How Private Equity Firms Assess Portfolio Valuation

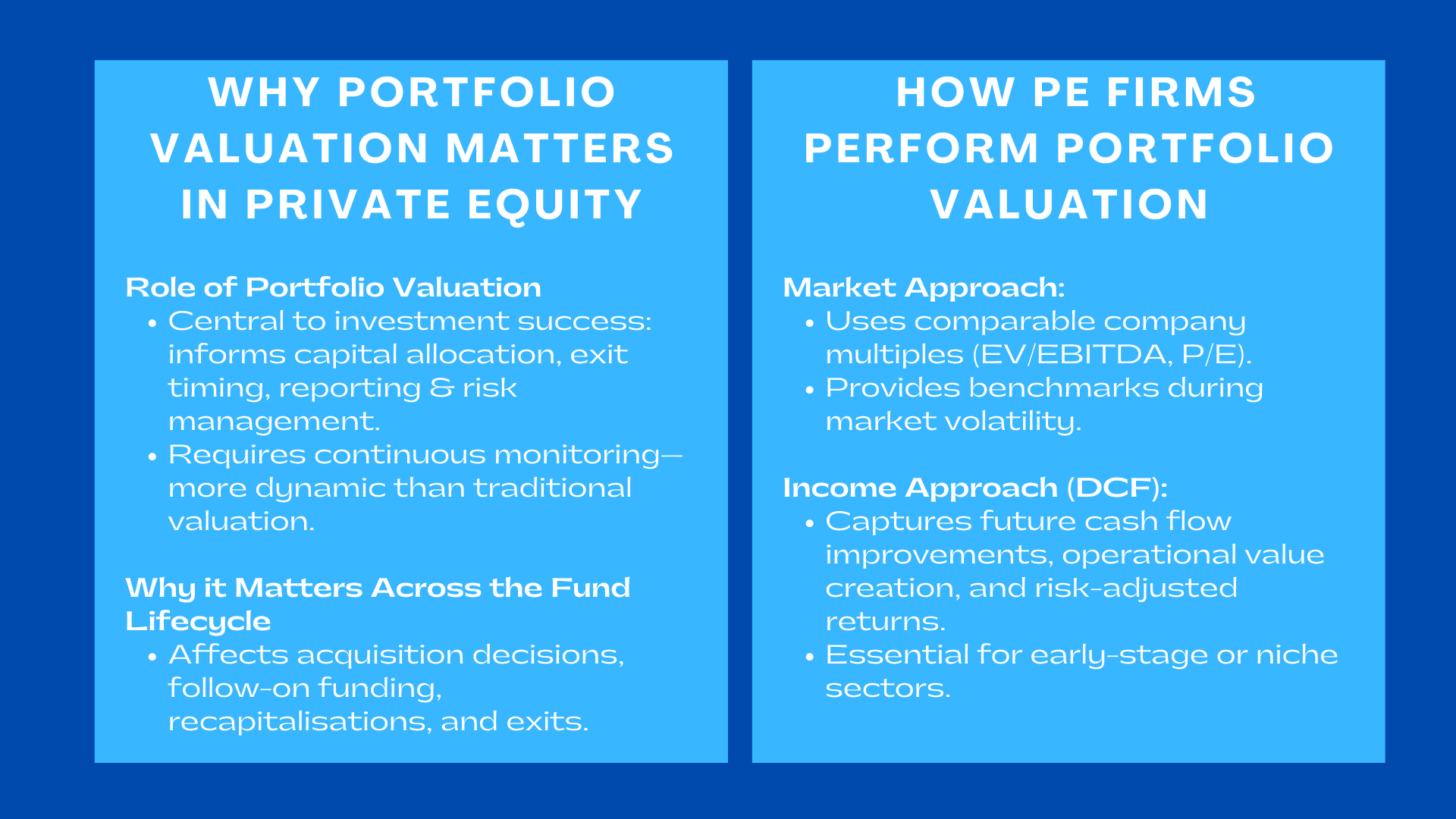

The business environment in which PE firms face is one where accuracy, timing, and the ability to remain analytic are the determining factors of the success of the investments. Portfolio valuation is at the core of this environment- it is part of the process that informs capital allocation, exit decisions, capital reporting to investors and risk management. In contrast to the traditional business valuation, PE portfolio valuation needs to be monitored constantly, put to test, and aligned to fund goals. In the current unstable economic environment, valuation is more than a best practice, it is a necessity that helps in protecting investor confidence and strategic performance, especially as many professionals enhance their skills through a business valuation course Singapore to meet rising industry standards.

Given the higher regulatory scrutiny requirements, the mounting limited partner (LP) questioning and the rising competition over high-quality deals, private equity funds require robust and defensible valuation frameworks. The dynamics of PE firms in their portfolio valuation allows one to see how PE firms make investment decisions and the rationales underlying investment decision making at the level of their performance through market cycles.

1. The Foundations of the Private Equity Portfolio Valuation.

1. The Foundations of the Private Equity Portfolio Valuation.

1.1 Why Valuation is important in the management of a Private equity Fund.

Valuation influences all the life cycle of the private equity, acquisition to exit. When companies attest the fair value of a portfolio company, they give the LPs a true picture of the performance of the fund. This helps in transparency, capital calls and future distributions expectations. It also affects internal decision making like following on investments, dividend recapitalisations and restructuring decisions.

To illustrate this point, a PE fund that handles a fast-growing technology company has to reappraise the valuation every quarter or semi-annually to make sure that the growth in revenues, expansion of margins, and customer retention is fairly represented. This is especially important when making audited financial statements as fair value has to be in compliance with recognised valuation standards.

