How COVID-19 Reshaped Business Valuation in Southeast Asia

Introduction to How COVID-19 Reshaped Business Valuation in Southeast Asia

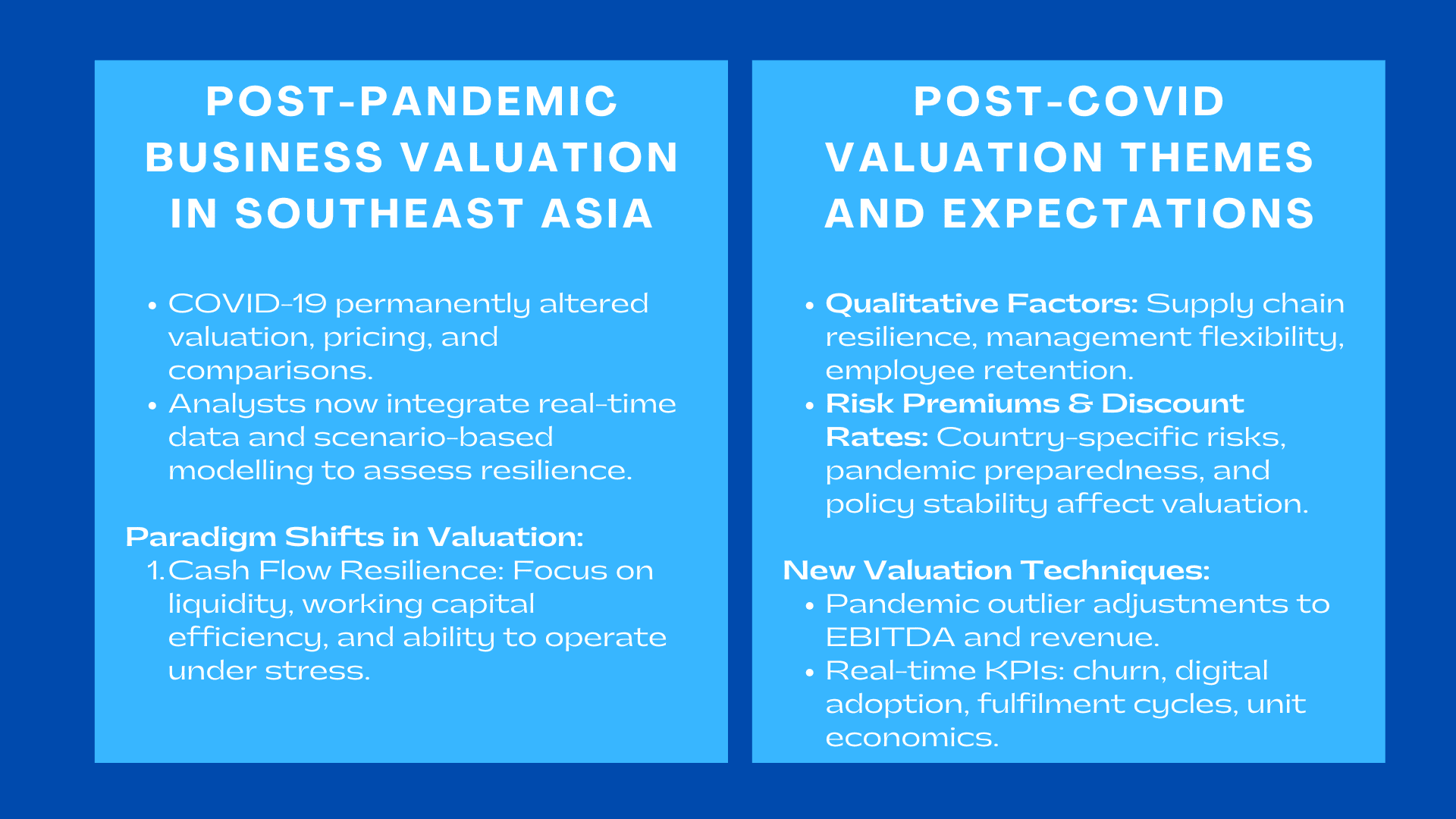

The COVID-19 has altered the business evaluation, pricing, and comparisons in Southeast Asia permanently. New frameworks are now used by buyers, investors and valuation professionals to reflect volatility, resilience in operations and potential recovery in the long-term. These changes have taken centre stage in post pandemic valuation Singapore where analysts integrate real-time data in the sector coupled with scenario-based modelling to reflect the capacity of an organisation to endure shock in the future, a focus often explored in an advanced international deal valuation course Singapore.

