How to Value Service-Based Companies with No Physical Assets

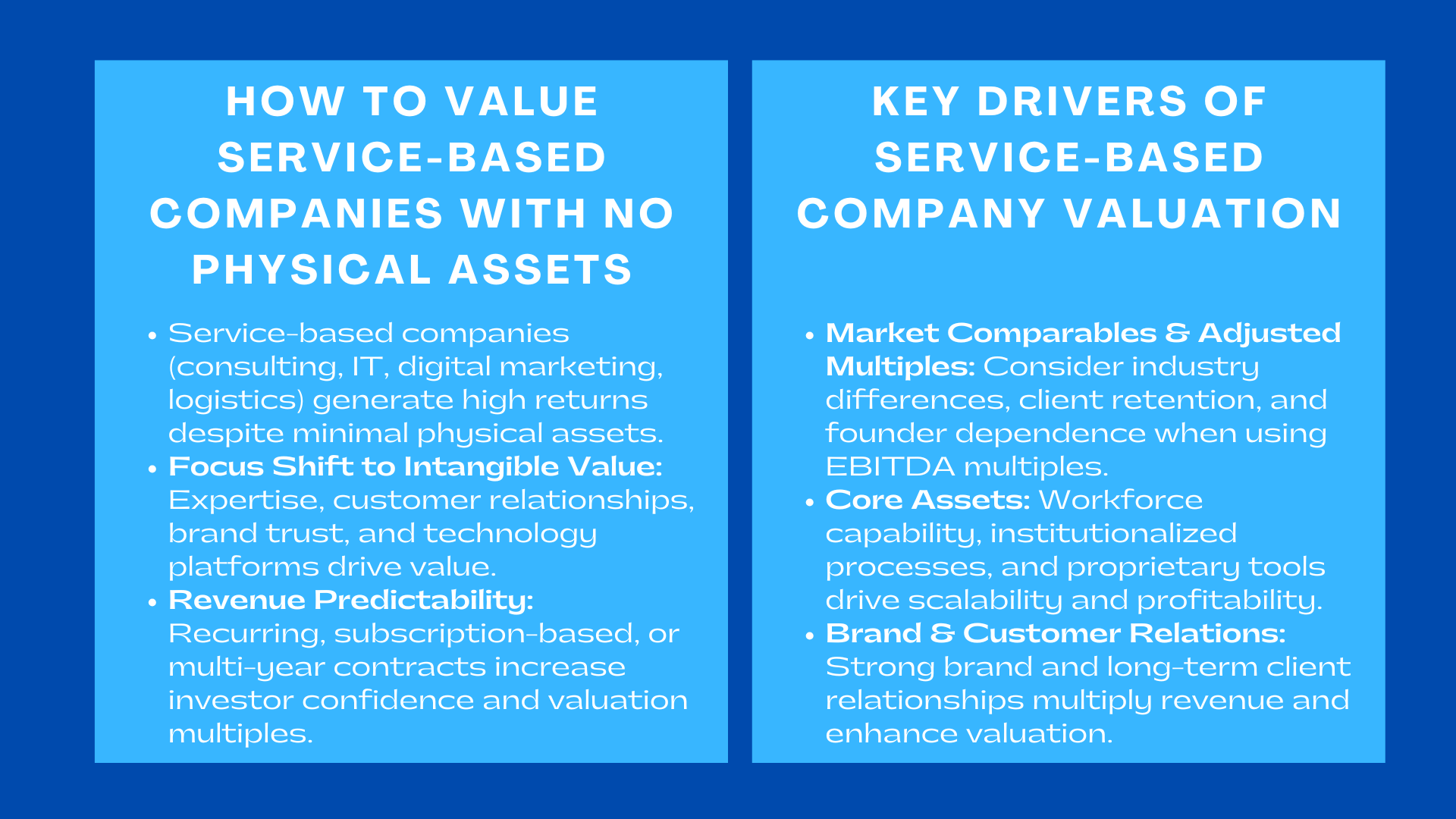

The newcomers in the service-based companies have swept over most of the industries such as consulting and IT services, digital marketing, coordination of logistics and professional practices. These enterprises have very little physical resource but they tend to make huge returns and command high value of the enterprise. The problem is that the conventional methods of estimating assets based valuation cannot reflect the entire economic reality of such organisations. In its place, analysts have to depend on frameworks that are created to quantify intangible performance, predictability or revenue, and scalability of operations, a topic often explored in certified fundraising training Singapore.

1. Learning the Foundation of Service Business Valuation.

1. Learning the Foundation of Service Business Valuation.

1.1 The Change in Focus to Intangible Economic Value.

The intangible aspects that make up modern service businesses include expertise, customer relationships, technology platform, and brand trust, which are the most valuable aspects. As opposed to asset-heavy firms, the value is not often reflected on the balance sheet. This is why a detailed service business valuation Singapore engagement places emphasis on analysing intangibles, operational efficiency, and the durability of revenue streams. The processes, tools and methodologies of a company are, in most instances, more likely to add to future earning than any physical equipment or facilities.

