Valuation of Patents and R&D Projects for Innovation Grants

Conclusion to Valuation of Patents and RD Projects for Innovation Grants

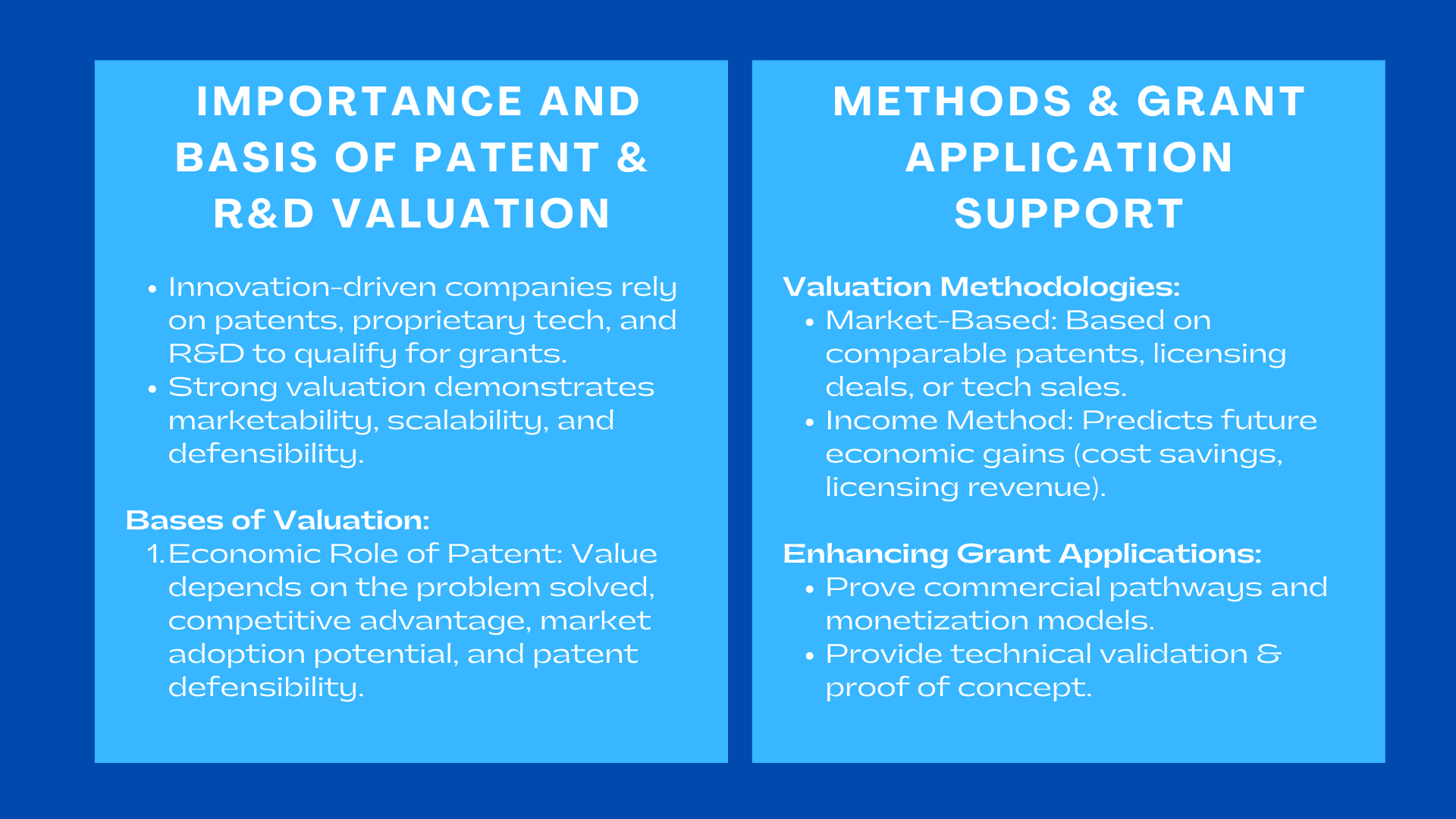

Companies that are based on innovation are increasingly depending on patents, proprietary technology, and research and development to qualify in terms of government grants, industry funding, corporate innovation programs, etc. With the rise in competition, organisations in need of a financial contribution would have to show that their technology is not only innovative, but it is also economically significant. This is where strict valuation comes in very important. Investors seek to see signs of market ability, scalability and defensibility before they invest. Consequently, this has led to the capacity to measure the value of intellectual property (IP) and research initiatives becoming one of the strategic capacities of technology companies in every industry, a topic often discussed in an advanced corporate finance masterclass Singapore.

In addition to financing, robust valuation practices assist companies in prioritising R&D portfolios, making decisions on what to commercialise and form a foundation on the decision to licence or spin-off. Be it the purpose of receiving an innovation grant, attracting private investment or commercialisation of a proprietary invention, plausible valuation enhances credibility and increases success in receiving approvals.

1. Bases of Patent and R&D Valuation.

1. Bases of Patent and R&D Valuation.

1.1 The first step is to define the Economic Role of the Patent.

The initial process of appreciating a patent in the case of grant applications is to know the economic contribution of the same. Patent value does not come out of the technology but the type of problems to which the technology is used and competitive advantages that technology provides. The assessors normally consider the novelty, defensibility, scalability and commercial relevance of the invention. This in real life equates to evaluating the possibility of market adoption, licensing, the duration of the lifecycle and the chances of having substitutes developed by the competition.

