policies and financial performance of a company. A majority shareholder is able to endorse budgets, alter command, re-organize the operations, divestiture of assets, or declare dividends. Since they are the rights which directly affect the economic orientation of the company, they are more valuable than the rights of a passive minority investor. This is why many valuation practitioners incorporate a control premium calculation Singapore framework when estimating the value of majority ownership.

As an illustration, in a mid-sized logistics firm, a 60 percent ownership gives the buyer absolute decision-making power and allows him to incorporate the business with his current network, alter pricing configuration, and institute cost economies of scale. The fact that such strategic advantages can be unlocked supports a higher payment on the basis of a per-share basis as compared to what a minority shareholder would make in the purchase of a non-controlling block.

1.2 The cost of minority stakes is lower per share

Minority shareholders lack the power to control significant decisions, approve corporate activities and prevent transactions capable of impacting their economic interests. They have rights which are secured under the corporate law, but not in practice. Consequently, minority shares are generally discounted since the shareholder can do nothing in respect of dividends, acquisition, financing policies and strategic course.

Take a case where a technology firm needs more funds. The majority investor opts to raise capital by issuing of shares which dilutes all the current investors. Even an eventual dilution of minority shareholders cannot be avoided by the minority shareholders. One of the reasons why minority interests receive low prices in the market place is lack of influence in making such decisions.

2. Calculating the Size of Control Premiums.

2.1 Evidence and Benchmarks in the Market and Transactions.

Estimating the control premiums is one of the common methods that are undertaken by analysing the past mergers and acquisitions where the buyer attained controlling stakes. These deals usually deal with overpayment above market trade price of shares in order to have a strategic control. The premium is based on the perception of the buyer on the possibilities of synergies, superior governance or operational efficiency.

To illustrate, in the case of acquiring a local healthcare services company, the acquiring company can pay 25 percent premium over the market value of the acquired company due to the ability to standardise prices, merge supply chains, and exploit the brand name in the various clinics. This practical experience is a significant foundation of setting reasonable control premiums in the future dealings.

2.2 Company-Specific Factor Adjustments.

Control premiums do not exist in a homogenous way. They rely on the governance structure of the firm, shareholder contracts, its management quality, and its strategic value unlocking potential. When a company already enjoys good governance and operations, then the control addition value may be less. On the other hand, firms that have weak management controls or high levels of inefficiencies tend to have greater potential upside hence premiums are big.

Analysts in the valuation practice determine the presence of control in the enhancement of valuation, including cost-cutting, new orientations, and reorganisation. The magnitude of these potential improvements tells the level of the control premium.

3. Minority Discounts and the Practice of It.

3.1 The reasons behind minority discounts are based on economic rationales of self-interest and self-preservation

The value of a share that is not a control share is indicated in a minority discount. It uses a controlling valuation to determine a reasonable price which the minority investors would pay in a transaction. A minority interest valuation guide typically incorporates factors such as dividend restrictions, inability to appoint directors, and reliance on majority shareholders for liquidity events.

An example is the case of minority stakes that are not very marketable in privately held companies. Minority investors lack the right to effect a sale of shares and therefore might have to wait until the next liquidity event like trade sale or IPO. The risk of uncertainty and timing adds to an increased discount.

3.2 Minority Discounts on Shareholder Litigations and Laws.

Shareholder buy outs, estate valuation and corporate restructure are some of the areas where minority discounts are common in legal cases. Courts usually ask themselves whether the application of such discounts is fair particularly in compulsory acquisition cases. Other jurisdictions impose limitations on discounts in the case where the majority shareholders may use it to unfairly squeeze out the minority shareholders. This has forced valuation professionals to strike a balance between the law and economic reasoning that discounts are to capture the commercial reality, and the fairness is not compromised.

A typical one is when a family owned business, one of the sibling desires to get out and the rest of the siblings buy their share. In the case where the departing shareholder has a minority stake in the company, it may be reasonable to discount, although not in cases where the other shareholders are using the valuation mechanism to their benefit. This underscores the need to have clear and justifiable valuation disciplines.

4. Reconciling Control and Minority Perspectives in Real Transactions.

4.1 Negotiating between buyer and seller expectations

Involves negotiations that take place between buyer and seller regarding their expectations, such as punctuality, payments, delivery location, and similar aspects.

Minority discounts and control premiums usually present strains between parties when negotiating. Buyers will generally not welcome paying high premiums, and the sellers believe that control can allow considerable strategic value. The key to effective negotiations is to clearly state the valuation assumptions, compare it to other similar transactions, and be realistic about operational improvement.

To illustrate, a private equity company aiming to have majority stake in a professional service company may only be interested in premium because of its intended digital transformation efforts. Nevertheless, the buyer can also decrease the premium in case the current team of the target is unwilling to change. The result of the negotiation process is based on the plausibility of improvements that are expected.

4.2 Effective Implementation into Valuation Models.

The valuation practitioners tend to begin with finding out the total company value of the company on a controlling or minority basis. Then they also change individual share values. This will make sure that the valuation is not a measure of just the economic value of the business but also the economic value of the particular stake that is being purchased or sold.

Such modification is vital in venture investments, restructuring of corporations and estate planning as they give more accurate and commercially useful outcomes than mere pro-rata calculations.

Conclusion to Understanding Control Premiums and Minority Discounts in Valuation

Control premiums and minority discounts are paramount instruments that can be used to make valuation results consistent with economic reality. They have equity stakes that are valued based on their real rights, power and strategic value. The more companies are involved in shareholder transactions, buyouts, corporate restructuring, and fundraising, the more the adjustments have to be understood in order to come up with transparent, defensible, as well as commercially viable valuation. In the future, the availability of more information on transaction data and improvement in the standard of governance will further improve the precision and applicability of valuation adjustments at the level of ownership in advanced markets.