1.2 Portfolio Consistency and Frequency of Valuation.

The majority of private equity firms conduct quarterly valuations, with high-risk or high-volatility businesses perhaps having to be reviewed monthly. The frequency of valuation should be consistent since the LPs desire comparability between periods of reporting. It is at this point that an organized policy of valuation is essential.

Funds have generally adhered to the unified practices of the International Private Equity and Venture Capital Valuation (IPEV) Guidelines. The guidelines provide a basis of measuring fair value at each reporting date enabling firms to support whether there is any reported change due to genuine performances, market changes, or revised assumptions.

2. Approaches of valuation followed by the private equity firms.

2.1 The second market approach is associated with the benchmark of portfolio companies.

The similar company multiples are often used by the private equity analysts to determine fair value. The multiples that are used to evaluate the value of similar businesses in the market include EV/EBITDA, EV/Revenue, price-to-earnings, among others. Such benchmarks are particularly applicable in situations of market instability, in which the prices fluctuate at an accelerated rate.

Practically, an analyst who values an industrial portfolio company can make a comparative analysis to listed peers in the Southeast Asian region. Assuming that the median EV/EBITDA in the industry is 7x and the portfolio company is operating with above-average margins, the fund can place a valuation multiple a bit higher than market-based valuations. This reviewed perception shapes the foundations of defensible appraisal decisions and investor statements. One of the key phrases often referenced in such analyses is private equity portfolio valuation, which captures the complexity of assessing investments across diversified industries.

2.2 Income Approach and Cash-Flow Based Valuation

Discounted cash flow (DCF) analysis is one of the pillars of PE valuation. Because PE investments are usually implemented in the form of improvements of operations or strategy repositioning, the DCF enables the companies to take into consideration the anticipated changes in market share, pricing power, cost structure, and capital expenditure.

As an illustration, a PE fund that invested in a renewable energy operator may anticipate a consistent growth as a result of government subsidies. The firm obtains an intrinsic valuation by discounting future cash flows on the basis of risk-adjusted rate to capture the anticipated performance of a given firm and the associated risks incurred in the course of investment.

The DCF analysis is even more imperative in an early-stage or specialised business where the market comparables can be weak or scarce.

2.3 Control Premiums, Liquidity and Risk Adjustments.

The common factors that are adjusted by the private equity firms are the valuation outcomes that include; control premiums, minority discounts and liquidity factors. These modifications are an indication of the peculiarities of PE ownership that in many cases ensures complete control over strategic decisions.

As an example, where a fund has a majority ownership in a portfolio company it could realise the additional value it has through its capability to impact restructuring or to cause operational efficiency. Meanwhile, liquidity adaptations take into consideration that PE investment is usually illiquid and cannot be sold fast without a discount.

Macroeconomic risks that may be included in funds are the increase in interest rates, inflation rates and geopolitical tensions which might impact cash flows or the market multiples. This is where a structured investment fund valuation approach becomes essential, ensuring consistency and fairness in adjustments across portfolio companies.

3. Monitoring Portfolio Performance Against Initial Investment Thesis

3.1 Key Performance Indicators Aligned to Value Creation

Valuation in private equity is not merely in financial data, but also in the confirmation of the original data on investment. The monitoring of every portfolio company is performed according to the metrics specific to its industry and strategic goals.

Indicatively, a consumer retail investment can emphasize on same-store sales, customer lifetime value and gross margin expansion. On the other hand, a healthcare investment can target the development in the number of patients, approval from the authorities and utilisation.

The analysts of valuation then incorporate these operational KPIs in financial models to determine whether value creation is proceeding. A major anomaly of the investment thesis, whether positive or negative, brings an evaluation update.

3.2 Sensitivity Analysis and Scenario Testing.

Scenario testing enables funds to test the effect of change in market condition on valuation. Some of the down scenarios that can be modelled by the analysts include recessionary decelerations, disruption in the supply chain, or rising costs. This will make sure that portfolio values are not based on present performances but also future risks.

Indicatively, in the case of the COVID-19 pandemic, stress test of portfolio companies in the travel, leisure, and retail sectors was done by most PE firms. In other instances, the valuations were lowered to accommodate temporary disruptions. In different instances, strong industries like the technology industry or pharmaceutical industry saw increased revisions of their valuation.

Sensitivity analysis also facilitates funds to express the results of valuation more clearly when attending investor meetings or when under audit.

4. Exit Planning and Realisation Valuation.

4.1 Preparation of Portfolio Companies to Sell.

During the exit stage, valuation has a significant role to play. PE firms incorporate valuation analysis to identify whether the circumstances are favourable to sell an asset, a secondary buy out or an IPO. The performance of valuation is strong and negotiation is more powerful and exit multiples increase.

As an example, when a logistics company records a high rate of growth of EBITDA and cash conversion rate, the fund could expedite the sale process to leverage on the market momentum.

4.2 Level of Consonance with Buyer Expectations.

PE firms need to expect the way the potential buyers will perceive the portfolio company. The strategic buyers might be interested in synergies, whereas other PE companies might pay more attention to the reliability of cash-flows. Valuation tests are used to determine the price expectations and negotiation strategies.

The firms can also alter the valuation models to capture buyer-side assumptions so that it can be aligned in the due diligence and deals structuring.

Conclusion to How Private Equity Firms Assess Portfolio Valuation

The valuation of private equity portfolio is a demanding, multi-layered process that puts together financial modelling, market studies, operational analysis, and strategic assessment. Due to increased complexity of the markets and heightened expectations of investors, PE firms have to assume disciplined structures that guarantee reliable, transparent, and defendable valuations. Portfolio valuation will become more dependent on real-time data and analytics as well as closer alignment of financial and operational performance. A company that masters the capabilities will not just build on investor confidence, but also access more value over the lifecycle of the investment.