An example is a biotechnology firm seeking to be supported in innovation in the sector may prove that its patented diagnostic technique saves 70% of the time taken in the industry. The patent demonstrates value even prior to revenue is realized as it addresses an industry pain point that is proven or can have legal protection over a period of years. Such economic impact is articulated is the fabric of good valuation storytelling.

1.2 R&D Project Value Drivers Understanding.

An alternative analytical lens is needed in R&D projects as it is characterized by uncertainty, technical milestones, and changing market conditions. Evaluation in this case mostly draws on the anticipated economic returns in case the project is efficiently executed, discounting technical and commercial risks. The common value drivers are market size, decrease in the cost of production, customer experience improvement, process efficiency, or the establishment of new sources of revenue.

Technology grant assessors also analyze on a regular basis whether the R&D project tackles national priorities, the development schedule has credibility, and where it has a pilot testing pathway or commercial rollout. As an example, a start-up company that works on sustainable packaging may emphasize that its project is less carbon-emitting and that it will put the company in a better position to grab a share of a larger sustainability market in the world.

2. Valuation Methodologies adopted in respect of Innovation Grants.

2.1 The techniques of market-based valuation include

The market-based approaches evaluate value based on similar patents, licensing transactions or technology sales. In the case of reliable comparables, this method yields clear and grant-deeming justification. The rate of royalty, the multiples of transactions made, or historical prices of purchasing similar technology are observed by the analysts.

Nevertheless, highly specialised or emerging technologies may have only truly comparable data. An example here is when a robotics firm is seeking a manufacturing innovation grant but will have limited benchmark deals of AI-controlled robotic grippers, the task of an analyst will be to scale the comparables by industry, functionality, or level of maturity. This highlights the significance of the combination of several different valuation methodologies as opposed to using a single method.

2.2 Income Method to predict Future Economic Gains.

Income approach is one of the most common methods of valuation of innovation grants, and it is used to estimate the financial benefits that the project will produce in the future generated by the patent or by the project of R&D. This may consist of cost savings, royalty revenue, licensing revenue, or incremental gains through technology based product lines.

Here is where the article naturally integrates the first keyword: companies often perform valuations consistent with patent valuation Singapore practices, where grant assessors focus on defensibility, revenue pathways, and the innovation’s contribution to national R&D competitiveness. Such a strategy is especially applicable in cases where the technology has a demonstrated monetisation potential, like a patented algorithm to offer higher pricing of enterprise software.

2.3 Early Stage Project Risk-Adjusted Valuation.

Early R&D includes scientific, regulatory and commercial risk. Consequently, risk-adjusted valuation models, like decision trees, milestone probability analysis, or option-pricing models, are usually used in grant applications. The methods provide value calculation depending on the chance of attaining central development milestones.

As an example, a medical device prototype can undergo a number of regulatory checks. A risk-adjusted model assists in the quantification of the created value in every junction, which is more realistic and can be defended by the funding bodies. Such transparency helps to give the assessors the confidence that the company has identified and has anticipated inherent uncertainties.

3. Enhancing Valuation Support of Grant Applications.

3.1 Proving Commercial Pathways and Monetisation Models.

The more innovations are demanded, the more they need clear commercialisation plans. Even powerful patents or R and D discoveries would not get funds back unless the organisation is able to describe how the technology is to be monetised. This is especially relevant when applying valuation methodologies used in R&D project valuation techniques, which emphasise cost structures, pricing models, and integration with existing business operations.

As an illustration, a clean energy start-up who creates a new battery material could show that its innovation will save the manufacturing expenses by a third, allowing it to enter more profitable markets or be licensed by automotive companies. The articulation of these pathways is clear and the higher the valuation and chances of getting the grant.

3.2 Showing Technical validation and Proof of Concept.

Grant evaluators desire to be assured that the innovation is effective- or will be effective. This involves prototype tests, simulation report, patent investigations, technical feasibility report and research partner endorsements. High validation lowers the perceived risk and favors high estimates of valuation.

An example of the other way this could be presented would be a software firm that has been seeking a digital innovation grant and therefore may include benchmarks on system performance that demonstrate a 40 percent improvement over current solutions. This criterion equates innovation with quantifiable value and reinforces the rationale of the calculations of the valuation.

3.3 Valuing and Granting Objectives and Jurisdiction Requirements.

Different innovation grant programmes focus on various outcomes, e.g. sustainability, digitalisation, productivity, or technological self-sufficiency. In this regard, the valuation is supposed to conform to the targeted grants.

To take an example, a 5G communications start-up seeking a government-backed deep-tech grant may focus more on national competitiveness, whereas a logistics technology business seeking a grant through the digital transformation initiative may focus more on operational productivity and adoption by SMEs. When the valuation is tailored to these objectives, the confidence of the reviewer will be significantly high.

Conclusion

An appreciation of patents and R&D initiatives has become a provision that is crucial to companies in pursuit of a grant of innovation in a competitive funding environment. A strong valuation assists organisations to justify commercial potentials, risk perception and align technological breakthroughs and economic returns. When the measures and scalability of an impact become more important in the measurement implemented in grants, a significant benefit will be seen in companies that use the disciplined valuation framework. Innovators can also convert in factual research into financed prospects and sustained business endeavors with the backing of saying, excellent evidence, and strategic placement.