1.2 The Pivotal Position of Revenue Predictability.

Investors and acquirers are concerned with the visibility of revenue and not the amount of physical assets. To give better indications of stable business, there are long term retainer customers, subscription based customers and multi-year contracts. Higher valuation multiples are usually attained when a service company experiences predictable, recurring revenues, which are usually contracted. On the other hand, only companies with irregular and project-based income can afford to have extraordinary client retention or special expertise to demand such a level of investor confidence.

2. Cash Flow becomes the Leading Valuation Methodology.

2.1 Why DCF Is more reliable as compared to the Methods of Asset-Based.

Service firms have minimal physical resources and thus Discounted Cash flow (DCF) is the most believable valuation method. It quantifies present economic returns as opposed to investment in the past. For many intangible heavy company valuation engagements, DCF captures the company’s ability to generate stable, expanding cash flows from its systems, people, and brand equity. Forecast revenue growth, anticipated margin increase, and the extent to which operations can be scaled are evaluated by analysts to come up with a practical long-term perspective.

2.2 Growth in Revenue, High Margin and Operating Efficiency.

The ability to scale is very important in determining the valuation of the service company. As an illustration, an IT services company that automates routine operations using its own software can perhaps create more profits than a rival that relies on manual operations. Equally, a marketing agency that has good referral base and minimal churn will have more credible growth opportunities. Such operational features have a direct impact on cash flow estimates and consequently impact on the overall valuation of a company.

3. The Comparables in the Market and the necessity of Adjusted Multiples.

3.1 Service Industry Differences.

Market multiples are useful tools but they should be used cautiously. The service industries are highly diverse in terms of profitability, riskiness, and scalability. The EBITDA multiples of a fast-growing digital consultancy can be extremely higher when compared to those of a conventional recruitment agency. Analysts make comparisons of businesses that have similar business models, revenue structure, and dependency on key persons to ensure that they do not draw misleading conclusions. The unadjusted multiple is frequently exaggerating the worth of smaller companies where founders continue to be the core of the business.

3.2 Multiples Adjustments to Retain and Key-Person Risk Clients.

There are two aspects that have a significant impact on the quality of similar multiples, which include client retention and founder dependence. The multiples will be higher in a service firm having long-term contracts and diversified clients than in a firm that is dependent on a few large accounts. On the same note, when the company relies on the reputation or personal brand, consumers will use discounts to cover transition risk. Without making such adjustments, market multiples would indicate only an economic formality as opposed to the superficial comparisons.

4. The Core Assets are People, Processes and Brand.

4.1 The Workforce Capability as the Principal Value Co-contributor.

The value in service businesses comes mainly through the employees. The ability of the company to grow depends on their learning, training, output and capability to provide a steady output. Investors also analyse how deep the team is, how well the training systems are, and how well institutionalised knowledge is. An organisation in which knowledge is very distributed throughout the organisation is much more valued than that where very few senior people possess essential skills.

4.2 Processes and Proprietary Tools that are institutionalised.

Scalable service companies develop elaborate procedures that guarantee uniformity when delivering the service irrespective of who the employee doing the job is. These can be documented workflows, defined methodologies and internal solutions in technology. Indicatively, a consulting firm that has its own diagnostic tools has the capacity to serve more clients with less labour hours thus increasing capacity and profitability. The valuation is boosted by such systemisation as it makes less dependency on the workforce of an individual employee and increases efficiency.

5. The tactical power of Brand Image and Customer Relations.

5.1 Brand Trust as a Multiplier of revenue.

The brand reputation in service industries has a direct influence on the pricing power and acquisition of clients. The investors evaluate industry awareness, customer reviews, accolades and general market presence. A well-built brand reduces the marketing expenses and enables a high price, which in turn has a positive effect on valuation. As an example, a recognised accounting firm that has been in operation over several decades and is recognised usually attracts higher multiples as compared to a new firm with little track record.

5.2 Predictability of Long-Term Client Relationships as Value Drivers.

Repeat business, multi-year agreements, and high rates of retention are very effective signs of stable revenues. A firm that already has a rich portfolio of long time customers poses very minimal risk to investors. Such reliability assists in justification of high valuation since earnings of the future can be approximated with greater confidence. Conversely, companies with lower engagement should be able to deliver extremely well or have a niche to compensate the increased uncertainty.

Conclusion to How to Value Service-Based Companies with No Physical Assets

Service-based companies are difficult to value with the normal approach of seeking physical assets and evaluating them based on an economic output criterion. Recurring revenue, brand strength, workforce quality, the ability to scale up operations, and client retention are much more dominant in determining the results of valuation than any real investment. Those companies which develop strong processes, institutionalise knowledge and develop predictable revenue models are most likely to receive premium valuations in competitive markets