1. Paradigm Shifts that transformed the way valuation was done.

1. Paradigm Shifts that transformed the way valuation was done.

1.1 More Emphasis on Cash Flow Resilience.

Valuation models were usually concerned with growth projections and market growth prior to the pandemic. In Valuation in the post-pandemic era, analysts prioritise cash flow durability, evaluating a company’s ability to operate with lower revenue, reduced mobility, and sudden supply chain disruptions. Measures like liquidity buffers, ability to flex fixed cost, and working capital efficiency are more important than the headline growth is now.

1.2 Forecasting as a Standard Practice Scenario.

Investors are no longer content with the concept of having a single base case forecast. Several forecast paths such as slow recovery, rapid recovery and long stagnation are now built into valuation models. This change enables the analysts to measure risks in a systematic manner and compare the results of valuations during various economic and regulatory reactions.

1.3 Rapidized Digital Transformation and its Effect.

The level of digital adoption took off in Southeast Asia. Firms which monetised online or automated key processes performed better on resilience premiums. On the other hand, valuation discounts tend to be experienced by those businesses that have not digitised. Digital capability maturity, cybersecurity preparedness, and technology-driven scalability are now reviewed by the analysts as key inputs to core valuation.

2. Critical Valuation Themes that Arose during the Crisis.

2.1 Sector-Specific Volatility

The nature of demand and risk profile in different industries was redefined differently. For instance:

- Hospitality, aviation and retail were hard hit by declines in enterprise value.

- There was an uplift in the valuation of logistics, healthcare, and technology firms because of increased demand.

This divergence forms the basis of business recovery valuation insights, guiding investors on each sector’s long-term equilibrium and projected normalisation speed.

3.2 Greater Weight on Qualitative Factors

Resilience of supply chain, flexibility of management processes, employee retention plans, and ability to respond to crisis have come to be value drivers that can be quantified. Effective operational governance leads to an increased adjustment in discount rates, which is an indicator of less susceptibility.

3.3 Change in the risk premiums and discount rates

Discount rates have become country-specific risks, in particular those about future pandemic responses. Valuations of companies with headquarters or operations in Singapore are also better as the country enjoys low risk premiums because of the sound policies and fast containment.

3. New Valuation Techniques and Adjustments.

3.1 Pandemic Outliers Adjustments to normalisation.

Analysts have since isolated one-time surges or falls (e.g. 2020-2021 anomalies) and sustainable performance. The normalisation of EBITDA and revenue is done to indicate what the business can realistically attain in future. This saves mis-pricing of companies- particularly those who have only thrived on temporary pandemic conditions.

3.2 Actual Valuation Metrics Relying on KPIs in Real-Time.

Operational KPIs used by leading valuation methodologies include customer churn, digital adoption rates, time to fulfilment cycle and unit economics. Live data will give a better understanding on the effectiveness of how the business has come back on its feet and whether the growth trends are repeatable.

3.3 Hybrid Asset-Income Value Model.

Companies that have high intangible value (technology, proprietary processes, digital assets) are increasingly necessitating hybrid approaches that are based on combining income-based, market-based, and asset-based approaches. The strategy is able to capture value that is not clearly reflected in traditional financial statements.

4. What Investors now expect in the Post-COVID Market.

The fact that the company has been able to maintain its sustainability despite the recent bad news suggests the presence of evidence of sustainable recovery.

The buyers demand more sound information that proves recurrent revenues, diversified customer populations, and sustainable relationships with supply chain partners. The recovery metrics should be stabilized and not only rebounds.

4.1 Transparency Financial Reporting.

One-off losses, government grants, restructuring costs and pandemic related gains should be clearly documented. Companies in which adjustments are not clear or those whose reporting does not match are discounted by investors.

4.2 Preparedness in Long-Term Crises.

The investors appreciate business models that will endure disruptions in the future, such as an economic recession, new health epidemics, political instabilities, or even digital competition.

Conclusion

The pandemic has significantly redefined the value of businesses in the entire Southeast Asia. Organisations with a high cash flow stability, believable data on recovery and scalability through digital business enjoy greater valuation and increased investment. Such incorporation of post pandemic valuation Singapore, advanced standards of modelling and comprehensive business recovery valuation considerations are the essence of evolution of Valuation in the post-pandemic world where strategic resilience became the main factor of enterprise value.